Washington – Methane is a significant cause of climate change. Molecule for molecule, it is 80 times worse than carbon dioxide emissions over a 20-year period.1 It leaks into the atmosphere from oil and gas production and transport equipment as well as from other sources like coal mines. The infrastructure is literally leaky. As this causes our global economy to continue to increase the total amount of greenhouse gas emissions, we feel this is a financially material ESG issue for many companies, for investors in the energy sector and for industries across the energy value chain.

Venting of methane-to reduce the need to flare or store excess gas-is a major source of such emissions. Such venting is often deliberate, due to lack of storage or distribution capacity. Upstream oil & gas production in North America (U.S. and Canada combined) is the number one source of methane leaks worldwide2 and the easiest to fix.3 Fugitive methane (inadvertent leaks including from incomplete combustion during flaring) is also a significant contributor.

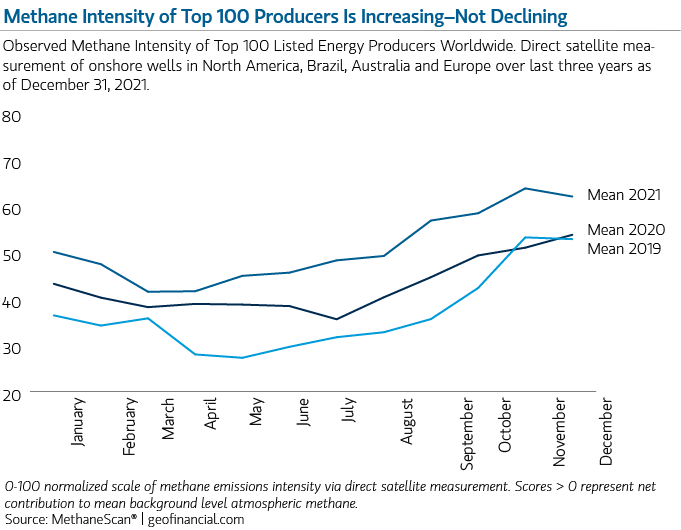

Stopping methane leaks represents the single best action we can take in the near term to avert catastrophic climate change. Unfortunately, satellite data analytics confirm that methane emissions are rising-not declining.

Calvert's Work to 'Stop the Leaks'

Today, we are ready to start talking publicly about what we have learned about this issue, why we believe more so than ever that “Stop the Leaks” is a smart step for the energy industry to take immediately, and why we believe this is good for long-term investment value creation.

Calvert has been working with Signal Climate Analytics and Geofinancial Analytics for the past several months to build a data-driven analysis of the leaks. We are sponsoring research with Signal regarding companies in high carbon-emitting sectors and their readiness for a post-carbon economy. Geofinancial uses the latest satellite data and geomapping of fossil fuel infrastructure to understand how much is leaking and from which wells, mines and infrastructure.

We’ve seen significant developments in the global oil and gas industry and from governments since we outlined this project over a year ago. These include the EU’s growing concern about methane as it increases liquefied natural gas (LNG) imports from North America, driving big U.S. infrastructure investment and making it likely that U.S. production will stay higher longer. The International Energy Agency (IEA) released its “Global Methane Tracker” report in February 2023 that includes country-level estimates for methane emissions from the energy sector. And in the U.S., the Inflation Reduction Act includes fees on methane that, based on satellite observations, look to be significant especially for oil & gas giants with U.S.-based operations.

All the developments make the issue of methane emissions more material to the long-term, and even the short-term, financial value creation of the energy sector and the many industries downstream in the value chain including utilities, capital goods, autos, steel and cement.

In the coming weeks, we will release a series of blog posts here that will share some insights that may surprise you, as we compare satellite data to corporate reports, how the Inflation Reduction Act adds new impetus for investors and corporations to get moving on this, and how it ties into research released in 2023 by the IEA.

In addition, we will keep you posted on our efforts to encourage real action by engaging with the oil and gas companies that own the leaking methane infrastructure.

Bottom line: The need to ‘Stop the Leaks’ for a rapid and sustained decline in methane emissions is greater than ever. As long-term investors, Calvert will be engaging with methane-leaking companies to help speed this process.

1. “Control methane to slow global warming — fast,” Nature, 25 August 2021.

2. IEA (2020). See chart.

3. Roughly 60 percent, around 75 Mt/yr, of available targeted measures have low mitigation costs, and just over 50 percent of these have negative costs – the measure pay for themselves quickly by saving money. source: Global Methane Assessment, UNEP, 2021

Risk Considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Diversification does not eliminate the risk of loss. Smaller companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk than larger, more established companies. Investing primarily in responsible investments or Environmental, Social and Governance (ESG) strategies carries the risk that, under certain market conditions, the Fund may underperform funds that do not utilize a responsible investment strategy. Funds are exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. No fund is a complete investment program and you may lose money investing in a fund.