We don’t expect inflation to remain sticky for long but aren’t especially confident about the developed world’s growth prospects. Which is why we’re underweight US and euro zone stocks.

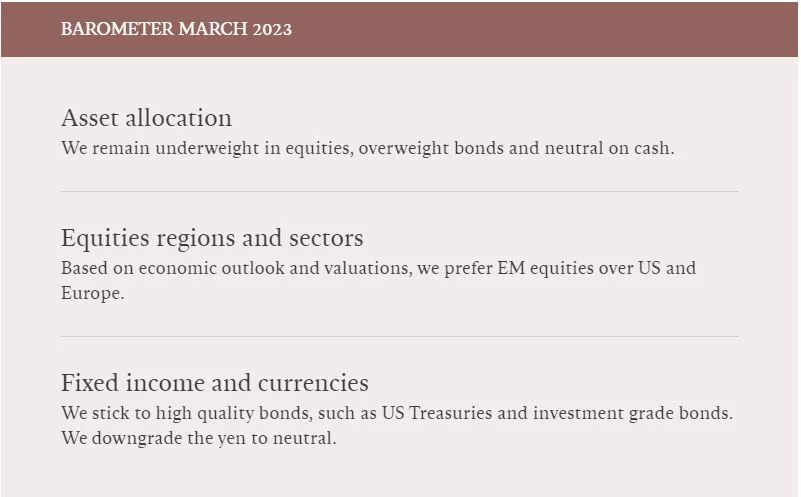

Asset allocation: second thoughts

The risk-on rally that framed the start of the year abruptly ran out of steam in February. Investors had convinced themselves of a goldilocks outcome to 2022’s big monetary squeeze. Inflation would come down fast while the economy remained resilient. They are now having second thoughts. Sticky inflation has reawakened fears about how high official interest rates are headed and how long they’ll stay there.

We take developments of the past few months with a pinch of salt. We have long believed that official rates are likely to plateau for significantly longer than the market consensus believed. And while the economy is more resilient than previously anticipated, we think that the widespread strength seen in industry and employment data could be overstated by seasonal factors and warmer than expected weather.

Moreover, even though inflation data were disappointing, we continue to believe that fundamental economic factors will tame price pressures over the coming quarters. Significant amounts of monetary stimulus are being withdrawn while supply bottlenecks are easing.

We therefore remain underweight in equities, overweight bonds and neutral on cash. We appreciate the allure of the unusually high yield on cash, but think that the valuation case for taking duration risk remains attractive and therefore retain our bonds overweight.

Our business cycle indicators have become less negative over the past month. Our macroeconomic assessment of the US has been upgraded to neutral on the back of a robust recovery in consumer confidence – retail sales remain significantly above trend – notwithstanding the weakness in the housing market. As a result we’ve upgraded our expectations for 2023 real GDP growth to 0.6 per cent from 0.4 per cent. Meanwhile, we expect services inflation to moderate in the second half as rents – which make up more than half of this component – start to decline.

We’ve also raised our growth forecasts for the euro zone. Here, industrial production is benefiting from a sharp drop in gas prices and from easing supply chain pressures. Our only real worry is a deterioration in credit creation.

The Chinese economy, meanwhile, is rebounding quickly with the country’s reopening. Excess savings, which we estimate at 8 per cent of disposable income, should help boost consumption growth in the months ahead, while the drag posed by a weak property market should ease as the sector bottoms out. More broadly, emerging markets (EM) are outpacing developed markets at close to their fastest pace in at least a decade, while fast declining inflation rates should allow EM central banks to support growth further with easier monetary conditions.

Our liquidity indicators show a positive impulse during the past couple of months, thanks in large part to the Bank of Japan. In trying to maintain its policy of keeping a tight lid on yields against a backdrop of rising rates elsewhere, the BoJ has been forced into aggressive bond buying and therefore in pumping significant amounts of liquidity into the financial system. China has also been boosting liquidity sharply to entrench the recovery emerging out of the removal of Covid restrictions.

The monetary easing in China and Japan have offset the European Central Bank’s increasingly aggressive tightening policy. Meanwhile, the US Federal Reserve’s own tightening campaign has been partly neutralised by the US Treasury’s USD400 billion cash injections into the system. The government is forced to draw down its balance with the central bank given the possibility of a debt ceiling crunch this summer. We expect some of these temporary factors to reverse during the first half of the year – though BoJ policy is harder to call. But overall, there should be a return to an overall draining of liquidity in the global financial system throughout 2023.

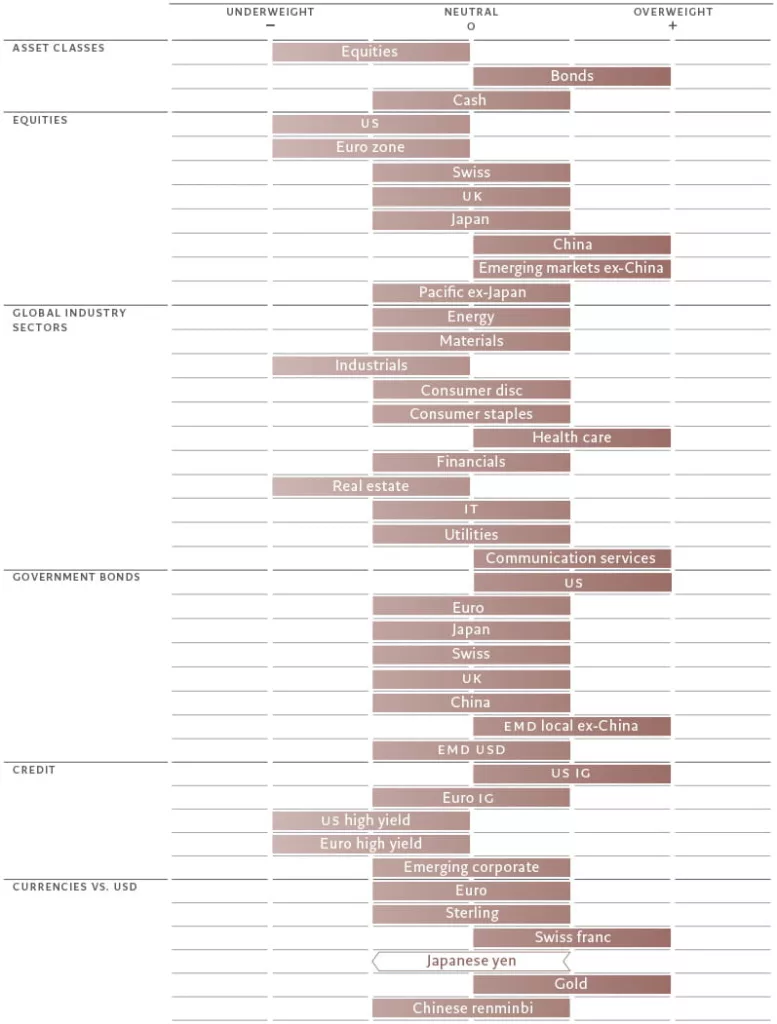

Fig. 2 – Convergence

Yields on US equities, investment grade corporate bonds and US cash, %

Our valuation indicators show that bond yields are back to cycle highs, making fixed income attractive again, while global equities are neutral, with the outperformance of US stocks leaving them somewhat expensive again. Indeed, US equity, cash and corporate bond yields have converged (see Fig. 2).

Cyclical stocks continue to trade at a significant premium to their defensive counterparts, suggesting the equity market is pricing in a sharp economic rebound. However, we continue to forecast that global corporate earnings will be flat this year relative to 2022, with risks skewed to the downside for European earnings in particular. Equity earnings multiples don’t leave much upside for investors, even though they were pulled back somewhat over the past month on a reappraisal of the outlook for official rates – the 12-month forward price to earnings ratio is currently at 15.4 for stocks in the MSCI World Index.

Our technical indicators remain largely neutral with a few exceptions, not least Japanese equities which appear overbought. And while the US dollar rallied sharply, investors show little appetite for chasing it higher. Risk sentiment and positioning pulled back, though surveys show that investors were also seeking out cyclical stocks while retreating from speculative bonds. Exposure to EM equities increased at the fastest pace ever, offsetting redemptions from funds.

Equities regions and sectors: all roads lead to emerging markets

In equities, all roads lead to emerging markets (EM). According to our models, it is within the emerging world where stock investors will find the best value, the strongest economic growth prospects and the most supportive liquidity conditions.

Currently at 2.5 per cent, we expect the GDP growth gap between emerging and developed economies to edge further up to a 10-year high this year. What is more, inflation is falling thanks to swift and early monetary tightening from EM central banks. And, because of their restraint through the pandemic, liquidity across EM economies remains supportive of risk assets – in contrast to negative or at best neutral conditions across much of the developed world.

China’s re-opening adds to EM equities’ investment appeal. February purchasing manager index data show Chinese manufacturing activity expanding at its fastest pace in a decade; the service sector is also growing strongly.

The firepower of Chinese consumers is also considerable. Assuming they take two years to spend the savings accumulated during the pandemic, consumption should rise by 6 per cent a year, according to our economists.

That, in turn, means higher demand for imports and increased Chinese tourism, both of which should boost prospects for Asian economies in particular. Singapore, Vietnam and Thailand could be among key beneficiaries.

We thus maintain our overweight position in emerging market and Chinese equities. China’s stocks look especially good value given their recent correction. We believe that it is fair that they currently trade at a 30 per cent discount to global equities given China’s unique geopolitical and regulatory risks. Returns from here have to be driven by corporate earnings. And on that front, the signs are encouraging.

Earnings revisions for Chinese companies have turned positive, and we see potential for further upgrades. All that, combined with the fact that investor positioning in Chinese stocks is bearish, makes for a strong investment case for the asset class.

Conversely, we are still cautious on US and European equities, despite some improvement in the outlook for both economies. Valuations are relatively more expensive in the case of the US, growth prospects are anaemic across the developed world and monetary policy uncertainty remains.

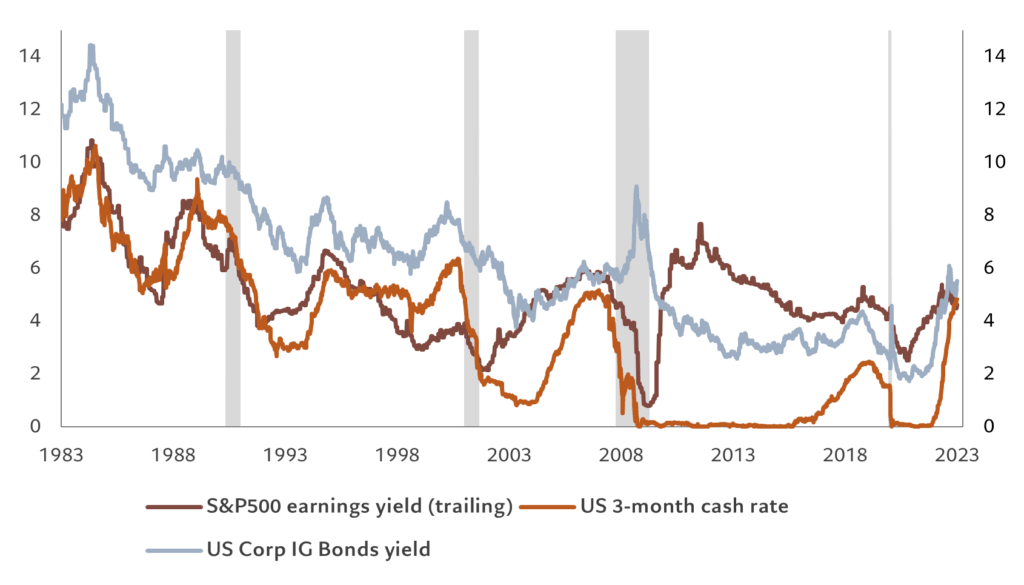

Fig. 3 – Earnings weakness

Earnings per share forecasts and upgrades for MSCI All Country World Index constituents

The outlook for corporate profits serves to reinforce our positioning. As Fig.3 shows, earnings trends are not especially inspiring for developed world stocks. For 2023, we expect US profit growth to remain flat and corporate earnings in the euro zone to fall 3 per cent – in comparison to an increase of around 11 percent in emerging economies.

As for sectors, healthcare remains our favoured defensive play. We also like communication services, which we believe offer exposure to structural sources of growth at an attractive valuation.

We remain underweight industrials, due such stocks’ extended valuations – it is the most expensive sector in our model – which would revert sharply on any evidence of weakness in global growth.

Fixed income and currencies: tilting to quality

Inflationary pressures are proving stickier than expected. A surprisingly strong US core inflation reading in January appears to suggest the Fed may raise interest rates to a peak of 5.5 per cent, some 30 basis points higher than market expected a month ago.

We are unconvinced. Despite the scare, our forecasts for a decline in US inflation remain unchanged: we expect core CPI to fall to 3.4 per cent by the year end. Price pressures are likely to come off as long as central banks are withdrawing stimulus and supply chain bottlenecks continue to ease. The labour market will play a key role too. Here, we already see signs of wage inflation – a key determinant of price pressures – peaking.

This is why we maintain our overweight stance in US Treasuries. Valuations are certainly appealing. US government bonds offer good value given the benchmark 10-year yield has risen to 3.95 per cent, above our long-term fair value estimate of 3.5 per cent.

And what holds for Treasuries is also increasingly the case for US investment grade bonds. Not only are their yields 1.5 standard deviations above the 20-year average, but they also exceed the dividend yields of some of the world’s highest dividend-paying stocks. Short-dated instruments issued by companies in defensive sectors issuers look particularly attractive.

We also like US inflation-linked bonds, whose 2-year real yields of around 2 per cent looks particularly attractive. Those yields are also higher than the dividend yield of the S&P500 Index – a first time since 2009.

Elsewhere, we remain overweight emerging market local currency debt.

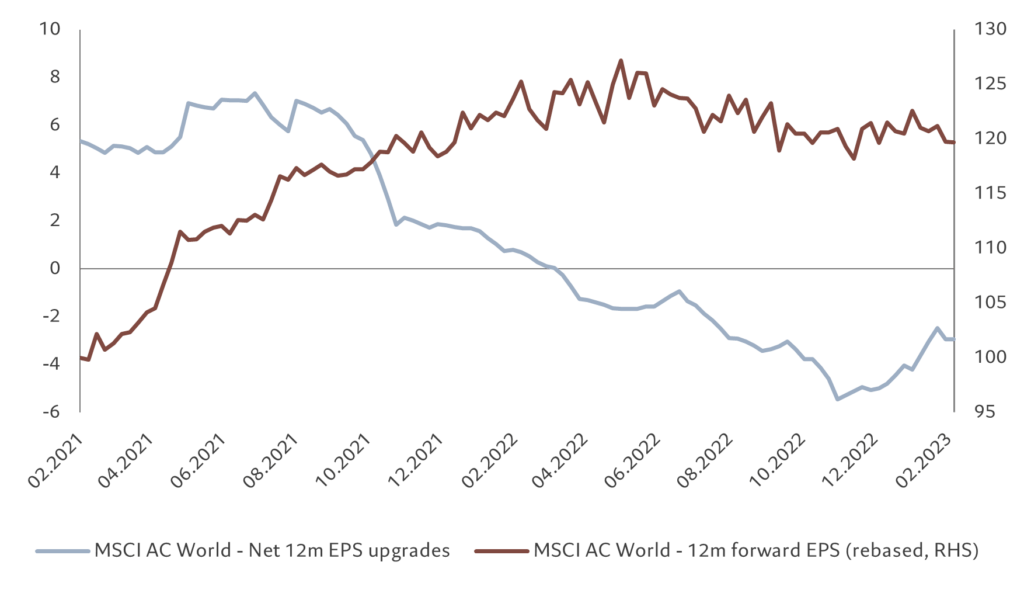

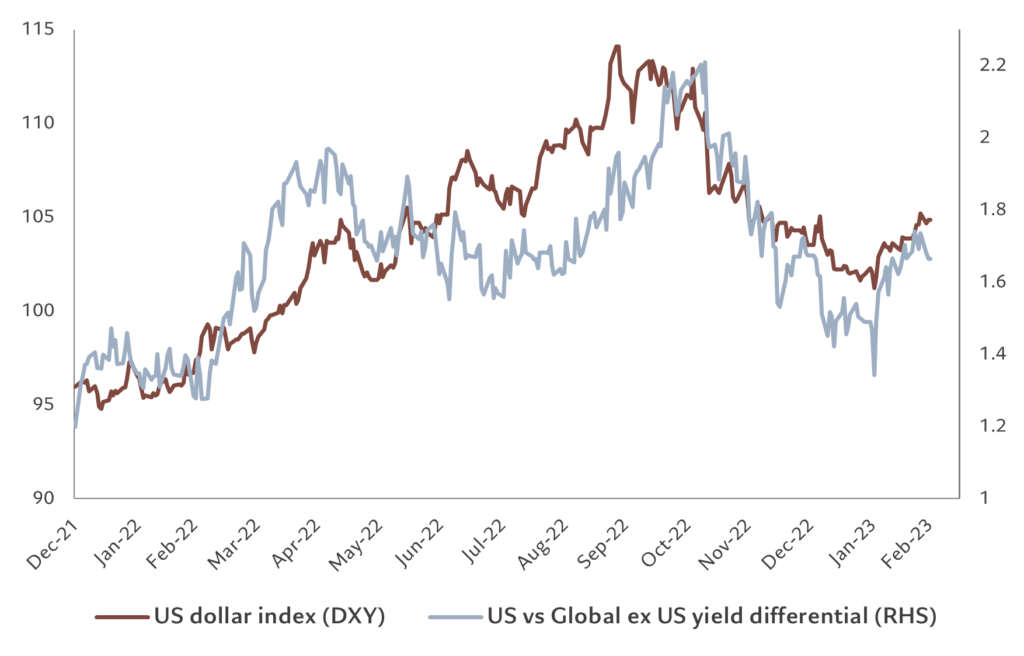

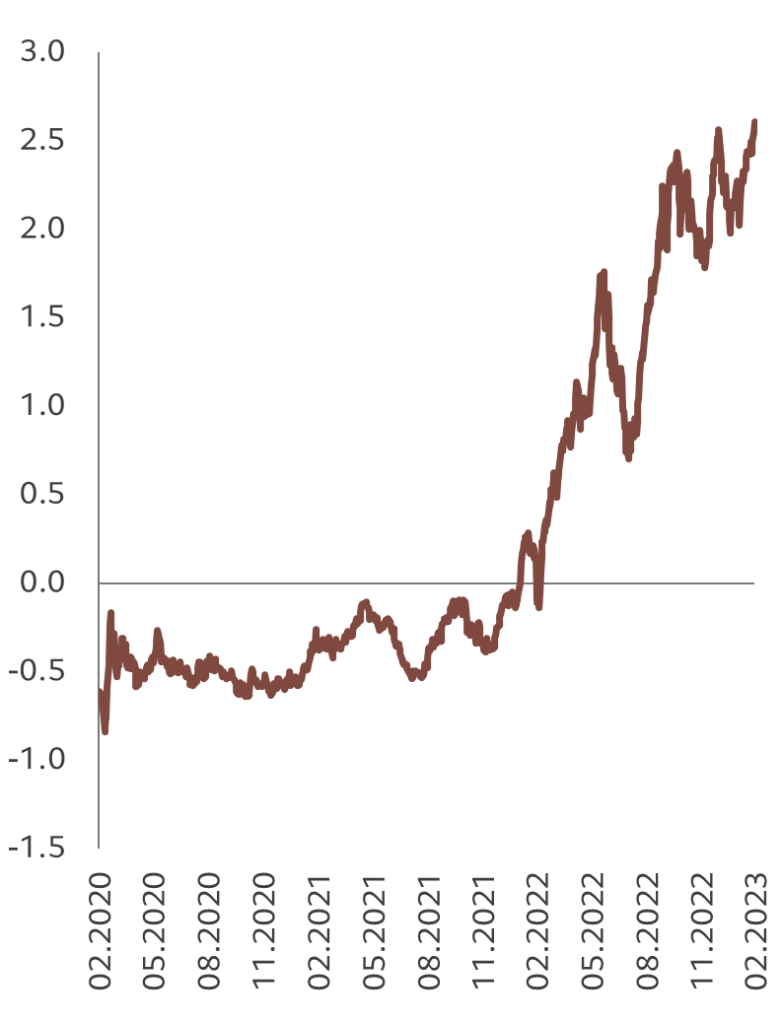

Central banks in emerging economies are providing stimulus to support the recovery and boost lending. The asset class should also benefit from dollar weakness. The dollar has gained in recent weeks on a trade-weighted basis as the yield gap between US Treasuries and other developed market bonds has widened (see Fig. 4). But with that differential likely to tighten over the coming months, we expect the greenback to weaken. Longer term, we see the US currency depreciating by more than 10 per cent in trade-weighted terms over the next five years.

Fig. 4 – Dollar and yield gap

Strong correlation between dollar and yield differentials

In contrast, we continue to be wary of high yield bonds. The asset class has enjoyed a strong start to the year, gaining more than 4 per cent since January in a rally that saw high yield credit spreads tighten by around 80 basis points. However, we think the current market pricing is at odds with the asset class’s fundamentals.

For one thing, default rates, currently at 1.5 per cent in the US and 2.6 per cent in Europe, are almost certain to rise as tighter lending conditions and slower growth could tip issuers in the most stressed corners of the market, such as cyclical triple-C rated ones, into insolvency.

We see yield spreads for speculative-grade bonds, which stand at around 400 basis points over government bonds, potentially doubling in the coming months.

When it comes to currency positioning, we have downgraded the Japanese yen to neutral from overweight. The BoJ is providing monetary stimulus at its fastest pace in three years while its new incoming governor Kazuo Ueda has pledged to maintain ultra-low interest rates and has warned against monetary tightening to respond to cost-driven inflation.

This has tempered the yen’s attempt to appreciate after the currency hit its weakest level in 36 years against the dollar in 2022.

Longer term, however, we expect the yen to strengthen. We don’t think the current bout of monetary easing is sustainable; instead, we think the BoJ is merely preparing the ground for abandoning the contentious yield curve control policy later this year in an orderly manner, before eventually exiting from the negative interest rates policy.

Global markets overview: reverse gear

Global equity markets went into reverse gear in February as investors braced for the possibility of more monetary tightening from major central banks. The shift in expectations was driven by a combination of slightly better economic data alongside signs that inflation may prove stickier than previously forecast.

Equities – as indicated by the MSCI index – finished the month down almost 2 per cent in local currency terms.

Elsewhere, weakness in commodities weighed on energy and materials sectors. In part, this reflected a cooling of optimism around the broader impact of China’s post-Covid re-opening.

Bonds fared only slightly better in aggregate, losing around 1.6 per cent and pushing yields up back towards this cycle’s highs.

Benchmark 10-year US Treasury yields climbed to 3.95 per cent, moving further above our long-term fair value level of 3.50 per cent. The front-end of the curve was hit harder still after several Fed officials ratcheted up their hawkish rhetoric and amid signs of a resilient US economy and sticky core inflation. Markets are now pricing in a terminal Fed Funds rate of 5.5 per cent, compared to the current 4.50-4.75 per cent level.

The story was similar in Europe, where markets are now expecting official interest rates to peak at 3.75 per cent – some 35 basis points higher than they were pricing in a month ago.US and European government bonds both ended February with losses of around 3 per cent.

One bright spot in the fixed income market in Japan, where the BoJ snapped up bonds in order to protect its yield curve control policy.

One asset class which benefited from increased rate hike expectations was the dollar. The greenback gained 2.7 per cent versus a basket of currencies.

In brief