A downside in US inflation data last week added further fuel to the recent bond rally.

Softer than expected inflation data was the latest in a recent trend of slower economic activity, which has spurred speculation that the US Federal Reserve (Fed) has reached peak policy rates. In response to this, US two-year treasury yields experienced their steepest decline in over two months as traders moved to price in over three cuts next year, with the first cut being fully priced in by June.

Bond yields have fallen globally in recent weeks, with 10-year bond yields in both the UK and US down over 0.5% from their October peaks. This steep decline in bond yields has been the main driver of moves elsewhere across financial markets.

Falling bond yields have had a particularly large impact on currency markets where the US dollar has sharply depreciated in recent weeks.

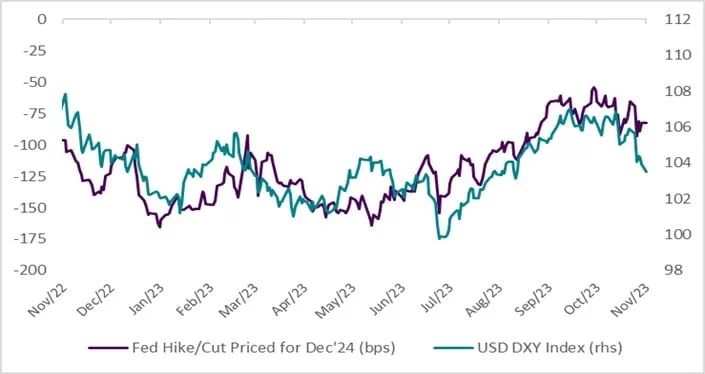

US dollar strength had been a major theme of markets over recent months, as resilient macro data saw the Fed continuing to tighten policy over the year. However, as markets have begun to price in more rate cuts over the next 12-months, this dollar strength has unwound (below). In fact, dollar performance is now negative over 2023.

Chart 1: Dollar strength unwinding

Left-hand side: Market implied interest rate hikes/cuts priced in up until the December 2024 Federal Open Market Committe meeting.

Right-hand side: DXY US Dollar Index.

Source: Bloomberg as at 20/11/2023.

Looking ahead

Bond markets have moved a long way in the last month. We believe that yields will fall lower still as macro data softens over the next year. However, we believe that it is unlikely that central banks cut rates to the extent currently priced in, unless the global economy moves into a sharp recession. In this case, the prospects for the dollar would be less clear. While falling rates would likely exert pressure, we note that the currency’s safe-haven status could see upside for the greenback.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.