The founder and CEO of ARK Invest is keeping her eye on the prize—positioning investors to significantly benefit from what she sees as historic innovation and growth opportunities that are emerging and converging over the next decade. BMO Global Asset Management’s recent partnership with ARK allows Canadian investors to access three new and disruptive funds.

It was seamless. In November, as we entered an autonomous taxi in San Francisco, it took our instructions on where to go with no pre-planned routing or programming required. Myself and Tasha Keeney, one of ARK Invest’s autonomous transportation analysts, exited the vehicle with a clear understanding of what we were witnessing: the future.

The robo-taxi was owned by a smaller rival to Tesla Inc. But it’s ARK’s belief that Tesla is in the pole position to be the dominant player in the fast-forming driverless taxi market for one reason: it possesses more proprietary data on routing, driver habits and other user information than all other car companies in the world, combined. Billions upon billions of recorded miles.

What investors will see from many of the holdings in our portfolios is a strong emphasis on proprietary data. We’re moving at speed into an artificial-intelligence world. The secret to competition in this future is what are called foundation models in AI parlance. In other words, a company having the right kind of data to become a platform upon which others can build. Tesla is emerging as a dominate foundation model for robotic electric vehicles (EVs).

Unprecedented technological advancement ahead

Autonomous mobility is one example of an emergent technology that meets the criteria we use for evaluating where to invest based on five innovation platforms we’ve identified as large-scale opportunities – robotics, artificial intelligence, energy storage, sequencing and blockchain. In this case, autonomous taxis fall within three of them: robotics, AI and energy storage platforms—they’re robots, electric and powered by AI. It perfectly illustrates how this handful of innovation platforms will converge and define the immense commercialization opportunities and value creation ARK sees in the years ahead.

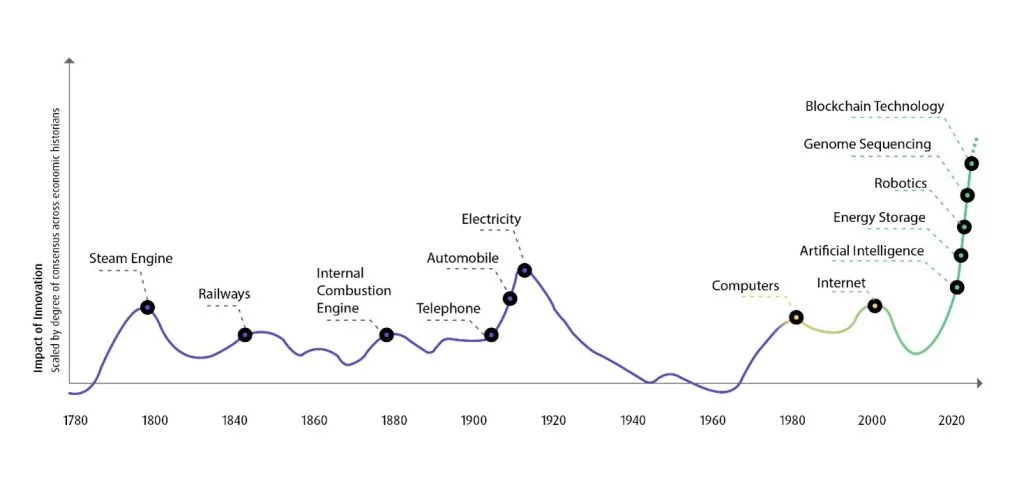

In fact, according to our research, the global economy is undergoing the largest technological transformation in its history. As figure 1 shows, the aggregate impact of the five platforms we’ve identified on general economic activity will be virtually without precedent.

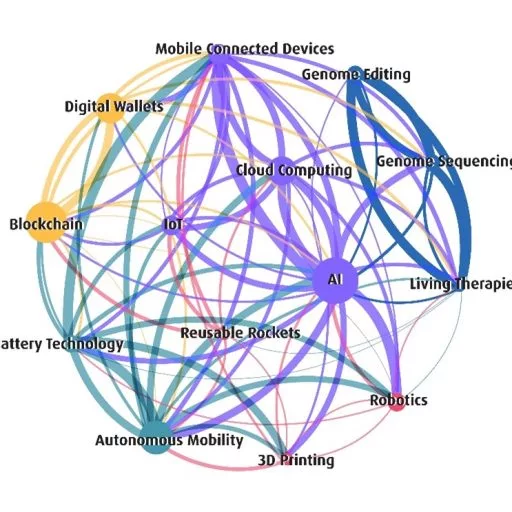

ARK’s research is centred around the belief that these platforms are evolving and converging at the same time. Subsequently, we’ve identified 14 transformative technologies that overlap and reside across these five verticals that are approaching tipping points as costs drop. As this occurs, demand is unleashed throughout sectors and geographies spawning yet more innovation.

Blockchain is yet another example. The convergence of application programming interfaces (APIs), social platforms, and blockchain technology could integrate business and consumer marketplaces, disintermediating the middlemen dominating financial ecosystems.

The collapse of FTX has illustrated something very important that Bitcoin and blockchain have: they’re highly decentralized and observable. With FTX, it was highly centralized and opaque. As blockchain adoption accelerates, the consolidated, non-transparent financial world is likely to give way to the open and transparent platforms. Our conviction about this has only increased.

In terms of overall scale, the growth potential of these foundational technologies is immense. We believe that historians will look back on this era as one of unprecedented technological foment—and they will say everything changed. ARK’s investment objectives are to identify large-scale opportunities within these groups by focusing on public companies that are the leaders, enablers, and beneficiaries of these 14 disruptive innovations.

Node Size: Log Prospective 2030; Market Edge Size: ARK Convergence Score; Color: Innovation Platform.

Forecasts are inherently limited and cannot be relied upon. | For informational purposes only and should not be considered investment advice, or a recommendation to buy, sell or hold any particular security/cryptocurrency. .

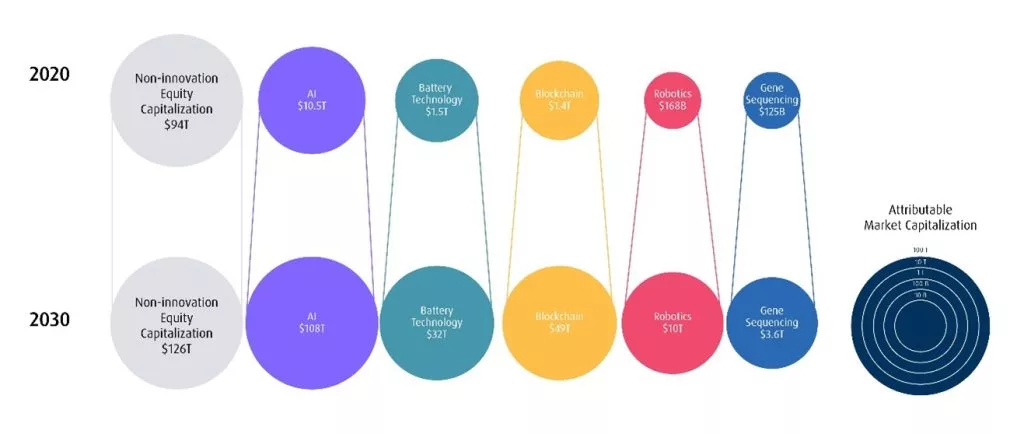

ARK Investment Management LLC, 2021. Forecast is compilation of forecasts for the 14 technologies that ARK defines as underlying the 5 innovation platforms. Assumes that traditional equity market exposures continue to compound value at a rate in excess of inflation and are not substantially disrupted or marked down by negative exposure to innovation. Cryptoassets are likely to be increasingly considered a different asset class by many; comparisons between cryptoasset values and equity market capitalization are cross-asset comparisons. Numbers rounded. .

Source: World Federation of Exchanges, ARK Investment Management LLC, 2021.

Figure 2 shows the interaction of each platform to create each of the 14 technologies, while the node size indicates relative estimated market size compared to the other nodes, with blockchain, AI and autonomous mobility representing the three largest opportunities, respectively.

An approach focused on convergence and disruption

According to our research, enterprise value attributable to companies that develop and provide these underlying technologies increased from roughly $7 trillion (U.S.) in 2019 to almost $14 trillion (U.S.) in 2020, and that that value creation is just getting started. As costs fall for leaders in their respective fields, the growth potential accelerates. To continue the autonomous mobility example, the convergence of robotics, battery technologies, and artificial intelligence is likely to collapse the cost structure—and therefore greatly boost margins—for the entire transportation space, impacting the economics and profitability of auto, rail, and airline activities.

Zeroing in on artificial intelligence, by 2030, AI software companies could produce $14 trillion (U.S.) in annual revenue collectively. The resulting $4 trillion (U.S.) in free cash flow could create over $80 trillion (U.S.) in enterprise value—up from $2.3 trillion (U.S.) in 2021.

As Figure 3 illustrates, by the end of the current decade it’s our view that the market value of the companies and assets across our five innovation platforms will exceed $200 trillion (U.S.) or roughly 1.5x the capitalization of the “non-innovation” market.

ARK is set up very differently than other fund managers. Analyst responsibilities are not broken out by sector or industry or sub-industry, but by the 14 technology groups we’ve identified as opportunities. Our team is comprised of technical specialists who are sector generalists. By breaking out our analyst responsibilities in this way, it has allowed us to develop our five-platform approach, and will continue to differentiate our research in the medium- to long-term.

The market can be easily distracted by short-term price movements, losing focus on the long-term effect of disruptive technologies. We believe there is a time arbitrage ARK can take advantage of for multiple significant opportunities that offer growth over the next three to five years that the market is ignoring or underestimates.

Approximately 25% of fund flows to ARK are institutional. It’s percentage we expect to increase as institutions look at their asset allocation and understand that our portfolios bear little resemblance to conventional indices and therefore represent a very good source of differentiation.

“As costs fall for leaders in their respective fields, the growth potential accelerates.”

Real diversification within innovation

Very few of today’s portfolios are well-positioned to take advantage of these kinds of opportunities. Within the broad-based benchmarks that many growth-oriented managers rely on, we’re already seeing much disruption. No one expected the mega-cap technology stocks to be as disappointing as they were in 2022, and yet that group represents a very significant portion of many portfolios.

Institutions have begun to see that many of their growth portfolios have begun to look alike in terms of their holdings, whether in the former FAANGs or Microsoft or Nvidia.

By contrast, with the exception of Tesla, ARK’s flagship portfolio hasn’t owned a technology mega-cap stock for roughly two years. We don’t own those names—we own the disruptors. The correlation between our portfolios and other technology and growth funds is extremely low.

My view is that investors over the next two cycles will come to recognize and appreciate the benefits of diversification within innovation itself. As importantly, in short order they will begin to understand that the ground is shifting beneath our feet—innovation platforms are converging and forward-thinking investors will see the need to get on the right side of change.

To learn more, please contact your Regional BMO Asset Management Institutional Sales & Service Representative.

Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. This communication is intended for informational purposes only.

Commissions, management fees and expenses (if applicable) all may be associated with investments in mutual funds. Trailing commissions may be associated with investments in certain series of securities of mutual funds. Please read the fund facts, ETF facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are not guaranteed and are subject to change and/or elimination.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™ Registered trademarks/trademark of Bank of Montreal, used under licence.