Russia’s invasion of Ukraine continues to cause considerable volatility in markets, undermining the idea – seemingly baked into investors’ psyches over recent years – that stock markets can only go up.

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

Our clients are understandably focused on this black swan event at present and the impact it might have on their assets – and we reiterate two comments on this. Geopolitical upheaval, however distressing, has tended not to have a major impact on long-term investment performance and, ultimately, the best antidote to volatility is a resolute focus on long-term outcomes.

Taking a step back, we continue to believe there are more influential factors at play that will likely have a far greater impact on long-term investment performance. Anyone who has heard us present or read any of our articles over the past few years will not be surprised to hear these centre on the prospects for US equities and value stocks.

Starting with the former, while America’s economic hegemony is increasingly under threat from various Asian giants, its stock market dominance has continued to grow over recent years, and US equities now account for 69% of the MSCI World Index. This has largely been driven by the rise of a few technology behemoths and a handful of stocks have come to influence not just US market performance but that of ‘global equities’ overall for much of the last decade. To quote some familiar figures, just five companies (Apple, Microsoft, Amazon, Facebook [or Meta], and Alphabet) contributed a third of overall S&P 500 returns over five years to the end of 2021. As we wrote recently, this has been a huge factor in multi-asset fund performance and our view on the US, having been a long-term underweight in our portfolios, is understandably a key focus for investors.

While we would certainly not see ourselves in the bearish camp overall (and remain broadly positive on risk assets this year despite ongoing volatility and uncertainty), our view on current valuations in the US does share common ground with that of celebrated perma-bear Jeremy Grantham of GMO, who is predicting tough times for the world’s largest equity market. In a recent note (written pre-Russia’s invasion), he calls the recent run-up in US markets the sixth ‘superbubble’ of the last 100 years (after the US in 1929 and 2000 and Japan in 1989, plus US housing in 2006 and Japanese housing, also in 1989). Grantham puts the case that these five previous superbubbles corrected all the way back to trend ‘with much greater and longer pain than average’ and believes the current one is starting its descent, with the situation intensified by the fact other smaller bubbles are occurring simultaneously, including global real estate and commodities.

“What we can say is that more than a decade of quantitative easing – ramped up in the wake of Covid to keep economies on their feet – has stoked huge asset price inflation, not just in mainstream equities but in more speculative corners of the market.”

Debating how far we agree with these other bubble assessments is beyond the scope of this piece – as is the reasons behind them; for his part, Grantham points an accusatory finger at over-generous central bankers, particularly those heading the Federal Reserve post-Paul Volker in the 1980s. What we can say is that more than a decade of quantitative easing – ramped up in the wake of Covid to keep economies on their feet – has stoked huge asset price inflation, not just in mainstream equities but in more speculative corners of the market such as special-purpose acquisition companies (SPACs), cryptocurrencies and non-fungible tokens (NFTs).

When pessimism returns to markets, Grantham says we face the largest potential markdown of perceived wealth in US history. If valuations return even two-thirds of the way back to historical norms, he suggests total wealth losses will be in the order of $35 trillion in the US alone. Recent falls may have taken some of the froth off US markets – indices such as the Nasdaq dipped into bear territory in February before rebounding – but if a greater fall is to come, we are clearly only in the foothills.

We are nothing like as negative or definitive as such a renowned perma-bear but would say that total returns from many equity markets, including the US, are likely to be considerably lower this year after such a strong run post the Covid-inspired fall in March 2020. The S&P 500 index was up close to 27% last year, for example, and history suggests that after a gain of at least 20% by the US index, returns are muted over the following 12 months, with an average rise of around 8%. Ongoing uncertainty around Ukraine plus tightening monetary policy would add weight to this argument.

Going back to the extremely narrow nature of US performance, debate over whether tech superiority can continue will rumble on but we suggest a situation where 1% of companies are producing 33% of US market performance seems unsustainable, particularly with a rising interest rate environment challenging for the longer-duration growth sectors – primarily technology – that have dominated.

While we agree that large parts of the US market are prohibitively expensive, however (again, recent volatility has taken the edge off this slightly), not everything is priced to perfection and there are sectors such as banks, and value more broadly, that are cheap and projected to perform well as rates rise. Alongside our long-standing underweight to the US, we have had a tilt to value across our funds and portfolios and, with this style outperforming over recent months after a decade-plus in the doldrums, investors are also asking how long this might continue.

We stress that our crystal ball is no clearer than anyone else’s but data show the sheer scale of undervaluation in value stocks after such a long period of lagging tech giants. December figures from US firm AQR, headed up by Cliff Asness, highlighted an unusually high value spread, which simply compares the valuation multiples of expensive stocks to cheap ones. At that point, this metric was still extremely cheap – in the 90th percentile across all regions – and AQR has subsequently dismissed concerns the strong rotation so far this year may have ‘killed’ this spread; it might not be as wide as a few months ago but is still at a similar level to the late 1990s tech bubble.

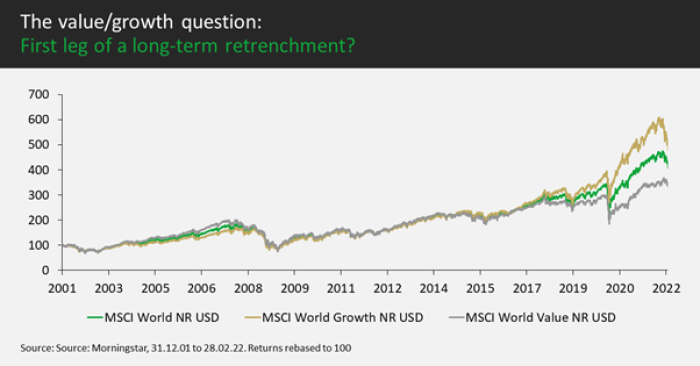

We continue to favour more value-oriented markets such as Europe and the UK, with the latter in particular still attractive and well positioned amid the ongoing cyclical recovery, especially as the economy moves towards a living with Covid strategy. Value has flattered to deceive over recent years, with many short-term rallies petering out in the teeth of tech giants, but if we are set to be in a rate hiking world for the foreseeable future, the current rotation may ultimately prove the first leg of a multi-year retrenchment.

In a reflationary environment, we expect to see tailwinds for value, developed markets ex-US and small-cap stocks, giving these three under-owned areas an overdue pullback against growth, the US and large caps respectively. As we have stressed, however, these outperformances will not all come at once, so it is sensible to retain diversification in portfolios rather than gambling that one particular thesis pays off.

Looking at funds held across our portfolios, in UK equities for example, our positions include Evenlode Income, a high-quality, concentrated strategy with a focus on high and consistent ROICs, and JOHCM UK Equity Income, a high-yielding small and mid-cap fund. In the US, we own Ossiam Shiller Barclays CAPE US Sector Value, an ETF based on Shiller’s CAPE (cyclically adjusted PE) metric and skewed towards the four most undervalued sectors on a monthly basis, and Loomis Sayles US Growth Equity, which focuses on pragmatic quality growth opportunities to hold over the long term. As for Japan, our holdings include the deep value Man GLG Japan CoreAlpha and the quality growth-focused Baillie Gifford Japanese.

We maintain that multi-asset portfolios able to tilt between growth and value, while keeping a foot in both camps, offer the optimal risk/reward balance.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds and Model Portfolios managed by the Multi-Asset Team have exposure to foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The majority of the Funds and Model Portfolios invest in Fixed Income securities indirectly through collective investment schemes. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. Some Funds may have exposure to property via collective investment schemes. Property funds may be more difficult to value objectively so may be incorrectly priced, and may at times be harder to sell. This could lead to reduced liquidity in the Fund. Some Funds and Model Portfolios also invest in non-mainstream (alternative) assets indirectly through collective investment schemes. During periods of stressed market conditions non-mainstream (alternative) assets may be difficult to sell at a fair price, which may cause prices to fluctuate more sharply.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.