Financial markets have endured significant pain already across 2022, but investors are still faced with several risks as they approach year-end and look ahead to 2023.

Virtually every asset class (with the exception of certain commodities) has posted deeply negative returns year-to-date as markets have repriced rapidly to take account of inflation and central banks’ increasingly aggressive attempts to tame it.

In our view investors can certainly take some solace in the fact that, with the S&P 500 and the US investment grade corporate bond index1 both down by around 20% YTD as of November 4, we believe much of the pain of this adjustment has already been felt. Indeed, with the Fed having hiked rates by 75bp to 3.75-4.00% at its November meeting, the bulk of its journey to a market-implied terminal rate of around 5% is now done.

However, for some time central banks have been walking a tightrope between inflation and recession, and the continued strength of the former has significantly increased the risk of the latter. If the inflation narrative was to fade in early 2023, then we think it could swiftly be replaced by talk of slowing GDP growth and the threat to corporate earnings.

Therefore, we strongly believe this is the time for investors to focus on where the most reliable risk-adjusted returns are expected to come from in the next 12 to 24 months, and we don’t think they need to look further than investment grade short term bonds.

Rare relative value in IG credit

The 2022 bond sell-off has been remarkable for many reasons, but one of the most important in our view is that IG credit has underperformed high yield.

For obvious reasons the reverse is usually true; IG issuers are higher quality, typically less leveraged and generally have a lower cost of funding than HY issuers, and thus drawdowns in IG tend to be shallower and shorter when economic conditions deteriorate. That was the case in 2000, in 2008 and in 2020, but it has not been in 2022 YTD, as the chart below demonstrates (the chart shows US IG vs. HY but European and UK credit have experienced the same dynamic).

This rare IG underperformance is largely put down to the strength of inflation and the pace of the current rate hike cycle (375bp so far from the Fed, 300bp from the Bank of England and 200bp from the European Central Bank). With IG credit generally being longer dated and higher duration, the repricing in rates quickly overwhelmed the relatively lower spreads in the sector, meaning IG has underperformed HY in a downturn for the first time this century.

But the end of QE looms large

Such a steep drop in one of the safest sectors of fixed income (historical IG defaults are vanishingly small) would appear to be a strong buy signal.

True, fixed income as an asset class finally looks fundamentally attractive again, given yields have now risen to something approaching ‘pre-QE’ levels. If we look at IG credit indices specifically, the yield on US IG corporates is now around 6%, while for European corporates it is around 5%; those are levels that should attract plenty of buyers.

However, while we certainly view this as a rare buying opportunity in IG credit, we think it should be treated as a selective one, as we remain wary of longer duration assets given the important risks that remain.

One of these is inflation, which has confounded expectations again and again this year, and retains the potential to do so going forward despite the recent pace of rate hikes. Much of the anticipated rate hike pain has already been felt, and while markets have now priced in more bad news by way of lofty terminal rate expectations, we think we are still probably six months away from peak rates in the US and the UK, and perhaps longer in Europe. That is several data prints and policy decisions away, plenty of time for changing expectations and more rates volatility.

Another is the threat of recession, the depth of which will be influenced both by inflation and whether central banks can avoid a policy mistake as they move towards terminal rates. In the words of the Fed chair, Jerome Powell, in September, “No one knows whether this process will lead to a recession or, if so, how significant that recession would be”.

Last but certainly not least is the end of QE, a withdrawal of liquidity that could have unpredictable and unintended consequences in fixed income. The Gilt crisis that followed the UK government’s disastrous fiscal policy announcement in September was not related to quantitative tightening by the Bank of England, but it was an example of the kind of unseen market imbalance years of cheap and plentiful central bank liquidity can produce.

Short IG bonds can offer yield and protection

Therefore, we think investors should be looking to access the attractive yields that now exist in IG in the part of the curve where they are best rewarded for the risk.

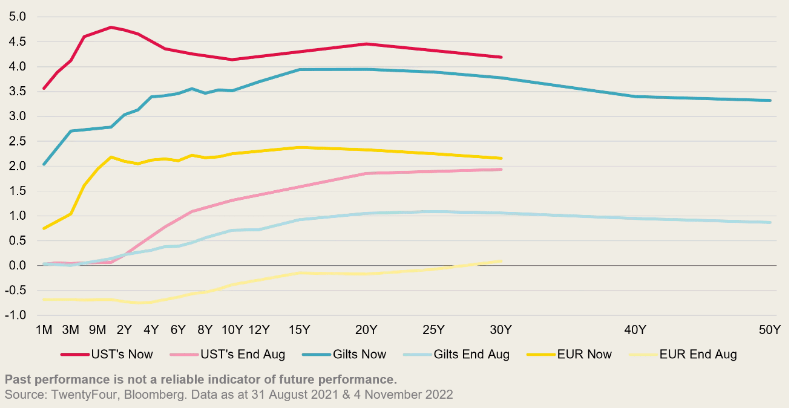

The chart above shows the shift in front end rates we have witnessed over the past 14 months, with two-year US Treasuries incredibly going from yielding nothing to 4.75% in that period. That savage repricing means the major rates curves are now either inverted or extremely flat once you get past the two-year mark, which means diminished returns for taking on the extra duration risk of longer dated credit.

Importantly, IG credit spreads have also widened considerably year-to-date (again, more so than HY spreads on a relative basis), which on top of the rates move means we think the yields available in short term bonds look particularly attractive given their comparatively low duration.

For example, given the two-year is now the high point of the US curve, an elevated credit spread on top of the 4.75% risk-free curve is more than enough to push the yield on many IG corporate issuers’ two-year bonds over 6%. In a still uncertain environment, 12% over two years would be a handsome return for a sector that traditionally offers such a high degree of certainty your money will be returned.

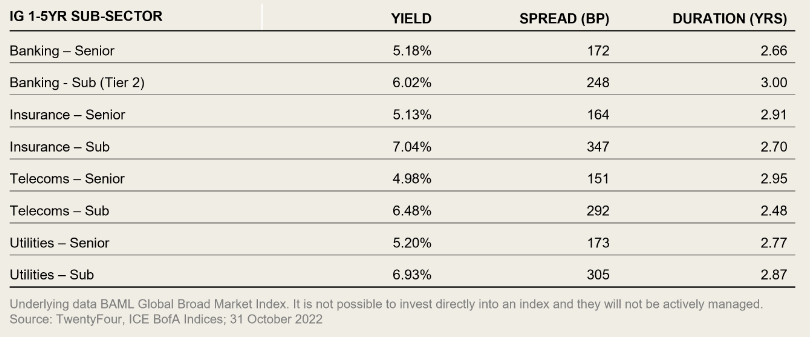

These yields can be found in defensive sub-sectors of IG, where firms are generally seen to have strong pricing power and dependable revenues, such as banking, insurance, telecoms and utilities.

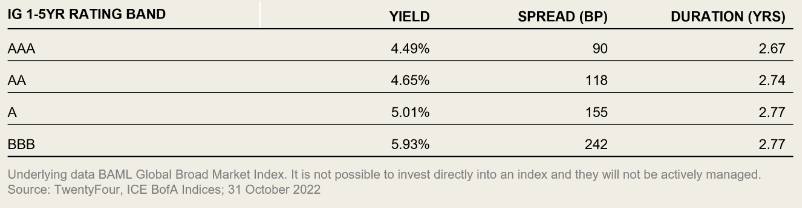

In our view, the chart above highlights the value available in short dated IG today. The headline yields are higher than they have been in years, but the credit spreads in sub-sectors with an average duration of three years or less look particularly attractive to us given the potential we see for continued rates volatility in the next few months. The table below highlights where we think the sweet spot is currently, with an average spread of 242bp for BBB rated bonds in the 1-5yr bracket acting as a buffer against any further rates weakness.

As usual, individual bonds can display more attractive metrics than the sub-sector averages. Among the largest issuers of subordinated telecoms bonds, for example, is France Telecom (Orange), which currently has an outstanding April 2025 maturity bond yielding 6.69%, rated BBB. If we look at subordinated utilities bonds, one of the biggest issuers is Italy’s Enel, which currently has an outstanding May 2025 bond yielding 8.05%, also rated BBB. The UK’s SSE, which is rapidly becoming a clean technology champion, is also one of the bigger issuers in the utilities sector, and has a July 2027 bond, again rated BBB, yielding 7.45%.

Again, these are widely regarded as ultra-defensive credits carrying solid IG ratings, offering to return your money in a short timeframe at a yield in excess of 6% or 7% depending on the sector. Heading into a recession of unknown depth, we think it is hard to find better risk-adjusted opportunities than this right now.

High quality at low prices

The amount of bad news thought to be priced into high quality bonds today is worth repeating. A recent Bloomberg analysis showed that of the 1,555 IG bonds sold in the US and Europe since Russia’s invasion of Ukraine, all but 137 of them were trading below par as of October 28.

In our view, the yield levels now available are pricing in not just a downturn but severe economic distress. We don’t think this is warranted in a high quality universe such as this, where investors are able to lock in elevated yields and credit spreads while still positioning away from areas we think should be avoided, such as deep cyclicals, high street retail and other sectors with limited or no pricing power.

While we believe the valuation argument alone should attract buyers, the uncertainty surrounding global inflation and policy responses means we cannot call the absolute bottom for the credit market just yet, which in our view makes the defensive characteristics of short term bonds even more valuable at this time.

On any reasonable timeframe, we think the yield opportunities highlighted above predict decent positive returns can be achieved over the medium term.

Important Information:

The views expressed represent the opinions of TwentyFour as at November 2022, they may change and may also not be shared by other entities within the Vontobel Group. TwentyFour, its affiliates and the individuals associated therewith may (in various capacities) have positions or deal in securities (or related derivatives) identical or similar to those described herein. The companies identified above have been used for illustrative purposes only to help elaborate on the subject matter under discussion. Further, the investments referenced herein should not be considered as a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable They should not be deemed a recommendation to purchase, hold or sell the same or similar. No assumption should be made as to the profitability or performance of any company identified or security associated with them.

Any projections, forecasts or estimates contained herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such.

1. Based on the iBoxx US Liquid Investment Grade Index.