Biogas and biomethane are renewable gases which may help reduce emissions across the energy value chain. Yet, their potential remains largely untapped.

Key takeaways

- Biogas and biomethane are renewable energy sources with multiple applications, ranging from heating and power supply to clean transportation.

- The deployment of biomethane to replace fossil fuels does not require building new infrastructure.

- Biomethane can be stored, and its production volume can be adapted to meet fluctuating energy demand.

- Government incentives enable increasing investments in biogas projects.

Biogas has gained popularity in recent years as yet another source of renewable energy next to hydro, solar and wind. It is produced from the decomposition of organic matter,1 such as agricultural or urban waste residues, which can then be used to replace conventional natural gas. As the share of biogas and biomethane in the world energy supply is less than 1%,2 their potential remains largely untapped.

What is biogas?

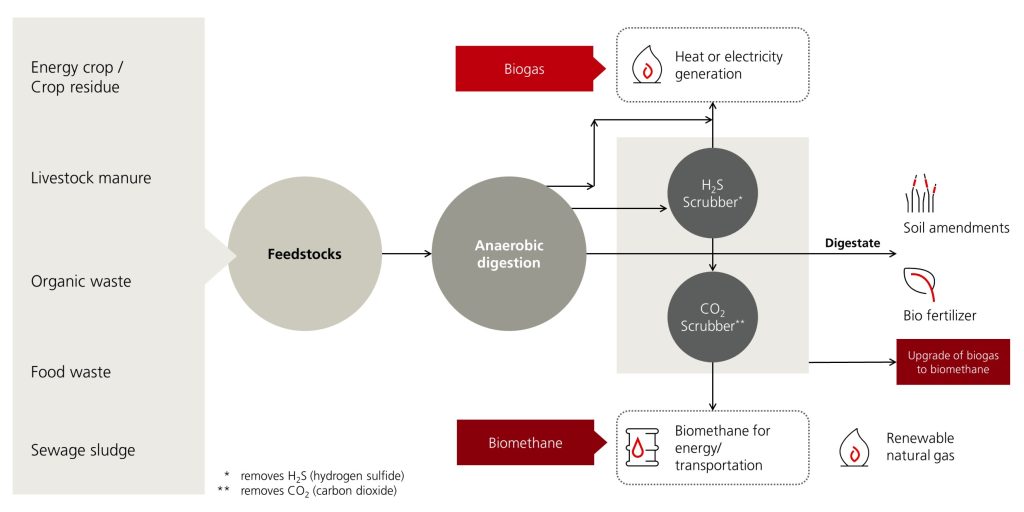

When organic matter breaks down with the help of bacteria, methane and carbon dioxide are released in the process. Carbon dioxide can then be removed, which leads to the production of biomethane, an upgraded form of biogas, consisting of almost 100% methane.3 Biomethane is considered a “green gas” or “renewable gas,” since it is a 100% renewable fuel.4 As Figure 1 shows, biomethane can be injected into and transported via natural gas pipelines. This means that no additional investment is needed to develop new infrastructure since the existing gas infrastructure can be used to transport biomethane.

Figure 1: Biogas and biomethane production process

Tap the graph to zoom

A schematic diagram illustrating the production of biogas and biomethane.

Benefits of biogas

Solar and wind power are intermittent sources of energy since they depend on the availability of sunlight and wind to generate power. Batteries can partially offset these limitations, but only for a few hours. In contrast, biomethane can serve as a baseload fuel, overcoming the limitations of intermittent renewable power generation systems,3 as electricity generated from biomethane is available 24 hours a day.

There are many benefits of biogas.4 Off-grid and on-site energy production reduces the dependence on transmission grids. Biogas can be used to fuel district heating through combined heat and power generation. There is an environmental benefit of biomethane as well. It can contribute to mitigating climate change and help reduce methane emissions, one of the most harmful greenhouse gases (GHG), in accordance with COP26 Methane Pledge.5 What is more, biogas can enable the circular economy by reducing resource use. Using digestate, a by-product of biogas, as natural fertilizer it can contribute to food security.

Opportunities and challenges

The scale of biogas and biomethane projects varies. In emerging economies, biogas production largely stems from small-scale plants often situated in rural settings.6 Despite the potential from agricultural crop residues in many developing countries, access to technology and fiscal incentives have constrained larger scale biogas production. This contrasts with developed countries, where larger biogas plants generate electricity and heat from agricultural and urban waste.7

Similar to other renewable energy projects, one of the challenges in implementing biogas solutions is social acceptance, currently considered one of the main non-technical barriers to the successful implementation of site-specific biogas projects. Research has shown that lack of support from local communities, including local decision makers, stakeholders, and citizens, may jeopardize the outcomes of energy projects that are otherwise deemed technically and economically feasible. Identification of non-technical factors and an appropriate communication strategy are therefore vital to alleviate the public perception risk.8

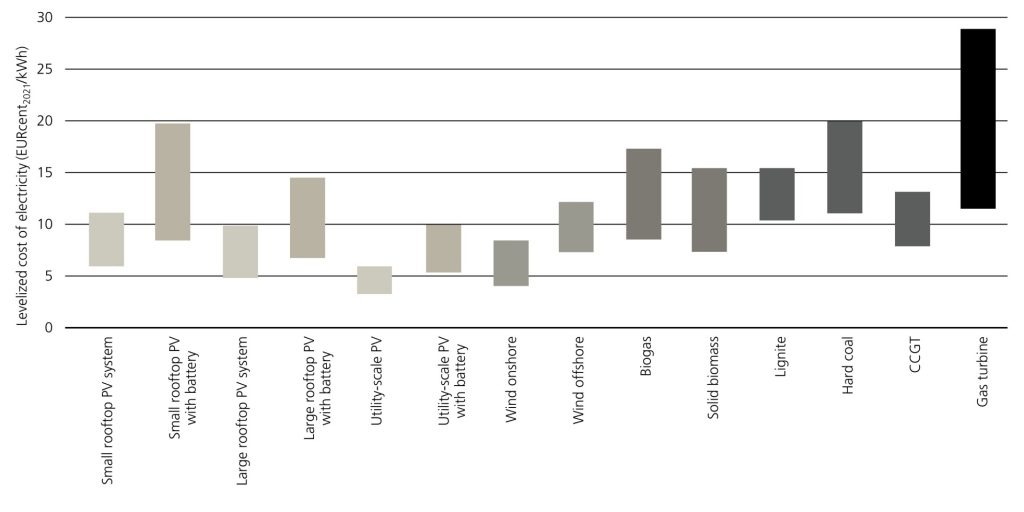

Historically, the main challenges for biogas projects stemmed from competing with other renewable technologies on a levelized cost of electricity (LCOE)9, as Figure 2 shows for Germany. Biogas ranked behind solar and wind in the merit order of electricity dispatch in 2021. The example of Germany highlights the role of changes in subsidies for biogas plants fueled by energy crops with a major cut in subsidies in 2014 because of the effects on agricultural land use and the introduction of a tendering system in 2017.10 Yet government incentives have changed over time, which turned biogas production into an increasingly attractive investment opportunity for utilities and industries.

Figure 2: Levelized cost of electricity from renewable energy technologies in Germany

Tap the graph to zoom

Source: Fraunhofer Institute for Solar Energy Systems ISE (June 2021). Levelized cost of electricity renewable energy technologies. Based on Fraunhofer Institute for Solar Energy Systems ISE (June 2021). Levelized cost of electricity renewable energy technologies. Page 2. Retrieved on 30.07.2024.

A bar graph depicting levelized costs of electricity produced from renewable sources in Germany, from small rooftop photovoltaic systems to gas turbines.

In the EU, grants from the European Green Deal (2019),11 Renewable Energy Directives (2018 and 2023), Fit for 55 (2021), and REPowerEU Plan (2022) support investments in biogas and biomethane. Similarly in the US, entities investing in biogas projects qualify for investment tax credits (ITC) under the Inflation Reduction Act (IRA) (2022).12 According to the EurObserv’ER’s projections,13 electricity produced from biogas in the eurozone will increase from 58.7 TWh in 2022 to 80 TWh by 2030. In the US, ample availability of natural gas at low production costs makes it more difficult to achieve growth rates similar to those in Europe in the medium term.

A recent announcement of a long-term Biomethane Purchase Agreement (BPA) between a French utility and a German chemical company14 illustrates this opportunity. The chemical company would be able to offer products with zero carbon footprint, which could be used across numerous industries such as automotive, detergents, textiles, and woodworking. In the US, renewable natural gas (RNG) projects enable the processing of biogas collected from landfills. Part of it is then used to fuel heavy-duty vehicles, which helps displace fossil fuels and avoid GHG emissions.15 This leads us to believe that biomethane is an important enabler of circular economy, contributing to a positive environmental impact over the life cycle of sustainable products.

1. AsiaBiogas. What is biogas? BIOGAS – Asia Biogas (Accessed on 29.07.2024).

2. World Bioenergy Association (2023). Global Bioenergy Statistics Report.10th Edition pp.29-31. Global bioenergy statistics – Worldbioenergy Accessed on 29.07.2024.

3. Energy Institute (2023) Europe’s market for anaerobic digestion and biogas production | Article Page (energyinst.org) (Accessed on 29.07.2024).

4. World Biogas Association (2019). Global Potential of Biogas pp.8-9. WBA-globalreport-56ppa4_digital-Sept-2019.pdf (worldbiogasassociation.org) (Accessed on 29.07.2024).

5. Global Methane Pledge (2023). Global Methane Pledge | Global Methane Pledge (Accessed on 29 July 2024).

6. Energy Reports 6 (2020) 2973-2987. Abdulmoseen Segun Giwa et al. Prospects of China’s biogas: Fundamentals, challenges and considerations – ScienceDirect. Accessed on 29.07.2024.

7. NS Energy (2017). Largest Biogas Plants – NS Energy (nsenergybusiness.com) (Accessed on 29.07.2024).

8. Mancini E., Raggi A. (2022) Out of sights, out of mind? The importance of local context and trust in understanding the social acceptance of biogas projects: a global scale review. Science Direct. Accessed on 29.07.2024.

9. Fraunhofer Institute for Solar Energy Systems ISE (2021). Levelized cost of electricity renewable energy technologies. pp. 2-3, 23-24 Accessed on 29.07.2024.

10. Yang et al. Energ Sustain Soc (2021) 11:6. Effects of the German Renewable Energy Sources Act and environmental, social and economic factors on biogas plant adoption and agricultural land use change. Effects of the German Renewable Energy Sources Act and environmental, social and economic factors on biogas plant adoption and agricultural land use change (biomedcentral.com) Accessed on 29.07.2024.

11. European Commission. The European Green Deal The European Green Deal – European Commission (europa.eu) (Accessed on 29.07.2024).

12. US Congress. Inflation Reduction Act of 2022. Text – H.R.5376 – 117th Congress (2021-2022): Inflation Reduction Act of 2022 | Congress.gov | Library of Congress (Accessed on 29.07.2024).

13. EuroObserv’ER (2023). Biogaz Barometer, p 15. Biogas barometer 2023 – EurObserv’ER (eurobserv-er.org) (Accessed on 29.07.2024).

14. BASF and Engie, Joint News Release, 4.7. 2024. BASF and ENGIE signed a long term Biomethane Purchase Agreement in Europe (Accessed on 29.07.2024). BASF and ENGIE signed a long term Biomethane Purchase Agreement in Europe (Accessed on 29.07.2024).

15. Waste Management (2023). WM Unveils New USD 35 Million Eco Vista Renewable Natural Gas Facility. WM Unveils New USD 35 Million Eco Vista Renewable Natural Gas Facility (Accessed on 29.07.2024).