Given that the current downturn really is global, we are struck by the gap between optimistic equity analyst views and the caution voiced by economists. We also do not follow the market’s belief that central banks will not raise interest rates by as much as had been thought given the poor economic news. Can the end of their rate rising cycle already be in sight?

Not for us. Inflation is unlikely to fade quickly enough. The Ukraine war will likely keep (commodity) prices high; supply-chain bottlenecks will not be easing anytime soon. High house prices will likely keep pressure on rents for months to come. Wage demands are rising in response to a tight labour market and high inflation.

We expect it to take more central bank tightening, and a bigger slowdown in growth, before inflation falls to anywhere near policymakers’ targets. Consequently, we are underweight duration.

Earnings season

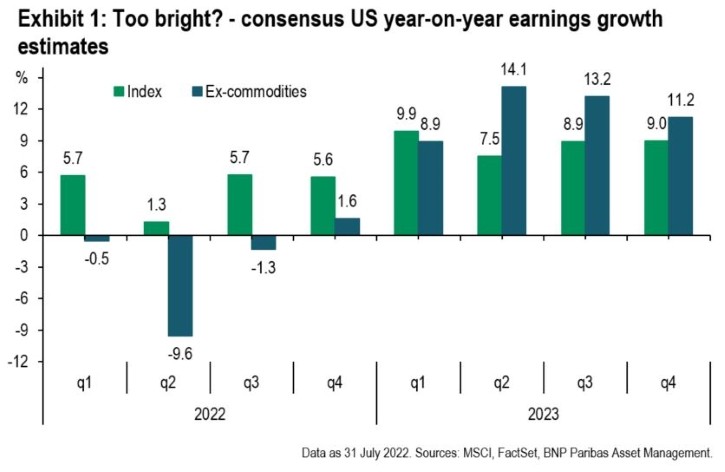

In this context, the latest earnings season has nonetheless been encouraging. Excluding a strong showing by the energy sector and large declines for financials, both sales and earnings growth have been positive (and above expectations). We do not think this can last. Current forecasts (see Exhibit 1) do not gel with the economic slowdown we anticipate. Earnings will likely fall and equity prices should follow suit.

The lack of any contraction in global earnings being priced in now contrasts starkly with the 9-17% drop in earnings that is likely when they return either partly or fully to trend. A 9% fall places the price/earnings ratio at 16.3x for the MSCI US – roughly where it is today. A larger 17% fall is consistent with a P/E of around 19.5x, while a meaningful recession could see a 35% drop in earnings.

Portfolio adjustments

Our multi-asset portfolios are cautiously positioned: we are seeking to increase risk gradually in areas such as high-grade corporate credit and commodities, while we are underweight duration and neutral on equities.

We made four changes to portfolio positioning during the month:

- First, we upgraded credit to ‘favour’, looking in particular at European investment-grade credit where distress is now pronounced and where the valuation opportunity looks increasingly attractive. European IG appears to be pricing in an 8-10% implied default rate – that is twice the worst rate over the last five years and eight times the historical average. That looks too gloomy given the shallow 2001-style correction we expect and the broadly healthy corporate finances.

- Second, in European duration, we tactically deepened our short. Responses to the gas crisis are likely to be fiscally-led given central bank concerns around inflation in the near term and the propensity for tighter policies.

- Third, we deepened our tactical exposure to commodities. Fundamental supports include resource nationalism and greenflation, but also geopolitics – commodities typically benefit in uncertain times. There is also a clear scarcity of supply. Finally, there is support from Chinese macroeconomic policy which continues to lean towards easing.

- Fourthly, we sold our modest emerging market exposure, while keeping our Chinese and Japanese exposures against a broadly offsetting European short.

Asset class views

Disclaimer

![]()