Risks related to biodiversity and ecosystem degradation are beginning to affect company valuations and financing conditions.

Biodiversity loss has long concerned scientists and conservationists, but new research shows it has now become a material financial risk for listed companies and their investors.

Several studies published this year have found that biodiversity-related risks are beginning to affect company valuations.

Listed businesses that contribute most to biodiversity loss have seen their shares penalised, while firms with more sound ecological credentials appear to enjoy more favourable financing costs.

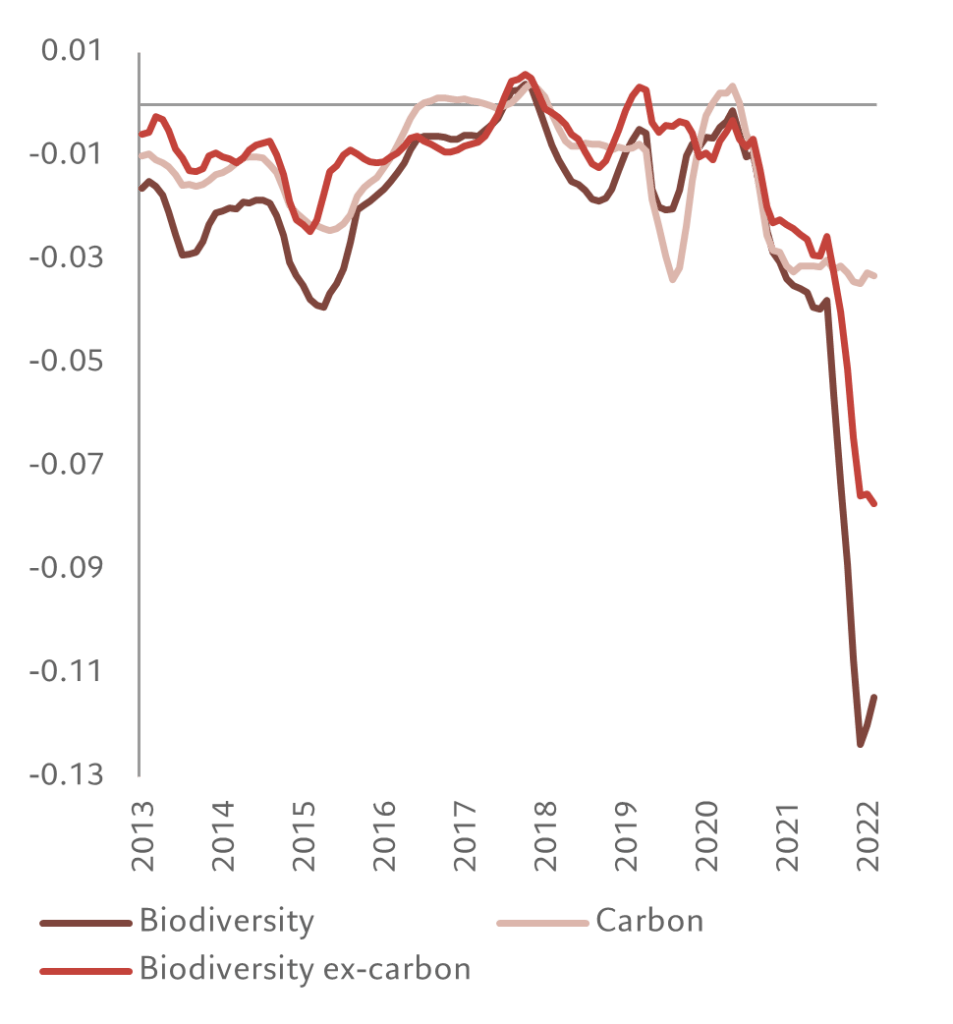

One study published by the Swiss Finance Institute showed that the risk premium investors have demanded on stocks of companies with larger biodiversity footprints has risen in the past two years.1

Based on stock returns of more than 2,000 firms from 32 countries, researchers found that stocks experienced an additional monthly rise in risk premium of 23 basis points, or an annualised increase of 2.8 per cent, for a one-standard deviation increase in the value of their corporate biodiversity footprint.2

Companies with the largest average biodiversity footprints along the value chain were those operating in industries such as retail and wholesale, paper and forestry, and food.

Among the sectors with the smallest footprints were leisure, services and education.

This increase in the premium occurred between the two COP biodiversity summits, held in the Chinese city of Kunming in October 2021 and in Montreal in December 2022. It was at those gatherings that governments agreed the landmark Global Biodiversity Framework (GBF), which researchers say has increased both investor awareness about the loss of biodiversity and the prospect of future regulations.

“Our findings suggest that investors anticipate that new regulations will target business activities whose biodiversity footprint is large. As a result of the associated policy uncertainty, a biodiversity footprint premium starts to emerge,” the study reads.

“We confirm (previous research papers) that ESG risks are increasingly getting priced, and demonstrate this for what is now, next to climate change, the focal ESG topic among institutional investors.”

The GBF includes a target which requires large companies and financial institutions to monitor and disclose their impact on biodiversity, as well as the risks they face from biodiversity loss.3

These requirements will apply across the entirety of a business’s value chain. For financial institutions, the provisions will extend to portfolio investments4.

The Europe-based researchers also found that companies with large biodiversity footprints experienced a cumulative stock price decline of 1.18 per cent relative to small footprint stocks in the three days following the Kunming meeting, compared with the three days before.

Emergence of a risk premium

Other research suggests the biodiversity risk premium may have existed even before.

A working paper published by the National Bureau of Economic Research analysed financial statements and corporate annual reports from 2010 to 2020. It found that companies which were more exposed to biodiversity risk saw their stock prices underperform compared with others when biodiversity risk increased.5

To determine the extent to which biodiversity risks were being incorporated into equity prices, researchers performed a two-part study.

First, they constructed a news-based measure of biodiversity risk using a natural language processing model.

They then built model equity portfolios along sector lines, grouping them according to what the researchers judged as their exposure to biodiversity risk.

The portfolios held long positions in industries with low biodiversity risk exposure – such as semiconductor, software and communication services – and short positions in industries with high biodiversity risk exposures – including energy, utilities and real estate.

Researchers assumed that if biodiversity risk is priced, the return on these biodiversity-risk-sorted portfolios should move together with their aggregate biodiversity news index, effectively behaving like a hedging portfolio for biodiversity risk.

The correlations between the return of this hedging portfolio and their biodiversity risk index were positive at up to 0.2 — what researchers said was large and comparable to those obtained by climate hedging portfolios when evaluated against aggregate climate news. This reflects the fact that biodiversity is becoming as important a risk factor as climate change.

Negative return expectations

A separate group of researchers examined companies in industries that have a large biodiversity footprint – those which depend more on ecosystem services and natural capital such as agriculture. They found that investors require higher compensation for holding large biodiversity-impacting firms.

The French researchers found a “negative and significant” impact on their expected stock returns, or the expected average return from stocks computed from option prices.6

“These results demonstrate that, similarly to carbon risk, markets anticipate that biodiversity will become a major risk factor in the years to come, in particular for companies that rely the most on nature-based exploitation,” reads the working paper.

Premium in bond markets

Another study showed the emergence of biodiversity risk in fixed income markets.

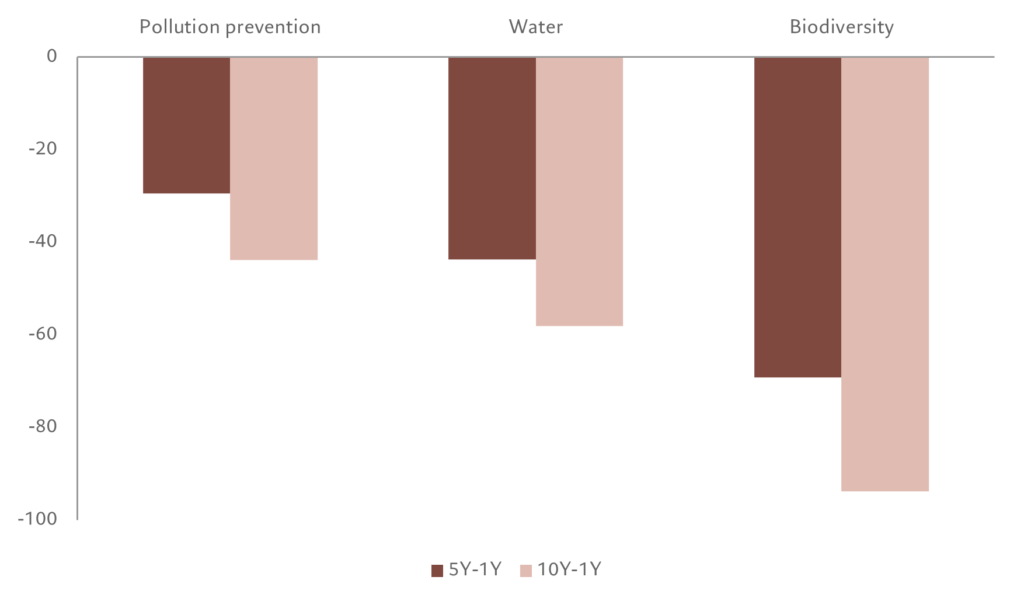

Researchers from Ireland, France and Switzerland compared the Credit Default Swaps (CDS), or the cost of insuring debt against default, for a term between one and ten years.7

They focused on the infrastructure industry, which they say is key to addressing the triple planetary crisis of climate, biodiversity loss and pollution. It is also responsible for nearly 90 per cent of all adaptation costs, more than half of which will need to be spent on the water sector, developing protective infrastructure as well as deploying nature-based solutions such as reforestation.8

They found that companies with better biodiversity risk management had up to 93 basis points better relative long-term financing conditions than the worst ones (see Fig. 2).

What is more, the results show the difference was bigger in the long term – or the slope showing one to ten years – than that of one to five years. This flattening of the CDS curve indicates, researchers say, that investors perceive those risks as long-term issues.

Fig. 2 Flatter curve

Scale of negative effects on CDS slopes from three environmental variables

“To protect endangered species or preserve natural habitats, laws that, e.g., forbid building roads or rails in protected areas, could lead to high additional costs for firms operating in this business,” the study reads.

Researchers said legislation that already internalises clean-up costs for companies when they pollute on- or off-site, such as the US Clean Air Act, could be one of the reasons for this phenomenon.

Biodiversity: not business as usual

The growing catalogue of research attesting to the financial materiality of biodiversity loss lays bare the complexities and costs of the net zero transition.

The biodiversity risk pricing mechanism is a complex phenomenon that will evolve over time.

Yet this doesn’t mean businesses and investors can afford to disregard biodiversity loss as a risk factor. To the contrary.

The Taskforce for Nature-Related Financial Disclosures (TNFD), an industry body representing financial institutions and companies representing assets of over USD20 trillion, has just launched a set of 14 disclosure recommendations that are aligned with the GBF.

In the near future, biodiversity risks will become a major topic for debate across corporate boardrooms worldwide. It is already a material financial variable, affecting the way firms conduct their businesses and how investors allocate their capital.

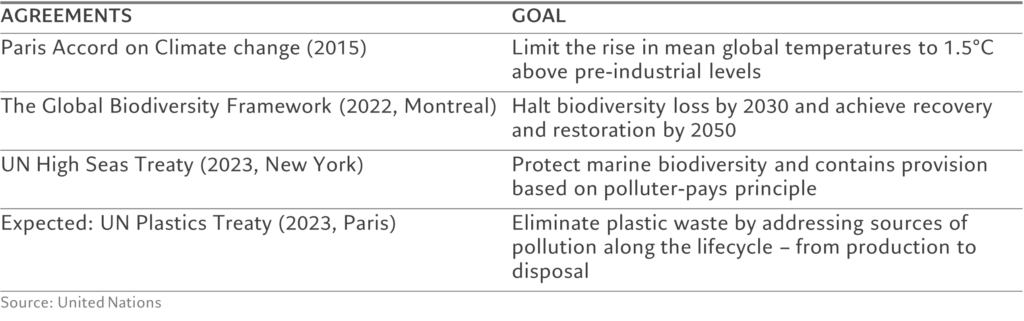

Appendix: Rapidly developing policy scene

International agreements that took decades in the making are now all falling into place, reflecting how policymakers consider halting the degradation of nature an urgent environmental issue.

This comes eight years after nearly 200 countries agreed to limit global warming in Paris in a sweeping deal that has aligned finance flows and investment portfolios with climate objectives. The Paris agreement has also raised risk premium for companies for both climate transition and physical risks from global warming.9

The Montreal Agreement of December 2022 could have the same transformative effect, encouraging businesses to accelerate efforts to protect biodiversity, and investors to incorporate biodiversity risks when allocating their capital.

[1] Garel, A. et al, Do Investors Care About Biodiversity? (May 26, 2023). Swiss Finance Institute Research Paper No. 23-24, European Corporate Governance Institute – Finance Working Paper No. 905/2023 https://ssrn.com/abstract=4398110

[2] The biodiversity footprint was calculated using a metric based on a species-based indicator of biodiversity intactness

[3] https://www.cbd.int/article/cop15-cbd-press-release-final-19dec2022

[4] For more, please read our related article: https://am.pictet/en/globalwebsite/global-articles/2023/expertise/thematic-equities/cop15-and-investors

[5] Giglio, S. et al, Biodiversity Risk (April 4, 2023). https://www.nber.org/papers/w31137

[6] Coqueret, G. and Giroux, T. A Closer Look at the Biodiversity Premium (July 21, 2023). https://ssrn.com/abstract=4489550

[7] Hoepner, A. et al, Beyond Climate: The Impact of Biodiversity, Water, and Pollution on the CDS Term Structure (February 8, 2023). Swiss Finance Institute Research Paper No. 23-10, Michael J. Brennan Irish Finance Working Paper Series Research Paper No. 23-4 https://ssrn.com/abstract=4351633

[8] https://www.unep.org/resources/report/infrastructure-climate-action

[9] https://www.bis.org/publ/bppdf/bispap130.pdf