Asia Pacific’s growing urban population coupled with low housing affordability continues to drive demand for rented residential property in key cities. Changing mindsets and policies around renting, as well as higher interest rates, further suggest APAC Living could be a long-term, scalable opportunity.

APAC cities’ population has doubled in the last 15 years, both through domestic urbanisation and immigration. Today, APAC cities house 2.2 billion people – half the global urban population. This is expected to grow by a further 50% by 20501.

“Until recently, most developers operated build-to-sell models, selling apartment units to individuals prior to completion, while renters have generally leased units from individual landlords. However, market dynamics are changing.”

Governments have raised their efforts to bring in international workers and students to reinvigorate economies and address labour shortages since the pandemic. Australia has increased its annual permanent migration cap by over 20% to 195,000 in 2023 to attract skilled professionals into its healthcare, education, engineering and agriculture sectors2, for example.

International students are also returning to key APAC cities in large numbers, having grown steadily by 10-15% annually in Australia and South Korea in the five years prior to the pandemic. With growing affluence and an emphasis on education among both Chinese and Indian parents, we expect the number of international students to continue to grow over the next few years.

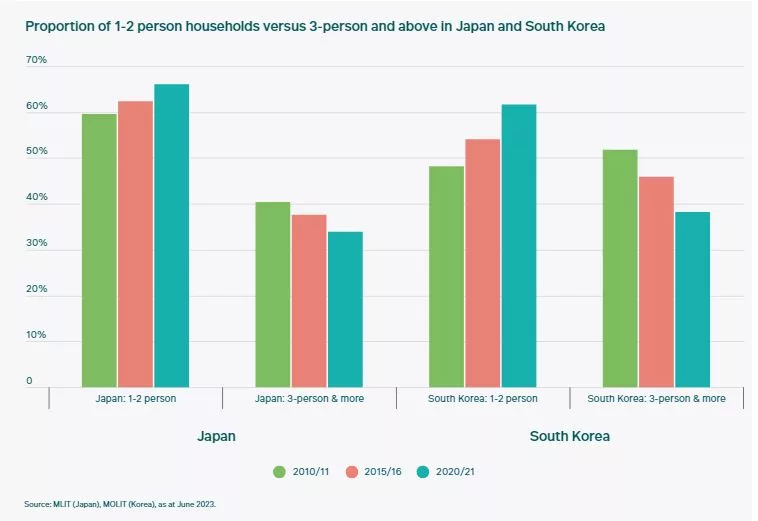

In addition, the number of single and two-person households is rising in Japan and South Korea, outpacing population growth in the last two decades, owing to a decline in marriages, a rise in divorces and increased longevity3.

Housing challenges

Providing accessible housing for these urbanisation trends has been a multi-faceted challenge. In some cases, planning and land supply constraints have limited new development. In other cities, high demand and low interest rates have pushed prices out of reach for buyers.

In Australia, supply has consistently lagged demand, with current vacancy rates below pre-pandemic levels. While in South Korea, Seoul house prices grew by almost 70% between 2018 and 2021 due to low mortgage rates and ample market liquidity4. It now takes 10-15 years of income to buy a home in Australia, Japan and South Korea.

Rising interest rates will further erode affordability. As such, renting a home is often more feasible than buying a home, particularly for young professionals at the outset of their career. Renting remains considerably more affordable, with average rents for apartments in multifamily housing buildings in Japan and South Korea accounting for 20-25% of average monthly wages, compared to 40-50% of monthly income for mortgage payments5.

Changing mindsets

Historically, people and governments in Asia have leaned towards home ownership. However, the proportion of renters has grown steadily in the last decade6. In Japan and South Korea, over half of all households now rent rather than buy their homes. This is driven by affordability constraints as well as changing mindsets.

With more people remaining single and couples, childless, in Japan and South Korea7, the propensity to buy a home in a permanent location, near to schools has naturally waned. Moreover, renting has become increasingly normalised among younger generations, offering the benefit of flexibility and freedom from the costs and responsibilities associated with home ownership.

Governments’ mindsets are also shifting, in order to tackle housing issues. To this end, governments in Singapore, Hong Kong, Australia and Korea have increased stamp duty in the last decade to reduce the number of individual ‘mom-and-pop’ landlords investing in residential, in an effort to manage price escalation.

Promoting growth of the rental sector is another strand of this. For example, the Chinese government has encouraged young families to consider renting rather than buying in the past five years by granting tenants the same access to public services as home owners, including education and healthcare resources. Since 2017, the government has zoned hundreds of sites for rental residential, delivering over 200,000 multifamily units. South Korea, meanwhile, introduced rental housing REITs in late 2015 to encourage investment into rental housing.

A potentially scalable opportunity

Further changes in government policies and taxes in 2023 to incentivise the development of rental housing are signposts that the rental residential sector may develop into a deep, scalable sector suitable for institutional investment in the coming decades. Australia has reduced land and withholding taxes to encourage Build to Rent (BTR) projects, while South Korea has adjusted building regulations to allow shared accommodation facilities to be built outside of schools/factories8.

Outside of Japan, which has become an established multifamily housing market over the last decade, institutional-quality rental housing markets are beginning to develop in other parts of the region.

Until recently, most developers operated build-to-sell models, selling apartment units to individuals prior to completion, while renters have generally leased units from individual landlords. However, market dynamics are changing.

Australia’s Build to Rent market continues to develop

Australia’s BTR market began to gain traction after stamp duty hikes for foreign buyers in 2019 prompted developers to repurpose unsold apartments for rent. This opened up the market for institutional investment into newly completed and development BTR projects.

Australia’s deep rental pool is expected to expand as a result of favourable immigration policies and a recovery of international student demand. We expect these fundamentals to drive strong rental growth and continued institutionalisation of the Private Rented Sector over time.

South Korea – an emerging market

In South Korea, existing structural barriers are dissipating, allowing institutionalisation of the rental residential sector. Developers’ build-to-sell model is facing disruption as renters start to shift from ‘Jeonsei’9 – a lump sum rent deposit system – to monthly rent, impacting individual landlords’ purchase ability. The repercussions of higher interest rates are similarly affecting the for-sale model.

Within the rental market, tenants are starting to recognise the value proposition of institutionalised multifamily housing with professional property management, amenities, legal safeguards and certainty of tenure renewal, as evidenced by the success of new co-living projects developed in Seoul in the last two years. These schemes have secured high occupancies and above-market rents. We expect multifamily investment opportunities to emerge gradually as renters become familiar with the sector, offering attractive income yields and sustained growth potential.

Significant headroom for growth

We believe there is significant headroom for the institutional rental housing sector in APAC to grow, particularly in more nascent markets such as Australia and South Korea, considering institutional multifamily assets make up 40% of the rental residential market in the US – the world’s largest market10.

As the various APAC rental residential markets continue to mature, yields could potentially compress, allowing investors to capture low volatility combined with value appreciation. Over the next decade, we think that residential investments could grow 2.5x, potentially accounting for around 12-15% of total APAC investment volumes. As such, we believe the Living sector is likely to become a core, liquid asset class in the next decade.

1United Nations World Urbanisation Prospects, as at June 2023.

2Australian Department of Home Affairs, Ministry of Foreign Affairs of Japan, as at July 2023.

3MLIT (Japan), MOLIT (Korea), as at June 2023; Australia Centre for Population, as at July 2023.

4Source: Korea Real Estate Board, as at June 2023.

5MLIT (Japan), MOLIT (Korea), as at June 2023.

6In Australia, the proportion of households renting has increased from 20% in 2000 to 30% in 2022. Similarly, the ratio of rental households in Tokyo went up from 50% to 55% over the past decade. Source: Australian Bureau of Statistics, Statistics Japan, as at June 2023.

7MLIT (Japan), MOLIT (Korea), as at June 2023.

8The Australian government has announced that the withholding tax on foreign capital investing into the BTR sector through MIT structures will be reduced from 30% to 15% and take effect after July 2024. Besides introducing rental housing REITS, the Korean government has adjusted building regulations to allow shared accommodation facilities to be built outside of schools/factories. Source: National statistics, as at July 2023.

9In South Korea’s Jeonse system, tenants pay landlords a large lump-sum deposit (usually about 70-80% of the property value) which is returned when the tenancy ends. As interest rates have risen in the last year, home prices and rents have declined. In some instances, over-levered landlords have been unable to return full deposits and cases of deposit fraud have been reported. Source: various news articles, as at June 2023.

10Savills, as at June 2023