Relief rally in equities shows a change in market leadership; backdrop for the recently bullish dollar could shift

Snapshot

Investors eager to call the top in US bond yields are increasingly frustrated with US Federal Reserve (Fed) Chair Jerome Powell’s unwillingness to give hints of a pause or slowing of rate hikes. But why would he, given the Fed’s desire to keep financial conditions tight to slow demand and bring inflation down? So far, labour markets remain robust, and there is scant evidence of inflation rolling over, so the aggressive tightening of monetary policy is probably still sensible. Notably, it does not appear that markets were nearly as wrong-footed following the Federal Open Market Committee’s (FOMC) November meeting compared to late August when Powell aimed to dispel the myth of a pause or pivot, which sent the S&P down by more than 14% through the end of September.

Outside of deepening systemic turmoil, the marginal seller has likely already sold and many wait anxiously on any sign of a recovery in risk appetite, aiming not to be left behind if markets give back some of the drawdown from an horrendous year across almost all asset classes. Markets are, not surprisingly, very jumpy on this premise and have the potential to squeeze higher, in our view. Earnings across big tech were poor, which seems to have broken the façade of being a “safe asset”, and the rotation to value and under-loved opportunities seems poised to continue. Is China soon to re-open? We would not count on it yet, but this eventual outcome is likely to change the opportunity set in the months ahead.

The dollar, as measured by the DXY index, has risen almost inexorably. It is up 16% year-to-date (YTD) on Fed tightening, slowing global growth, and partly the perception of the US being the “least dirty shirt”. However, as extreme hawkishness is baked into the price and many investors have simply given up on China, the backdrop for the dollar could shift. Peak dollar is likely coming, which is potentially bullish for risk assets—but likely not for the winners of the last decade.

Cross-asset 1

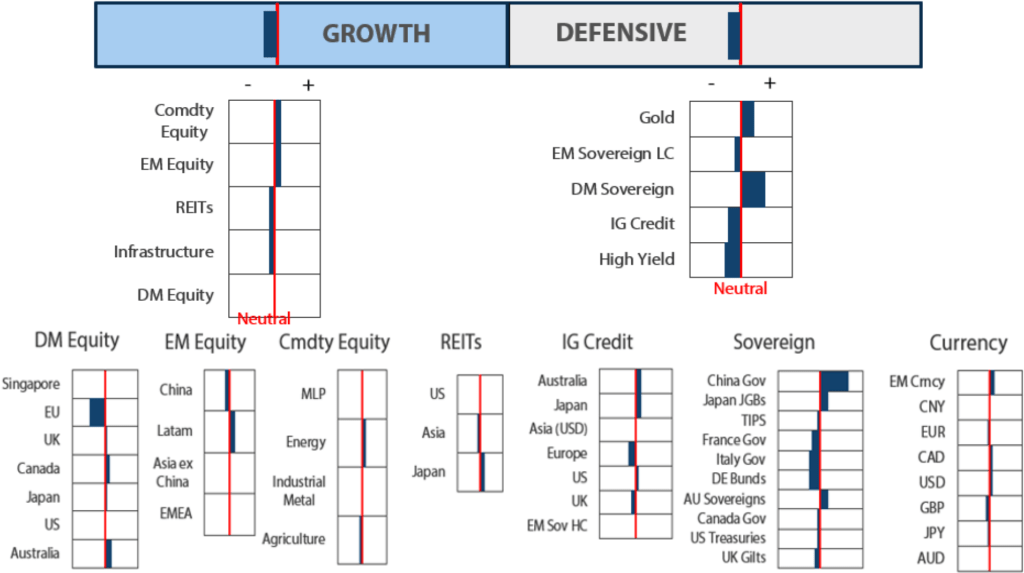

We marginally reduced our underweight position to both growth and defensive assets. Global equities found some relief and global rates recovered marginally from recent highs. Interestingly, the relief rally in equities brought with it a significant change in leadership from that experienced last summer. This time, value sectors outperformed growth sectors while energy made a particularly strong comeback. What has changed? Earnings for one as big tech has finally shown its vulnerability to the tightening cycle and slowing demand. Meanwhile, “still-okay” demand lends natural support to value-tilted sectors.

On the energy side, blockbuster earnings growth is showing few signs of dampening demand while the supply side looks to be still constrained by the following factors: 1) Organization of the Petroleum Exporting Countries Plus (OPEC+) opting to cut production, 2) the US Strategic Petroleum Supply (SPR) release likely coming to a close (or dramatically slowing down) in November and 3) price caps on Russian oil exports expected to curtail global oil supply in December. This may be bullish for oil prices but may also make the central banks’ jobs more difficult in their quest to take down inflation. Central banks may be prepared to slow the pace of tightening but are far from any kind of pivot when tight financial conditions are still required to ultimately soften demand. Of course, much still depends on upcoming inflation data.

Within equities, we lowered scores for listed infrastructure and REITs and redistributed evenly across the rest. Given the sudden rise in volatility, at least partly sparked by the liquidations in UK pension plans, we are on the lookout for opportunities as these dislocations eventually normalise. We maintained relative weights across our defensive assets, favouring developed markets (DM) sovereign and gold over high yield and investment grade (IG) credit.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

Research views

Growth assets

Markets remain manic from “hope”—both in its destruction (based on a datapoint or a Fed speech) and rebirth when too much pessimism may have been baked into market sentiment when a plausible “less bad” datapoint starts the sentiment cycle anew. In this sense, sequence matters. This month, Fed Chair Powell seemed hellbent on quashing any last hope of a pivot or at least slowing the pace of rate hikes sometime soon. But this crushing blow to hope helped sow the seeds of an eyewatering rally when one inflation print showed some promise—hence, the manic cycle continues.

We are still negative on S&P 500 (SPX) prospects into 2023, but we would not be surprised to see a rally continue as the “hope genie” is out of the bottle, and despite several FOMC governors reminding markets that this was “just one data point”, the genie remains out for now and could have further to run markets to the upside. We also have another bullish take—that peak dollar may finally be here or just behind us, which is positive for risk assets into 2023.

Our signposts for passing peak dollar are 1) any form of pivot by the Fed and/or 2) slowing relative growth in the form of a weaker US economy or improving growth elsewhere. Today, the Fed has yet to pivot, but growth prospects are improving as China appears to be on the cusp of shifting away from zero tolerance policies toward COVID-19 and finally addressing the problems in its property market more seriously.

Does the Fed need to pivot to complete the sequence to a weaker dollar? A pivot would certainly firm our conviction, but it is not a requirement, in our view. Note, we believe the dollar has remained strong for these reasons: 1) fast monetary tightening, 2) weaker global growth prospects and 3) a perception of the US being the “least dirty shirt” having attracted massive flows (accelerating in 2015), which is yet to fully abate. With better growth prospects elsewhere attracting investment flows away from the US, we think the tidal reversal could be quite strong—weakening the dollar despite slowing growth and a still hawkish Fed. We are yet to be fully convicted on this view, but we see the probabilities of such a reversal on the rise.

Still, we are bearish on the long-term prospects for SPX, as we believe it continues to be overvalued for dimmer earnings prospects that lie ahead. However, as by far the largest capital market in the world, we know that global equities can still be batted around on SPX volatility, which is why we see SPX hedges as a protective factor for portfolios, as they are the most liquid instruments in the world and also the most direct protector against portfolio volatility in an environment that continues to be plagued with high levels of uncertainty.

The mitigation of risks through options strategies

Options strategies can make sense to mitigate portfolio risk while also expressing our view on market outcomes over the longer term. As noted above, SPX options are the most liquid instruments that also happen to be the best mitigator of portfolio risk given the high correlation. However, in our view a hedging strategy makes the most sense if one sees further downside for the instrument chosen—which we do.

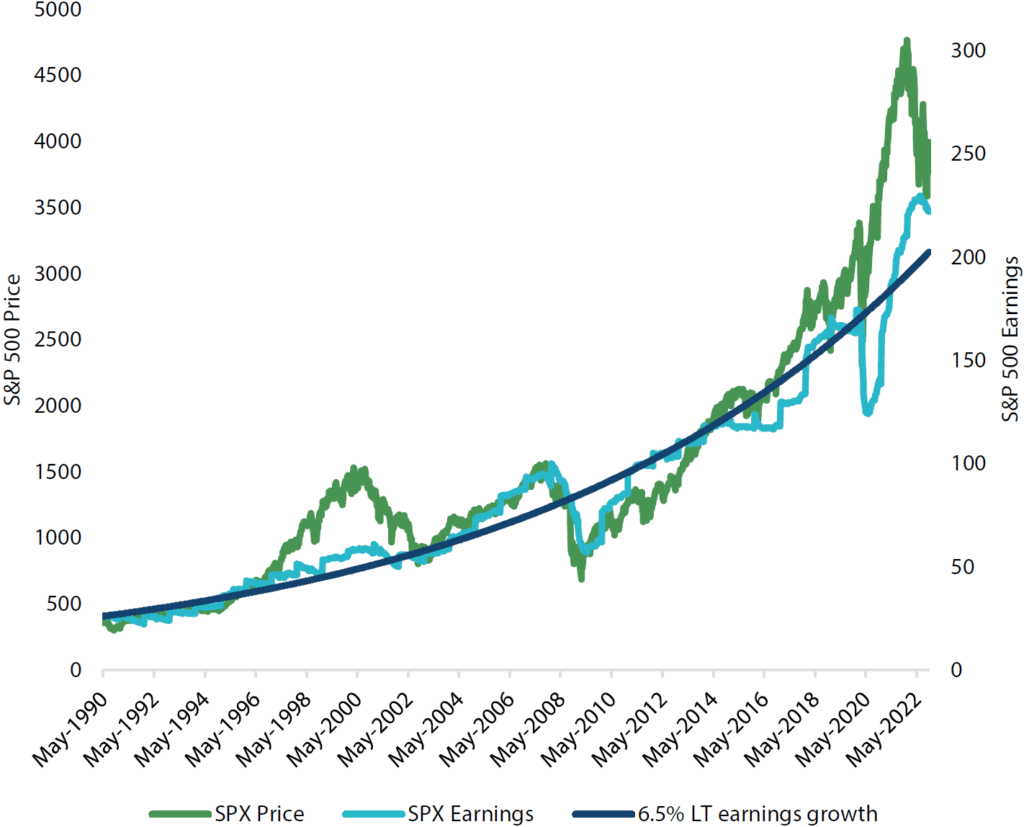

Yes, SPX looks more attractive than where we started at the beginning of the year, but we still see further downside—both for price and earnings. Price follows earnings over the long-term, and long-term earnings growth from 1990 is about 6.5% per annum. The COVID-driven outsized stimulus lifted earnings (and price) significantly above-trend, and while price has derated, the decline in earnings has just begun. This is a simplistic analysis, but broadly speaking SPX looks closer to fair value at 3,000 than 4,000, particularly if there is a recession on the horizon.

Chart 1: S&P 500 price and earnings (still above trend)

We are bearish on SPX into next year, but we see better prospects outside of the largest caps, both in the US and abroad. We believe inflation will not return to historical norms any time soon, but this does not weigh on our optimism for other equity assets that have been incredibly battered by negative sentiment mainly emanating from a uber hawkish Fed, a strong dollar and a stubborn China that has been slow to shift its approach toward COVID-19 and also adequately dealing with the property crisis. However, the tides are changing.

We favour an options strategy utilising SPX derivatives, dampening portfolio volatility and protecting against downside while allowing for upside optionality in the assets where we see the best growth prospects. We have a diversified view regarding options strategies, favouring combining option puts and covered calls at various tenors to follow an expected trajectory, which for SPX is eventually at a lower level from here. We believe that combining options in this way helps to mitigate costs while offering the right degree of protection that is sensible in a variety of market environments and scenarios.

Conviction views on growth assets

- Favour Australia and Canada: We like these two markets for their value characteristics, their direct exposure to commodity-linked equities which we see as having further upside and reasonably priced financials sectors that provide defensive characteristics to the overall portfolio.

- Increasingly constructive on commodity-linked equities: Better prospects for China ahead and continued supply-side constraints—both for energy and metals—provide interesting opportunities going forward.

- US dollar agnostic: For now, we have tempered our view regarding dollar hedges. The dollar has been a strong risk-mitigator YTD, but this characteristic is fading as its momentum is beginning to wane. At this point, we consider other assets like emerging market bonds that can add to yield while benefiting from a weaker dollar. Dollar hedges can always be added as necessary.

Defensive assets

Our cautious view on sovereign bonds remains unchanged. While central banks continue to front-load their monetary policy tightening, some have chosen to reduce the magnitude of those hikes in recent meetings. This has led to renewed market speculation on both the future pace of tightening and the eventual terminal rates. At the same time, inflation in many countries is still sitting at multi-decade highs, suggesting that central banks have further work to do in the face of potentially slower growth outcomes.

IG credit returns have been volatile as underlying benchmark yields gyrate from one day to the next. Spreads for both IG and high yield credits have also continued to trend wider as investors worry about the global growth outlook. As global monetary policy continues to tighten, the cumulative effect of rate hikes will work to slow demand and make it challenging for companies to maintain strong credit quality.

Gold has been under pressure due to a relentless rise in real yields and a stronger dollar. Even so, gold has been relatively resilient given those headwinds and the historical relationship between these factors. We view gold as an inexpensive hedge against rising geopolitical risk, sticky inflation, and potential systematic risks arising from the aggressive tightening of financial conditions by central banks.

Global comparisons favour Australian sovereign bonds

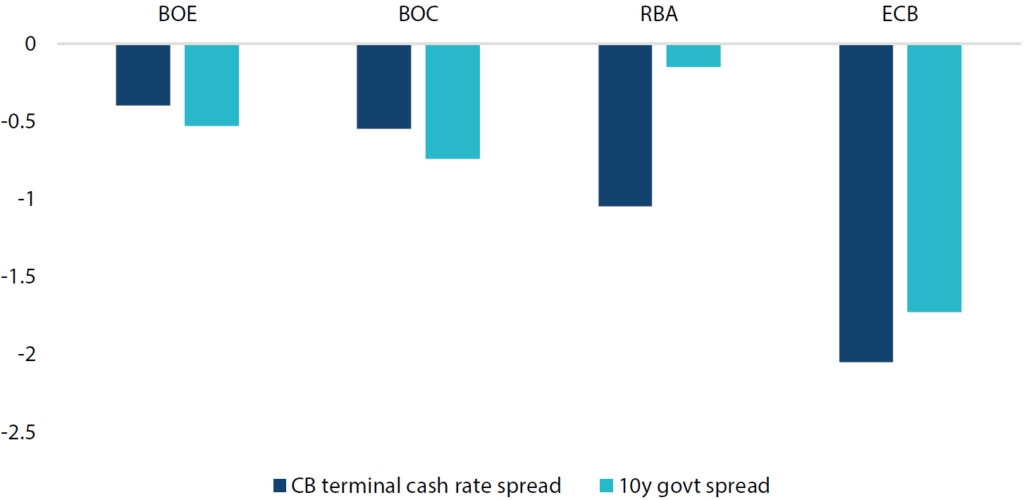

While central bank policy is a key factor that drives our outlook for the overall direction of global bond yields, it can also provide guidance on the relative attractiveness within sovereign bonds. One useful indicator is the market’s expectation for terminal cash rates. These are observed rates that are implied from derivatives pricing and tell us where the markets expect each central bank’s target cash rate to be when its tightening cycle ends. By looking at the spread between the terminal rate of one central bank versus another, it can help us evaluate where there might be relative opportunities within sovereign bonds.

In Chart 2, the dark blue bars show the spread between the target cash rates of the Bank of England (BOE), the Bank of Canada (BOC), the Reserve Bank of Australia (RBA) and the European Central Bank (ECB) relative to that of the Fed; the light green bars show the yield spreads between the respective 10-year government bonds and US Treasuries. For example, the BOE terminal rate is approximately 4.5% versus the Fed’s rate of 4.9%, resulting in a spread of -0.4% and UK 10-year gilts are yielding roughly 0.5% less than equivalent US Treasuries.

Chart 2: Central bank terminal cash rate and 10-year government bond yield spreads

The terminal rate spreads and respective 10-year yield spreads are at similar levels in the UK, Canada and Europe (represented here by German bunds). However, Australia is the exception where the RBA’s terminal cash rate is expected to be more than 1% lower than the Fed’s but its 10-year spread is only marginally negative. This divergence can be used as a signal that Australian bonds may be undervalued relative to their US counterparts. Chart 3 looks at the history of US and Australian cash rate targets versus 10-year Treasury bonds over the last 20 years.

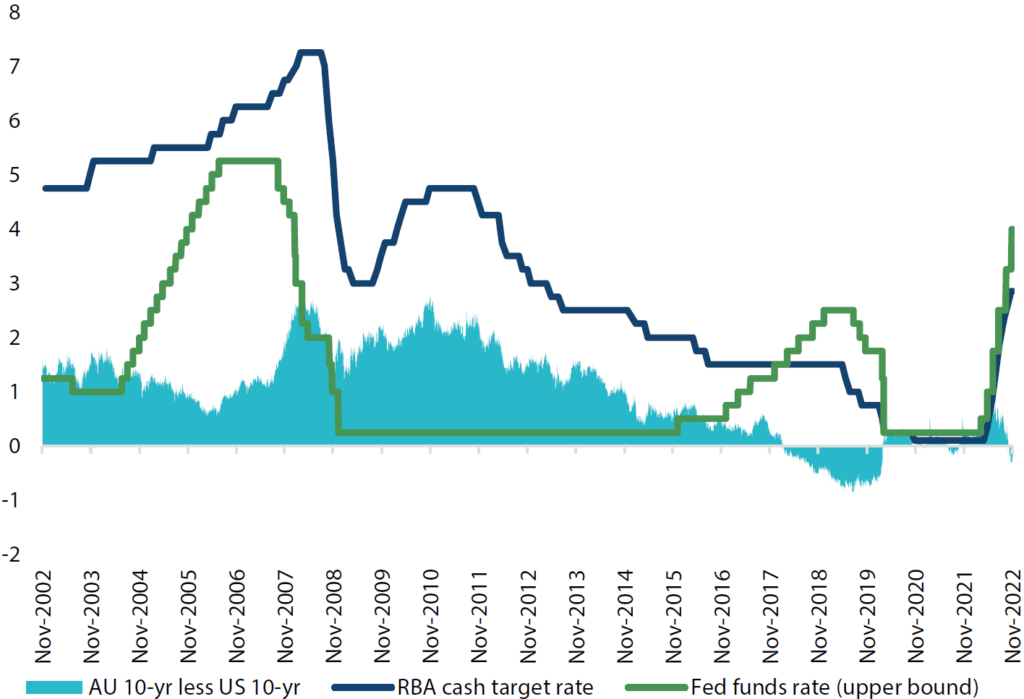

Chart 3: US and Australia cash rate targets and 10-year yield spread

We can see that Australian 10-year bonds normally have a significant yield premium over US Treasuries. However, this is also matched by a much higher RBA cash rate target over most of this period. During the one period (2018–2020) where the Fed funds rate moves significantly above the RBA’s rate, the 10-year spread also turns significantly negative. The historical precedent is quite striking, suggesting that Australian 10-year bonds have plenty of room to outperform US Treasuries assuming the current terminal rate pricing continues. We think this is quite likely as the Fed funds rate is just beginning another lengthy period where it stays above the RBA’s rate. The transmission of monetary policy in Australia is much more direct where over 60% of home mortgages are held on a floating rate basis. On top of this, a significant portion of Australia’s fixed rate mortgage are due to reset in mid-2023. For these reasons, the RBA is likely to be more cautious with its rate hikes and find its terminal rate well before the Fed is finished with its tightening cycle.

Conviction views on defensive assets

- Remain cautious on duration: Central banks have more to do in this tightening cycle as inflation remains uncomfortably high, even if markets are eager to call time on further rate hikes.

- Prefer sovereigns over credit: As global monetary policy tightening translates to slower global growth; pressures are likely to mount on corporate credit quality and spreads can continue to widen.

- Gold can continue to perform: Gold should prove to be an inexpensive hedge against rising geopolitical risk and sticky inflation, while waning strength in the dollar turns a headwind into a tailwind.

Process

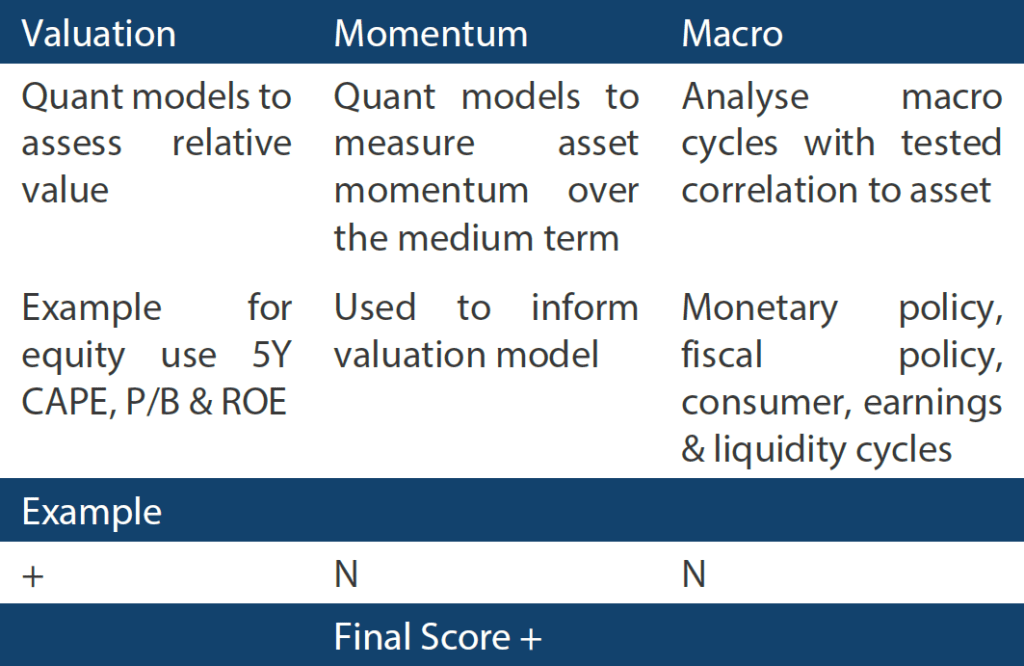

In-house research to understand the key drivers of return:

Please note that much of the content which appears on this page is intended for the use of professional investors only.