China’s reopening offers growth potential and helps sustain trends in automation, digitalization, energy transition and health care innovation.

Key Takeaways

Reopening in China should bolster non-U.S. growth stocks and spur global economic growth.

Companies in the travel and consumer sectors should see significant growth acceleration as restrictions ease.

Opportunities can be found in stocks positioned to benefit from specific growth trends and select premium brands with high exposure in Asia.

China's Controlled Reopening May Boost Global Economic Growth

The Chinese government recently ended its zero-COVID policy to allow a controlled reopening of its economy. We believe this development improves the outlook for non-U.S. equities because it should spur global economic growth.

While the rest of the world enjoyed economic recovery as the pandemic waned, China saw growth stall. Its restrictive policies on mobility and gatherings to fight COVID resurgence resulted in economic contraction as consumer and business activity all but ceased.

The government began to roll back restrictions in late 2022. And we believe select industries and companies could see a significant inflection in growth as pro-growth fiscal and monetary policies kick in. The government’s easing of corporate regulation, such as that it imposed on Big Tech companies last year, should also drive growth.

Travel and Consumer Sectors Should Bounce Back as Restrictions Ease

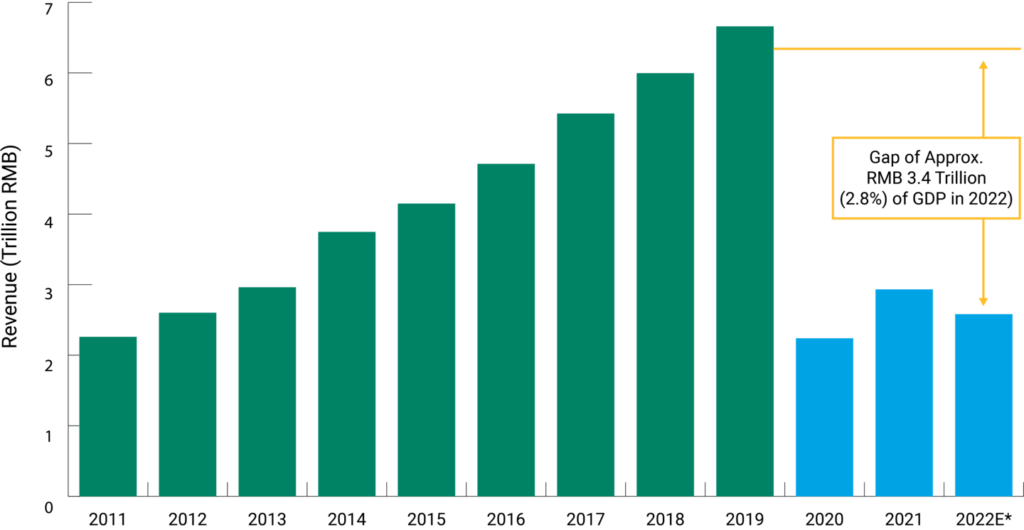

The zero-COVID policy led to a significant drop in domestic tourism revenue. See Figure 1. We expect the lifting of restrictions first to benefit domestic travel stocks, including airlines, hotels and travel agencies. For example, hotel chain operators in China should see a swift recovery in occupancy and room rate growth.

Figure 1 | China’s Domestic Travel Revenue Rebounds as Restrictions Ease

Increased air travel should lead to higher engine overhaul and maintenance activities. We also expect international travel to recover shortly after domestic travel. Duty-free sales should surge after years of stagnation. Luxury companies like Pernod Ricard, L’Oréal, Hermes and LVMH will likely see meaningful growth from this trend.

Life insurance companies, such as AIA Group, a leading Hong Kong-based life insurance provider, could also benefit. As cross-border travel recovers, we expect a significant growth tailwind because mainland Chinese visitors to Hong Kong represent a substantial portion of life insurance sales.

The zero-COVID policy significantly reduced consumer spending and excess savings. We estimate that current cumulative extra savings are equivalent to 14% of annual consumption in China. Pent-up demand could drive significant growth acceleration in the consumer sector.

Leisure apparel brands, such as Puma and Li Ning, and premium brands like Hugo Boss, Mercedes, Hermes and LVMH, may also see significant growth tailwinds as consumer activity resumes.

Ongoing Growth Trends Fuel Investment Opportunities

Despite high inflation, well-respected consumer brands and luxury goods names are benefiting from resilient demand. Premium companies in apparel, beauty, spirits and automobiles with high exposure in China and other parts of Asia are among the leaders in this trend.

We are also finding opportunities in companies positioned to benefit from these ongoing growth trends: