Key Takeaways

- New regulations aimed at education and technology companies have led to market uncertainty and volatility in China.

- We don’t view these regulatory reforms as broad attacks on market forces or principles because they align with China’s economic growth agenda.

- While regulators may target other industries with additional rules, sectors positioned to help China achieve its long-term economic goals continue to enjoy strong policy support and present intriguing investment opportunities.

New rules for education and technology companies have dampened performance in these industries and weighed on Chinese equities in general. Combined with the delta variant-led resurgence of COVID-19 across the nation, concerns about the government’s reasoning for the reforms have caused Chinese equities to lag those of other regions in 2021.

In our view, global investors are justifiably concerned about the potential effects of similar government action on other industries.

What Investors Should Know About China’s Scrutiny of the Education Sector

Regulatory initiatives targeting education seek to reduce the burden of compulsory schooling on students and their parents and improve the quality of education and teaching. With private tutoring costs reaching up to 20% of families’ monthly incomes, the regulations may also help reduce a notable drag on China’s economy.

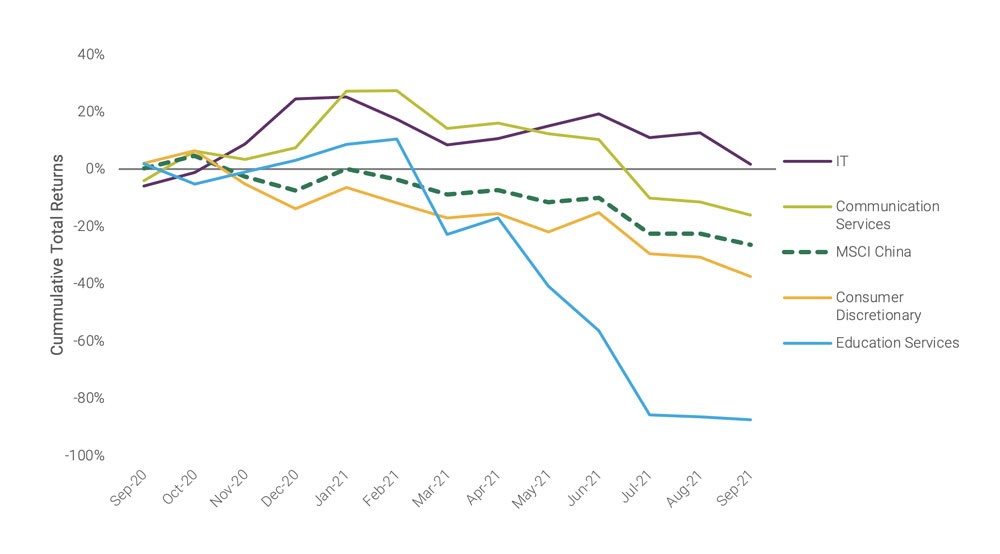

China’s central government finalized policy changes for the K-12 after-school tutoring portion of the education sector in late July. The new policy requires K-12 core subject-tutoring firms to convert to nonprofit status and limits foreign capital involvement in academic tutoring institutions. Such restructuring could bring a range of outcomes, so uncertainty has weighed on the sector. See Figure 1.

The new regulations aim to effect sweeping changes that include:

- Reducing the burden of excessive homework and off-campus training.

- Reducing families’ educational expenditures.

- Improving children’s sleep patterns and encouraging exercise while limiting their online activities.

- Promoting fairness for less affluent families and narrowing the rural-urban education gap.

During times of volatility and uncertainty, investors may want to monitor their portfolios more actively to consider if new regulation compromises an existing investment thesis. In the case of after-school tutoring companies, we believe regulation may delay, not derail, the investment thesis.

Figure 1 | Regulatory Changes in China Trigger Sell-Off in Education Companies

MSCI China and Underlying Sector Performance

Data from 9/30/2020 – 9/30/2021. Source: FactSet.

Vocational Education Companies May Present Investment Opportunities

The situation is different for companies in China’s vocational education sector. Still, these companies have traded down even though the new policies don’t apply to their firms’ operations.

We expect the government to renew its focus on promoting higher vocational education to address the mismatch in employment supply/demand. University graduates are having difficulties finding white-collar jobs, while many manufacturing companies are experiencing shortages of skilled factory workers.

Successful implementation of China’s economic agenda will require large numbers of skilled workers, so we expect to find opportunities with vocational education providers.

Companies Should Adapt to China’s New Tech Regulations

China has also imposed new rules on the technology sector. The nation’s social media and e-commerce platforms have grown rapidly in recent years, and COVID-19 accelerated their adoption.

The new tech regulations aim to ensure fair competition and sustainable growth, according to the government. While these regulatory changes will affect business models, they should also clarify acceptable business practices. We believe companies will be able to manage the impacts of the new rules.

Recent government scrutiny has included:

- Regulators fined internet giant Alibaba Group for violating antimonopoly regulations.

- Regulations aimed at financial tech platform Ant Group addressed financial sector risks.

- Cybersecurity concerns led to probes of rideshare service Didi due to worries that individuals’ travel data could create a national security risk.

- E-commerce platform Meituan will now be required to follow new food delivery guidelines and ensure delivery workers earn at least the local minimum wage and receive social insurance (e.g., pension, maternity, medical).

China’s Focus on Economic Growth Could Benefit Long-Term Investors

Economic growth remains important to China, and the country hopes to double its GDP by 2035. Even though more regulatory actions might be forthcoming, we don’t interpret them as a crackdown on all private businesses.

We believe companies positioned to address the government’s agenda will continue to receive strong policy support. For example, green development is a priority strategy. Decarbonization not only addresses global climate change, it’s also an opportunity to develop new energy, new technologies and new sectors.

Our approach is to understand how regulations and government priorities affect individual firms. If the rules are too stringent or limit our ability to evaluate future earnings potential, we can shift our focus to companies that are already aligned with government regulations.