The current energy crisis may mean the green transition is sailing through more turbulent waters, but the underlying tide remains strong. The argument for clean, renewable energy supplies has only been reinforced by the war in Ukraine, which has added both energy security and fuel price inflation to the list of environmental reasons why this transition is so critical.

Increasingly, governments, businesses and consumers are rethinking what energy they consume, how much energy they consume and where that energy is going to come from in the future. Many are turning to solar, with solar PV generation increasing by a record 22% last year from 2020 levels[1].

Solar is particularly gaining traction among residential energy users amid concerns over spiralling fuel prices, potential blackouts this winter, as well as a desire by individuals to cut their carbon footprints. The switch to solar also presents an attractive investment angle as its projected growth over the next decade is huge, yet an abundance of relatively small companies makes it tough for investors to identify which these of businesses could become the superstars of tomorrow.

Solar is set to soar

The energy challenges presented this year have made it abundantly clear that energy power systems are desperate for change. Aside from the growing need for cleaner energy, fuel inflation has skyrocketed, and climate events have disrupted the reliability of traditional energy systems.

Many of us are now also living our lives differently. Since the pandemic, more of us work from home on a regular basis and we are also embracing digitally enabled domestic appliances – the Internet of Things – so that our reliance on connectivity and having a stable, consistent electricity supply has never been greater.

For most domestic users, solar represents the best option for taking greater control of our energy generation. Solar gains its power from the sun, meaning it’s a decentralised fuel system. As long as there’s even just a little sunlight, you can generate electricity. Homes are still connected to the central grid, which can fill any energy gaps for when there is not enough light for solar to produce power. Batteries can also be used to store excess energy to help householders gain greater benefit from the energy their solar panels produce.

Unsurprisingly, this has seen the adoption of residential solar soar worldwide. Recent analysis suggests global rooftop solar PV installations are expected to jump to almost 95 GW by 2025, up from 59 GW in 2020[2].

Solar’s deflationary benefits

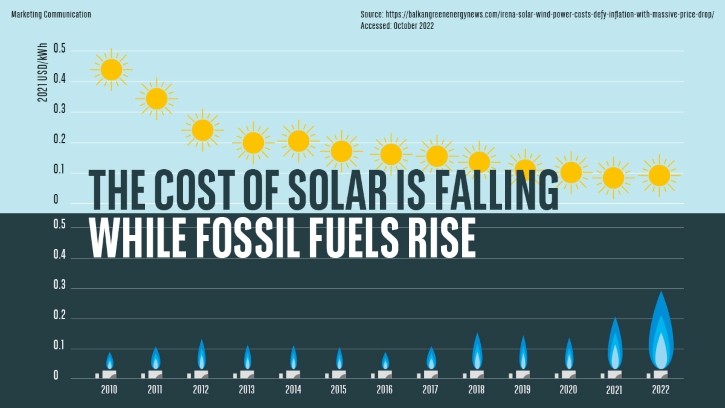

In this world of rising living costs, solar can present a more economic solution for homeowners and highlights a structural and deflationary difference between renewable and fossil fuel-based energy sources.

The latter are commodities, part of the Earth’s finite resources and require costly extraction for supply to be maintained. As mankind’s thirst for fossil fuel has continued to grow, the easily assessable reservoirs – those close to the surface or on land – have diminished, prompting producers to source alternative supplies from less accessible areas – such as deep water or the polar regions or by using alternative extraction techniques like fracking. Such efforts to extract fuel comes at a greater cost and has a much lower chance of success. This is one of the reasons why the cost of fossil fuel has trended higher over time. While it is impossible to predict what will happen to fossil fuel prices in the long-term, in the interim they will continue to be driven by supply and demand forces, as well as being impacted by geopolitics and manipulated by producers such as OPEC. It is therefore fair to assume that they will remain inflationary.

The price trajectory for renewable energy is completely opposite. Solar gains its electricity from the sun, and is free at source, but that power can only be harnessed by technology. Technology, as defined by Moore’s Law, is generally deflationary which means that not only will the speed and capability of technology increase every two years, its price will also lower. While the accuracy of Moore’s Law can be debated, its application to solar is valid. Recent advances in photovoltaic technology mean that solar panels now convert more sunlight into electricity; efficiency improvements have seen the power rating of a standard size panel increase from 250W up to 400W[3]. At the same time, the International Energy Agency confirmed that solar power schemes now offer the cheapest electricity in history[4], while the European Commission (EC) has said that the price of solar PV panels decreased by 75% from 2009 to 2019[5] on the back of growing market demand. Solar does, indeed, appear to be deflationary.

While deflationary, solar can’t escape traditional supply / demand dynamics and many consumers turning to solar may find they have to be patient in the near-term as supply chain delays are plaguing the industry. While most of this disruption can be linked to the ongoing fallout from the pandemic, amid factory closures and transportation challenges, trade disputes have also held up supply – most notably between the US and China.

US: growth powered by government policy

The US is currently the leading country in residential solar capacity[6], and in Q2 2022 the segment set its fifth straight quarterly record which represented a 37% increase year-on-year[7]. Despite such strong growth, the nation’s overall adoption rate is still a mere 3%[8] suggesting there is much more growth to come.

American homeowners tend to favour a combination of rooftop solar and battery storage, which despite supply chain problems, often still work out cheaper than buying electricity directly from utility companies. Many US solar companies also offer attractive installation packages which can often mean no upfront expense. In many states, the attraction of solar has been reinforced by recent grid outages – extreme weather events have caused disruption (notably in Texas last winter) and this summer California urged its residents to use less energy due to record heat levels. Meanwhile, in states such as Hawaii – which relies on imported energy – solar represents a home-grown, lower cost alternative.

The US solar market has recently received a further boost from President Joe Biden’s new Inflation Reduction Act, which includes ten-year tax incentives for solar that provides the industry with some much-needed long-term certainty. Experts suggest this legislation will prompt the segment to triple over the next five years[9].

Europe aiming for the rooftops

Demand for solar power in Europe has been strong, thanks to the region’s leading carbon emission goals. In 2021, the European Union (EU) saw an increase of 34% new solar PV capacity on the previous year[10]. And Europe’s efforts to end its reliance on Russian fuel for power generation should see greater demand for residential solar, with the compound annual growth rate forecast at 7.6% for the rest of the decade[11].

As in the US, growth is expected to be supported by favourable government policy. The UK currently has Europe’s largest market for residential solar, with homeowners benefiting from selling their surplus electricity back to the grid. At the start of 2022, the government also reduced tax on the sale of renewable power generation products to promote further growth. In Germany, the government introduced a subsidy on solar panels with battery storage back in 2016, and also has feed-in tariffs for surplus energy generation. While France provides preferential loans for homeowners to install solar power in their homes.

In the EU, domestic policies are also bolstered by the European Commission which is seeking to make solar the largest electricity source in the EU, with more than half that share coming from rooftops. New proposals – as part of the EC’s REPowerEU plan – aim to make the installation of solar panels mandatory for all new buildings by 2029. Its goal is to generate over 320 GW of solar photovoltaic energy by 2025 (more than doubling 2020’s levels) and almost 600 GW by 2030[12].

Multiple investment angles

Unlike the traditional energy sector, which is dominated by national and global champions, the solar market is characterised by a much broader range of suppliers. This makes it highly competitive, as companies vie to take a technical edge, combat supply challenges and tackle regular regulation and government policy changes.

However, the investment angle is not solely about the suppliers and installers of solar power. Attractive opportunities also exist around the components that are used to make solar equipment – such as the inverters and batteries. Software is an area that is changing rapidly thanks to the growth of machine learning in this space. Such technology is now offering virtual power plant micro grids, the ability to benefit from two-way charging from electric vehicle fleets so surplus power can go back to the grid, and the development of new algorithms that can help users sell back energy to the grid at optimal times and prices.

Finally, the new US Inflation Reduction Act creates a strong ‘made in America’ investment bias, as companies will be incentivised for onshoring manufacturing and the sourcing of primary materials. Such onshoring trends should also help alleviate supply chain blockages over time.

Identifying the long-term winners

There is no denying that the energy transition is creating an influx of investment opportunities – particularly in the solar segment. However, the vast number of companies operating in this space and the speed of transformational developments makes it extremely difficult for investors to identify the companies that will thrive and survive for the next ten to 20 years.

At BNP Paribas Asset Management, the role of our Environmental Strategies Group is not only to identify the newest environment solutions in the marketplace, but also seek out those companies that are truly making an impact. By using an expert and holistic lens – which factors in past themes as well as future trends – we aim to target those businesses that could prove to be the long-term winners of tomorrow.

References

[1] https://www.iea.org/reports/solar-pv

[2] https://www.powermag.com/a-global-look-at-residential-solar-adoption-rates/

[4] https://www.carbonbrief.org/solar-is-now-cheapest-electricity-in-history-confirms-iea/

[6] https://www.powermag.com/a-global-look-at-residential-solar-adoption-rates/

[7] https://www.seia.org/research-resources/solar-market-insight-report-2022-q3

[8] https://www.powermag.com/a-global-look-at-residential-solar-adoption-rates/

[10] https://www.solarpowereurope.org/insights/market-outlooks/market-outlook

[12] https://earth.org/eu-set-to-make-solar-panels-mandatory-on-all-new-buildings/

Disclaimer

Please note that articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. This document does not constitute investment advice. The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns. Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions). Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.