We know that UK minority ethnic pension savers have less in their DC pension pots than white British people, but what does that gap look like in 2023? Kinna Patel talks about her experience and what the industry can do to alleviate the problem.

Before joining LGIM, I used to work in investment consultancy. Once, as a bright-eyed analyst, I went to a meeting where a well-known manager was presenting to a group of trustees on their diversified growth fund. When it came to questions, one of the trustees immediately asked how they could call themselves diversified when key members in the fund team all were of the same gender and race.

At the time, I acknowledged her point, but didn’t think too deeply about it. Roll forward five years and I’m still thinking about that moment. I’m still thinking about how there was and potentially still is a lack of diversity across senior roles. I’m still thinking about how a lack of cultural diversity can make it harder to understand that cultural differences and attitudes may play a part in perceptions about pensions. Most of all, I’m still thinking about how these and other factors might contribute to the ethnicity pensions gap.

In late 2022, LGIM partnered with Humankind Research and Tapestry Research to explore this very subject by surveying over 4,000 UK adults.

The numbers

So, what did we find out? Firstly, the average minority ethnic person’s pension pot is less than half the size of the average white British person’s. Secondly, nearly seven in 10 of minority respondents have no pension pot at all.

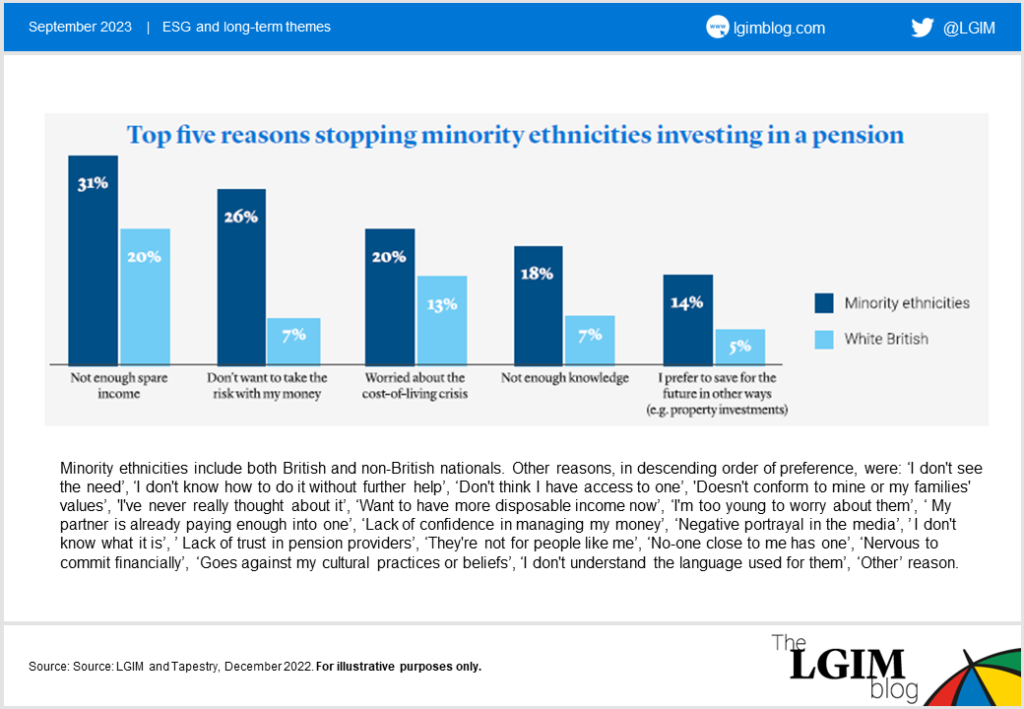

These statistics are staggering – but why are so many ethnic minorities without a pension? We explored this and, perhaps unsurprisingly, not having enough spare income was the top reason. We found that people from minority ethnic backgrounds are more likely to have a lower income and hence will not reach the £10,000 auto-enrolment threshold. Half of those from minority ethnic backgrounds worry about not being adequately prepared and are concerned about running out of money in retirement.

The obvious call to action here is for all organisations to work towards establishing pay parity. As part of the asset manager community, LGIM holds one of the keys to propel this agenda forward – engagement. As a large, influential investor, we can help create and promote change. Alongside our efforts to encourage diversity, inclusivity and fairness within our own business, we can hold the companies in which we invest to account.

At LGIM, our Investment Stewardship team has been engaging with companies on their commitments to ethnic diversity since 2020, and in the 2022 AGM season we voted against specific companies due to a lack of board-level ethnic diversity. We also have funds which score companies on social diversity metrics. Some of this work is highlighted in our latest Active Ownership report.

But it doesn’t stop there. Lowering the auto-enrolment threshold to allow low-earners to save for their future is also a vital step. One of our respondents called retirement a privilege. If it is a privilege, I for one am taking it for granted.

Interestingly, a lot of people didn’t want to take the risk with their money or felt that they didn’t have enough knowledge. Investments can be a minefield, even more so when things such as language are a barrier. It’s clear we need to make pensions communication more accessible; a one size fits all approach is not appropriate and we should cater to different cultural needs. Member communications in different languages are the first step to help overcome cultural barriers and perhaps better equip individuals with more knowledge.

A vast number of our ethnic minority respondents said that they look to religious institutions to provide guidance relating to finance. Using a mixed-medium approach alongside religious institutions could get people to engage more with their pension. Another option is for more culturally acceptable/religious funds, and while we’ve seen some movement in this area, there’s a lot more to be done.

The tangibles

Unsurprisingly, almost three times as many ethnic minorities preferred to save for retirement through other methods. I’ve seen this first-hand, with people I know saying they don’t need a pension because they have properties. This links to the idea that some people stick to what they know from within their own culture, or do something in a certain way because that’s how their parents or friends did it.

I see both sides, based on how property markets have fared over the last couple of decades and also because property is a tangible asset that you could sell at any time, whereas a pension is only seen in an annual statement. People often don’t know where their money has been invested for 30-40 years before accessing it.

We often provide information on the pension product, but maybe we’re missing a trick and information needs to be provided on the idea of a pension itself. How does it work? Where is your money going? When can you access your money? What happens should the worst happen? Answers to these questions may help people make informed choices and target better outcomes at retirement. Find out more on this and other suggestions by reading the full research report.

So, revisiting my opening scenario of the ‘diversified’ fund manager coupled with the LGIM research, plus all the points I’ve made in this blog, and I’ve come to two conclusions:

- Diversity of thought in decision-making is important in getting the right decision-making outcomes

- Diversity of engagement is important in getting the right engagement outcomes for all members

Knowledge and retirement should not be a privilege and together, as a (somewhat diversified) industry, we can make positive strides towards eradicating some of the gaps.