Market volatility remains high in the banking sector as central banks work to dispel contagion fears. In the case of Credit Suisse, the Swiss National Bank moved swiftly and decisively in order to prevent contagion across the wider banking and financial services sectors. As a result, Swiss regulators wrote-off Credit Suisse’s $17 billion in additional tier 1 bonds (AT1) in the emergency take-over by rival Swiss bank UBS. While this write down was always theoretically possible, many investors were stunned when equity holders received value and AT1 holders were wiped out. Why was this a surprising move by regulators?

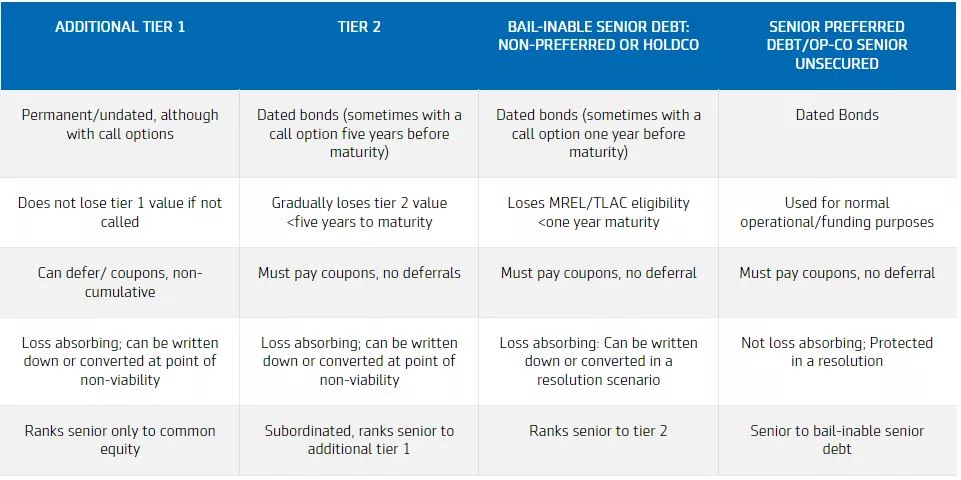

In order to understand why a full write down of its value is significant, it is important to understand European bank debt tiers and where AT1s fall within this hierarchy (exhibit 1).

Exhibit 1: Hierarchy of European bank debt tiers

Basel: Stipulates minimum capital levels for banks. As such, it dictates how much additional tier 1 and tier 2 capital a bank must have, in additional to common equity. Normally expressed as % of risk weighted assets.

MREL/TLAC: On top of the Basel capital requirements, MREL/TLAC rules dictates that the bank must have a certain volume of bail-inable senior debt (non-preferred or hold-co structure) that can be easily written down in order to recapitalize a bank in times of stress, to ensure it can continue to operate.

Source: Aegon Asset Management. As of March 28, 2023.

Additional tier 1, or AT1, securities were first introduced in the wake of the financial crisis in 2008. Considered just above equity in the capital stack, they are a key source of financing for many large European banks. They are intended to help banks improve capital positions to meet regulatory requirements, if needed. If the capital levels decline below the predetermined threshold, these securities can be written down in whole or part, temporarily or permanently, depending on the terms.

In addition, some of these securities involve a potential equity conversion (which was not the case for the Credit Suisse AT1s). Aside from the idiosyncratic nature of the Credit Suisse situation, AT1s can provide attractive investment opportunities as they can offer diversification benefits as well as attractive yield and carry for what is typically higher-quality bank exposure.

The broader AT1 market

Across jurisdictions, it is important to understand that there is a material difference in how these instruments are treated. The European Union and the UK, which comprises the bulk of the AT1 market, reassured investors that shareholders should face losses ahead of bondholders. This was confirmed by both the European Central Bank (ECB) (in conjunction with the Single Resolution Board (SRB) and European Banking Authority or EBA) and Bank of England on 20 March: “AT1 instruments rank ahead of [common equity tier 1] and behind [tier 2] in the hierarchy. Holders of such instruments should expect to be exposed to losses in resolution or insolvency in the order of their positions in this hierarchy.”

In the case of Credit Suisse, the Swiss regulatory regime allowed for Credit Suisse AT1s to be zeroed before any loss on the firm’s equity was imposed based on regulators interpretation that Credit Suisse had hit the PONV trigger (Point of Non-Viability). Although this outcome is disappointing for AT1 holders, it does appear that the regulator acted in accordance with provisions.

Bottom line? Not all AT1 securities are created equal as regulatory requirements vary across regions.

Opportunities remain in AT1s

Setting aside the idiosyncratic Credit Suisse situation, we see AT1s as solid long-term investment opportunities. Although they are not immune to short-term market swings, AT1s can provide attractive investment opportunities as they can offer diversification benefits as well as attractive yield and carry for what is typically higher-quality bank exposure.

While we believe the AT1 market will persevere and the European banking sector crisis should be contained, market sentiment is fragile. It is likely that markets will remain volatile as investors evaluate deposit and liquidity risk across the banking sector, as well as the broader implications of tighter financial conditions. This will likely lead to shorter term volatility, which could create interesting buying opportunities.

Important Disclosures

Disclosures

Unless otherwise noted, the information in this document has been derived from sources believed to be accurate at the time of publication.

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional, qualified, and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co, Ltd., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only.