China’s equity market saw strong performance in 2020 but has faced a setback this year amid regulatory tightening and other headwinds. The Franklin Templeton Investment Solutions team outlines current risks and opportunities of investing in China.

KEY POINTS

- China’s “Firsts” drove early equity outperformance in 2020, but has given way to marked underperformance in 2021, trailing global peers by 26% year to date (YTD).1

- Regulatory Recapture and macro headwinds dominate the landscape in China—a renewed regulatory push toward common prosperity, the re-emergence of COVID and limited monetary and fiscal policy support—and are not expected to subside anytime soon.

- COVID’s Comeback can’t be ignored as China begins to implement many heavy-handed policies again to control the spread.

- Portfolio Positioning will likely remain unchanged in terms of our less-favorable view on Chinese equities this year. However, our view has slightly improved given the recent sell-off and marked deterioration in sentiment.

THE TORTOISE VS. THE HARE IN THE YEAR OF THE OX

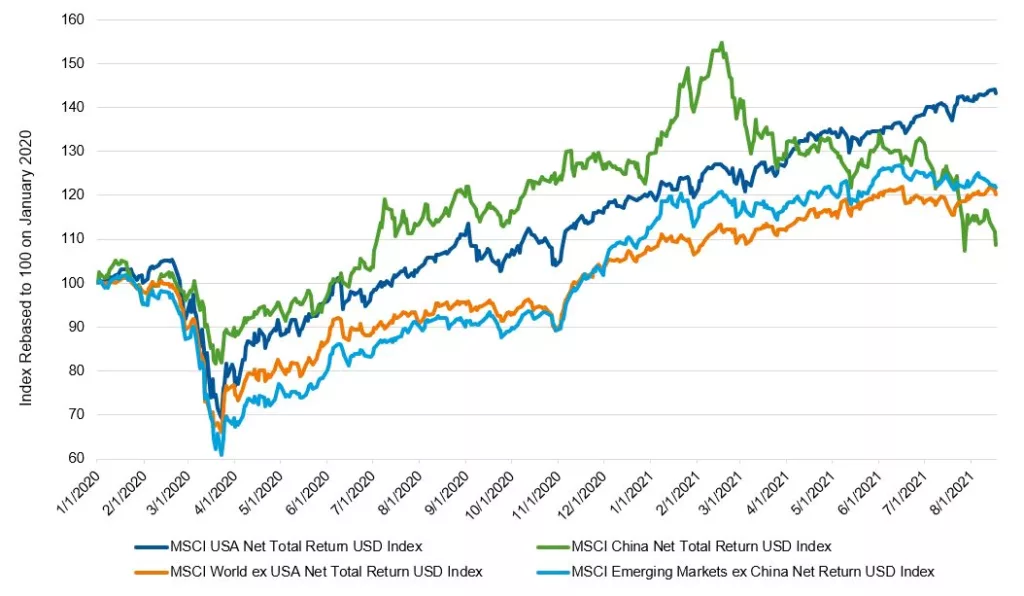

The classic tale of speed vs. perseverance has played out before us in global equity markets since 2020. Early in the pandemic, China emerged as the hare, swiftly outperforming other global equity markets through 2020 due to strong control over the COVID-19 outbreak, quick monetary and fiscal policy accommodation, and resilient export growth. China initially seemed destined to be this cycle’s “winner”—but not so fast.

While other global equities were initially paced as the tortoise, their slow and steady approach has been paying off since the March 2020 low, with only two drawdowns of ~7% since then.2 Now in 2021, global equities continued to rise, gaining 14% YTD,3 while the Chinese equity markets have run out of steam and experienced a drawdown of more than 30% since February 2021, and are currently underperforming global equities by 26% YTD.4

Sources: Bloomberg, Macrobond. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results. Important data provider notices and terms available at: www.franklintempletondatasources.com.

CHINA’S “FIRSTS”

China’s early pandemic outperformance was based on the ability to execute effectively on many global “Firsts”:

- China was the first nation to endure the COVID-19 crisis, with the initial outbreak emanating in Wuhan before spreading throughout the world.

- China was one of the first nations to execute (and then emerge from) the COVID-19 lockdowns, perform contact tracing, and require public adherence to mask-wearing.

- China was a premier beneficiary from rising global goods demand, where its export industry surged in response to higher demand for supplies including medical equipment and housing- related goods.

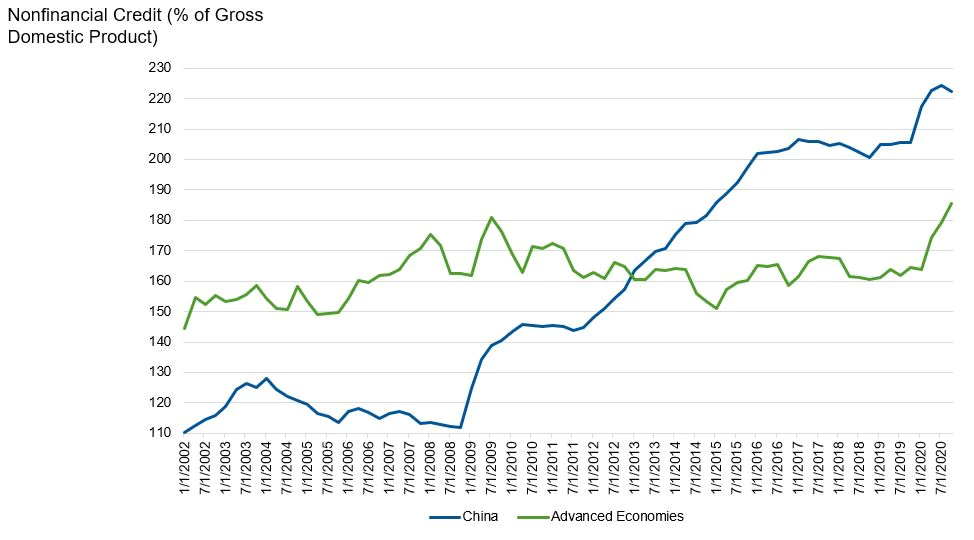

China’s transition from leader to laggard was also due to another “first,” as China was the first major nation to incrementally tighten its monetary policy stance following the COVID-19 crisis. For instance, China’s credit growth had begun to decline as early as January 2021.

A newfound sense of economic stability would eventually allow policymakers to resume the battle on economic leverage, an issue that had eluded policymakers over the past decade. For perspective, China’s nonfinancial private sector credit had more than doubled from the great financial crisis in 2008, rising from 112% of global domestic product (GDP) to 222%.5 During this same period, the debt levels of most advanced economies merely trended sideways. Overnight lending rates climbed to their highest rate in six years in January 2021.6

CHINA’S REGULATORY RECAPTURE

Tightening monetary policy was the first shoe to drop in 2021, but not the last. As the year progressed, a barrage of regulatory surprises stifled markets as Chinese policymakers turned their attention toward their goal of “common prosperity for all.” Regulators started zeroing in on giant technology platform companies, and most recently have turned to the private education sector as the cost of private tuition has become a burden for most of the parents.

China’s Tech Giants: Quick Facts7

- Alibaba hosts twice as much e-commerce activity as Amazon

- Tencent has 1.2 billion users and is the world’s most popular app

- China has 160 Unicorns (half are in fields such as artificial intelligence, big data, robotics)

- Didi, which provides transports, has more users than the United States has people

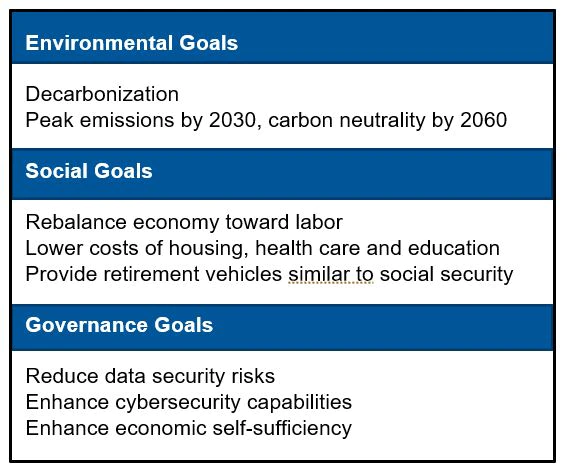

Many of these regulatory initiatives are unlikely to end soon since they fulfill a part of China’s Communist Party (CCP) long-term strategic vision. The CCP has been putting together five-year socioeconomic plans since 1953 and are now on its 14th five-year plan targeting years 2021-2025. The most recent 50 regulatory actions range from antitrust to data violations and green development— analogous to environmental, social and governance (ESG) efforts in Western economies.

We do not think China will significantly curtail efforts to increase productivity, especially as demographic headwinds are likely to pick-up in the upcoming decade. However, China is outcome-oriented and is prioritizing “common prosperity for all”; regulatory intervention will likely remain a key tool to achieve this outcome, and even increased market volatility is unlikely to change this approach.

China’s Roadmap to a “Common Prosperity”

COVID’S COMEBACK

On top of a new regulatory reset, China is now dealing with a COVID-19 resurgence as the Delta variant has permeated through the country. After the initial outbreak, China’s defense against COVID-19 was laudable, as strict lockdowns and contact tracing initiatives allowed the country to quell the number of cases and ultimately emerge as the first nation to begin normalizing its economy.

Unfortunately, the Delta variant is estimated to be more than twice as contagious as previous strains,8 making it much more difficult to prevent the transmission using lockdowns. Full vaccination is viewed as the best protection against Delta, and here, China is on par with developed market peers—China’s vaccination rate is estimated to be ~55% of their population, according to China’s National Health Commission.9 This compares to ~50% and ~60% (fully vaccinated) for the United States and eurozone, respectively.10 China’s remaining challenge lies not only in vaccinating the remainder of their population, around 630 million people, but also in coordinating this effort given the massive geographic reach of its territory. Moreover, the efficacy of their two most common vaccines, Sinovac and Sinopharm, has come under question as some studies have suggested that they are less protective than Western vaccine rivals, such as Pfizer and Moderna.11

China has already begun to undertake draconian measures in response to the Delta outbreak, enacting lockdowns in over 30 cities where clusters had emerged.12 This policy response contrasts with many other nations that are refraining from lockdowns and is likely to have a substantial effect on economic growth if sustained for any period of time.

MULTI-ASSET PERSPECTIVE

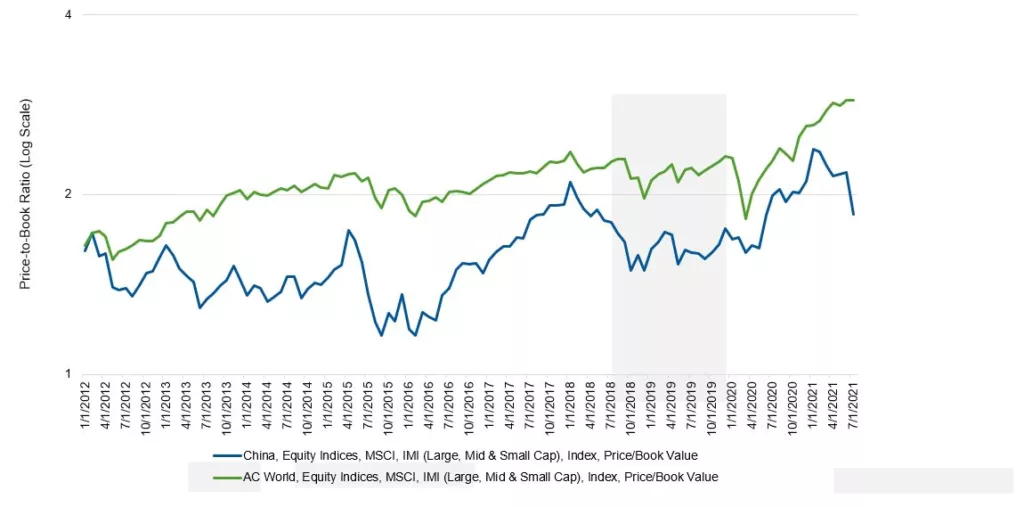

The macro environment in China presents several headwinds, which have clearly buffeted Chinese equities this year. The question we ask ourselves: is the bad news already priced in? Clearly, some of the news has been priced in as Chinese equities have de-rated, both in absolute terms and relative to their global peers. Of interest to us at FTIS is that some sentiment indicators appear to be near all-time pessimistic levels. This usually serves as a good contrarian indicator. As Sir John Templeton used to say, “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

As we weigh these considerations, the macro headwinds keep us cautious in regard to Chinese equities, although we think it is reasonable to rethink our views given the recent pullback in Chinese equities and sentiment. We are monitoring fiscal policymakers for additional easing measures that could lead us to evolve our positioning and outlook.

Sources: FactSet, MSCI, Macrobond. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenes or sales charges. Past performance is not an indicator or a guarantee of future results.

ENDNOTES

- Source: MSCI China Net TR USD Index relative to MSCI ACWI Net TR USD, as of July 31,2021. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

Source: Macrobond; MCSI Total Return USD Index. March 2020 through August 17, 2021. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

Source: MSCI ACWI Total Net Return USD. Year-to-date return through August 17, 2021.

Source: Macrobond; MCSI China Net Total Return USD Index February 2021 through August 17, 2021. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

Sources: Macrobond, BIS as of July 31, 2021.

Source: Reuters, “China short-term rate hits near 6-year high on holiday demand, policy tightening worries,” January 26, 2021.

Source: The Economist, “Xi Jinping’s assault on tech will change China’s trajectory,” August 14, 2021.

Source: US Centers for Disease Control and Prevention, “Delta Variant: What We Know about the Science,” August 19, 2021.

Source: Agencia EFE, China has fully vaccinated 55% of population: government, August 13, 2021.

Sources: USA Facts, US Coronavirus vaccine tracker, as of August 16, 2021. European Centre for Disease Prevention, COVID-19 Tracker, as of August 18, 2021.

Sources: The New England Journal of Medicine, “Effectiveness of an Inactivated SARS-CoV-2 Vaccine in Chile, July 7, 2021. BBC News, “2021 and Covid: What do we know about China’s coronavirus vaccines?” July 13, 2021.

Source: The Washington Post, “New restrictions sweep China as officials race to contain delta outbreak,” August 3, 2021.