Emerging market equities and bonds offer the best prospects for investors after a brutal year for financial markets.

01 Asset allocation: the promise of emerging markets

New year, same risks?

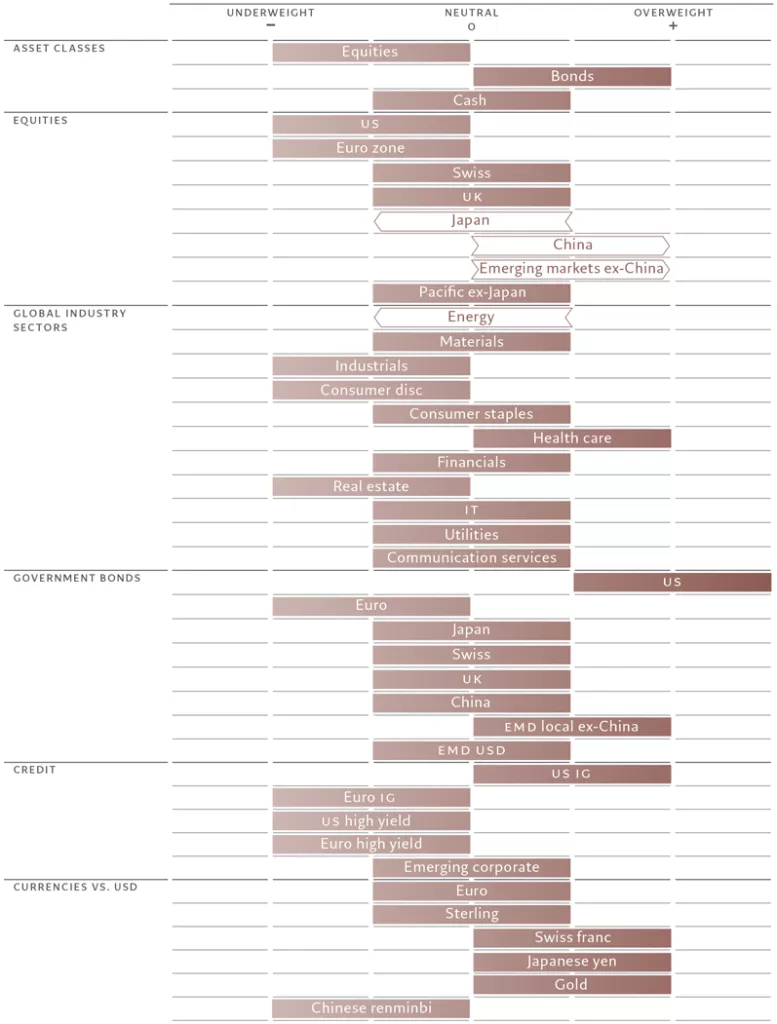

The global economy continues to face challenges – not least weak growth and tightening monetary conditions – and for this reason we have chosen to retain a defensive stance; we remain underweight equities and overweight bonds.

That said, there are encouraging developments in emerging markets.

China’s unexpectedly rapid exit from its zero-Covid policy is likely to result in a strong acceleration in growth towards the end of this year. This, coupled with a weakening US dollar and emerging market assets’ attractive valuations, should help boost the appeal of emerging market stocks and bonds over the medium term. We have consequently upgraded China and the rest of emerging markets to overweight.

Fig. 1 – Monthly asset allocation grid

January 2023

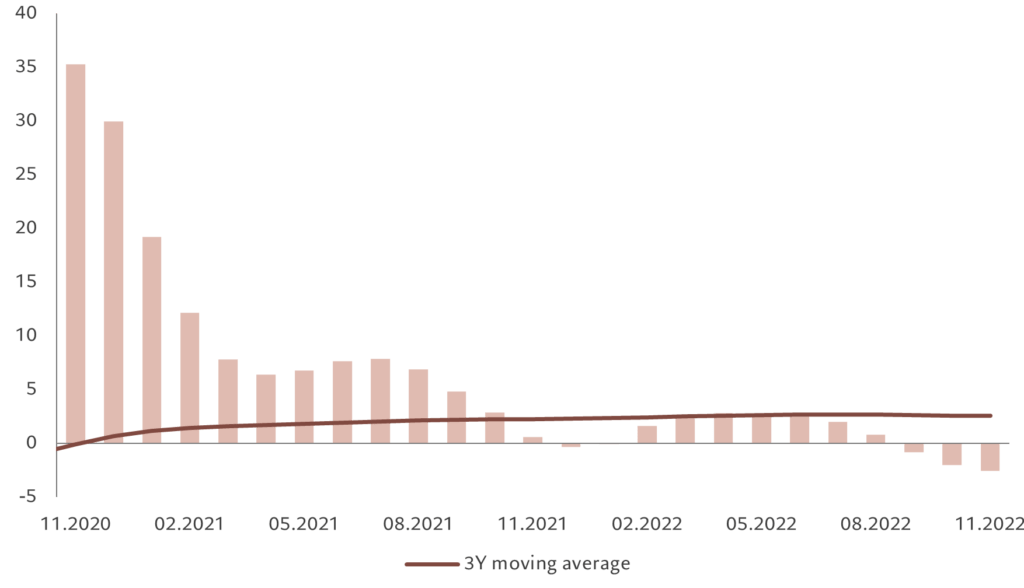

Our business cycle indicators show that the deterioration in global economic conditions is gathering pace. A recession will be unavoidable this year, but it should be both shallow and short before the economy begins to recover in the middle of 2023.

Global inflation is likely to decline this year to 5.2 per cent from 7.7 per cent in 2023, helped by weaker commodity prices and falling wage demands and rental prices.

In the US, the high level of excess household savings should support consumption and help the economy avoid a sharp contraction; we expect the US to register real growth of 0.4 per cent this year.

We also think the risk of a deep recession in the euro zone has somewhat receded. Despite weak economic activity and tighter lending standards, industrial production remains resilient.

Falling energy prices, meanwhile, should lead to a significant decline in price pressures across the region, with core inflation more than halving to 1.6 per cent from a 2022 peak.

Japan’s economy, meanwhile, is likely to outperform the rest of the world next year, supported by improving leading indicators, booming tourism and resilient capital spending.

That said, weak retail sales and consumer morale and a rapid deterioration in the current account balance – which is now negative for the first time since 2014 – point to a weak recovery in the coming months.

China’s recent economic data has been weak across the board, but the recent reopening of its economy suggests plenty of scope for recovery, especially for retail sales, which are currently some 22 per cent below their long-term trend on a real basis.

Beijing is likely to adopt a more pro-growth economic agenda, which should help lift growth in the world’s second largest economy to 5 per cent in 2023 from last year’s 3 per cent, according to our calculations.

Fig. 2 – Deceleration

Pictet Asset Management world leading indicator, quarter/quarter annualised (%)

Our liquidity indicators support the case for retaining a cautious stance on risky assets over the near term. But conditions will likely improve after the first quarter of 2023, especially in emerging economies.

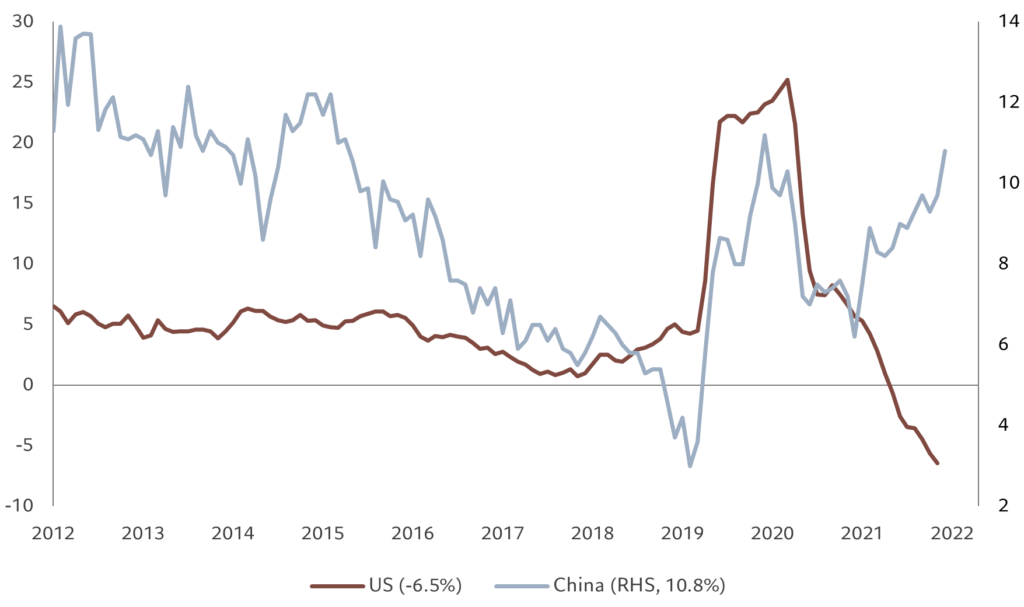

We expect the global economy to experience a net liquidity drain equivalent to 6 per cent of GDP in 2023 as central banks including the US Federal Reserve and European Central Bank continue to tighten the monetary reins. Investors should however expect a shift in monetary tightening trends.

The Fed is, we believe, entering the final phases of its tightening campaign with the benchmark cost of borrowing set to peak at 4.75-5 per cent in the first quarter of this year. The ECB’s balance sheet contraction, meanwhile, is likely to be more aggressive than the Fed’s, amounting to a reduction of some EUR1.5 trillion, or 11 per cent of GDP, which should add to downward pressure on the dollar.

After a hawkish statement in December, investors now expect euro zone interest rates to rise to 3.25 per cent by September 2023.

The Bank of Japan’s surprise change to its bond yield control policy – it will now allow the 10-year bond yield to move 50 basis points either side of its zero rate target – should pave the way for the central bank’s eventual exit from its zero interest rate policy.

Bucking the global trend, China is leading a moderate easing cycle with the People’s Bank of China delivering targeted support measures.

The credit impulse – a leading economic indicator – is positive while China’s real money supply (M2) is expanding at 12 per cent year on year, the highest in six years. In contrast, developed economies continue to experience tighter conditions.

Our valuation model shows bonds and equities are both trading at fair value.

Valuations for global bonds are neutral for the first time since February, with yields 50 basis points lower than their peak in mid-October.

Global equities, meanwhile, trade at a 12-month price earnings ratio of 15 times, in line with our expectations, but our models point to mid-single digit re-rating of multiples over the next year provided that US inflation-adjusted 10-year bond yields fall to 1 per cent.

Corporate earnings momentum remains weak across the world and we forecast 2023 global EPS growth to be flat, which is below consensus forecasts of around 3 per cent growth, with significant downside risks in earnings in case of weaker than expected economic growth.

Our technical and sentiment indicators remain neutral for equities with seasonal factors no longer supporting the asset class.

Data shows equity funds experienced outflows of USD17 billion in the past four weeks. Emerging market hard currency and corporate bonds posted consecutive weekly inflows for the first time since August.

02 Equities regions and sectors: tilting to Asia

We start the new year with a tilt towards Asian and emerging market equities. With recession looming over Europe and the US, the dollar drifting lower and developed world central banks publicly determined to stay the course in their fight against inflation, emerging market economies are looking attractive.

We upgrade Chinese equities to overweight from neutral amid signs that Beijing is seeking to normalise its pandemic policies. Pent-up consumption should be a big boost to the domestic economy once it gets past Covid, though there’s still no indication official support for the ailing real estate sector is having much effect. A recovery in China should benefit Asian emerging markets more generally while signs that the dollar’s appreciation has run its course should benefit other developing nations too. Meanwhile, emerging economies are well advanced on the tightening cycle, suggesting less bad news to come on that front. We expect emerging market companies to deliver 6.6 per cent year on year earnings growth in 2023 against a 0.1 per cent decline for US stocks and a 7.1 per cent drop in the euro zone. As a result we upgrade emerging market equities to overweight.

We downgrade Japanese equities to neutral from overweight as the BoJ makes a nod towards less accommodative policy by widening the bond yield targets it has stuck to since 2018 (from an even narrower band set with the introduction of yield curve control in 2016). Following their strong performance and with the yen expected to strengthen over the coming year, we downgrade Japanese equities to neutral from overweight.

Fig. 3 – US tightening, China loosening

Real M2 money supply growth, year-on-year % change

We remain cautious on developed market equities. We don’t think investors have fully appreciated quite how dim prospects are for corporate earnings and margins in these markets. Simultaneously falling output and inflation rates will squeeze nominal GDP, and nominal GDP is a key determinant for earnings. At the same time, firms will struggle to protect profit margins if inflation eats further into household incomes, especially as savings accrued during the pandemic lockdowns are spent. Zero earnings growth over the coming year should be met with further analyst downgrades. Overall we think there’s 15 per cent downside risk for US stocks. In other words, the first half of the year is likely to prove less than vintage for equity investors.

Finally, as the energy shock that was triggered by the Ukraine war and sanctions on Russia starting to fade, we take this opportunity to downgrade the energy sector to neutral from overweight.

03 Fixed income and currencies: weaker dollar gives rise to new opportunities

The new year appears to have all the ingredients for a renaissance in fixed income – positive real yields, a shaky economic backdrop and a likely peak in monetary tightening. Short-term technical trends are also positive.

After the recent rally in debt markets, valuations are somewhat less compelling for many fixed income asset classes, but they are still healthy enough to support a broadly positive stance on bonds.

Weakness in the dollar – we expect the US currency to fall further in the coming months – bodes particularly well for emerging market debt. The monetary backdrop also looks positive. Tightening is at an end in many developing economies, with South Korea among those leading the transition. All this supports our overweight on emerging market local currency bonds. The GBI-EM yield is still high at 6.8 per cent, and likely to decline as the year progresses.

China should provide an additional boost. The removal of pandemic-related restrictions is gathering pace, including the end of mass testing and reports of an imminent lifting of travel restrictions with Hong Kong.

In developed markets, we believe US bonds remain attractive. The Fed is arguably further along the tightening cycle than any other major central bank. The price of core goods should continue to decline, even if the services components of inflation (such as rents) remain elevated. Overall, we expect headline US inflation to nearly halve to 4.2 per cent in 2023 from 8 per cent in 2022, while the Fed’s preferred measure of inflation, the core PCE, falls below 3 per cent by year-end. That in turn will pave the way for an end to US interest rate hikes. Our models suggest the Fed’s tightening is already 90 per cent complete and that a terminal rate of 5 per cent would inflict severe damage to the US economy.

For these reasons, we remain overweight US Treasuries and also see potential in higher-rated US credit. Investment grade debt is one of the cheapest fixed income asset classes according to our model and we believe its current yield – of around 5.3 per cent – offers good compensation for the risk. The same is not true for high yield, where we remain underweight. The default cycle has barely started and high yield spreads are noticeably lower than they have been during previous recessions.

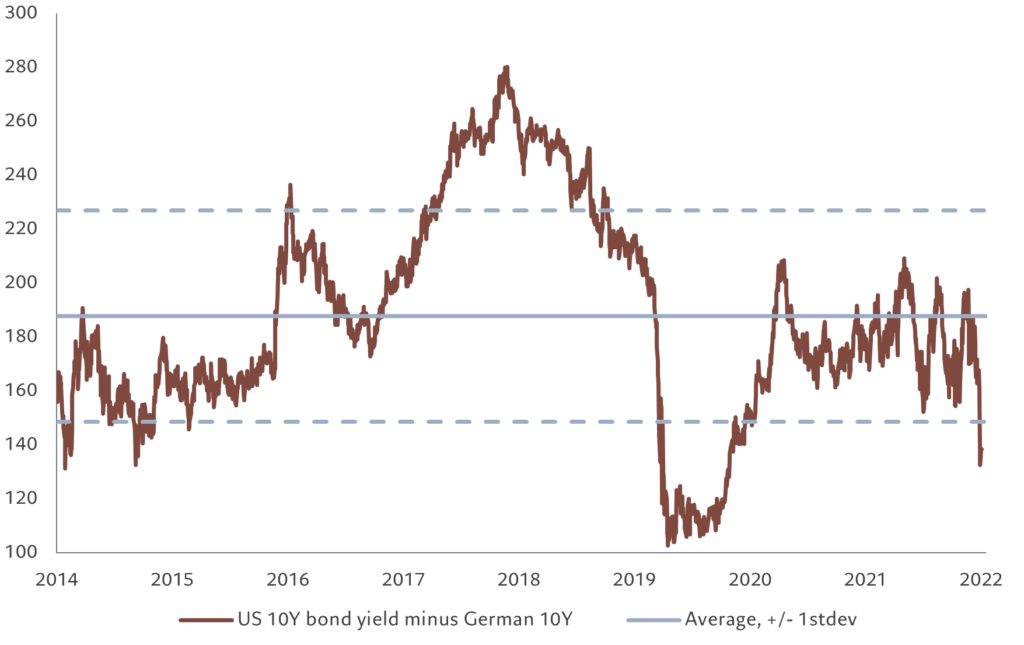

Fig. 4 – Diverging rates outlook

10-year sovereign bond yield differential, US minus Germany, ppts

We are also cautious on European debt, given greater inflationary pressures in the euro zone and the need for more rate hikes. The yield spread between Treasuries and Bunds has already started to tighten, reflecting this disconnect in monetary policy expectations (see Fig. 4).

In currencies, we prefer to position for a further decline in the dollar with overweight positions in the Swiss franc and the Japanese yen. The yen is about 40 per cent undervalued versus the dollar, and the recent shift in Japan’s monetary policy could prove a catalyst for a rebound. The yen should also benefit from an expected repatriation of capital by Japanese investors, who are likely to be attracted to the market’s higher yields.

Investment flows data suggest other investors also expect a turnaround in the yen, closing short positions in the Japanese currency, while extending net shorts on the US dollar.

04 Global markets overview: a bad end to a bad year

World stocks ended sharply lower in December as investors grew concerned at the prospect of a recession in early 2023. The MSCI World equity index declined 4 per cent on the month, underperforming bonds, which ended more or less flat on the month. US stocks were among the worst-performing markets while the US dollar also fell.

The December sell-off marked the end of a brutal year for stock and bond markets worldwide, the worst 12-month period since the financial crisis of 2008.

Not only did investors have to deal with the legacy of the Covid-19 pandemic, but they also had to contend with war in Europe, an energy crisis, surging inflation and rapid increases in interest rates across much of the developed and developing world.

The MSCI All Country equity index lost more than 20 per cent and its European counterpart closed the year down by more than 15 per cent. But it was Chinese and tech stocks that suffered the most in 2022. The tech-heavy US Nasdaq index ended the year down by more than a third while China’s CSI Index fell some 28 per cent in dollar terms as the country’s economy was derailed by strict anti-Covid measures.

Havens were in short supply. With both the Fed and the ECB raising interest rates to curb double-digit inflation, sovereign bonds fell by almost as much as stocks. The US 10-year Treasury note ended the year down some 17 per cent, a record annual loss. Emerging market bonds also suffered double-digit declines.

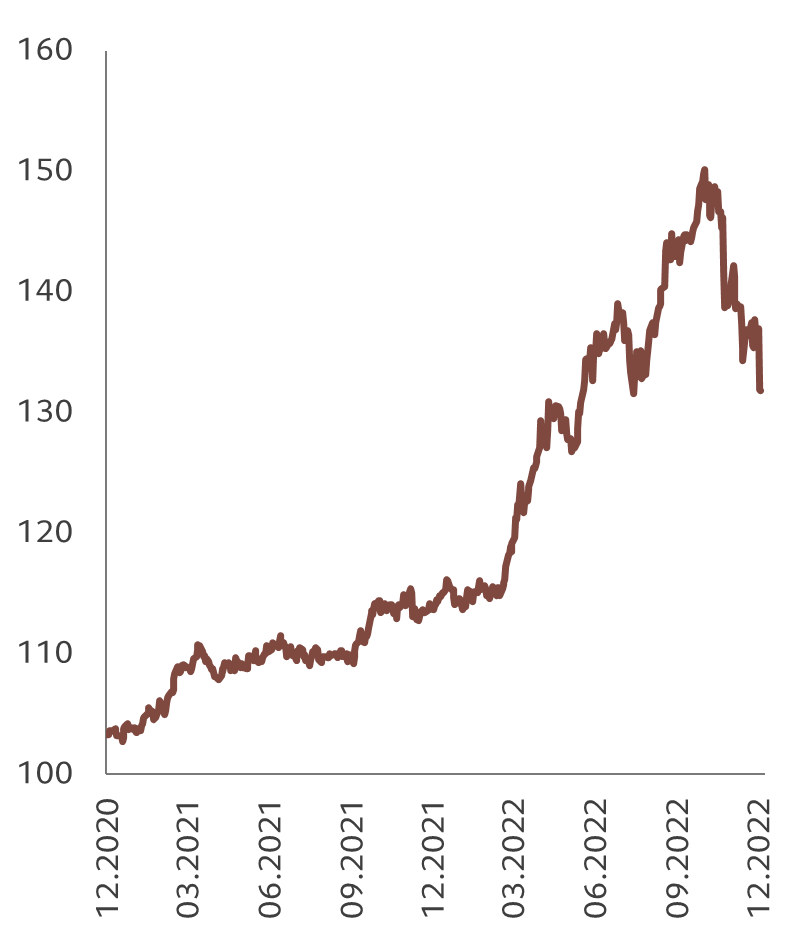

In the foreign exchange markets, the dollar gained against almost all major currencies as investors were attracted to its defensive properties and as aggressive interest rate hikes from the Fed offered the greenback strong yield support. The greenback rose by 8 per cent against a basket of the world’s major currencies over the 12-month period but its appreciation began to falter towards the end of the year, most notably against the Japanese yen (see Fig. 5).

05 In brief