The shift towards the exchange traded fund (ETF) vehicle as a wrapper for an investment strategy has seen significant growth in recent years. In 2021, the assets under management (AUM) in ETFs globally increased by over US$1 trillion and despite a volatile start to the year currently stands at over US$10 trillion in 8,829 ETFs in over 60 different countries.1

Among developing economies, one area of significant interest has been in China-focused ETFs. This market has seen double-digit growth since 2018. Flows into China-focused ETFs reach US$45 billion over the last year, with nearly US$15 billion coming from the U.S. and US$5 billion coming from Europe. The onshore ETF market is now significantly contributing to these flows with nearly US$24 billion being raised year to date. Future growth of this market could be supported by capital flows into China domiciled ETFs from offshore investors as well as the existing onshore demand for these products.2

At a local level, index funds and index ETFs are also being promoted by onshore fund advisory firms and public fund houses to support pensions management products. As at the end of March 2022, China’s domestic ETF market had more than 600 products and nearly US$200 billion in AUM.3 China’s securities regulator CSRC (China Securities Regulatory Commission) also recently encouraged the local asset management industry to develop fund products for private pensions in a bid to stabilize markets.4

There is no doubt that the recent lockdowns in major cities across China and supply chain disruptions have led to a deterioration in China market sentiment in recent months. The sell-off in China equities has also gathered speed exacerbated by concerns about the potential delisting of Chinese firms from American exchanges due to auditing disagreements. Nonetheless, in the first four months of 2022, China equity ETFs saw a net US$27.6 billion in inflows, the most among emerging markets.5

Many global investors are now looking towards potentially attractive entry levels buying back into the market. The drivers on potential futures return are unchanged with a clear near-term policy floor for equity valuations after Vice Premier Liu He’s comments.6 The key three areas being:

- global policy divergence, particularly versus the US;

- historical equity market performance into leadership transition events;

- inexpensive valuations.

Investors looking to enter back into the broad China market can consider passive outperformance ETF strategies, that have captured index performance plus 1-10% in the past, an opportunity that is very much unique to China’s market dynamics.7

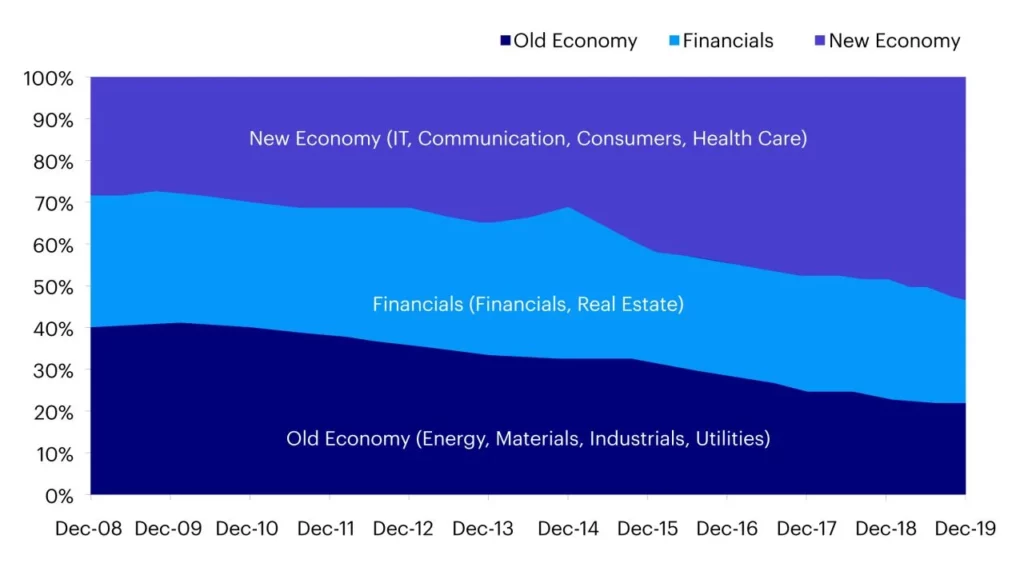

China is the world’s second largest economy and is quickly becoming a global leader in innovation and technology. The country has been transforming from an “old” manufacturing and export economy to a “new” economy focusing on domestic consumption and services.

The ongoing economic structural change is very much by design, supported by the country’s large market scale and government policies. China has unveiled its tech ambitions in its latest Five-Year Plan, as the country continues to strengthen its domestic growth and achieve “self-reliance” in science and technology. As the mainland economy continues to open up, we are seeing opportunities in China technology ETFs that are being supported by these strong policy tailwinds.

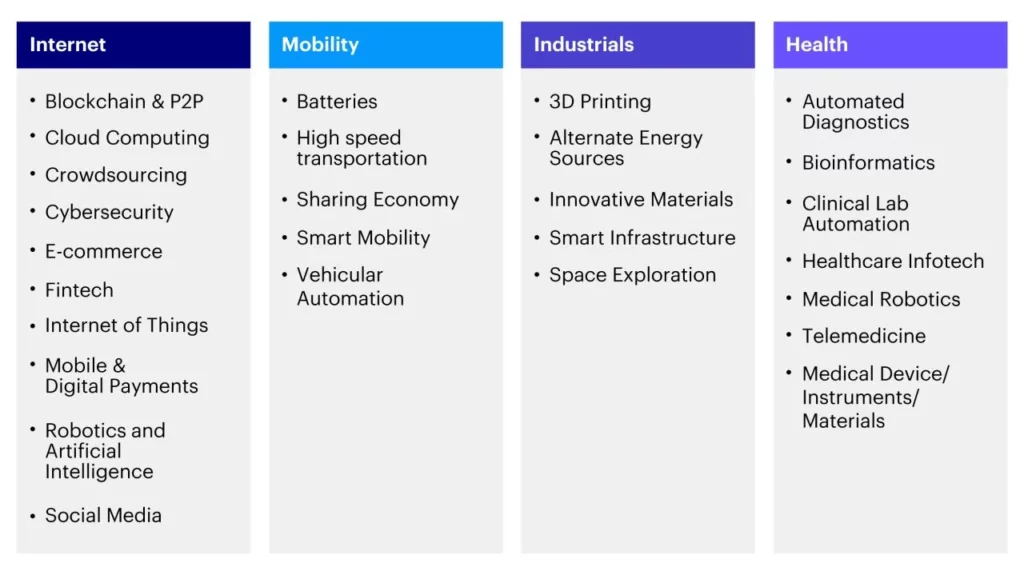

The ETF strategies that we believe can potentially benefit can be those products that capture trends that are aligned with the government’s 14th Five-Year Plan such as the “new infrastructure” initiative, the “smart” consumer opportunity, and the transformation of traditional sectors in areas such health, mobility, industrial and internet sectors. We expect there to be winners and losers out of this transformation so staying broadly diversified across this spectrum of companies can be important to many investors.

Footnotes:

1 Source: ETFGI.com; ETFGI Global ETF and ETP industry insights, March 2022

2 Stock Connect ETFs inclusion to enhance Chinese investors’ offshore exposure, January 2022, https://www.asianinvestor.net/article/stock-connect-etfs-inclusion-to-enhance-chinese-investors-offshore-exposure/474899

3 Source: Bloomberg as at 30th April 2022

4 Source: China nudges mutual funds to offer pension products, stabilize markets, April 2022, https://www.reuters.com/world/china/china-nudges-mutual-funds-offer-pension-products-stabilise-markets-2022-04-27/

5 Source: Bloomberg as at 30th April 2022

6 China Has to ‘Put Action Behind Words’: Analysts on Policy Vows, April 2022, https://www.bloomberg.com/news/articles/2022-04-29/china-has-to-put-action-behind-words-analysts-on-policy-vows?sref=xv12TOW5

7 Source: Goldman Sachs Global Markets Division as of April 2022