China’s burgeoning renewable energy industry offers strong growth prospects as the country sets ambitious net-zero targets.

From air pollution and rising sea levels to soil contamination and water scarcity, China, the world’s largest emitter of greenhouse gases, faces a series of environmental problems.

Its predicament is further complicated by the fact that it is also home to almost half of the planet’s electricity and industrial assets – infrastructure that is most at risk from stranding.

Yet the world’s second biggest economy is well placed to take a leading role in the battle against climate change. That’s because of its burgeoning environmental industry, and more specifically its competitive edge in renewables.

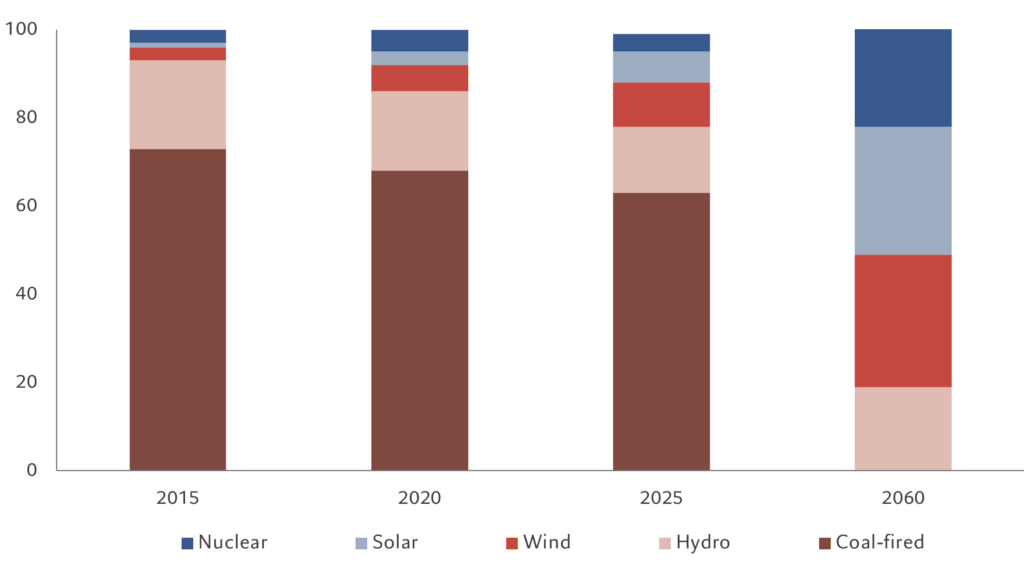

In line with Beijing’s ambitious plan to peak emissions by 2030 and become carbon neutral by 2060, China’s electricity mix is changing rapidly.

Renewable sources of energy are expected to oust coal, currently the country’s primary power source, as the main contributors to the grid. Wind power is expanding particularly rapidly.

The share of wind power in the country’s electricity generation has doubled in the five years to 2020, and is expected to rise five-fold in the coming decades to 30 per cent (see chart).

Wind picking up

China’s electricity generation mix

Since 2010, the country has been the world’s largest wind market by installed capacity, with the International Energy Agency expecting the total capacity to reach 1,000 gigawatts (GW) by 2050 from the current 300-plus GW.

While China’s main wind resources to-date are based inland in areas such as Xinjiang and Inner Mongolia, we think offshore wind will experience considerable growth in the coming years given the 18,000 km of coastline and 3 million km2 of sea available for offshore wind installations.

Offshore areas near Guangdong are rich in wind resources thanks to frequent typhoons which typically pass through the western province in July to October.

Research by the Chinese University of Hong Kong shows that the intensity of typhoons around South China Sea has been steadily increasing in the past 40 years.

Its modelling shows that by the end of the century, typhoons’ average wind speed could strengthen by 6 per cent to 7.2km per hour, with an average typhoon lasting five hours, or more than 50 per cent, longer.1

While typhoons can cause problems if particularly severe, they may be a blessing for China’s renewable energy industry.

Guangdong, the country’s manufacturing hub, is rapidly developing its capacity as it aims to become the first province to reach offshore wind electricity-pricing grid parity with traditional feedstocks, such as coal, by 2025. This parity refers to a point where wind power is generated unsubsidised at a levelised cost to fossil fuel energy.

China’s renewables sector could receive an additional boost due to the problems laid bare by Covid and the conflict in Ukraine.

Post-pandemic supply disruptions and a growing urgency among European governments to gain energy independence in the wake of the Russia-Ukraine war represent a major commercial opportunity for Chinese renewable equipment manufacturers. Many of these firms have proved more resilient than their European peers, whose margins have been hit by higher steel prices.

An A-share listed renewable equipment manufacturer, for example, is steadily growing its global market share thanks to next-generation wind power technologies which are more efficient and cost effective, with more than a third of its key components supplied domestically.

More broadly, large Chinese renewable energy firms have been delivering strong earnings growth; according to consensus estimates, the sector’s earnings per share is forecast to grow at least 30 per cent in the coming 12 months. That is some distance above the rest of China’s listed companies, whose profits are expected to rise just 5 per cent over the same period.2

China’s net-zero pledges are expected to require some USD16 billion of investments. The signs are that such capital would be put to profitable use.

[1] https://cuhkintouch.cpr.cuhk.edu.hk/2022/02/7922/

[2] Goldman Sachs China Renewable Index and MSCI China Index as of 25.08.2022