Our Franklin Templeton Investment Solutions team continue to view inflation as being primarily a demand-driven phenomenon.

WALKING A TIGHTROPE

As we moved into a new year, the flow of economic data and central banks’ likely response to it suggest that investors have no shortage of challenges to face. Indeed, when we sat down to consider the outlook for 2022 and review how our conviction levels were shifting, we anticipated that this was a time when a nimble approach could be especially appropriate.

The ongoing threat posed by the Omicron variant of COVID-19 further complicates the picture. Although a seemingly milder form of the disease, which may help move us toward the end of the pandemic phase if it increases the level of natural and vaccine-induced immunity, it will still likely act as a drag on confidence and activity in the near term. Equally, if governments respond to the resurgent pandemic with tighter restrictions, it could easily delay the normalization of supply chains and inflation, which remains elevated. For global society, this may feel increasingly like walking a tightrope!

Inflation expectations remain a concern

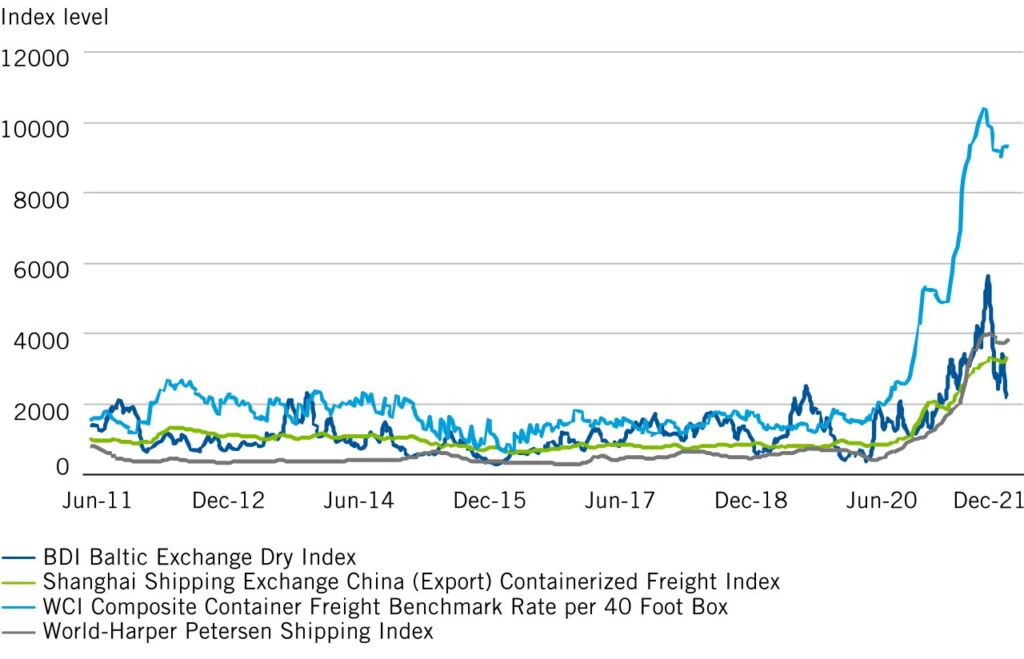

Inflation developments remain a dominant concern for us, for the market more broadly and notably for the US Federal Reserve (Fed). The current pace of inflation is showing tentative signs of approaching a peak. Certain measures of prices, for example in US purchasing managers’ indexes, have eased back a little. Similarly, the costs of shipping goods across the Pacific and globally have come off peaks seen late last year (see Exhibit 1). However, the ongoing impact of the Omicron variant, especially in economies that continue to adopt a zero-tolerance approach to containing the virus’s spread, such as China, may delay the peaking of supply-chain worries. It may also slow the normalization that we continue to anticipate over the course of this year. Although we, like the Fed, do not anticipate the current surge in inflation to be permanent, it feels like the notion of persisting with calling it temporary was itself too much of a highwire act to be worth the risk.

THE COST OF SHIPPING GOODS MAY HAVE PEAKED

Exhibit 1: Global freight indexes

As of December 31, 2021

As a result, we have reviewed our key inflation theme this month. We continue to view inflation as being primarily a demand-driven phenomenon. Hence it is likely to moderate of its own accord as growth decelerates toward a more trend-like pace later in 2022, but the risks of this feeling more permanent are mounting.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio. There is no assurance any forecast, projection or estimate will be realized. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Derivatives, including currency management strategies, involve costs and can create economic leverage in a portfolio which may result in significant volatility and cause the portfolio to participate in losses (as well as enable gains) on an amount that exceeds the portfolio’s initial investment. A strategy may not achieve the anticipated benefits, and may realize losses, when a counterparty fails to perform as promised. Currency rates may fluctuate significantly over short periods of time and can reduce returns. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term. Investment in the commercial real estate sector, including in multifamily, involves special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector.

The companies and case studies shown herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The opinions are intended solely to provide insight into how securities are analyzed. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. This is not a complete analysis of every material fact regarding any industry, security or investment and should not be viewed as an investment recommendation. This is intended to provide insight into the portfolio selection and research process. Factual statements are taken from sources considered reliable but have not been independently verified for completeness or accuracy. These opinions may not be relied upon as investment advice or as an offer for any particular security. Past performance is not an indicator or a guarantee of future results.