Peaking bond yields, measured rate hikes in Asia and still healthy credit fundamentals among Asia’s higher quality corporates present investors with an attractive entry point to the Asian bond market. As China growth risks recede, we are likely to see flows return to Asian bonds, further supporting prices.

Rising global inflation and interest rate hikes have caused global bond prices to reprice swiftly in 2022. In June, the Federal Reserve undertook its biggest interest-rate hike since 1994. From just 1.5% a year ago, the US 10-year Treasury yield has crossed 3% at the point of writing, the highest in ten years1. While Asian bonds were affected by the rise in US yields, China’s growth slowdown in the first half of 2022 had further weighed on investor sentiment towards Asian and Emerging Market assets.

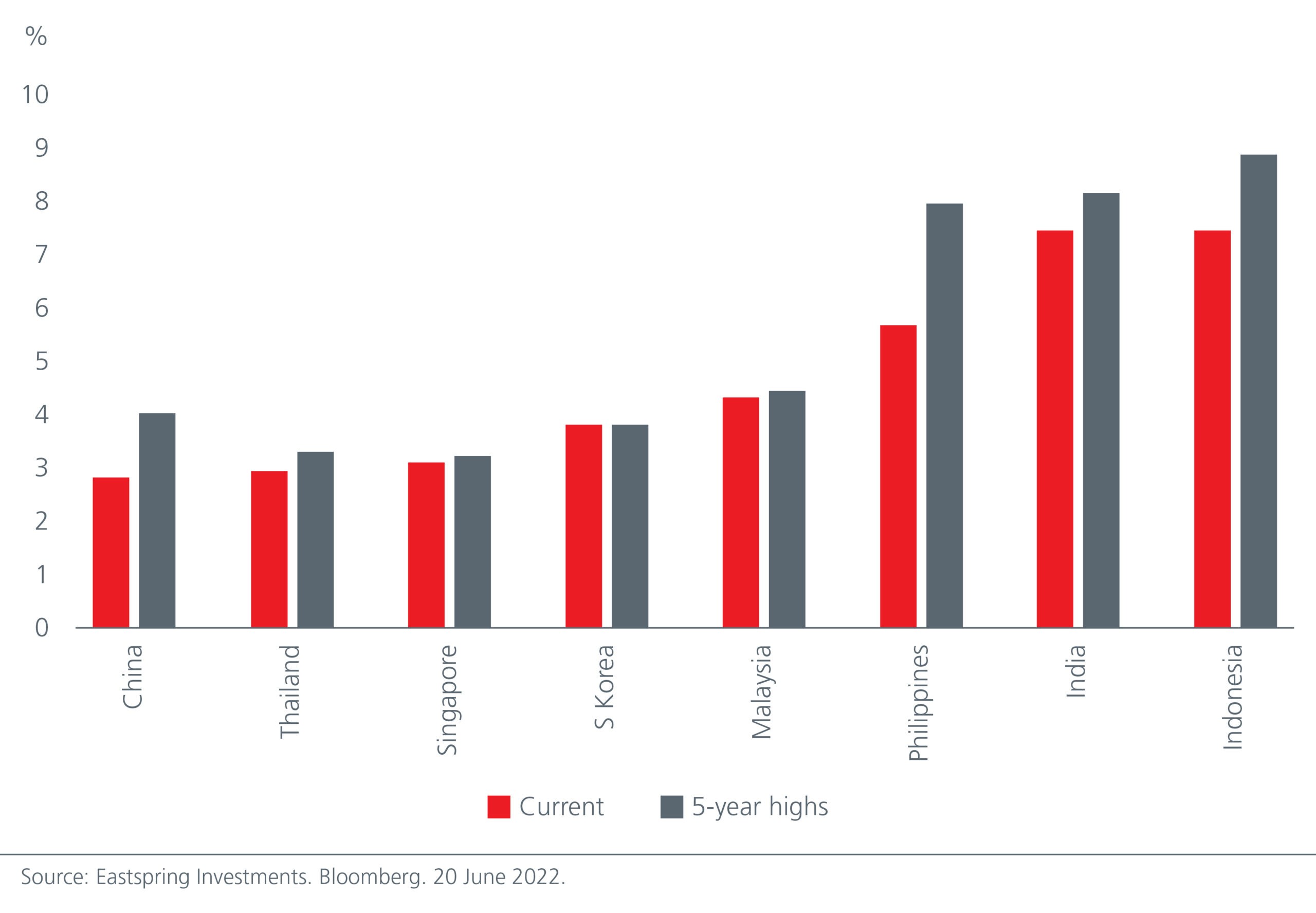

We note that most local currency 10-year bond yields are currently close to their five-year highs, and many have exceeded previous highs during the 2018 Fed hiking cycle. Fig. 1. We believe that Asia’s higher bond yields today offer investors an attractive opportunity to gain bond exposure.

Fig. 1. Asia local currency government bond yields

Meanwhile, the steepness across most Asian yield curves relative to their historical averages suggests that it is viable for investors to add longer duration bonds to their portfolios. If market risk sentiment stabilises and improves, which we expect, we would likely see Asian bond returns enhanced by the higher yields and more attractive credit spreads.

We may be past the worst for the Chinese economy

China’s economy needs to stabilise in order for investor sentiment, especially sentiment towards Asian assets, to improve. On this front, Chinese policy makers have announced greater fiscal support in the form of tax cuts. Infrastructure investment will also be an important growth driver. Chinese state-owned policy banks have been asked to set up a RMB 800 billion (USD120 billion) line of credit for infrastructure projects. In terms of monetary easing, the People’s Bank of China has cut the reserve requirement ratio, loan prime and mortgage rates. Further easing can come from liquidity injections, targeted credit support and further cuts.

Stabilising the real estate sector, which accounts for 20-25% of China’s GDP, is important for the Chinese economy. While contracted property sales continue to register sharp year on year declines in May, higher quality developers saw smaller declines. Sales may pick up as lockdowns ease and consumer confidence returns. The People’s Bank of China has also been encouraging high-quality China property developers to acquire property projects owned by the distressed developers. This can help lower the default rate in the sector. We expect more aggressive easing and support measures in the real estate sector in the second half of the year. These are likely to include a relaxation of pre-sales proceeds by local governments, and further easing in mortgage and home purchase restrictions in Tier 1 cities.

As such, we may have moved past the worst for the Chinese economy in the second quarter of 2022, but it would take time for the counter cyclical measures to be reflected in the real economy. Meanwhile, the Chinese Renminbi should be more stable in the second half of 2022. Consistent with a supportive economic policy, the Chinese authorities are likely to want a stable currency as well. This should in turn help to anchor the region’s currencies.

Still healthy credit fundamentals for high grade corporates

Trade volume growth was already softening even before the US Federal Reserve started to hike interest rates. With the decline in COVID restrictions globally, consumption is likely to continue to shift from goods to services. Against this backdrop, Asian economies with large domestic populations are expected to fare quite well relative to the more trade-dependent Asian economies. The ASEAN economies should continue to benefit from their delayed reopening: this should be especially positive for Thailand whose economy is highly reliant on tourism. Commodity exporters like Malaysia and Indonesia should also see strong GDP growth in 2022.

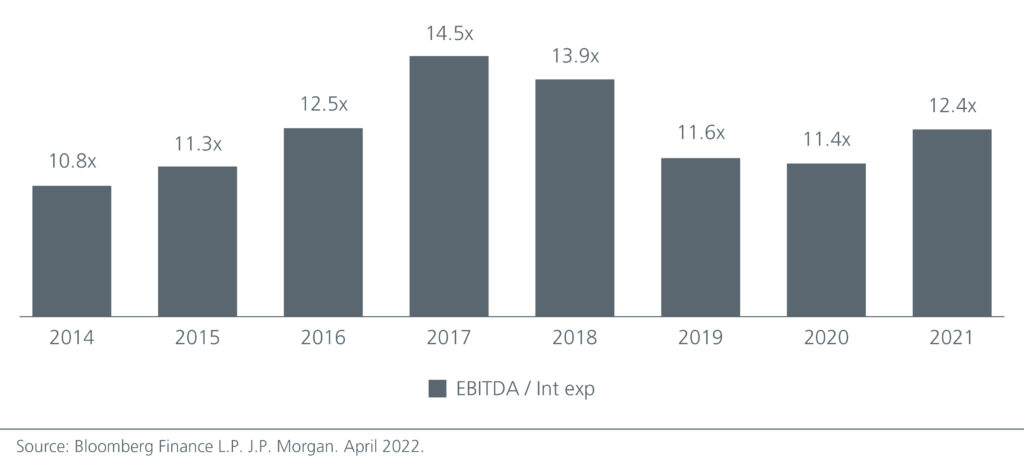

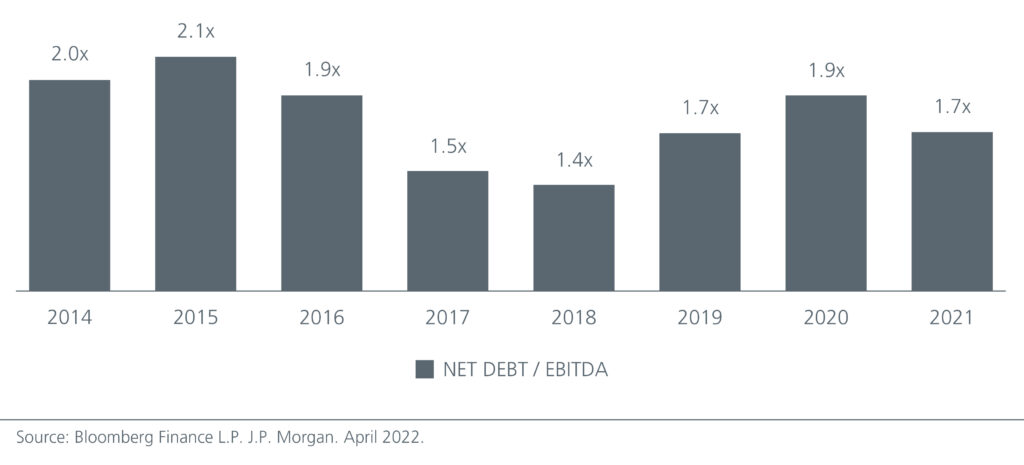

We note that corporate fundamentals, particularly among Asia’s higher quality companies, have remained healthy. In fact, leverage and interest coverage ratios are largely back to pre-COVID levels for Asian Investment Grade corporates. Interest coverage has improved on the back of lower borrowing costs. See Fig. 2. Net debt/EBITDA has also fallen, implying that Asian corporates are requiring less time to pay off their debt. See Fig. 3.

Fig. 2. Interest rate coverage has improved

Fig. 3. Asian high-grade corporates paying off debt quicker

Given still healthy corporate balance sheets coupled with wider spreads following the Asia bond market’s sell off year to date, the risk return profile for Asia investment grade credits is improving.

Rate hikes in Asia are likely to be more measured

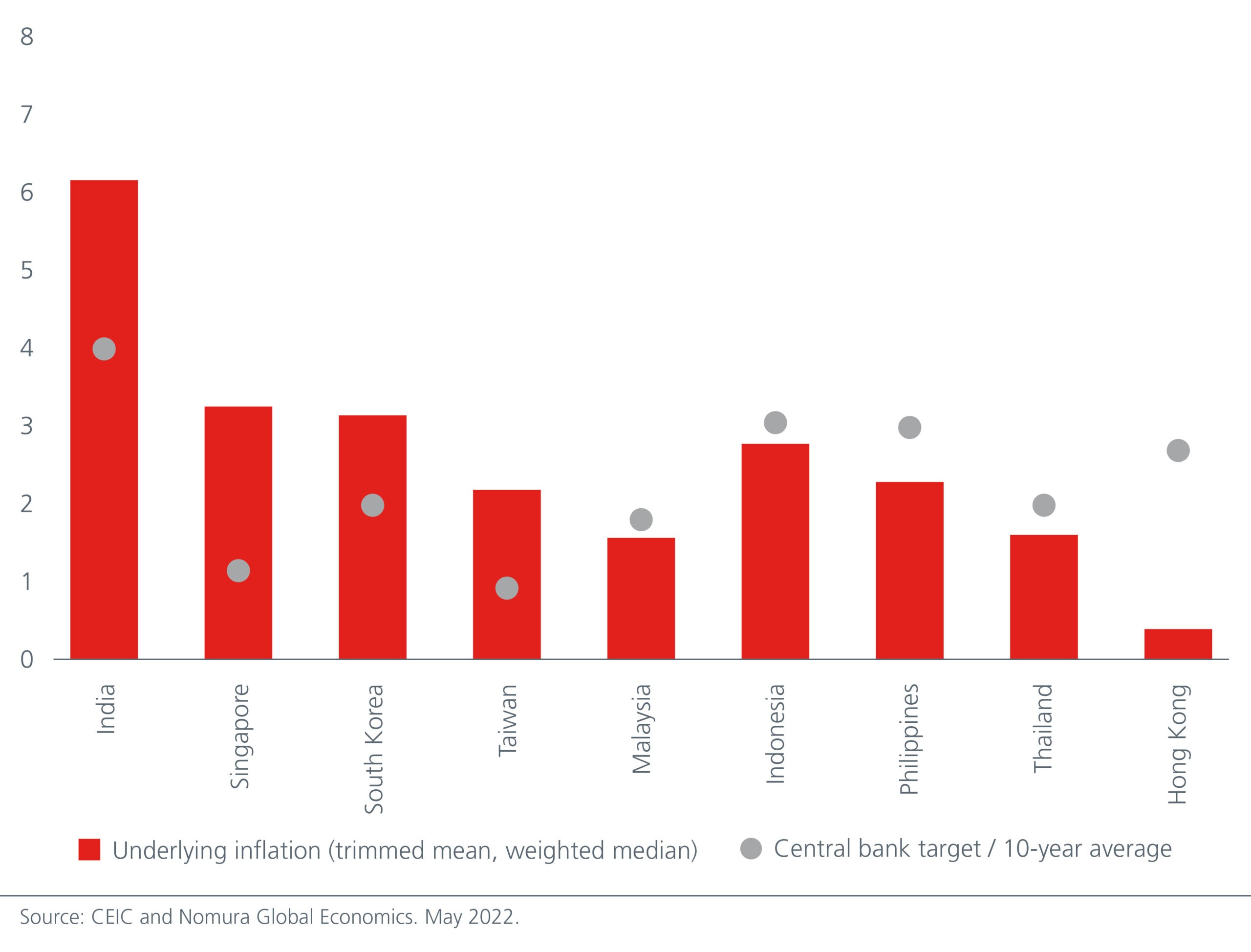

Higher commodity prices from supply chain disruptions, rising energy prices and reopening pressures have lifted inflation across Asia. Inflation is above central bank targets in Singapore, South Korea and Taiwan – higher income economies which have mostly managed the COVID outbreak better and have brought economic activity back to or above potential. Fig. 4. Accordingly, the central banks in these economies have also been among the first in the region to have tightened their monetary policies.

Fig. 4. Inflation versus central bank targets

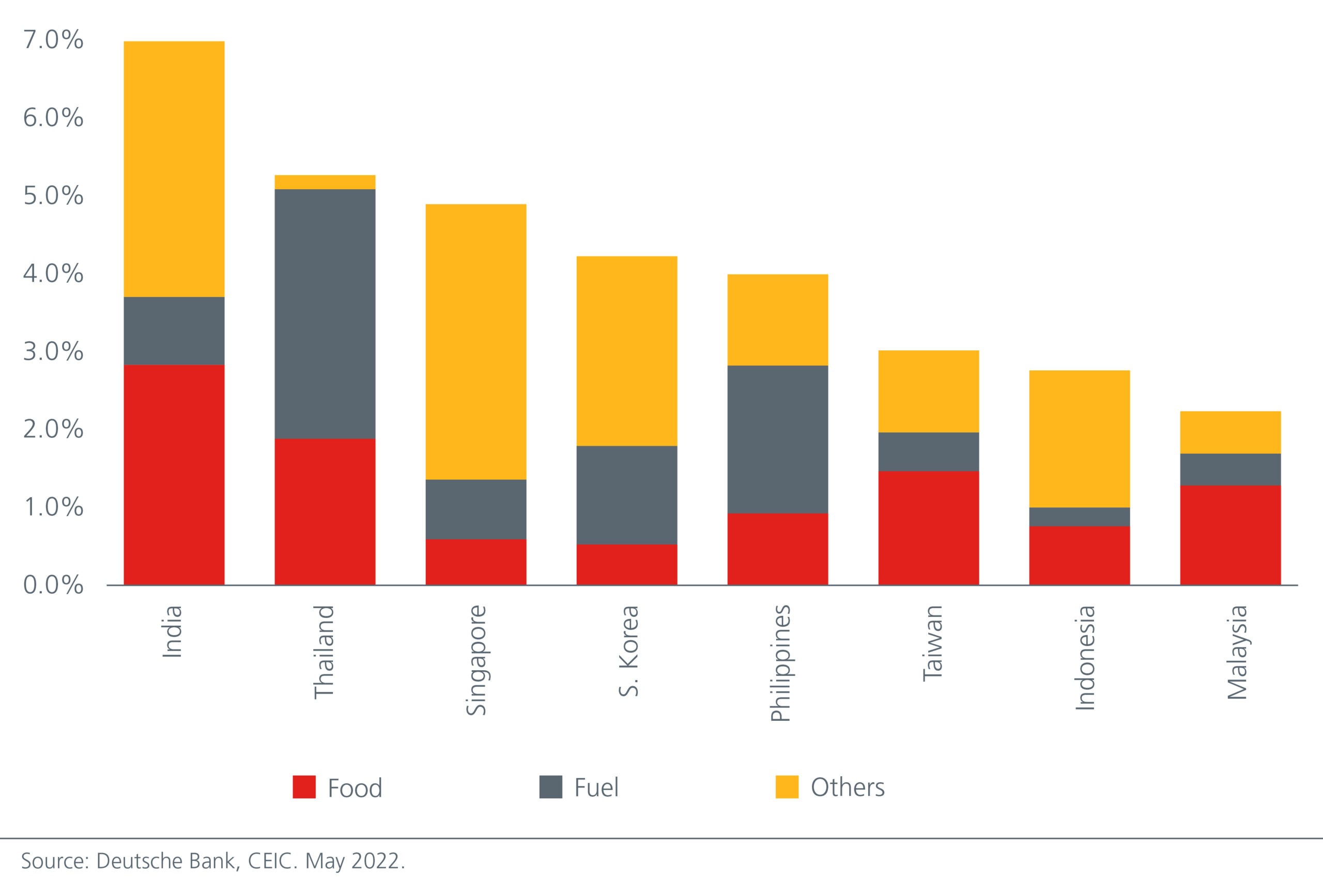

India, Indonesia, Malaysia, Philippines and Thailand were previously struggling with the Delta variant but now, with higher immunity levels and declining social distancing restrictions, policymakers are refocusing on inflation. While the pace of rate hikes is picking up in Asia, Asian central banks are likely to be less aggressive than the Fed. The weight of food in the inflation basket in the region is 3-4x larger than for fuel. See Fig. 5. With supply disruptions responsible for the rise in food prices, higher interest rates are unlikely to be effective in bringing prices lower. Therefore, Asian central banks are likely to respond to supply-driven food inflation with non-monetary measures such as subsidies. Nevertheless, the rise in food prices and the impact on inflation bears monitoring.

Fig. 5. Contribution to headline inflation, last 3-month average

Meanwhile, inflationary pressures in the US may peak as US growth momentum slows. Although a 2023 US recession is currently not our base case, we note that the Citi U.S. Economic Surprise Index declined in May as key economic data came in below consensus. The market may eventually moderate its expectations on the magnitude of future Fed rate hikes.

Inflationary pressures from supply chain disruptions could also ease in the US, as consumption shifts from goods to services as economies re-open. Energy prices could be tempered by weaker demand as well as by an increase in US shale output. Finally, one of the key drivers of inflation in the US – used car prices – is moderating as auto production rises. A peak in inflationary pressures will cap US and in turn Asian bond yields.

A unique opportunity for bond investors

Peaking bond yields, measured rate hikes in Asia and still healthy credit fundamentals among Asia’s higher quality corporates present investors with the potential for more attractive returns and diversification. As China growth risks recede, we are likely to see flows into Asian bonds, further supporting prices. The divergence in the macro, inflation and currency outlook within Asia also presents active investors opportunities to enhance returns through duration management, credit selection and currency bets.

This is the last in our series of eight articles which examines the different investment strategies investors can adopt to tap on the opportunities that are emerging in Asia.

Footnotes:

Sources:

1 28 June 2022. Bloomberg.

Disclaimer:

This document is produced by Eastspring Investments (Singapore) Limited and issued in:

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

This document is produced by Eastspring Investments (Singapore) Limited and issued in Thailand by TMB Asset Management Co., Ltd. Investment contains certain risks; investors are advised to carefully study the related information before investing. The past performance of any the fund is not indicative of future performance.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. – UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing.

Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc (a company incorporated in the United Kingdom).