Global dividend levels have returned to pre-pandemic levels, but this upward trajectory will be challenged by 2023’s tougher economic environment.

As populations age across both developed markets and large emerging nations like China, investment priorities are increasingly shifting towards capital preservation and the income needs of those approaching retirement. This demographic trend has focused attention on the role of dividend-paying equities in providing a steady income.

But it’s also important not to overlook the role that dividends can play for investors seeking capital appreciation: over the past 20 years, reinvested dividends accounted for almost half of the total return provided by global equities.1

Bouncing back from 2020

Global dividend levels dipped during the pandemic as companies hunkered down and tried to preserve cash. That period is now well and truly behind us, with global dividends comfortably above their pre-pandemic levels.2

Despite 2022 being generally a bleak year for financial markets, global dividend payouts rose 8.4% to a record $1.56 trillion.3 Soaring oil and gas prices following Russia’s invasion of Ukraine were one driver, with producers accounting for around a quarter of the overall increase thanks to special payouts.

Other notable sectors were financials, which built on their 2021 recovery, and transport companies, which reaped the benefits of still-high freight costs.

Can momentum be maintained?

However, this year has brought fresh challenges, with the threat of recession hanging in the air as higher rates pressure corporate cash flows and constrain consumer spending. Will 2023 mark a reversal of the post-pandemic dividend recovery?

We expect recession risks to persist in most developed economies on the back of restrictive monetary policy and tight credit conditions. This is likely to slow dividend growth this year.

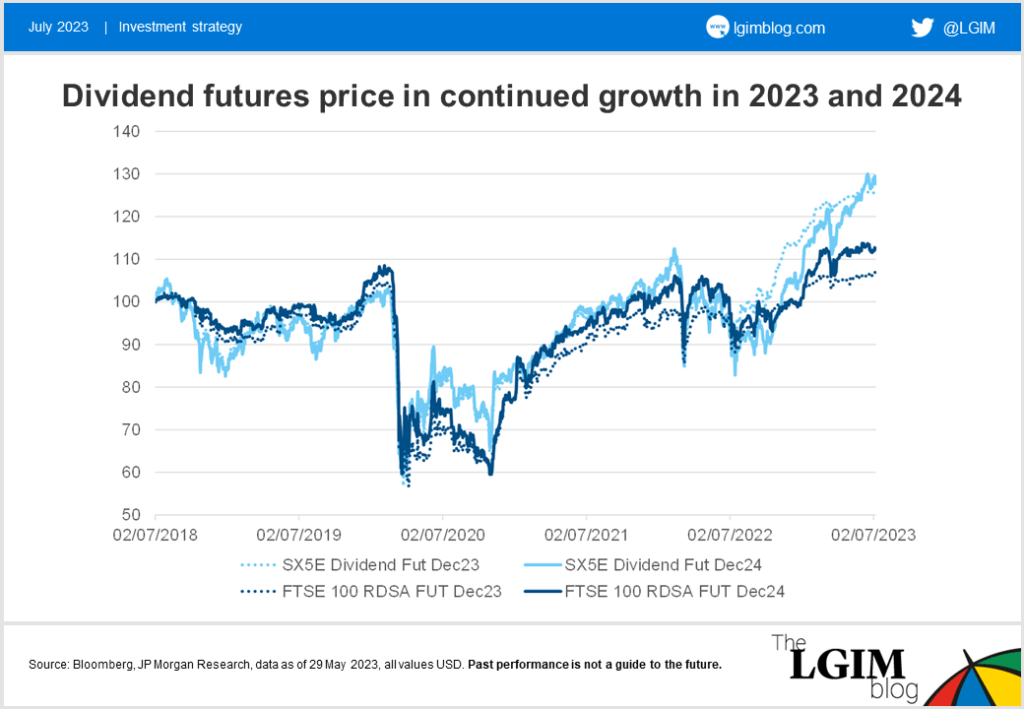

However, dividend futures for 2023 and 2024 are nevertheless pricing in continued growth. Euro Stoxx 50 2023 Dividend futures are up 8.9% in the year to date and FTSE 100 2023 Dividend Futures are up 5.22%.4

Bottom-up analyst expectations, meanwhile, are even more optimistic than implied dividend futures, given the current resilience of corporate earnings in the face of inflationary pressures.

Such optimistic data suggests that dividends may keep rising, though perhaps at a slower pace in this uncertain environment.

Quality counts

Despite the optimism implied by both futures pricing and analyst expectations, we believe it’s likely that today’s harsher economic backdrop will claim casualties, making the case for a selective approach to equity income.

Identifying companies with long-term track records of dividend sustainability, consistency and potential for future dividends can focus portfolio exposure on consistent and resilient dividend payers.

Looking for income on its own might not be sufficient because a company that pays high dividends or is growing its dividends today will not necessarily be able to keep up in the future, might not necessarily be profitable, or might not have a capital structure that allows it to sustain such payouts in the future. A long-term track record of paying out dividends can certainly help indicate consistency.

Simultaneously, we believe a tilt towards quality names derived from profitability and leverage metrics could potentially add value by screening out speculative growth and value traps with poor fundamentals and weak growth prospects.

We will cover the potential uses of quality screening and tilting – including in equity income strategies – in a podcast on Thursday. Stay tuned to find out more.

1. Source: MSCI World index, Bloomberg and LGIM, as at July 2023

2. Source: JHI Global Dividend Index, as at March 2023

3. Source: ibid.

4. Source: Source: Bloomberg, June 2023, values in EUR for Euro Stoxx 50 and GBP for FTSE 100