The recent successful listing of nine new Chinese infrastructure real estate investment trusts (C-REITs) portends a promising future for this asset class. China’s real estate companies will have access to more cost-effective capital, whilst investors will have more asset class choice. REITs will also help to bring greater breadth and depth to China’s capital markets, as we expect the scope to extend beyond infrastructure assets in the future.

Infrastructure spending is a key growth pillar for China, not only due its vast urbanisation but also given its proven track record in stabilising and leading the economy out of downturns. This strategy once again helped China to reverse the early and heavy recessionary effects of the COVID-19 pandemic and allowed the economy to expand by 2.3% in 2020.

Future infrastructure spending, driven by both traditional and green energy projects, will require significant funding. Hence, the recent launch of the first onshore C-REITs is a positive move to widen the financing channel for infrastructure projects from the public to the private markets. This way, it can mobilise the country’s savings for critical infrastructure projects, help to reduce property companies’ gearing and expand the financial instruments for capital markets.

This new asset class will widen the range of long duration assets available to Chinese savers and supplement pension and life insurance investments. In the past – many longer duration products had the ‘non-standard assets label’ where the instrument was levered, and the structuring was not explicitly approved by the regulators. The regulators labelled it ‘shadow financing’. But the development of C-REITs has been carefully considered, with explicit rules and regulation, which we think will lead to C-REITs becoming mainstream investment products over time, similar to REITs in other markets.

Large infrastructure asset base with likely extension to additional property types

REITs are already a popular asset class in major financial markets like Singapore, Japan, and the US, and China’s REITs portend a game changer; the market offers immense potential. Although the C-REIT market is starting out with infrastructure assets, we anticipate that over time it will expand to other property asset classes. Moreover, the initial launch size of the nine new infra C-REITs of ~RMB 30bn exceeded market expectations.

The nine new listed C-REITs will be invested in infrastructure projects such as datacentres, industrial parks, warehouses, roadways, sewage systems, and airports. There are guidelines on the selection of projects, focusing on those with steady cash flow and “user-charge” types of investment projects, whose revenue streams are expected to back the long-term income and growth potential. According to global rating agency Standard & Poor’s, China has a large stock of infrastructure assets, with more to come from its ambitious infrastructure targets. S&P’s rough estimates point to a USD300 billion-USD735 billion investment pipeline over the next 10 years.

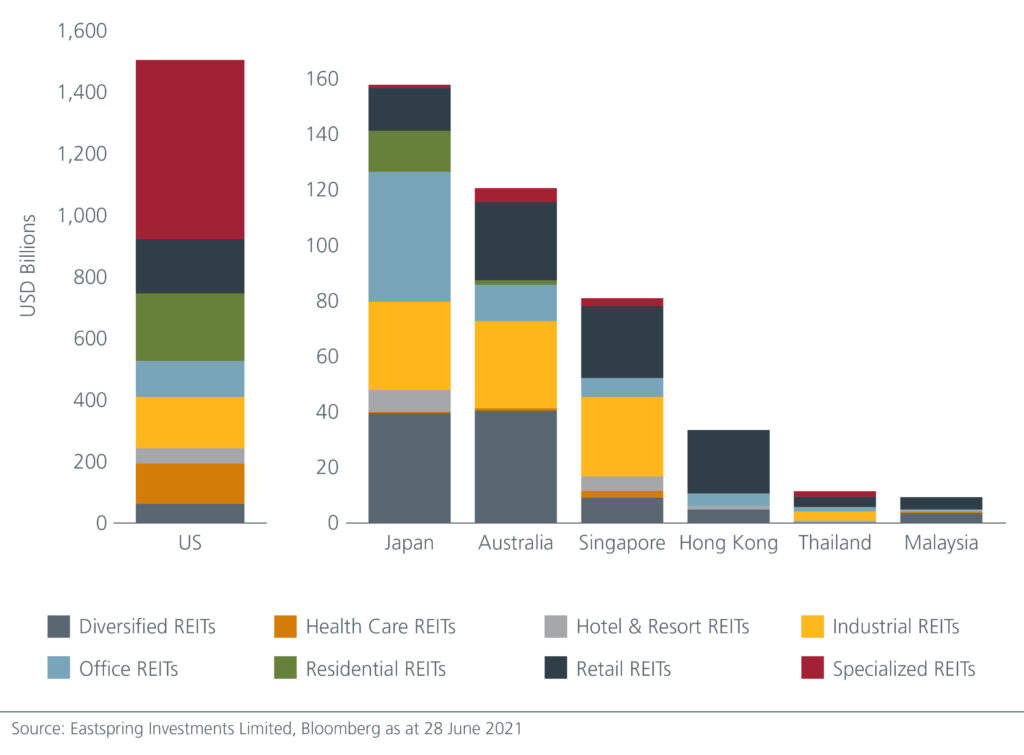

This pilot launch has been a success aided by the strong backing of sponsors (20-35% stakes), and strategic and long-term institutional investors. New investors were assured by the rigour of the listing conditions such as operations having to be no less than 3 years, dividend yields to be 4% or higher, loan to debt ratios to be capped at 28.6% and a minimum cash flow payout ratio of 90%. The keen response from third-party investors (wealth managers, mutual funds, insurers etc) also led to a 7x oversubscription rate. Consequently, China may approve the listing of REITs outside the infrastructure domain and into commercial properties (offices, shopping malls, logistics, residential housing). In fact, since the launch, they have included affordable rental housing, hydropower stations and Natural Heritage National Geopark assets as eligible to be included in the REITs. China could therefore become a USD 3 trillion REIT market, overtaking the US, currently the world’s largest REIT market and far outpacing the rest of Asia. See Fig 1.

Fig 1: Major country REITs by sub-industries

Rising investment options for investors

Many investors turn to real estate to diversify their portfolios. But for Chinese investors there have been no such choices in the domestic market. There are a handful of listed offshore REITs in Hong Kong or Singapore that are invested in mainland China properties. There are onshore quasi REIT products invested in various asset types including shopping malls, offices and rental housing. But unlike standard REITs, quasi REITs have more debt and lack liquidity rendering them unattractive for many institutional investors.

Direct investments in residential properties have been the affluent Chinese modus operandi. But the tighter measures on housing loans, speculative behaviour and an increasingly price controlled market – are major obstacles. Hence, the launch of the onshore infrastructure REITs can provide an avenue for Chinese domestic investors to switch from direct property ownership to investing in a REIT and possibly extend investments into sub-sectors outside of the infrastructure space.

C-REITs can mobilise savings of the investment public as well as large institutional asset pools, with explicit rules around leverage, ownership, fees, etc., providing a solid governance framework. This will provide transparency to both regulators and investors. Today, large developers in China own investment properties with low returns on equity and structuring a REIT would indeed help to avail their balance sheets for more active investments. This has been the model adopted by stapled REITs in Australia, where the development company is a separate legal entity to the REIT – although both entities are ‘stapled’ together under a listco. In the case of Singapore – the developer/sponsor co-owns the REIT with the public investor.

That said, it is important to note that yields and the underlying assets’ quality will be key factors for investors when it comes to choosing and investing in REITs.

How yields stack up across Asia Pacific

Globally, the REITs market has been established in more than 40 countries with the assets under management approximating USD 2.3 trillion1. In Asia Pacific, REITs have gained significant traction with Japan, Hong Kong, Singapore and Australia as substantial REIT markets. India and Philippines have also joined this group more recently.

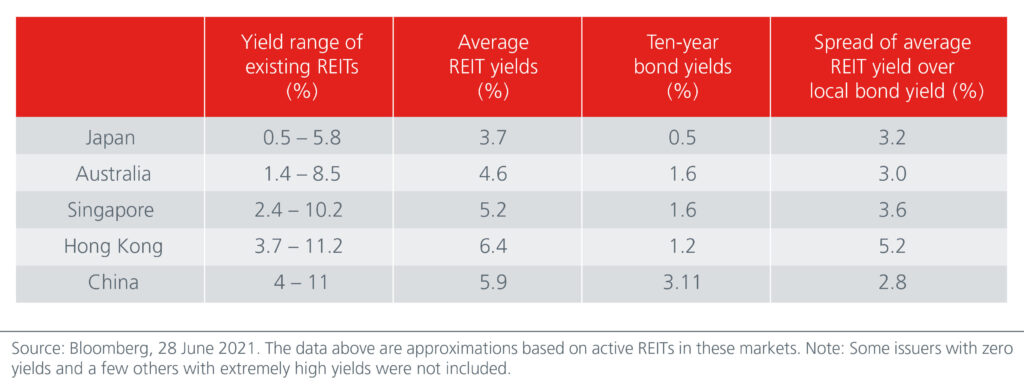

Although COVID-19 has been challenging for many property sectors, REITs have not lost their appeal. Yield hungry investors, facilitated by massive liquidity, continue to see REITs as one way of achieving higher yields. Low yields on government bonds have also made REITS sticky investments. See Fig 2.

Fig 2: Major Asia Pacific REIT market average REITs yields vs ten-year bond yields

More clarity needed to appeal to wider group of investors

While the investment opportunities appear promising, there are challenges. For one, only A share investors can invest in the infra REITs as of now; it is not yet available on the Stock Connect trading platform, which is typically how international investors access Chinese A shares, though we expect C-REITs to enter Stock Connect next year.

Management quality could also be of concern; REITs tend to establish better valuations over time with a proven management track record. Investors will then have more comfort around acquisition capability, asset enhancement initiatives and general REIT operational management. This would affect the REIT’s profitability and impact returns for investors. A REIT’s ability to grow is another important consideration.

All said, the launch of C-REITs is a positive move to unlock value, release capital and revitalise the market to become more return focused and institutional in quality. It is early days and the immediate focus will be on how the current listed C-REITs perform. Nevertheless, China’s vast investable real estate stock and its experience with quasi REITs should stand it in good stead to grow the REITs market.