Our focus this quarter was on China’s economic and regulatory policy changes and what they mean for our portfolios. We also discussed how we in Asset Management are addressing the data challenges in sustainable investing and building robust frameworks moving forward. See the full overview below.

What is QIF?

The Quarterly Investment Forum (QIF) is an ongoing cross-investment team discussion and debate about the most relevant active risks in major markets and across asset classes and funds.

Each QIF is a mix of ‘top down’ and ‘bottom up’ perspectives, beginning with a ‘top down’ discussion of the major macroeconomic themes identified by the Asset Allocation Team. Each quarter, a rotating roster of portfolio managers present a ‘bottom up’ view of major active risks in their portfolios.

We have a unique depth and breadth of investment expertise across traditional and alternative asset classes in all regions globally. The QIF leverages that expertise through regular, structured communication between investment teams. The ultimate goal is to improve client outcomes.

3Q 2021 Quarterly Investment Forum highlights

Macroeconomic and market outlook: Economy is decelerating, not deteriorating

Nicole Goldberger, Head of Growth Multi-Asset Portfolios

Macro update

Though the global economy is decelerating, it is far from deteriorating. Investors are too pessimistic on the outlook for real activity in the remainder of this year and into 2022.

To the extent that economic momentum has decelerated more than anticipated recently, we believe it will be made back up in the fourth quarter or early 2022.

We believe that the conditions are in place for a transition to above-trend growth led by the private sector. Leading indicators for business investment remain elevated. Companies have a need to replenish lean levels of inventories. And finally, demand is buoyed by a resilient consumer, still flush with excess savings and benefitting from healthy growth in labor income. Headwinds from the Delta variant are poised to lessen in intensity. So too is China’s credit impulse slated to stabilize. These factors will likely more than offset the negative effects of fiscal drag.

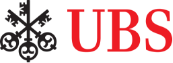

Exhibit 1: Growth in China likely to stabilize sequentially in Q4 relative to Q3

Source: UBS Asset Management. As of August, 2021.

Exhibit 1: Growth in China likely to stabilize sequentially in Q4 relative to Q3. Charts residential mortgage backed loans, shadow banking, corporate bonds, government bonds and total social financing excluding equity in the China market from January 2008 through August 2021.

Of course, there are plenty of risks that demand close monitoring and could undermine this supportive backdrop. These include ongoing legislative debates on US fiscal policy as well as the debt ceiling, the potential that the slowdown in China is more severe or prolonged than we anticipate, and the possibility that inflation expectations could become unanchored to the upside amid continued supply chain stresses.

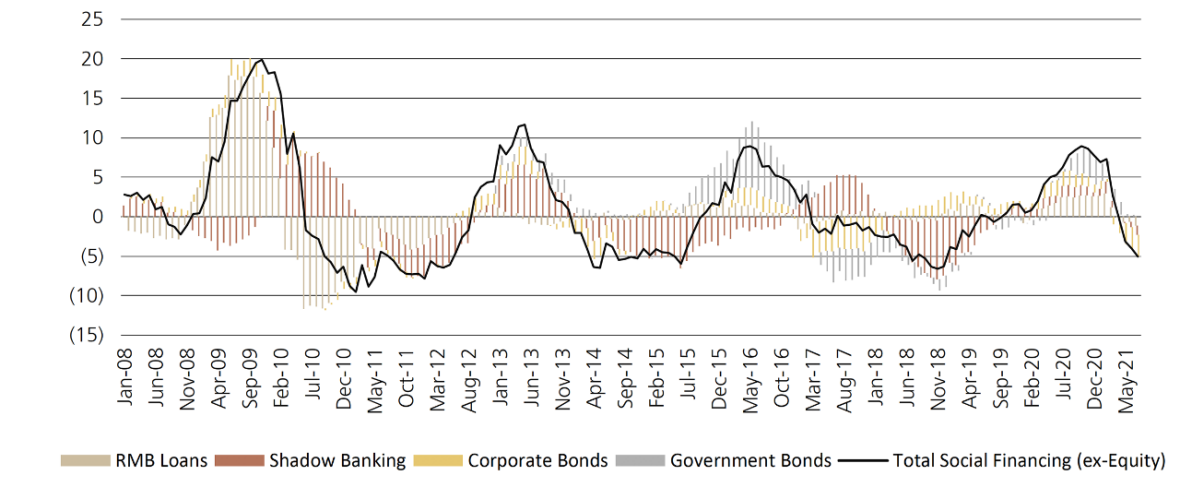

Exhibit 2: How much have pro-cyclical trades retraced since their peak?

Equities have corrected more than yields and spreads; particularly US HY

Retracement of peak risk on move since Nov. 6

Source: UBS Asset Management. As of September, 2021.

Exhibit 2: How much have pro-cyclical trades retraced since their peak? Equities have corrected more than yields and spreads; particularly US HY. A bar chart that tracks the retracement of various asset classes from the peak risk on November 6 2020 through September 2021. Categories are Russel 2000 vs S&P 500, MSCI World Value vs. growth, Stoxx Euro 50 vs. MSCI World, MSCI Japan vs. MSCI World, EMFX, 10-year US Treasury yield, 10-year US breakeven, 10-year bund yield, US high yield spreads.

We believe that the procyclical trade set looks very attractive into year-end given our positive outlook for activity. The equity market internals and low level of bond yields are pricing in too much of a growth slowdown, in our view. We see cyclical regions like Europe and Japan and sectors such as energy and financials to be inexpensive relative to defensive sectors, particularly at a time in which global activity may be set to re-accelerate. In rates, we favor Chinese sovereign bonds for the combination of carry premium and scope for compression. Asian high yield is the most attractive area in credit, in our view. We think investors are well compensated for the risk and volatility that comes along with this market. In currencies, we are neutral on the US dollar, and consider short dollar positions to be the least attractive expression of reflationary trades. Higher real yields, which is our base case, tend to coincide with a stronger greenback.

Opportunities in Chinese markets

John Bradshaw, Portfolio Manager, UBS O’Connor

Hayden Briscoe, Head of Fixed Income, Global Emerging Markets and Asia Pacific

Manish Modi, Portfolio Manager

Evergrande has commanded most of the attention as of late in Chinese and global markets. The indebted real estate developer’s plight is symptomatic of a change in the way Chinese policymakers are looking at the level of debt in the system and a higher tolerance for the potential negative economic ramifications associated with deleveraging.

The property market is too large a share of GDP for Chinese policymakers to allow for too much pain and risk triggering a more serious slowdown. And China has a strong track record of resolving high-profile corporate issues without allowing them to morph into systemic risks. We believe that a turn in Chinese macro policy support to allay and reverse the slowdown is likely, which should help both domestic assets as well as emerging market currencies and commodities broadly. Stronger players in real estate will likely have a good runway of opportunity as this soft patch ends and sector consolidation ensues. Based on the premise that in China, the government will ultimately be practical and back off on policy tightening, financials appear to be among the prime beneficiaries.

In the meantime, the moderation in activity suggests that Chinese government bonds remain attractive, and yields should move lower from 2.85% towards 2.5%. International investors are still positive on the diversification and defensive capabilities of Chinese government bonds. As a barbell to broad risk exposure, portfolios have typically needed a government bond holding that can decline 200 basis points when negative shocks hit. Chinese government debt is one of the few options among sovereigns that has that amount of scope for compression.

Beyond Evergrande, an ongoing regulatory campaign has weighed on parts of the Chinese equity market. The aim is populist in nature, to bring certain sectors more in alignment with the policy objectives of the authorities, most notably “common prosperity.” Controlling exposure to industries at risk of further regulatory tightening and waiting for a move in their favor is a prudent course of action.

In our view, two themes that may be useful in identifying stock-market winners in China over the medium term are the transition to more service-oriented growth and premiumization of goods and services (consumer moving towards higher-end products as income levels rise). The key is to find companies who are able to create and maintain their own moat, not those whose operational advantages are tied to government policy, because we’ve seen how quickly that can change. As a general rule, if companies are overearning because of a lack of competition or abusing pricing power, governments may step in and take their share of the market.

Long/short equity hedge fund strategies have recently performed quite well in China because of the high degree of dispersion in the market in the past few months. Over the long term, we expect Chinese equities to serve as a large source of structural alpha. Many opportunities are created due to the high degree of participation by retail investors, the lack of in-depth analyst coverage of many companies, and regulatory reforms that allow for more access to Chinese equities from the short side.

Building robust frameworks for sustainable investing

Adam Gustafsson, Quantitative Evidence and Data Science (QED)

Michele Gambera, Co-Head of Strategic Asset Allocation Modeling

In this panel discussion, participants detailed two papers – one published, one upcoming – from UBS Asset Management that provide guidance on how to better incorporate ESG considerations from both the bottom-up and top-down perspectives.

The Value of a Green Transition provides a methodology for bringing environmental externalities into corporate valuations. It provides a framework for answering, “How aggressively should companies be investing to mitigate emissions in order to maximize shareholder value?”

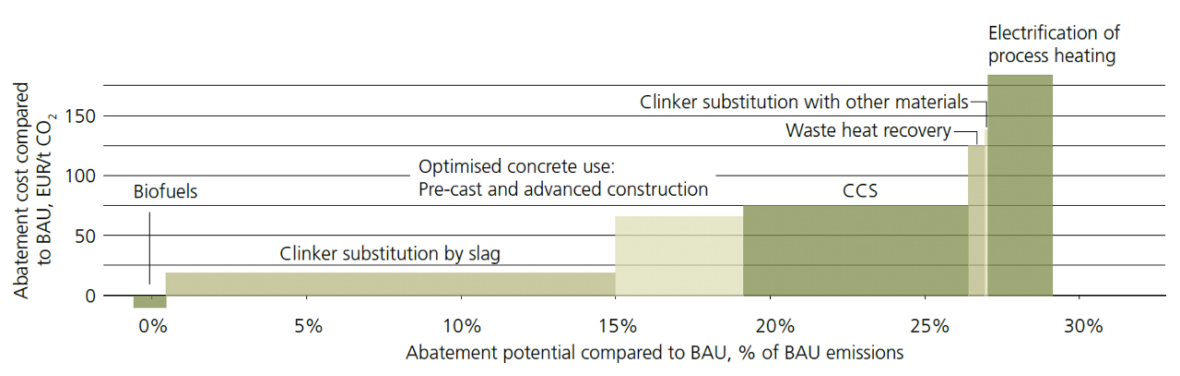

Exhibit 3: Marginal Abatement Cost Curve (MACC)

Illustrates the link between emission abatement investments and cost reduction

Source: Material Economics, UBS Asset Management. As of June 30, 2021.

Exhibit 2: How much have pro-cyclical trades retraced since their peak? Equities have corrected more than yields and spreads; particularly US HY. A bar chart that tracks the retracement of various asset classes from the peak risk on November 6 2020 through September 2021. Categories are Russel 2000 vs S&P 500, MSCI World Value vs. growth, Stoxx Euro 50 vs. MSCI World, MSCI Japan vs. MSCI World, EMFX, 10-year US Treasury yield, 10-year US breakeven, 10-year bund yield, US high yield spreads.

One key finding is that for European steel and cement companies, material emission reductions are self-funded, even value accretive under the EU Emissions Trading System (EU ETS). The paper reinforces that only investing in “good” is no longer good enough. Efforts to change attitudes and actions among heavier-emitting industries are critical to achieving material progress on mitigating climate change.

A separate upcoming paper, Asset Allocation with ESG, details a novel framework for investors on how to apply ESG at the portfolio level. It states that the traditional risk and return dimensions need to be augmented with time (the duration of the ESG transition in progress) and preferences (how much investors prioritize sustainability). The primary conclusion is that using conventional ESG benchmarks to build portfolios does not have any negative trade-off in terms of risk and return. In fact, over shorter time horizons, early adopters may be well-positioned to outperform as ESG assets are bid up.