Stronger US data, central bank interest rate cuts and a stimulus package in China make the case that the world economy is heading for a soft landing, not a recession.

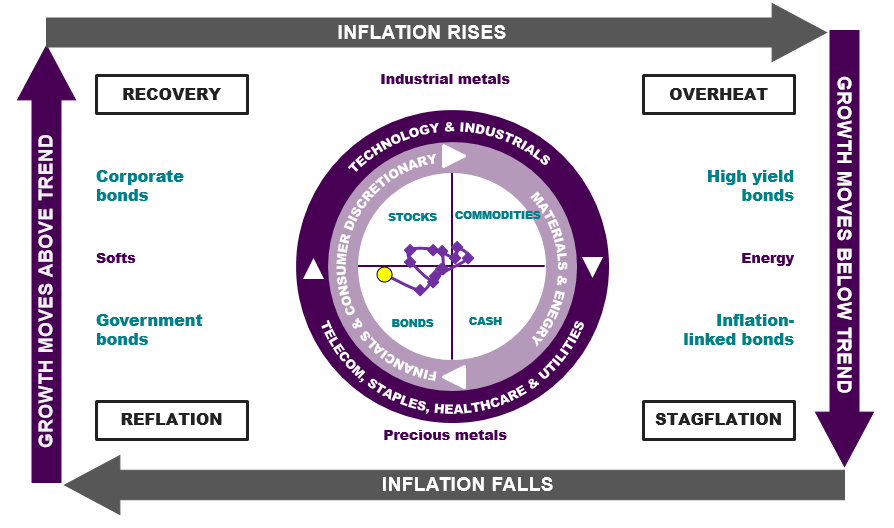

We expect global growth to pick up into 2025 as inflation drifts lower. This is the equity-friendly Recovery phase of the Investment Clock model that guides our asset allocation. While the fundamentals look positive for stocks, geopolitical risk could cause short term weakness. This could lead to commodities seeing strength against the risk of broadening conflict in the Middle East.

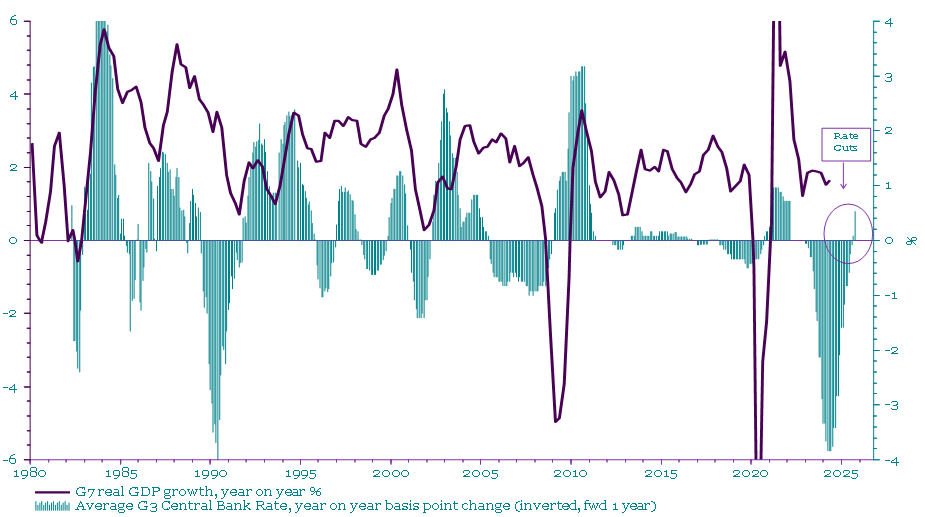

Global growth has been bumping along near to its long-term trend for a couple of years, with stronger US activity offsetting mild recessions elsewhere. Interest rate cuts and stimulus in China could bring the cycle back to life, however. The first rate cut from a central bank is a powerful lead indicator for growth but with a long and variable lag. One rate cut usually follows another, but it can take a year or so to impact investment and consumption decisions. The start of a new phase of Federal Reserve, European Central Bank and Bank of England rate cuts bodes well for global growth in 2025 (Chart 1).

Chart 1: G7 GDP Growth with year-on-year change in G3 average Central Bank rate (inverted)

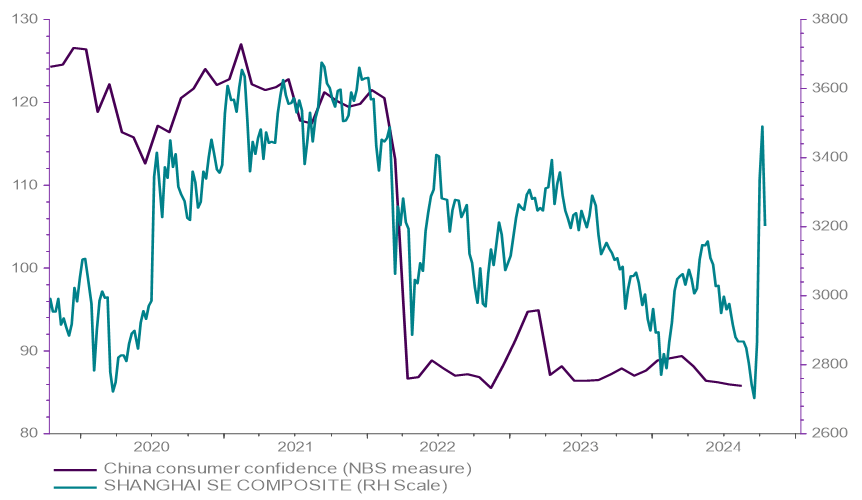

Meanwhile, China has responded to years of lacklustre growth with a new fiscal stimulus package, rumoured to be around 4% of GDP. While it remains to be seen whether this will be enough to boost consumer confidence and sustain the rally in China stocks (Chart 2), it’s another positive for global growth.

Chart 2: China Consumer Confidence and Stock Prices

The Investment Clock model we use to guide our asset allocation has been in the disinflationary Reflation phase of the business cycle which usually sees central banks cut rates, but it’s heading towards Recovery on the back of improvements in the global growth indicators we track along with the expectation of further interest rate cuts (Chart 3). This change suggests stocks could outperform government bonds.

Chart 3: The Investment Clock is heading towards equity-friendly Recovery

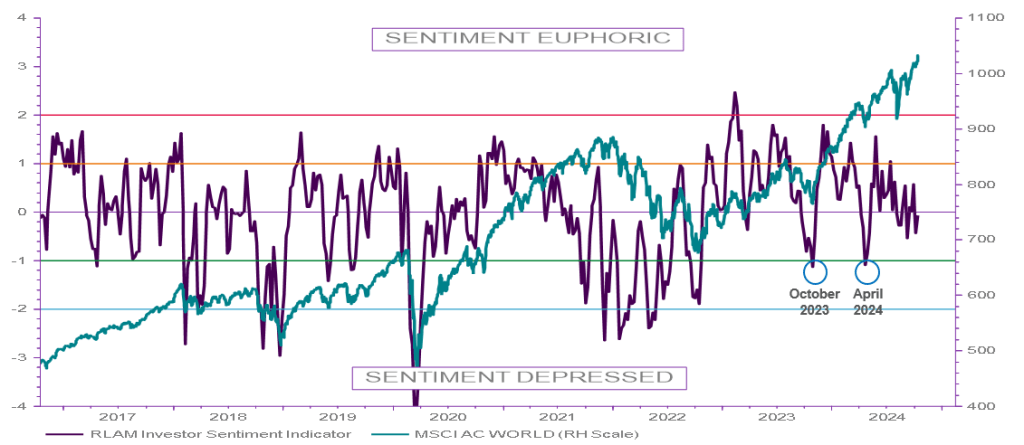

While the macro outlook appears positive, global stocks are already trading around all-time highs and geopolitical risk is rising. Investors have a contentious US Presidential Election to contend with, with the likelihood of civil unrest whoever wins, and broadening conflict in the Middle East that could trigger a surge in oil prices. Commodities could then be seen as a valuable hedge against equity weakness in the latter scenario. Whatever the cause, short term weakness could trigger a contrarian buying opportunity for stocks.

Chart 4: Investor Sentiment and Global Stocks

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.