Key Takeaways

- China has instigated disruptive regulations to protect its national security and support social stability.

- The current regulatory cycle is both broad and deep, resulting in significant price declines in China technology stocks.

- We think this regulatory disruption has created compelling long-term investment opportunities in China-based technology companies.

China’s long-term growth plans are based on establishing a consumer-based economic system centered around technology and innovation. To achieve its goals, the government has implemented various regulations on its technology sector, aiming to protect national security and support social stability. We believe the market volatility induced by these regulations presents investment opportunities.

Regulatory Disruptions Have Surprised Financial Markets

China issued a data policy framework in April 2020 that notes data as a “factor of production” and formally recognizes the importance of data in the nation’s economic model. So, the lack of clarity and communication behind recent regulatory actions have surprised financial market participants. Such activities include:

- Launching an investigation into ride-hailing giant Didi to protect national security and the public interest just days after the company’s IPO.

- Banning for-profit school tutoring companies (a significant regulatory intervention on social welfare grounds).

We think these actions clearly indicate China’s heightened commitment to its long-term, socioeconomic goals. Companies operating in China must operate under this framework and contribute to these objectives. These goals are not unique to China; the U.S. and Europe also aim to boost innovation through market-based mechanisms. But the U.S. and Europe have not invoked similarly swift regulatory disruption.

Previous Regulatory Cycle Focused on Technology

The current regulatory cycle has similar characteristics to previous ones, particularly 2018. Centering around mobile games and mobile payments, that cycle resulted in significant volatility and share price declines. Both sectors are highly concentrated in terms of market share of the top two, and both are going through significant structural growth.

- Mobile games regulation in 2018. The government sought to improve the content-auditing process and address gaming addiction among youth. It stopped approving games for nine months before establishing an improved oversight process in December 2018. Lawmakers also issued a new statute limiting the amount of time and money minors spend on videogames.

Gaming companies have continued to experience high growth rates despite these measures. Tencent’s gaming revenue today is approximately 70% larger than before the 2018 upheaval. (Source: FactSet.)

- Mobile payments regulation in 2018. Since mid-2018, all mobile payment transactions must route through a central clearing house operated by the People’s Bank of China. The government’s stated objective was to curb illicit activity over mobile payment networks. As a result, the central bank and government can inspect transaction details for all transfers made through mobile payment platforms.

As with gaming regulations, this has not prevented the industry from experiencing significant growth. Ant Group and Tencent have continued to grow their payments businesses while adopting the government’s guidelines.

Current Regulatory Cycle is Broader and Deeper

The current regulatory environment is both broader and deeper than previous cycles, but the overall framework guiding the regulation is similar.

- Data security. Measures are strengthening data security and placing a tighter grip on the data that tech companies accumulate. In 2018, regulations focused on securing and having access to mobile payments data, while this year the regulatory scope has expanded to data from the tech industry overall. There is no indication that sharing data by mobile payment providers is limiting companies’ ability to grow.

- Social welfare. China seeks to protect consumers against monopolistic behaviors, improve employee social benefits and reduce minors’ addiction to gaming. These measures may affect companies’ operations and financials differently but do not seem to constrain or alter the long-term growth of the tech sector. In fact, the opposite may be true.

Markets Have Punished Tencent’s Shares

From an investment standpoint, Tencent is a good example since it has experienced two regulatory cycles in recent years. The similarities to the previous regulatory cycle are observable in market expectations:

- Short-term EPS downgrades of 12% to 13%.

- Peak-to-trough price action of around 37% as of 8/31/2021.

- Similar valuation multiples, which sit at one standard deviation below its long-term mean.

Market Sentiment Has Quickly Flipped

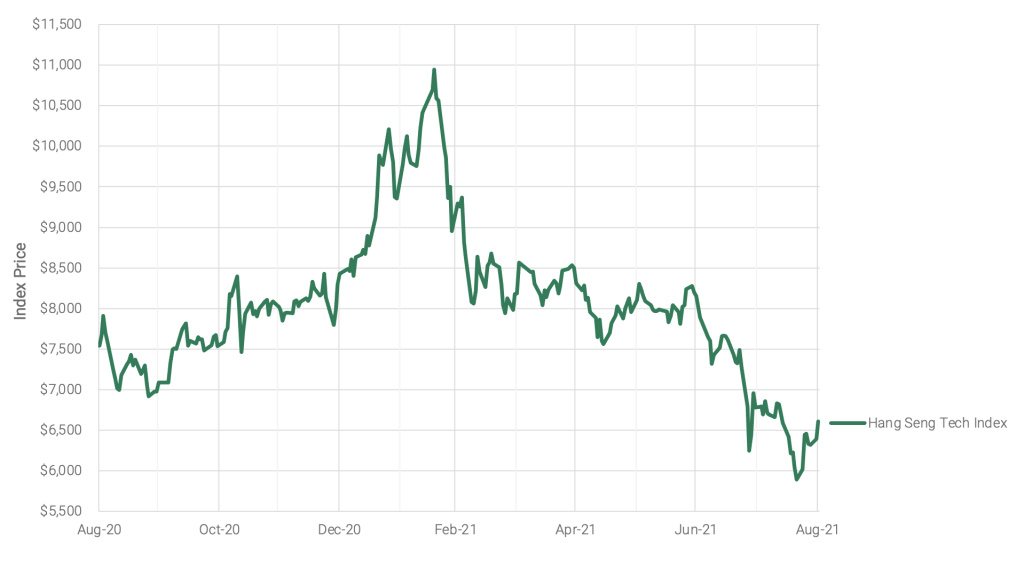

As shown in Figure 1, the one-year price chart for the Hang Seng Tech Index reveals how market sentiment has quickly flipped from bullish to bearish. Following a one-year 47% rise, the index quickly reversed course and dropped 40% (through 8/31/2021). We think these price declines present potential investment opportunities.

Figure 1 | Disruptive Regulations Slam China’s Tech Stocks

Data from 8/30/2020 – 8/31/2021. Source: Bloomberg. Past performance is no guarantee of future results. The Hang Seng TECH Index aims to represent the 30 largest technology companies in Hong Kong that have high business exposure to innovative tech themes.

Is China’s Current Regulatory Path Actually a Departure?

China’s evolving regulatory environment will create new risks and uncertainties for investors. But we don’t believe the government’s recent actions present a departure from its stated development path while also increasing access to foreign capital under a state capitalist system. For example, China granted BlackRock a license to start a wholly owned onshore mutual fund business, and JP Morgan obtained approval for the first fully foreign-owned brokerage.

Other large foreign financial institutions are following suit, in line with China’s stated long-term goals of steady development of capital markets, entrepreneurship and openness to investment by foreign investors. The key difference versus the U.S. or Europe is the Chinese state runs capitalism to serve the interests of most people. This may add uncertainty as Chinese policymakers devise further regulations.

Volatility Creates Compelling Investment Opportunities

While regulatory disruption in the Chinese marketplace has created uncertainty, we believe the accompanying spikes in volatility can create compelling long-term investment opportunities. In the past, we’ve made similar investments out of line with consensus that we believe added value over the longer term. For example, we found opportunities amid unforeseeable events, including:

- European debt crisis of 2010.

- Japan’s Fukushima power plant disaster of 2011.

- Oil price plunge of 2014 – 2016.

Short-term volatility can be painful and create an uncertain environment, but we believe the current environment may present a rare opportunity to invest in temporarily undervalued, China-based technology companies.