China’s government recently enacted new regulations on a number of industries, which has caused some investor concern.

China is in the middle of a tightening regulatory cycle, implementing anti-monopoly, data security and industry-specific regulations. This has elevated market volatility and investor fears of policy risks in China. It is critical to evaluate the alignment of companies with China’s long-term strategic goals, as China ultimately seeks to strike a balance between sustainable growth, social equality and security.

Regulatory changes have ramifications across most sectors, but policies do not have a uniform effect on all companies within a given sector.

We have assessed the impact of regulatory changes on long-term earnings power and revised our assessment of the intrinsic worth of the securities we hold.

Regulatory cycles are not uncommon in China—policy and regulatory scrutiny should be seen as an ongoing, inherent risk to investing in China, to be carefully monitored and integrated in company research and portfolio management. We aim to add value for investors by understanding which business models are more aligned, resilient or vulnerable to regulatory changes designed to achieve common prosperity, improve competition, ensure national security and reduce inequalities, and understand how their valuations can be impacted.

LONG-TERM POLICY GOAL: BALANCE SUSTAINABLE GROWTH, SOCIAL EQUALITY AND SECURITY

- As highlighted in our piece released in early August about heightened regulatory scrutiny in China, China is in the middle of a tightening regulatory cycle, implementing anti-monopoly, data security and industry-specific regulations. This has elevated market volatility and investor fears of policy risks in China.

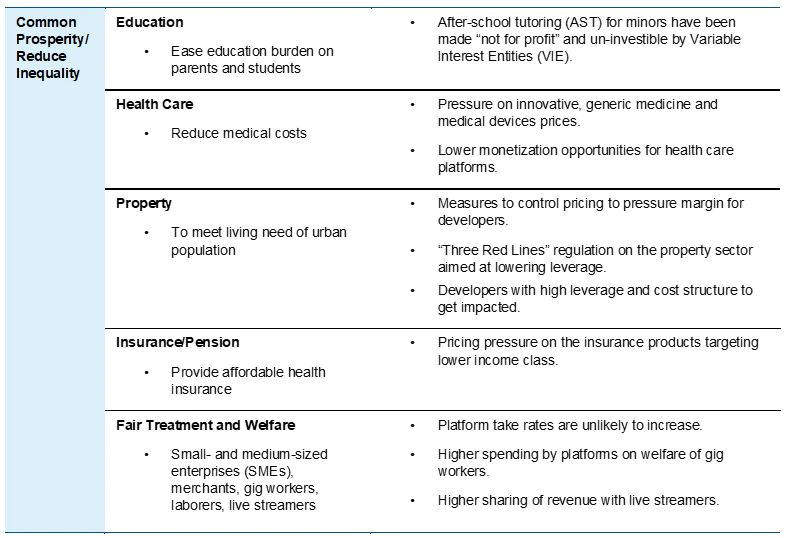

- Regulatory tightening spans several key strategic government priorities: common prosperity/reduction of inequalities, national security, orderly expansion of capital, sustainability/stability (e.g., financial, environment targets).

- The “Common Prosperity”/reducing inequality goal has ramifications on education, health care, property, insurance/pension as well as fair treatment and welfare. Regulatory changes in these areas have implications across various industries, in particular internet, education, financials and property.

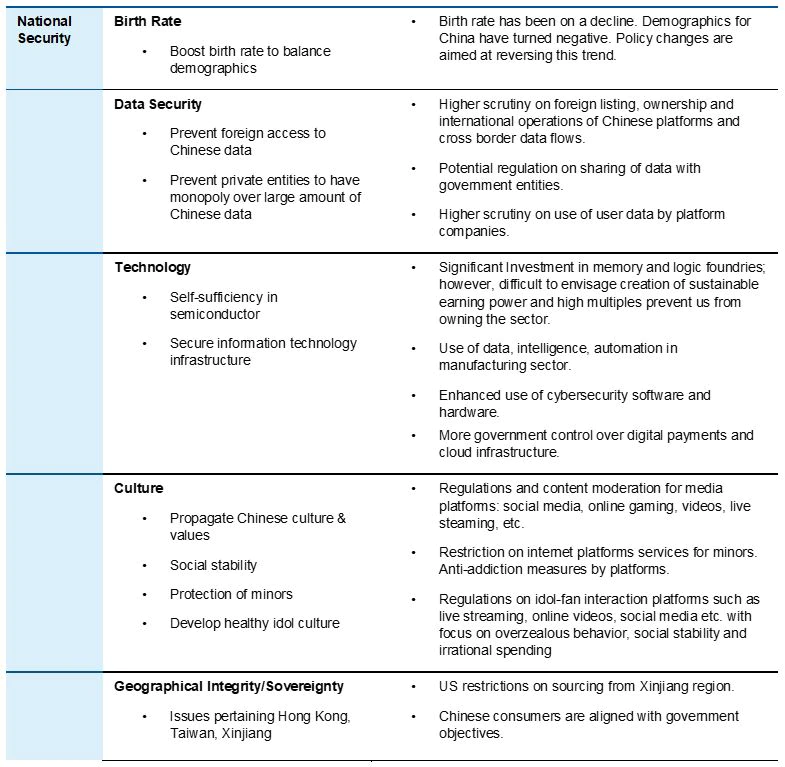

- The “National Security” pillar drives policies around technology (self-sufficiency in strategic technology areas and secure technology infrastructure), data security, demographics (boosting birth rate to balance the demographics profile of the country), culture (Chinese culture and values, social stability, protection of minors) and geographical integrity/sovereignty (Hong Kong, Taiwan, Xinjiang).

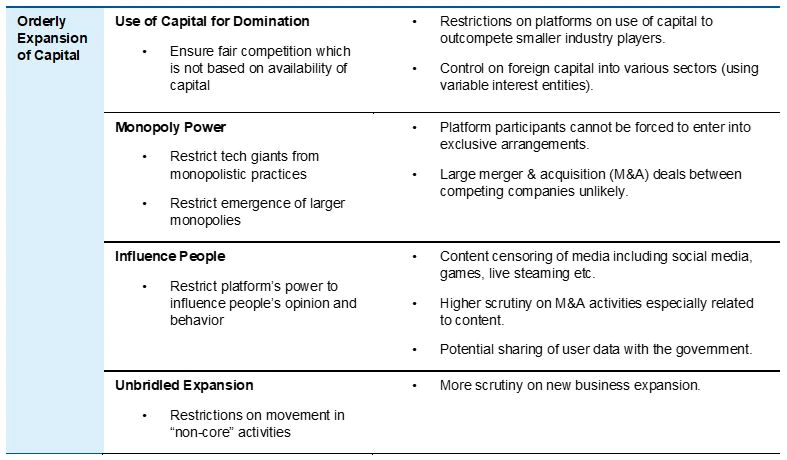

- Orderly expansion of capital is deemed key to ensure that growth is achieved in a sustainable manner (ensure fair competition is not based on availability of capital, restrict monopolies, control influence on people, avoid unbridled business expansion).

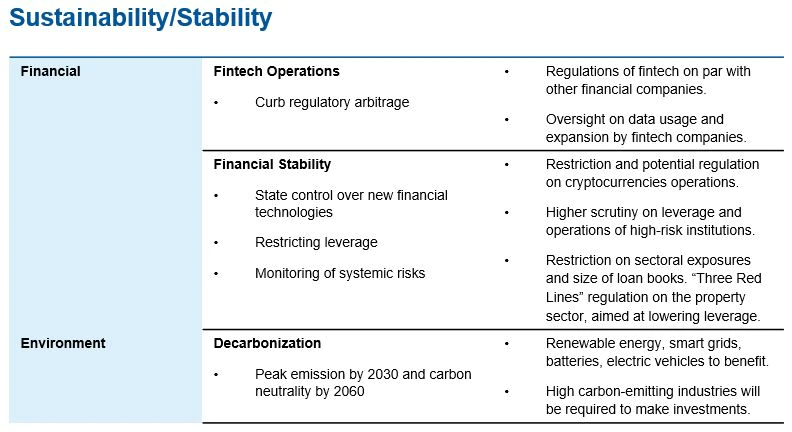

- Sustainability/stability is sought through regulations on fintech operations, regulating financial services to ensure financial stability, as well as pushing the country’s decarbonization agenda by supporting areas contributing to decarbonization and tightening rules in high carbon-emitting industries.

- Efforts by the securities regulator to ease market concerns offers evidence that recent actions affecting the after-school tutoring industry were targeted and intended to be limited in scope. Given the role of innovation as a driver of productivity and gross domestic product growth, we don’t believe government regulatory efforts aim to curtail digital sector growth as a whole.

- The tables below provide more details on China’s regulatory tightening measures.

OUTLOOK

It is critical to evaluate the alignment of companies with China’s long-term strategic goals, as China ultimately seeks to strike a balance between sustainable growth, social equality and security. The recent regulatory changes were announced at a time when China was seeing a slowdown in its economy and resurgence in COVID-19 cases, which has further weighed on equity performance.

We believe China’s government remains committed to fostering innovation, despite the regulatory crackdown. More recent efforts by the securities regulator to ease market concerns evidence this—the key takeaway was that recent actions were targeted and intended to be limited in scope.

As in the past, we can expect to see future cycles of government intervention to ensure a level playing field for all segments of society. While the short-term volatility is painful for investors, these cycles have historically not unduly impeded the long-term structural growth of the digital or indeed broader economy.

Policy and regulatory scrutiny should be seen as ongoing risks when it comes to investing in China, to be carefully monitored and integrated in company research and portfolio management. Importantly, policies do not have a uniform effect on companies. We aim to add value for investors by understanding which business models are more aligned, resilient or vulnerable to regulatory changes designed to achieve common prosperity, improve competition, ensure national security and reduce inequalities, and understand how their valuations can be impacted.

We continue to focus on bottom-up stock selection to ensure we hold companies that can sustain their earnings power through regulatory cycles.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

There is no assurance any estimate, forecast or projection will be realized.