Equities dipped last Friday following the mixed US jobs report.

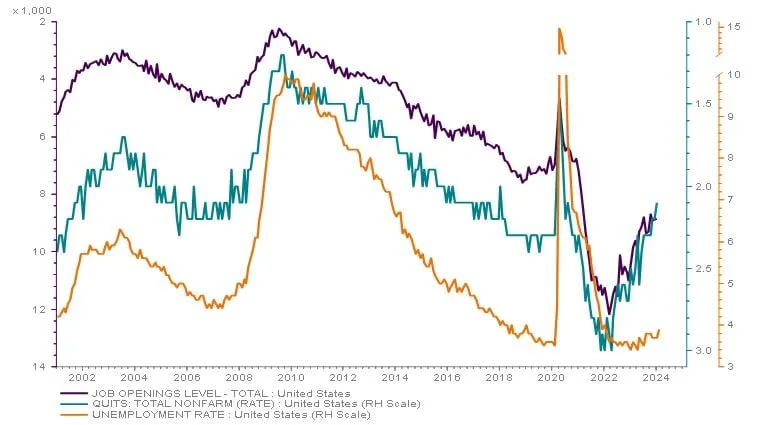

General employment gains continued with some back revisions (as indicated by non-farm payrolls), but the unemployment rate (based on household survey) rose to a two-year high (orange line on chart 1). This data has started to follow other softer labour market indicators like the reduction in job openings (inverted lines in purple).

Chart 1: Signs of loosening in the US labour market

Source: RLAM. For illustrative purposes only. Trails shows monthly readings based on global growth and inflation indicators. LSEG Datastream as at 15/01/2024.

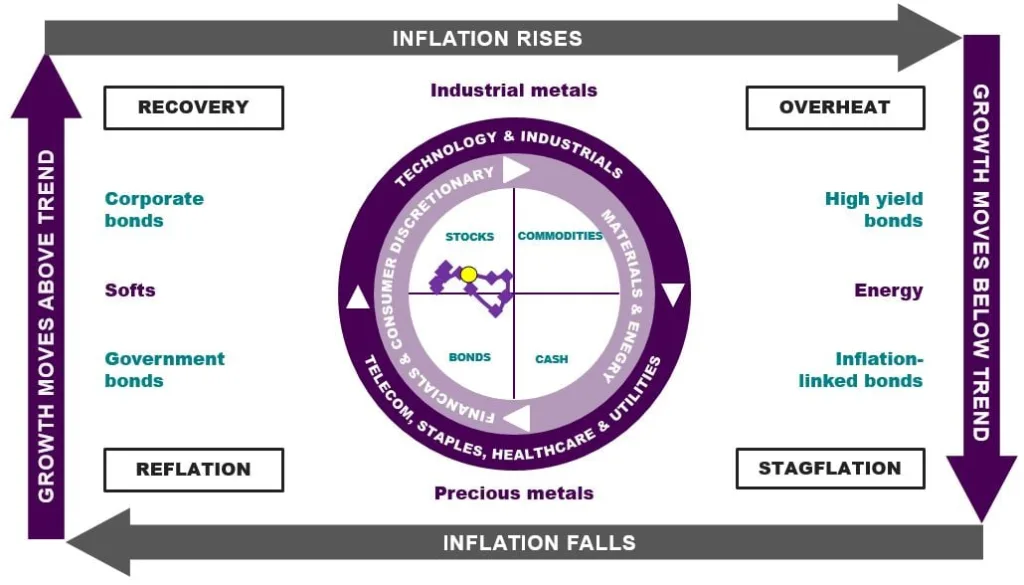

Despite the wobble in equity markets and US data being more mixed of late, our Investment Clock sees the current macro fundamentals more positively and has moved further into “Recovery” this month (chart 2).

Chart 2: Investment Clock moves further into Recovery

Source: RLAM 12/03/2024. For illustrative purposes only. Trails shows monthly readings based on global growth and inflation indicators.

In the near term, we see this US jobs report as another sign of loosening in what has been, to date, a resilient labour market. This helps lower the risk of any re-acceleration in US wage inflation and supports the case for the Federal Reserve to cut rates later this year.

Our measure of investor sentiment is positive but not overly stretched. While the technicals remain supportive, we expect investors to treat this macro picture of lacklustre growth with limited near-term recession risk, as a bit like Goldilocks.

That being said, using the term Goldilocks to describe markets makes me personally nervous; the growth or inflation picture can get too hot or too cold from here and the change could happen gradually or suddenly. Consequently, and very much in line with the Federal Reserve, we remain data dependent.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.