There is plenty to worry about in the world right now, whether that be central bank policy errors, inflation, the normalisation of interest rates or indeed the global pandemic!

But if we are completely honest with ourselves, we always have a tendency to worry about something. After all, investors’ worries can create volatility and market disruptions, presenting compelling investment opportunities for active managers.

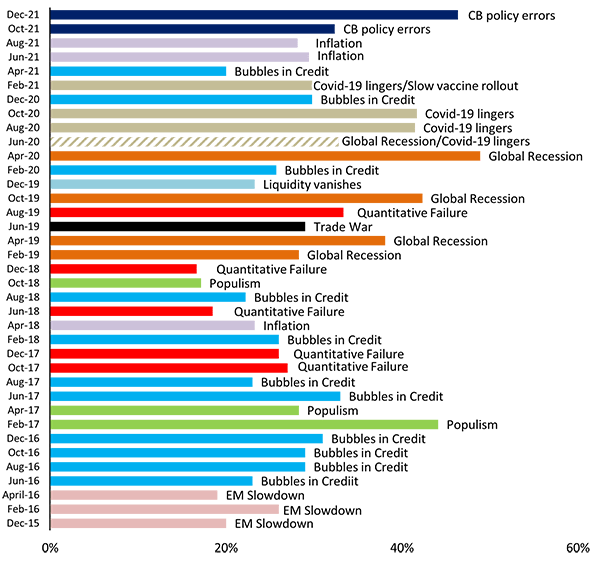

Bank of America publishes a credit investor survey every month (Exhibit 1) and it always surprises us that the market can come up with such a broad range of things to worry about. Now, that’s not to say these are not things to worry about; we are constantly scanning the marketplace for any potential risks. However, we should always be mindful to give them the proper risk weights within our thought and investment processes.

Amid the plethora of risks in the market today, the risks that we are most closely monitoring include stretched valuations; monetary tightening and rising rates; inflationary pressures; labour shortages; Covid-19 variants; as well as China property market stress and potential growth stagnation. Despite the many uncertainties and stretched valuations, we maintain a relatively positive view on the high yield bond market as outlined in our 2022 outlook. For fixed income investors, high yield continues to offer an attractive yield per unit of duration risk, especially relative to investment grade corporates. The short duration nature of the asset class has also allowed high yield to outperform many other fixed income assets during rising rate environments. Further, despite recent inflationary pressures and shortages, most high yield companies have been able to maintain margins and generate solid earnings. Nonetheless, we expect more divergence and disruption in 2022, which can present interesting opportunities to generate alpha through bottom-up security selection.

Exhibit 1: Credit investors’ biggest perceived risks

In a previous article, we asked the question in our HY spotlight – “Why do we panic?” And the answer is uncertainty. Uncertainty however will always be there, after all we are trying to predict the future and anyone that tells you they know what is going to happen is either a liar or a lunatic. We base our decisions on probability, risk adjusted outcomes. The famous investor, Howard Marks, talks about the market being a pendulum that swings from greed to fear. It’s not always easy to tell where you are. Expensive markets get more expensive and cheap markets get cheaper. Taking a long-term approach is always a sensible strategy while trying to not get too caught up in the day-to-day noise of headlines.