The Global Natural Resources Team discusses the highlights of their recent study into avoided emissions and the implications for investors.

Global decarbonisation necessitates the increased use of carbon-intensive commodities like copper, steel, aluminium, lithium and blue-hydrogen to name a few. But increased demand for these commodities could also increase the absolute greenhouse gas (GHG) emissions for some companies in the short-to-medium term. As these ‘enabling’ industries focus on reducing the different types of carbon emissions (Scope 1, 2 and 3) that a company creates over the medium-to-longer-term, investors should not lose sight of the positive societal impacts from the ‘avoided emissions’ associated with the increased customer use of products and services derived from these commodities and the products that they make possible.

What are avoided emissions and why is it important to measure them?

Avoided emissions, also known as Scope 4 emissions, go beyond Scope 1,2 and 3 emissions, providing additional ‘colour’ on the real-world outcomes from the products or services of a particular company. This includes helping customers and suppliers reduce their carbon footprint, which also encourages innovation. For example, copper cables that transmit renewable electrons, the use of recyclable packaging, a laundry detergent that can be used at lower temperatures, or renewable diesel that has a lower carbon footprint compared to regular fossil diesel.

“Avoided emissions are emission reductions that occur outside of a product’s lifecycle or value chain, but as a result of the use of that product. Other terms used to describe avoided emissions include climate positive, net-positive accounting, and Scope 4.”

European Copper Institute

Identifying, setting targets, measuring and reporting avoided emissions can, in our view, be a source of competitive advantage for companies, adding to the overall body of evidence to back up a company’s sustainability impacts, claims and targets.

Understanding avoided emissions provides a more holistic view of total emissions and can be reported and measured at multiple levels (investment portfolio, enterprise or product/service). As such, avoided emissions can assist consumers, investors and other stakeholders make more informed decisions.

There are a multitude of reasons for measuring and reporting avoided emissions, including:

- A useful measure of real-world outcomes occurring outside of an organisation’s value chain and beyond efforts to reduce Scope 1, 2 and 3 emissions.

- Help consumers understand the impact of the use of a product and encourage the consumption of less carbon-intensive products and services.

- Provide a basis for corporations to make claims about the positive GHG impacts of their products or services, relative to the situation where those products do not exist.

- Provide a basis for investors to accurately identify and support sustainable investment opportunities that underpin their own net zero commitments and portfolio-level carbon intensity metrics.

Who is measuring and reporting avoided emissions?

Over the past decade there has been a growing number of companies across various sectors, including Stora Enso, Air Products, Walmart, Neste, Linde, BT, as well as financial organisations measuring and reporting avoided emissions. Most of the focus is at a single-product level, but increasingly companies are attempting to assess avoided emissions at an enterprise and investment portfolio level. From an investor perspective, the measurement and reporting at an enterprise level and portfolio level is more relevant.

Figure 1: Avoided emissions can be measured and reported at three levels

Case Study – Stora Enso measuring its positive climate handprint

Stora Enso is a leading global provider of renewable solutions in packaging, biomaterials and wooden construction products. In 2022, with support from the Swedish University of Agricultural Sciences, a company-wide climate impact calculation was published, showing the ‘substitution’ of fossil fuels from its products.

Stora Enso’s Packaging Materials Division (PMD) also participated in a similar project led by VTT Technical Research Centre of Finland and LUT University. The project assessed the wider positive impacts (handprints) for water, nutrients, air quality, resource efficiency, and carbon at project and company levels.

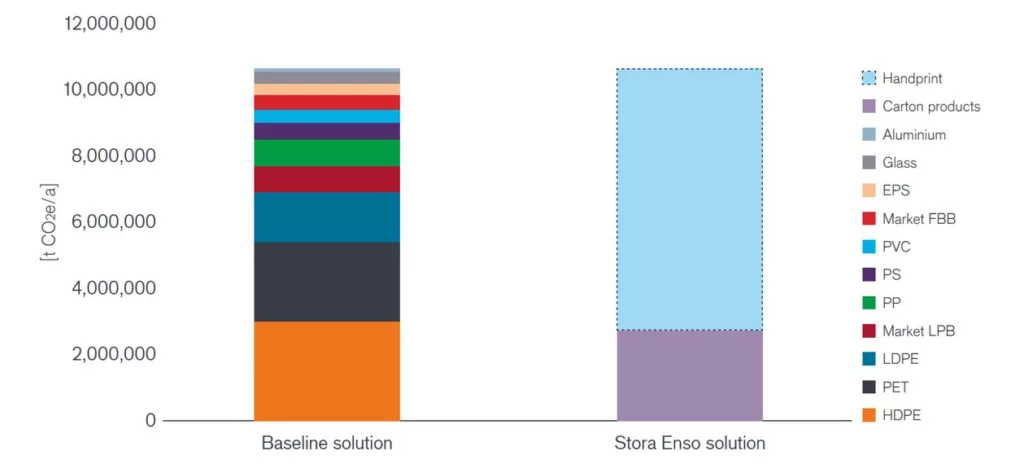

While the handprint should be treated as purely indicative, due to uncertainty resulting from several assumptions, the results showed there is large potential for reduced carbon footprints from using Stora Enso’s paperboard packaging materials.

Figure 2: Handprint of Stora Enso’s Packaging Materials Division’s European Business Units (handprint = difference between the footprints of the existing solutions)

The opportunity for investors

The lack of financial sector avoided emissions related standards and data creates potential informational inefficiencies for investors. As a result, investors may miss opportunities to invest in companies whose full contribution to decarbonisation is underappreciated. Investors could also find they have invested in companies that have used avoided emissions metrics inappropriately, which can be associated with greenwashing.

In the absence of internationally-accepted standards, investors have an opportunity to collaborate with companies by providing guidance on their expectations with respect to the measuring and reporting of avoided emissions at an enterprise and portfolio level. For example, there may be appetite for leading investors to collaborate via an existing forum (eg. GHG Protocol, the UN Principles for Responsible Investment, Partnership for Carbon Accounting Financials) to appoint a competent organisation (eg. World Resources Institute, WRI) to engage with a range of financial sector stakeholders with the aim of co-developing avoided emissions ‘best practice’ frameworks and principles relevant for investors.

For a copy of the full white paper please contact your regional Janus Henderson representative.

Acknowledgements

This paper has been prepared by Janus Henderson Investors in collaboration with ISS ESG and participating companies, Stora Enso and Air Products. The data and analysis presented in the case studies was prepared by the latter. We would also like to acknowledge the contributions of the participating companies, the initial research undertaken for this project by University of Sydney Masters student Victoria Calderbank, and the paper’s principal author, Mark Lyster, a sustainability expert specialising in business strategy, ESG risk, climate change, human rights and sustainable finance.

Definitions:

Scope 1 emissions are direct emissions from company-owned and controlled assets; Scope 2 are indirect emissions from the generation of purchased energy, from a utility provider; Scope 3 are indirect emissions (not included in scope 2) that occur in the value chain of a company and occur as a consequence of the activities of a facility, but from sources not owned or controlled by that facility’s business.

Carbon footprint: the sum of GHG emissions and removals in a product system expressed as CO2e and based on an LCA using the single-impact category for climate change.

Carbon handprint: an indicator of the climate change mitigation potential. Describes the GHG emission reduction in a user’s activities that occurs when the user replaces a baseline solution with the offered solution.

CO2e: carbon dioxide equivalent is a term for describing different greenhouse gases in a common unit. For any quantity and type of greenhouse gas, CO2e signifies the amount of CO2 which would have the equivalent global warming impact.

Net zero: achieving a balance between greenhouse gases emitted into the atmosphere and those removed from the atmosphere.