Germany sets dial to ‘11’: European government bond yields sent through roof as Germany unveils plans to loosen strict fiscal rules

The new government in Germany looks set to alter decades of fiscal policy stability and ramp up spending. The incoming CDU/CSU regime has proposed a historic new spending package, signalling an expansion for Europe’s largest economy

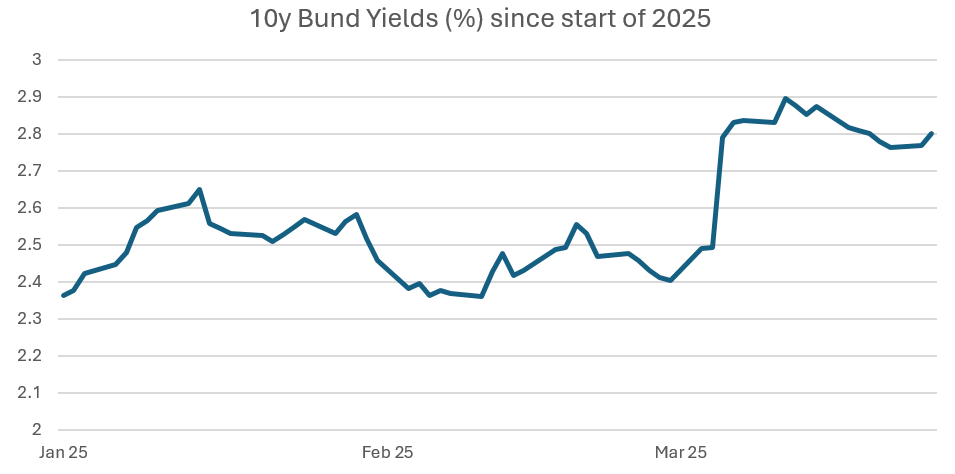

The move comes as Donald Trump pivots the US away from Europe and, in particular, the conflict in Ukraine. This has seen election-winner Friedrich Merz set out plans for hundreds of billions of euros in investment into Germany’s infrastructure and military – sending German government bonds (bunds) sharply higher (figure 1).

Uncertainty remains, but with the German economy struggling, will this fiscal bazooka help? And how do we expect bund yields to behave long term?

Figure 1: Bund yields have jumped

Bubbling away

The move from Merz feels sudden, with markets reacting sharply, but Germany has long been staring down the barrel of economic stagnation. Germany has been the growth engine of Europe, where it has been the beneficiary of accommodative monetary policy; consumer demand from China; and cheap energy prices. These tailwinds for growth, however, have shifted over recent times, with a tightening of monetary policy as the ECB seeks to tackle the post-Covid inflationary pulse, Chinese demand has fallen away and energy prices spiked after Russia’s invasion of Ukraine.

In recent weeks, the country, and wider world, has also seen a strategic re-prioritisation from Donald Trump’s administration in the US, leaving Europe more exposed to geopolitical threats. Trump has sought ‘America first’ policies and threatened to withdraw American spending on some war efforts abroad – with a public stand-off with Ukraine’s Volodymyr Zelenksyy making it clear the US is no longer keen to fund a war in Europe.

Behind all of this is the looming threat of tariffs. While it is difficult to keep track of Trump’s threats and pullbacks, the US look set to raise the average tariff on goods imported from the rest of the world to 10%, from 5% previously. Whilst the exact magnitude and scope of the tariffs remains uncertain, we maintain the assumption that the US raises the average tariff on goods.

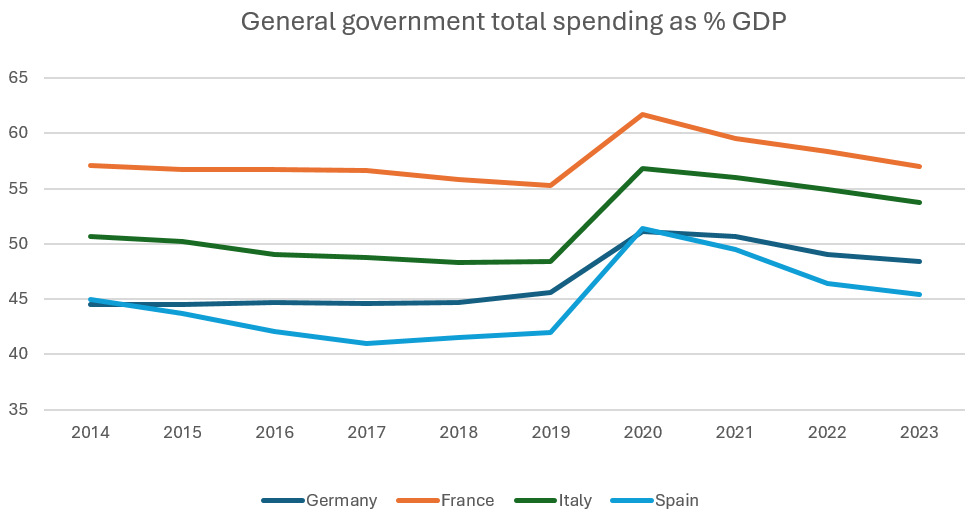

Merz has had to act quickly. The government will now see borrowing rise from 0.35% to a maximum of 1.4% of GDP, if the debt ratio is below 60% (figure 2). The hope is to loosen the strings and help boost the German economy.

Figure 2: Scope to increase borrowing?

Twists and turns

What has taken markets by surprise is the sheer size of the money being made available. While many commentators expected a move in this direction from the new Merz coalition, not many predicted this scale. A proposal of this magnitude is always difficult to navigate, which is why Merz has taken the historic step of recalling the outgoing parliament to vote on the resolution.

Any drag in approving the proposals causing them to spill over into the coming weeks could hamper any potential agreement, so there is an impetus to approve the package sooner rather than later. Markets are behaving as if the package will be approved, even before Germany’s parliament was recalled and subsequently gave the green light.

There is also an assumption that this will prove growth positive for the German economy. This, in turn, could lead to a less accommodative monetary policy position from the ECB, (potentially cutting interest rates by less) – which has fed through to bund yields as the market has priced a higher terminal rate in this cutting cycle than was previously the case.

The other key driver of rising yields is the expected increase in supply – this fiscal expansion has to be paid for, likely via increased debt issuance, which the market has to absorb.

Sea change move for European govvie bonds

This change in fiscal stance will have far-reaching implications for bunds – and wider European government bond markets. Ten-year bund yields jumped 0.5% on the announcement and show no signs of reversing.

For a market that has seen negative net issuance, post central bank purchases, for seven of the past 10 years, the implications of this fiscal shift are hard to understate. The long-term consequences are still being digested but an abundance of new supply guarantees a sea change in the bund market.

What we have also seen is a shift higher in other European government bond yields. Bunds have not decoupled from their Italian or Spanish counterparts. Financial conditions have tightened across Europe. This is a European issue, not just a Germany issue: refinancing across the continent has become more expensive.

What’s next

From an historical perspective, this would be a large, unprecedented, multi-year increase in public investment for Germany. But what does it mean for government bond yields? A lot still needs to be answered but we are slightly more cautious buying European government bonds.

Something to note is the infrastructure spending plan will happen over 10 years, so any growth from the plan will happen over a couple years from now but we have seen markets price in any economic growth immediately. Therefore, the level at which yields settle could further shift from here, but there are so many things, over and above German fiscal loosening than can impact yields. However, the re-pricing 0.5% higher yields across Europe looks set to stay.

We expect to see more issuance, as more debt now has to be financed but the concern remains how this will come and at what pace: will it be front-loaded or as and when the new government sees fit?

For professional investors only. This material is not suitable for a retail audience. Capital at risk. This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.