As we close 2024, we continue to see weaker-than-expected economic activity data from China. The latest round of data has shown retail sales slowing unexpectedly again, alongside weaker than expected aggregate financing and loans data – all despite stimulus measures announced earlier in the year.

Chinese policymakers have been gradually increasing monetary and fiscal support this year, with last week’s Central Economic Work Conference reinforcing the earlier messaging from the Politburo meeting. Among the nine key areas of focus laid out for economic policy, it was encouraging to see boosting domestic demand moved to being top priority.

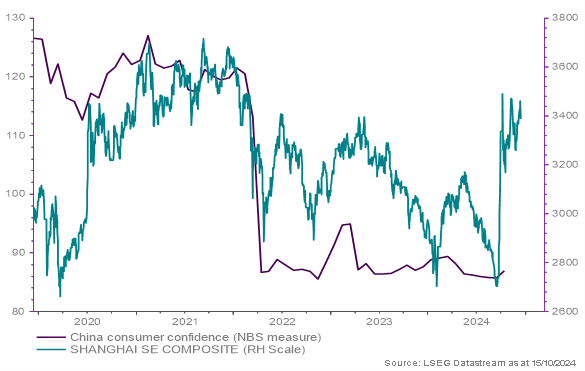

While the Chinese equity markets rebounded in September following a more assertive tone around fiscal support, consumer confidence remains weak in China (see chart 1). It remains to be seen if the measures will boost consumer confidence, which has likely been affected by the ongoing property crisis and relatively high youth unemployment. Weak domestic demand, in turn, will also be contributing to deflationary pressure.

Chart 1: China Consumer Confidence and Chinese equity prices

We remain positive on global equities, especially on US equities. Our Investment Clock is firmly in the equity-friendly disinflationary Recovery phase (characterised by improving growth indicators and softening inflationary pressure); rate cuts from central banks should help economic growth stay moderately positive. Inflation remains at lower levels. Recession risks look limited near-term. In the US specifically, earnings trends remain encouraging and technical factors such as seasonality and price momentum are supportive.

However, regionally we remain negative on emerging market equities and European equities, areas where corporate earnings have been impacted by weaker Chinese consumer demand. China’s disappointing economic growth picture could be exacerbated if potential tariffs from the US were to reduce external demand for Chinese produced goods. Economic activity could pick up as policy support steps up; However, we suspect Chinese officials may be waiting on decisions from President-elect Trump before embarking on more significant stimulus, and we are monitoring the situation closely.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.