Investing in China lately has come with higher risks and volatility, but the scale and variety of opportunities on offer remain compelling to those looking for returns across asset classes for the long run.

Opportunities in step with China’s objectives and priorities

The culmination of these recent events—some expected, some unexpected—in the past few months unnerved investors, but there has always been a lot of volatility when it comes to investing in China. It’s helpful to take a step back and look at the big picture. Over the past decade China has been in a boom, punctuated many times by the expectation of a hard landing or meltdown. Each time, China has made its way out. Today, the macroeconomic picture in China is driven by the overarching objectives that the Chinese government is looking to achieve. These include: improving security, financial market stability, common prosperity, the environment, dual circulation and demographics. Most of these long-run goals are a net positive for the long-term development of the Chinese economy—and therefore for investing in China—despite generating short-run headwinds for some sectors and companies, as evidenced by the regulatory intensity last year.

Beijing’s long-term goals illustrate how the Chinese model of growth is evolving from a focus on the quantity to the quality of growth, transitioning to a more domestic, service-oriented economy, shifting priorities to balancing growth and sustainability, tackling social equality and security, after a decade-long journey to eliminate absolute poverty. We believe the increased focus on automation and digitization, healthcare, life insurance and asset management, deleveraging and stronger balance sheets, and the move towards green energy and a cleaner environment, are among the long-term trends that make China’s investment case attractive.

Why invest in China

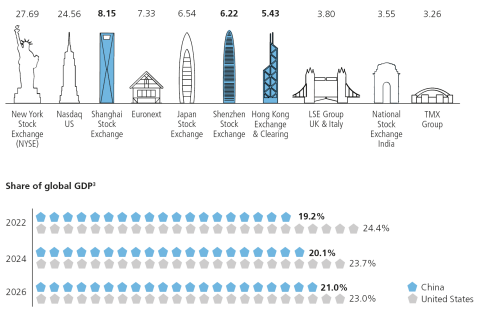

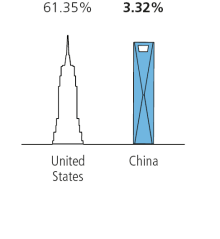

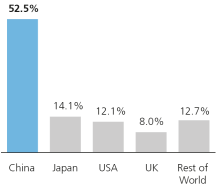

We are behind the long-term China investment case, while acknowledging higher risks and more near-term volatility, and cognizant that not everyone feels the same way. Simply put, we view China as a core standalone allocation, the same way that we look at the US, Japan, Europe and the UK. China is the second largest economy in the world and one of the most significant drivers of global growth, but investors are still under-invested (Chart 1).

Chart 1: The world is underinvested in China

China is the second-largest stock market but significantly under-respresented in global portfolios

10 largest stock exchanges by market capitalization1

(in trillion USD)

Weights in the MSCI All Country World Index2

(ACW)

2 Not to scale, for illustrative purposes only. Source: MSCI data as of March 2022

3 Source: International Monetary Fund, World Economic Outlook Database, Gross Domestic Product (GDP), current prices in USD, estimates, April 2022

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

Chart 1 – We are behind the long-term China investment case, while acknowledging higher risks and more near-term volatility, and cognizant that not everyone feels the same way. Simply put, we view China as a core standalone allocation, the same way that we look at the US, Japan, Europe and the UK. China is the second largest economy in the world and one of the most significant drivers of global growth, but investors are still under-invested

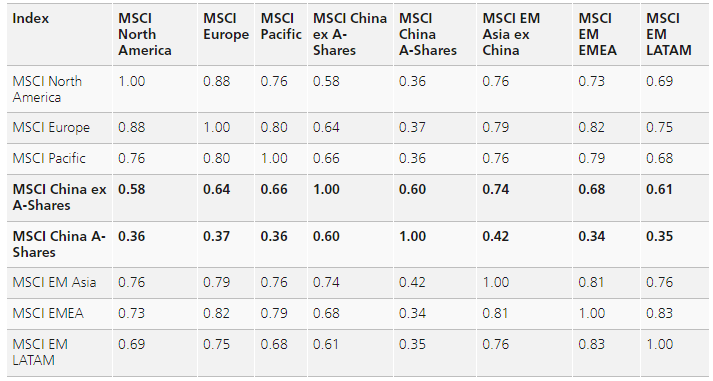

The country’s pattern of growth differs from other markets, both in emerging and developed regions, and its monetary policy direction is also diverging from the rest of the world. Although this can sometimes create short-term headwinds, it also means that Chinese equities and fixed income asset classes offer investors low correlation and diversification benefits (Chart 2) compared to other widely-held portfolio allocations. The scale and variety of the opportunities offered is compelling to investors looking for both market and active returns across asset types. These factors mean that China offers active opportunities for investors, both from an overall portfolio allocation perspective and within individual asset classes. China’s capital markets also continue their rapid internationalization through index inclusions and the lifting of capital market controls.

Chart 2: China A benefits from low correlation across global indices

Correlation (TR USD)

January 2002 to April 2022

A strong case for inclusion in a portfolio for diversification purposes and improve risk-return profile

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS

Chart 2 – The country’s pattern of growth differs from other markets, both in emerging and developed regions, and its monetary policy direction is also diverging from the rest of the world. Although this can sometimes create short-term headwinds, it also means that Chinese equities and fixed income asset classes offer investors low correlation and diversification benefits.

Equity

Understanding Beijing’s overarching objectives and their potential implications should be front and center for any successful China investment strategy, and is an increasingly important consideration when picking stocks. China equities are volatile partly because the market is retail investor-driven, which is challenging but also presents a clear opportunity for active managers with the on-the-ground knowledge and research capabilities to identify and take advantage of mispricing and deliver value for investors. We have always believed that it’s about picking the right stocks in a fast-changing environment—and we are now in an even faster-changing environment than ever before.

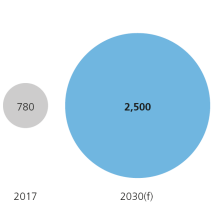

Some of the most exciting long-term equity opportunities have been in the healthcare sector as we believe Chinese healthcare expenditure will continue to grow at double digits (Chart 3). We are positive in the long run on select leading pharmaceutical companies with rich innovative pipelines to diversify from the impact of reduction in drug prices, as well as Contract and Research Organizations (CROs) which are gaining international recognition in new, advanced drug therapies such as cell and gene therapy.

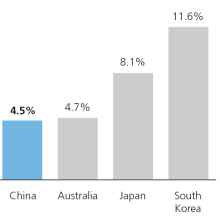

In the financials sector, there is great potential in the insurance segment and wealth management services as the country continues its decades-long transition from low income to affluence. We believe the need for these financial products and services is somewhat nascent and can become significant with time, given the progression is structural in nature. While part of China is still in lockdown, we believe that when it does eventually open up, investing in the banking sector will be an attractive way to participate in the reopening.

Chart 3: An aging population presents opportunities

Healthcare market size in China

(USD billions)

Insurance penetration

Gross written premium as % of GDP, 2020

Asset management services

5 years average growth in AUM 1

ending March 2022 (%)

1AUM = Asset under Management

Chart 3 – Some of the most exciting long-term equity opportunities have been in the healthcare sector as we believe Chinese healthcare expenditure will continue to grow at double digits.

But “opportunity” also sometimes means being patient and waiting on the sidelines when necessary. Given our focus on the fundamental story and the fundamental value of the companies we own, last year we did not get carried away by the hype in certain sectors such as the renewable energy space, particularly the electronic vehicle (EV) industry. As we saw it, there was a big gap between the valuations these EV companies were trading at and their fundamental value, even after accounting for government support. Not investing in this part of the market has shielded us from much of the volatility of the past few months. We continue to believe that our holdings of good quality companies with strong competitive advantages will deliver results in the long run as investor focus returns to sector and company fundamentals.