In the face of economic uncertainty and stubborn inflation, we continue to favour bonds over equities.

Asset allocation: looming economic slowdown casts shadow over stocks

The outlook for most major developed economies remains uncertain.

Economic growth in the US is likely to turn anaemic and stay below its long-term trend, while Europe is not expected to recover anytime soon.

We expect earnings growth of US companies to contract more than 2 per cent next year, in stark contrast to the estimates of analysts who forecast growth of as much as 10 per cent.

Also concerning is that developed central banks are poised to withdraw more liquidity from the financial system at a time when inflationary pressure is building once more.

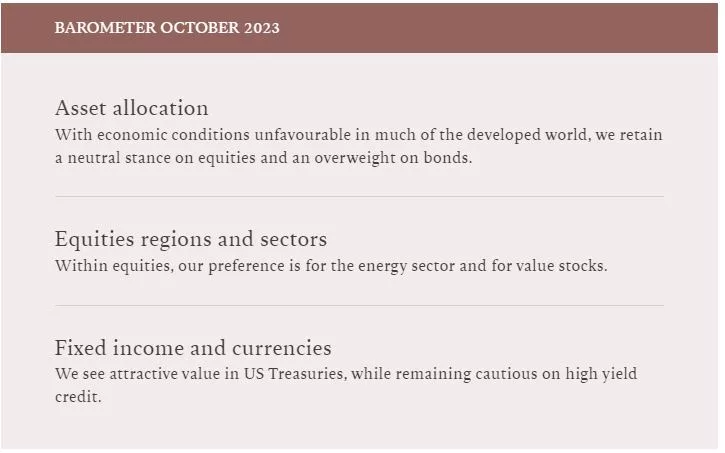

With economic conditions unfavourable in much of the developed world, we retain a neutral stance on equities and an overweight on bonds; we are also underweight cash.

Fig 1. Monthly asset allocation grid

October 2023

Our business cycle analysis indicates the US economy is in a delicate state.

Industry surveys point to a drop in services consumption, which represents 70 per cent of economic activity in the country, while non-residential investment is also likely to fall because of high interest rates and a tight labour market.

All of this should weigh on the world economy, which we expect to grow just 0.5 per cent year on year next year, well below its pre-pandemic trend. Europe also remains weak as the economy feels the chill from tightening monetary policy and our leading indicator and consumer confidence are weakening.

In contrast, Japan is going from strength to strength.

We expect the world’s third largest economy to grow at 1.5 per cent next year, above potential and driven by strong exports. We expect higher private consumption in the coming months, and a sustained pick up in wage growth should prompt the Bank of Japan (BoJ) to end its negative interest rate policy.

China is showing early signs of an economic recovery. Consumption appears to have stabilised in the short term, leaving plenty of scope for improvement given retail sales remain 16 per cent below trend at a time when household deposits are 20 per cent above trend.

A recovery in the property sector is a missing piece of puzzle that would bolster consumer confidence.

Growth in the rest of the emerging world is likely to accelerate into next year, comfortably outpacing that of developed peers.

Our liquidity indicators support our neutral stance on equities.

Developed market central banks, apart from Japan, continue to withdraw liquidity from the financial system, even as they approach the end of their interest rate hike campaigns.

Liquidity conditions are likely to remain tight as inflation could well prove stickier than previously thought – not least because of a spike in oil and food prices.

In the US, a pick-up in government bond issuance expected in the coming months should also add to the liquidity squeeze.

Liquidity remains ample in Japan, however, as monetary policy there is accommodative, underpinning the flow of money and credit.

The beginning of an interest rate cut cycle in some parts of emerging markets should be positive for liquidity conditions there. Our valuation score supports our preference for bonds over equities.

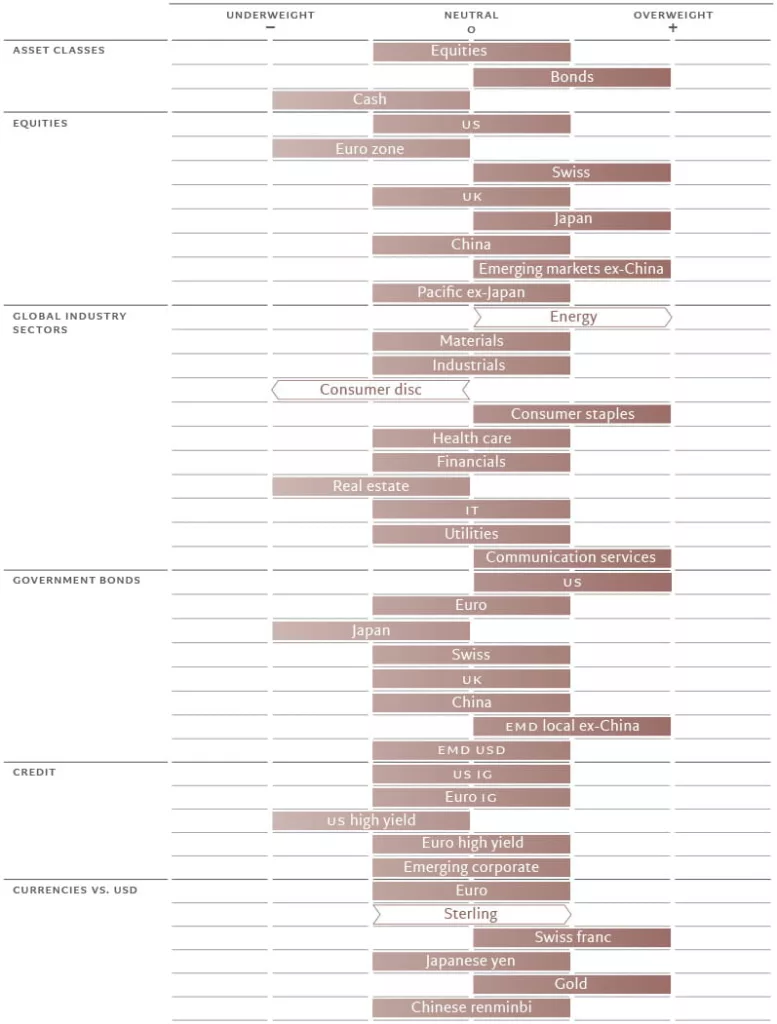

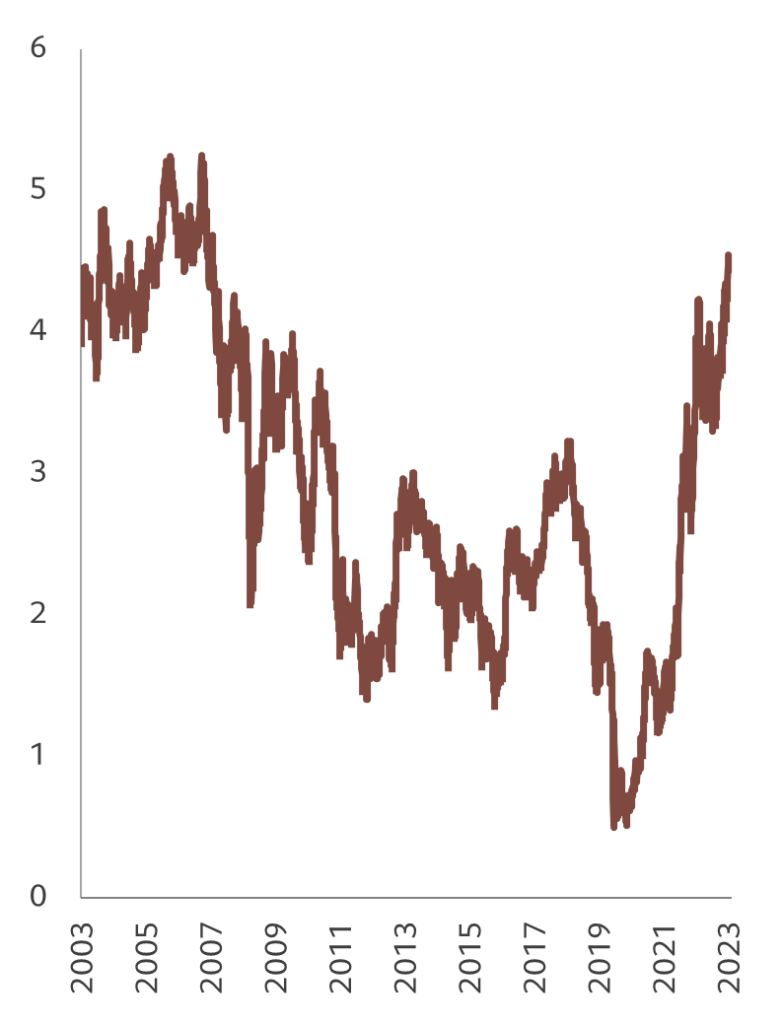

The US equity risk premium – or extra return investors get over risk-free rate — has fallen to 3.4 per cent, the lowest in more than 20 years (see Fig. 2).

Fig. 2 – US stocks still too risky

12-month earnings yield minus 10-year local government bond yield in percentage points

Ion comparison, offering a 10-year yield of more than 4.5 per cent, US bonds look particularly attractive.

Our technical indicators support our neutral stance on equities.

Investor sentiment and positioning indicators show that equities are falling out of favour, but they are not quite depressed enough to give us a contrarian buy signal.

Equities regions and sectors: positive energy

Equities in general may look expensive relative to bonds, but there are opportunities emerging. Energy and value stocks in particular.

Energy stocks have been underappreciated by the market despite a rally in oil prices amid tight supply. Brent crude prices are once again approaching USD100 a barrel, a level that – apart from the surge triggered by Russia’s invasion of Ukraine – hasn’t been seen since 2014. At the same time, energy is the second cheapest sector (only financials trade on lower valuations), with a price-to-earnings ratio of just 10 times, and is the only sector trading at a discount to sales. As a result we upgrade the sector to overweight from neutral.

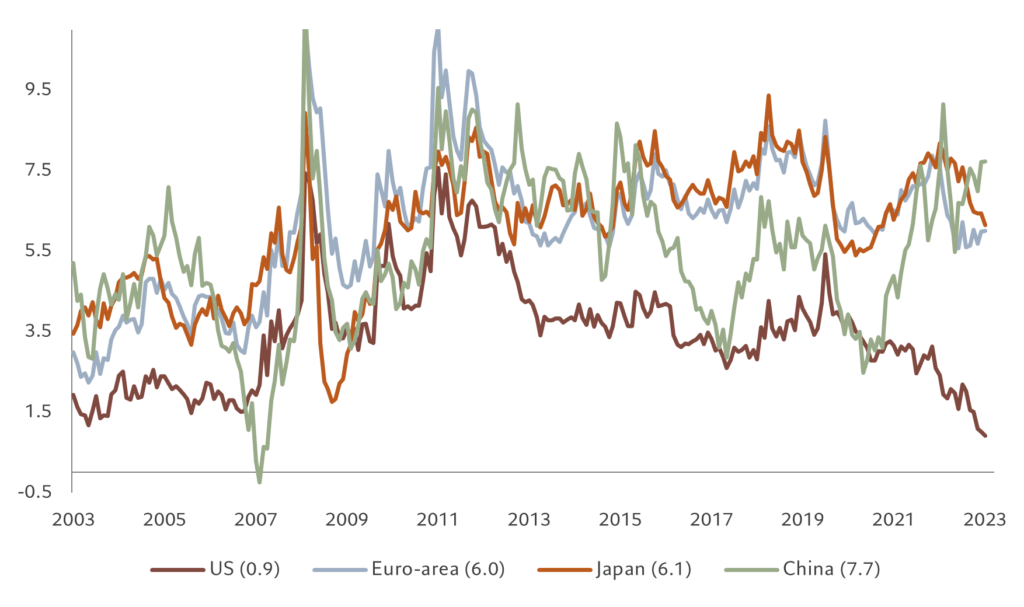

Meanwhile, value stocks are trading at a significant discount relative to growth stocks given where real bond yields are (see Fig. 3).

Unless real yields start to fall sharply, we would expect value stocks’ recent outperformance of growth to continue.

That’s not to say there aren’t attractive growth stocks. There are some sectors that have relatively stable earnings, are a play on the artificial intelligence theme and yet do not demand high valuations – for instance communication services, where we remain overweight. We are also overweight consumer staples to retain defensive protection to the portfolio with slower growth ahead.

Fig. 3 – Value could outperform growth if real yields remain high

Value relative to growth (index) vs US real yields (%)

Elsewhere, consumer discretionary stocks look particularly vulnerable at this point in the cycle. High oil prices are likely to add to the strains being felt by consumers, who are already feeling the pinch from central banks’ rate hikes of the past year and a half.

What is more, as household savings as a percentage of GDP fall, lower-income US consumers have begun to cut back spending; there are also signs of stress in credit card and auto loan delinquencies. For these reasons we have downgraded consumer discretionary to single negative.

We remain underweight real estate, which has underperformed this year and which we expect to continue to do so, given the feed through to mortgage rates of higher official interest rates and significant dislocation in the office real estate sector.

We leave our regional allocations unchanged. We continue to favour high profitability, good earnings visibility and low leverage, in other words ‘quality’ and as a consequence remain overweight Swiss equities. We also remain overweight emerging markets excluding China. Emerging economies are set to grow more robustly than developed markets, not least because central banks in the developing world are better placed to start easing monetary policy. China, however, remains moribund, which, in turn, is also weighing on European corporates.

Fixed income and currencies: sterling profits

The recent sell-off in US Treasuries has pushed their valuations into attractive territory according to our models. At around 4.5 per cent, yields on benchmark 10-year Treasury bonds are at levels last seen some 15 years ago – an entry point that is all the more attractive given that we expect the Fed to have reached peak policy rates before possibly easing later in 2024.

We therefore retain our positive stance on US government bonds. This extends to inflation-linked notes, which also look attractive, with real yields now above 2 per cent and thus higher than our estimate for trend real GDP growth for the US. (In economic theory, over the very long-term, the real interest rate equals the growth rate as it is seen as the balance between the marginal return on capital and the marginal increase in productivity.)

Our other overweight among sovereign bonds is in emerging market local currency debt. We expect the GDP growth gap between the emerging and developed world to widen to 2.3 percentage points (ppts) this year and 3.2 ppts next year from just 0.4 ppts in 2022. This bodes well for emerging market bonds, as well as for currencies, which could provide an additional source of returns.

Of course, with real rates now at multi-decade highs, there are questions over whether debt sustainability might become a problem for some nations. While there are some debt trouble spots within the developing world (such Egypt, South Africa and Chile) overall we think most major countries have the tools to combat a rising interest rate burden.

The same is not necessarily true for corporations, however. Higher rates increase the risk of corporate defaults, particularly among lower rates borrowers.

At just over 400 basis points, we believe the risk premium offered by US high yield over Treasuries does not offer sufficient compensation for the risk, justifying our underweight position.

We are also cautious on Japanese bonds because we believe the BOJ’s ultra-easy policy stance is untenable and set to change by year-end. We are therefore underweight on Japanese government bonds.

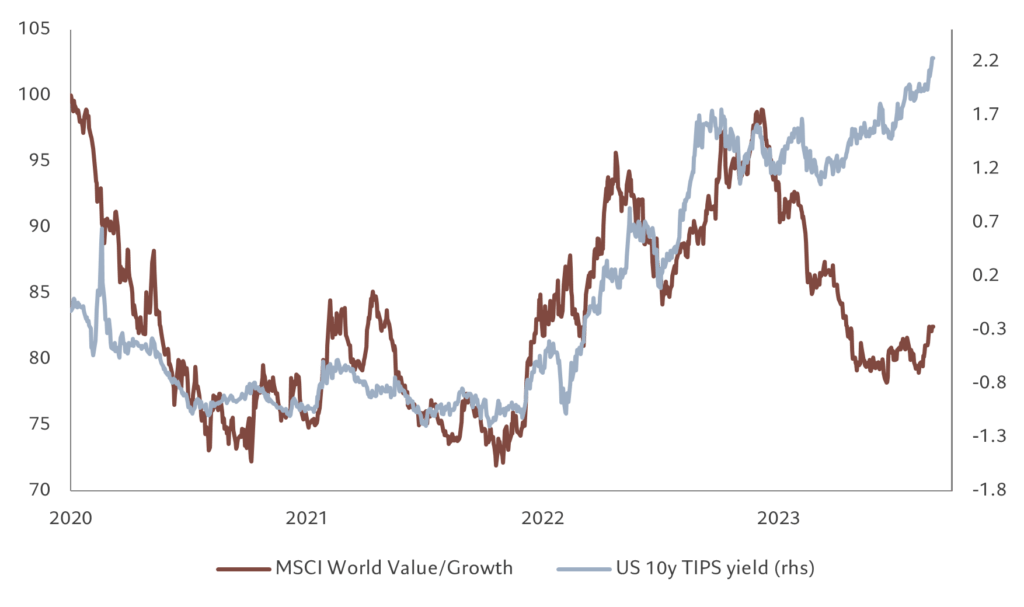

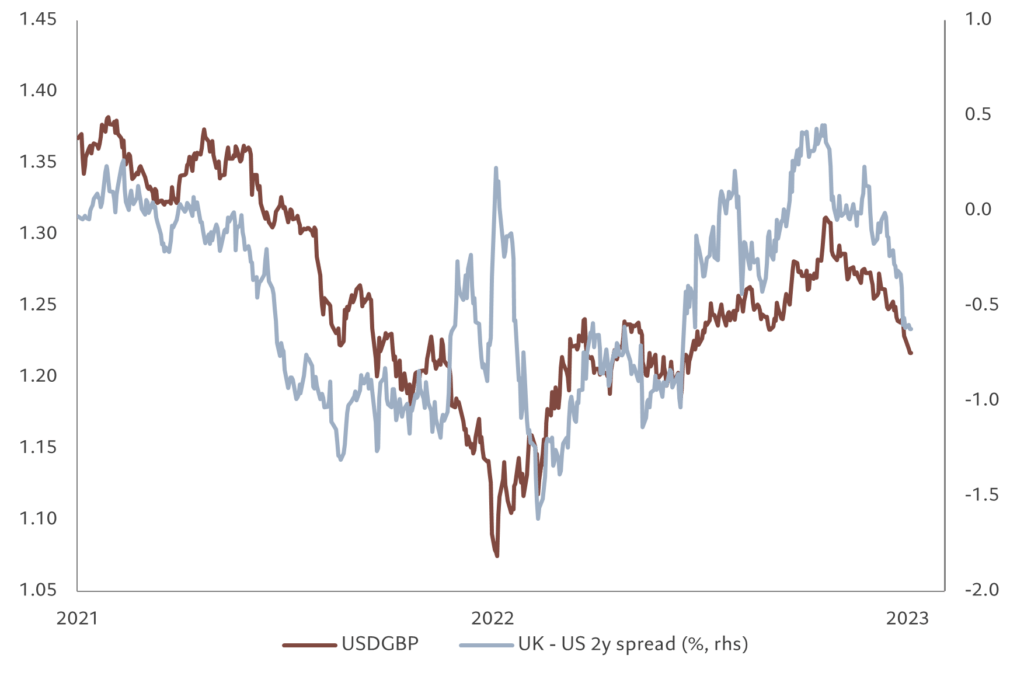

Fig. 4 – Driven by rates: sterling decline set to east

Sterling/dollar exchange rate versus UK-US 2 year government bond yield spread, bps

In currency markets, we have taken profits on our bearish position on sterling and turn neutral. Following its recent sell off, we believe sterling’s exchange rate now fairly reflects UK’s economic prospects. We see the UK economy growing at 0.3 per cent this year and 0.4 per cent in 2024.

Our preference remains for the Swiss franc and we retain a strategic overweight in gold which, while not cheap, but should benefit from an imminent peak in real interest rates.

Global markets overview: autumn blues

September was a gloomy month for global markets as investors fretted about lacklustre economic data and ongoing inflationary pressures. Equities lost 3.5 per cent in local currency terms, while bonds were down 1.9 per cent.

US nominal 10Y government bond yield, bps

In the US, the “rates higher for longer” signal from the Fed pushed up yields on benchmark 10-year Treasury bonds to 4.5 per cent, the highest since 2007. The move in yields was exacerbated by the prospect of a deluge of bond supply – the US budget deficit is running at 8 per cent of GDP, while the costs of servicing existing debt are already eating up 14 per cent of tax revenues.

Similar trends were at work elsewhere, with yields in France, Germany, UK and even Japan all hitting multi-year highs.

In equities, some of the steepest losses were sustained in IT and real estate sectors. The only positive performance came from energy, which added 3.4 per cent, reflecting a jump in the oil price. Several key oil producers, including Saudi Arabia and Russia, have pledged to reduce production, helping push crude towards USD100 a barrel.

The main feature in the foreign exchange markets was the continued strength of the dollar which added 2.5 per cent against a trade weighted basket of currencies in September and posted 11 straight weeks of gains. The rally was particularly pronounced versus sterling, euro and yen. Versus the Japanese currency, the greenback hit one-year highs, closing in on the psychologically key 150 yen level. The move put markets on alert for possible official intervention.

The dollar’s strength weighed on emerging market local currency bonds, which lost 3.4 per cent. Mixed data from China and inflation troubles in Turkey – where the central bank raised rates to 30 per cent – added to the gloom.

In brief