Portfolio Manager Luke Newman considers the opportunities for equity long/short strategies in a world of higher-than-expected inflation, with persistent supply chain issues and rising energy prices pressuring governments and central banks to shift policy.

Key takeaways:

- Those companies with pricing power can pass on higher prices to customers, but many businesses are very sensitive to rising interest rate assumptions, given that there is less opportunity for earnings growth.

- The US equity market has significantly lagged Europe as investors sought to price in the stress on corporate revenues from steepening cost of living pressures for consumers.

- A flexible long/short strategy, utilising dynamic net and gross exposure, should be as comfortable in bear markets as bull ones.

Fear and hope have been powerful motivators for investors since the start of the COVID era, with investors in turn gripped by panic about the health of the global economy and optimism that governments and central banks had done enough to bolster growth.

2022 so far has seen fear take root once more, driven by an increasingly hawkish stance from central banks, led by the US Federal Reserve (Fed), combined with clear signs of deteriorating global growth. The raft of sanctions targeted at Russia in response to the invasion of Ukraine has understandably exacerbated existing inflationary pressures. Elsewhere, the impact of higher gas and electricity prices have been made more acute by COVID-induced lockdowns in China and persistent supply chain issues.

Easing turns to tightening

The Fed has continued to toughen its stance against rising prices, announcing the biggest increase to its benchmark interest rate in over two decades in May (a hike of 0.5%), following a 0.25% increase in February, with several further hikes expected in 2022. Not only has the Fed moved quickly on interest rates, but the shift to quantitative tightening has been faster than expected, with consequences for both equity and bond markets. Outside the US, the Bank of England Monetary Policy Committee has increased interest rates four times since December 2021, to 1.0% in May, with inflation reaching a 40-year high of 9.0% in April. In contrast, the European Central Bank looks like it will be less aggressive than the Fed, given lower core inflation.

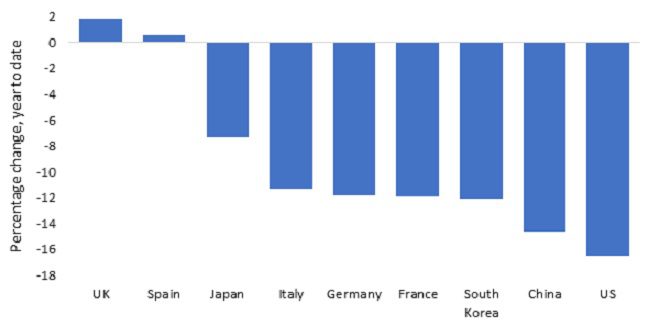

While persistent or rising inflation can represent a real problem for those businesses that have limited capacity to cut costs, those companies with pricing power (the ability to pass higher input prices onto customers) can offer an implicit inflation hedge. The issue is that many businesses are very sensitive to rising interest rate assumptions, given that there is less opportunity for earnings growth. We have seen US stocks come under particular pressure in the first part of 2022, with weak earnings factoring into views on slowing global growth and growing geopolitical uncertainty (Exhibit 1).

Exhibit 1: US equities have been among the weakest thus far in 2022

Source: Refinitiv Datastream, Janus Henderson Investors, year to date to 25 May 2022. China: Shanghai SE Composite Index, France: CAC 40, Germany: Dax, Italy: FTSE MIB Index, South Korea: KOSPI, Spain: IBEX 35, UK: FTSE 100 Index, US: S&P 500 Composite Index, Japan: Nikkei 225 Index. Past performance does not predict future returns.

The US equity market has significantly lagged Europe as investors sought to price in the stress on corporate revenues from steepening cost of living pressures for consumers. The knock-on impact in Europe and Latin America has been price rises, leading to lower demand in terms of consumer discretionary spending.

Should investors look to absolute return?

The objective of an allocation to long/short equity is to pursue a consistent, positive return over time, with performance drivers that are differentiated from the underlying equity market. These strategies are not designed to compete with the performance of long-only funds (stocks held specifically to benefit from any rise in value over time) in a strongly rising market, but they should aim to deliver a lower level of volatility during periods of market uncertainty.

This is made possible by combining long and short positions in carefully selected stocks, which takes skill and experience. Short positions can be achieved via the use of derivative instruments, such as equity swaps, commonly known as Contracts for Difference (CFDs) and futures. Long positions may be held through a combination of direct investment and/or derivative instruments including CFDs.

A flexible long/short strategy, utilising dynamic net and gross exposure, should be as comfortable in bear markets as bull ones, with a short book capable of operating as a profit-centre as much as a hedging tool. Every investment should be made with consideration of the downside risk. Such strategies, if managed correctly, should help to reduce the risk to capital during initial periods of macro uncertainty, and then shift to a position to capitalise from the subsequent market rebound – or variations in performance between different parts of the market.

Pricing dispersion represents the opportunity

Looking beyond current headlines, we continue to see a reasonable level of pricing dispersion between stocks, providing opportunities to make a positive return from investing on both the long and short sides.

On the long side, we would expect more defensive businesses, capable of growing revenues in a weakening economic environment, to hold up better than others. The characteristics we would look for are structural growth stories; companies with the ability to pass higher input prices onto customers, or those with strong balance sheets, given that credit markets are struggling with the move from quantitative easing to quantitative tightening. As always, price matters – we seek valuations that appropriately factor in a higher discount rate than has been seen for much of the past decade, offering some prospect for absolute upside. The UK market still looks cheap in absolute terms, with some attractive opportunities on the long side.

Tactically, consumer-exposed short positions within sectors such as retail seem to have already discounted much of the pressure consumers are likely to face over the coming months. Fast-growing technology stocks were significant beneficiaries of the rebound in sentiment following the initial COVID-led crash in February and March 2020, as investors ploughed back into the market. But now, the potentially inflated valuation assumptions associated with tech stocks lead naturally to a view that the sector represents opportunities on the short side. Despite the relative underperformance of US stocks so far in 2022, valuation excesses seem more extreme, and direct fiscal stimulus measures that resulted in extra spending power for households seem to have, in our view, saturated demand for certain goods within the discretionary spend arena.

Inflation – a self-righting mechanism

We expect nominal inflation to remain persistently high, but we anticipate seeing the rate of change slow over the course of 2022. While high/rising inflation is harmful for growth in the economy, it is something of a self-righting mechanism for corporate investment levels and discretionary spending. Demand destruction in the face of higher prices is likely to address many areas of inflationary pressure, meaning that (less predictable) supply and input cost constraints should ease as the year progresses.

There are so many unknowns at present with COVID continuing to impact economies and supply chains, and the conflict in Ukraine adding to inflationary pressures (primarily energy and food). Expectations for growth have fallen, and the risk is that central banks could be too aggressive in their decisions on interest rates, adding to the risk of recession. Were that scenario to prove true, long/short strategies have tools to hand capable of generating a return for investors throughout the market cycle, regardless of corporate earnings. In that environment, the emphasis will land squarely on stock selection at a tactical and core level, conditions that we consider well-suited to equity long/short investing based on detailed company analysis and research.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.