Stocks remain vulnerable to a wave of profit forecast cuts, particularly in the US and Europe.

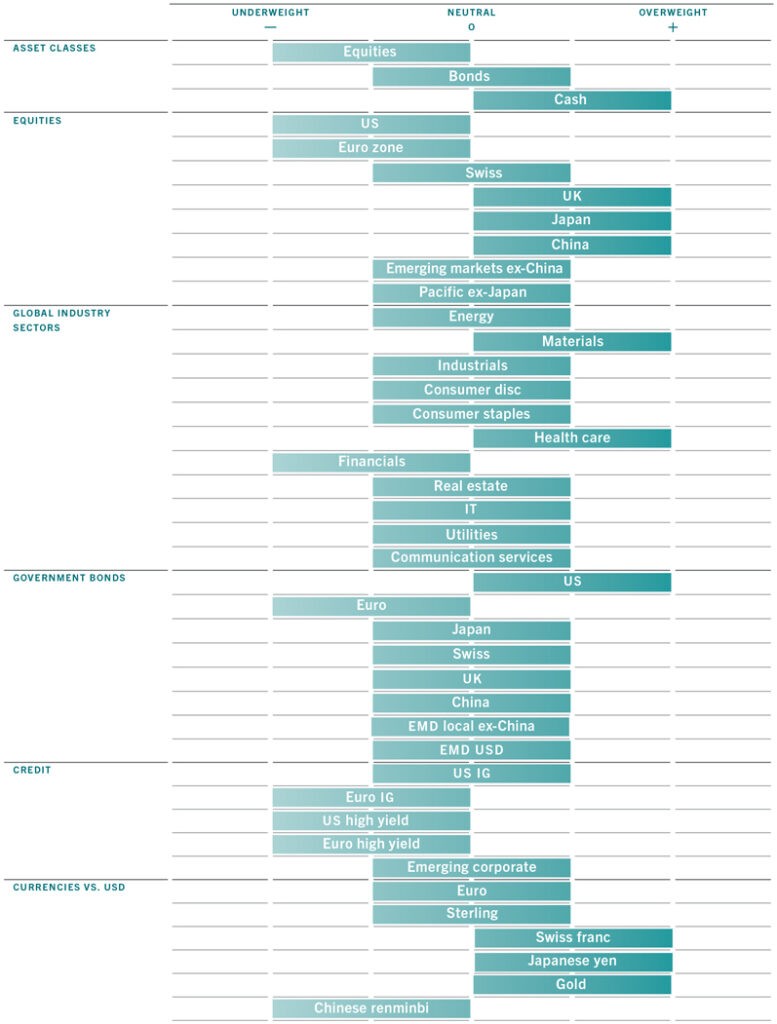

Asset allocation: not yet priced in

Slowing economic growth, surging inflation, tighter monetary policy and heightened geopolitical risks have all taken their toll on financial markets. However, we believe most risky asset classes have yet to fully price in a recession – a scenario which to us looks increasingly likely.

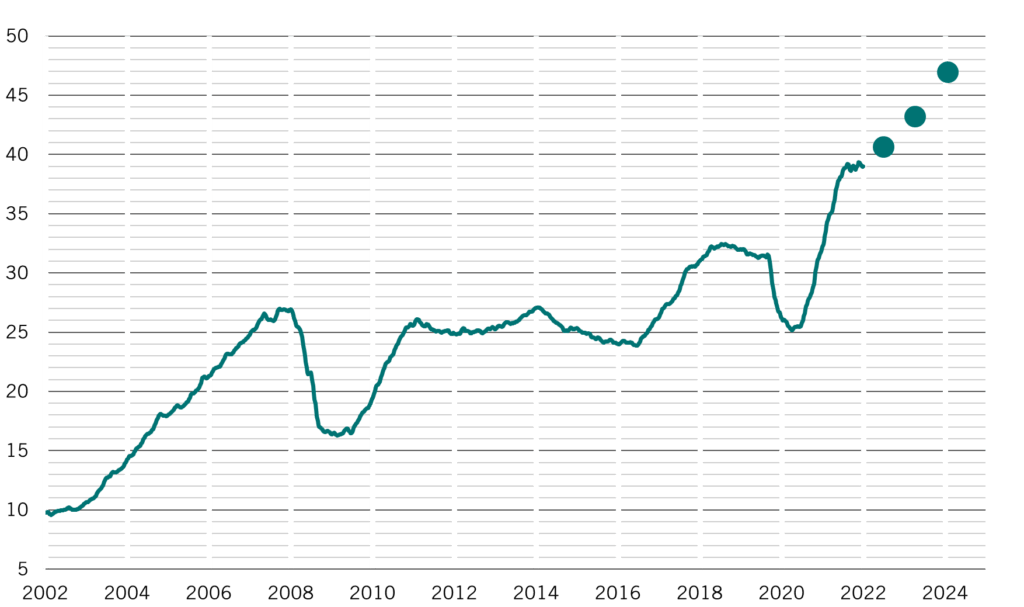

Although world stocks’ 12-month price/earnings ratios have declined by more than 30 per cent since September 2020, consensus forecasts for corporate earnings remain remarkably optimistic (at 11 per cent this year and close to 8 per cent over the next two), starkly at odds with underlying economic conditions. We expect those projections to be revised sharply lower. History shows that when a recession hits, corporate profits fall by as much as 25 per cent – a drop that looks all the more likely given that company earnings are currently running at record levels.

We therefore remain underweight on equities, waiting for either a stabilisation in earnings revisions and economic momentum or, indeed, a confirmation of a sharper than anticipated disinflation before considering an upgrade. We have an overweight in cash, which we are ready to deploy when conditions improve, and a neutral allocation to bonds.

Fig. 1 – Monthly asset allocation grid

August 2022

Our business cycle indicators show a growing chasm between business and consumer sentiment surveys and hard data. While the former are deteriorating sharply, the latter have so far remained relatively strong, likely supported by excess savings among households and pricing power of corporations.

Such resilience may not last, as we are already starting to see in the US, where tightening financial conditions are beginning to bite. We downgrade our US macro-economic score to negative and cut our 2022 GDP growth forecast to a near-consensus 2.2 per cent (from 3.0 per cent previously).

The silver lining for the US economy is growing evidence suggesting inflation may be about to peak.

The situation appears bleaker for the euro zone. Here, our leading economic indicator is now below pre-pandemic levels. Momentum continues to deteriorate, dragged down by Germany, while price pressures are still accelerating. The European Central Bank is clearly some distance behind the curve in fighting inflation compared to the US Federal Reserve, which last month raised interest rates by an additional 75 basis points.

Emerging Asia is one of the few economic bright spots, supported by a recovery in China – an economy with the tail wind of reopening as well as the headroom, means and motivation to stimulate growth. Although this must be balanced against the ongoing problems in China’s property market, we believe the backdrop is broadly positive for Chinese equities.

Our liquidity indicators suggest riskier asset classes could continue to struggle. Across most major economies, central bank interest rate hikes and quantitative tightening measures are leading to a contraction in excess liquidity. In all, over the past quarter, the world’s five major central banks have removed USD1.8 trillion of liquidity.

While the Fed has now raised policy rates to neutral territory and has indicated that the future course of action would be guided by incoming data, markets have taken a dovish interpretation of the central bank’s stance. Indeed, current market pricing has the Fed funds rates peaking in December this year, a full 50 basis points below the Fed’s own estimate. Although we do not rule out the possibility of a Fed pause, we caution that this is far from a certainty at this point.

Fig. 2 – Too much optimism?

MSCI All Country World Index, 12m trailing EPS forecasts

Our analysis of valuations shows stocks are approaching fair value the market’s sharpest peak-to-trough market fall in decades: our models indicate that equities are trading close to the mid-point of their historical valuation range (based on a range of measures from price multiples to the equity risk premium).

Bonds, meanwhile, remain relatively cheap, despite the recent rally. Some of the best value, however, is found in the riskier parts of the market, such as emerging debt and credit.

Technical indicators indicate that sentiment is now neutral across all major equity and bond markets. However, equities are still subject to negative scores both in terms of market trends and seasonal factors (with summer historically a problematic period for stocks).

Equities regions and sectors: US and Europe face a reckoning on earnings

US and European stocks have endured a brutal 2022 so far, but prospects do not appear especially bright for either market. Although the S&P 500 Index is down some 15 per cent year to date, US corporations will likely see business conditions deteriorate further as the Fed remains steadfast in its efforts to bear down on inflation, even if that means tipping the economy into recession. Such risks are not reflected in analysts’ forecasts for US profits.

Taking into account our own inflation forecasts and (recently reduced) projections for US GDP growth, we expect to see corporate earnings undershoot IBES consensus forecasts by some 12 per cent this year. That would translate to flat profits year-on-year – considerably below the long-term average growth rate of 6 per cent. With this in mind, we remain underweight US equities.

We have the same view of European equities, which arguably have an even steeper hill to climb. With energy prices across the region rising further as the Ukraine-Russia conflict intensifies, the economic damage is mounting by the day.

Russian gas supplies to EU are now running at just 20 per cent of their normal levels, raising the prospect of a growth-sapping energy crunch. Germany looks particularly vulnerable to a recession in the second half of this year – with business sentiment in the country having fallen to depressed levels. If Russia were to halt gas supplies to Europe, it could wipe some 1.5 per cent off German GDP this year and 2.7 per cent next year, according to IMF estimates. There are other risks facing European stock markets. One is the collapse of Italy’s reformist government.

The resignation of Mario Draghi as prime minister and the likelihood of a populist right wing administration taking the reins after general elections in September have rekindled fears of an Italian sovereign debt crisis. Not least because Italy’s disproportionately large share of the EU’s Covid recovery fund is contingent on the country implementing the structural reforms set in motion by the outgoing Draghi government.

The second, related, risk is the ECB’s struggle to convince investors it can both come to Italy’s aid – if needed – and at the same time rapidly reverse the surge in euro zone inflation rates.

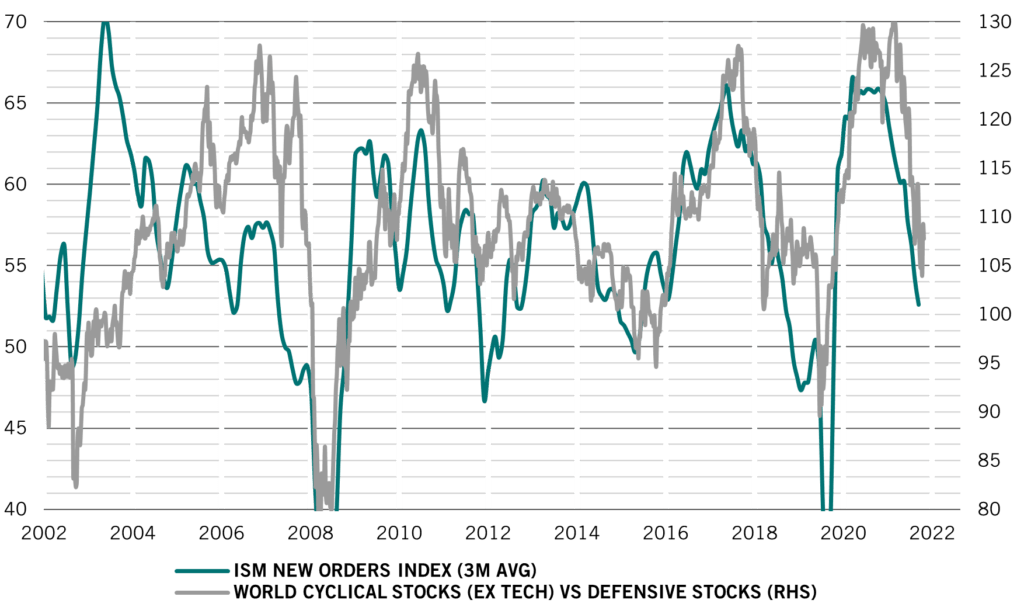

Fig. 3 – Fairly priced

ISM New Orders Index (3m average) and relative performance of cyclicals vs defensives (RHS)

A bright spot in the global equity market is Japan. The economy is a standout in the developed world in having reasonably healthy growth prospects, scoring positively in our framework; it is also less vulnerable to inflation. The weakness of the yen is a strong tailwind for Japanese corporate earnings, which we believe should meet consensus expectations. We are overweight Japanese equities.

Our belief in Chinese equities’ capacity for recovery has recently been reinforced by our liquidity readings showing that China’s credit impulse – which measures both the cost and availability of credit to businesses and consumers – has moved into positive territory for the first time in several months. This, coupled with authorities’ renewed efforts to increase infrastructure investment, should improve the outlook for Chinese stocks; we remain overweight.

The positive trends we see unfolding in China – particularly those concerning infrastructure spending – bode well for materials stocks, in which we remain overweight. At the same time, we have chosen to retain our overweight in healthcare stocks, which should do well if economic conditions deteriorate further. With the global cycle on a knife-edge, the pricing of economically sensitive equity sectors versus their more defensive counterparts appears fair (see Fig. 3). For now, we prefer to avoid tilting our portfolio too strongly in either direction while closely monitoring the prognosis for growth in the coming weeks.

Fixed income and currencies: going for gold

Slowing growth and the spectre of a recession should be good news for bond markets. But only if inflation can be kept under control. The US seems closest to achieving this, even before the Fed’s latest rate hike makes its mark. Price pressure components of surveys have rolled over sharply, supply bottlenecks are easing, freight costs have moderated and lower oil and hence gasoline prices mean stronger headline disinflation. This supports our positive stance on US Treasuries.

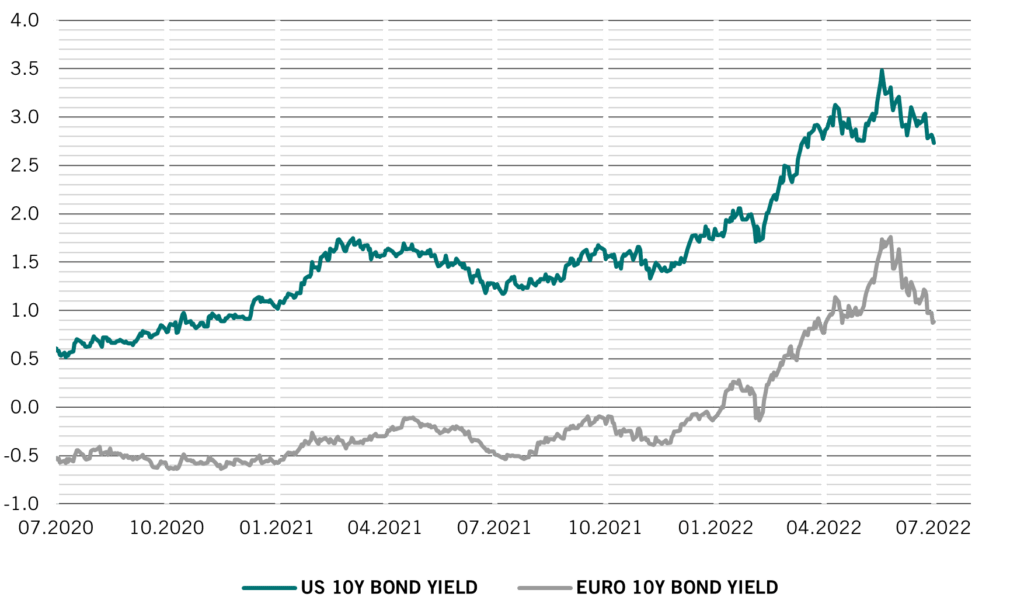

Valuations for US government bonds are also reasonable. At around 2.8 per cent, 10-year Treasury yields are in line with our fair value estimate (based on our forecast for a total of around USD1.5 trillion of quantitative tightening through to 2023). And, as the global economy slows down, Treasuries should also benefit from their defensive properties.

Conversely, we are underweight on euro zone government bonds, due to more worrying inflation trends in the single currency bloc.

In this context, European yields look particularly unattractive compared to US ones (see Fig. 4).

We are also negative on European credit – both investment grade and high yield. Economic risks are clearly skewed to the downside. Consumer confidence is below levels seen during the Covid shock and is providing a recession signal. Higher energy prices and tighter monetary conditions will no doubt add to the problems facing corporate borrowers.

Fig. 4 – Advantage US

US & Euro zone, 10 year government bond yields, %

Elsewhere, we see strong potential in gold against a backdrop of growing policy uncertainty and a possible peak in US real rates. Following a circa 20 per cent correction, it appears oversold and is no longer expensive on our valuation framework.

Adding to our defences should economic conditions deteriorate sharply, we remain overweight the Swiss franc. We also see value in the Japanese yen, which has dropped to a 24-year low versus the US dollar. Such weakness does not seem justified, particularly given that Japan is one of the few countries with a positive macro score on our model.

Global markets overview: rediscovering risk

Risk assets saw a strong rebound in July, after their heavy losses since the start of the year, as investors reappraised how committed central banks will remain to tightening policy in the face of economic weakness. Global equities gained 7.1 per cent on the month in local currency terms, leaving them down just under 12 per cent for 2022 so far.

US equities were the stand-out performers here, with the market picking up 9.3 per cent on the month, followed by a 7.3 per cent jump in euro zone stocks, with other major markets largely ranging around 4 per cent. Within sectors, energy stocks managed to post solid gains despite a 4 per cent drop in oil prices on the month. The big winners, however, were consumer discretionary and tech stocks, which had suffered some of the heftiest losses on the year so far.

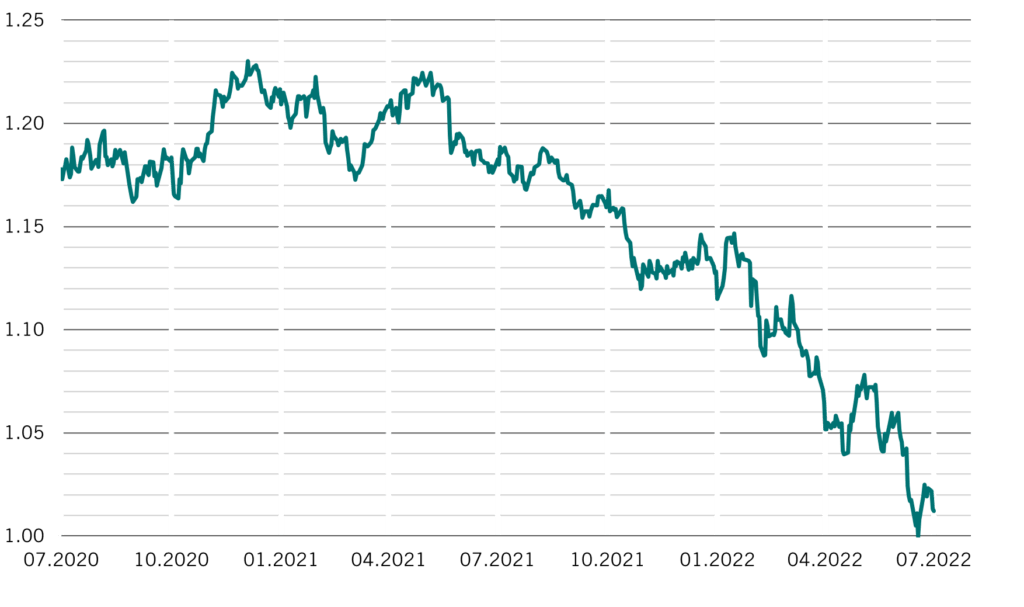

Fig. 5 – Euro doldrums

Euro/dollar exchange rate

Although a return to risk was the theme of the month, bonds also managed to reverse their downward trend by recovering some ground. The asset class gained 2.1 per cent on the month in local currency terms, with the US, euro zone and Swiss sovereign markets all picking up between 3 per cent and 4 per cent. The biggest gains were in the credit space, with European and US high yield bonds picking up 5 per cent and 6 per cent respectively.

Emerging market bonds and equities were laggards as investor focus shifted to concerns about weakening global growth and uncertainty in China’s property market.

The dollar reversed its strength half way through last month as the market priced in peak Fed hawkishness, but still finished up another 1.2 per cent versus a basket of currencies. The Japanese yen managed to claw back some lost ground, picking up 1.9 per cent against the greenback, while the euro remained weak (see Fig. 5). Gold dipped 2.4 per cent to show a 3 per cent loss on the year.

In brief

Information, opinions and estimates contained in this document reflect a judgement at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.