Sentiment is positive at the moment in the US, not just for fans of the Kansas City Chiefs who have just seen their team win a second consecutive super bowl, but also in the wider investor community.

Last week, the S&P 500 closed above 5,000 for the first time in history, marking the 14th positive week of returns in the last 15. In sterling terms, the S&P has rallied for four consecutive quarters, and we would not be surprised to see this rally continue.

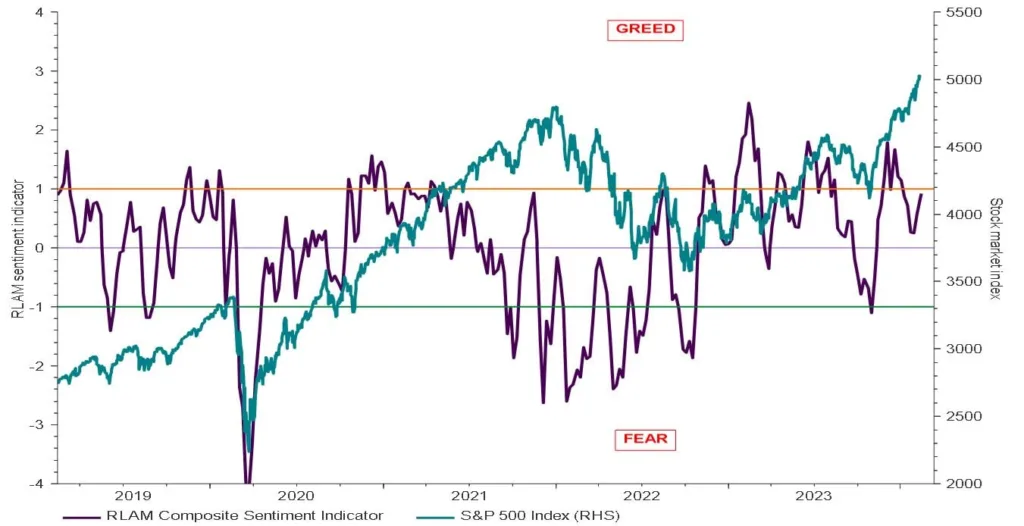

The strength of the recent rally has seen valuations move to lofty levels and indicators such as put/call ratios and retail investor surveys are now at bullish levels. That being said, our own broad measure of investor sentiment still remains at neutral levels for the time being (Chart 1).

Chart 1: Royal London Asset Management composite sentiment indicator is still neutral despite stock market rally

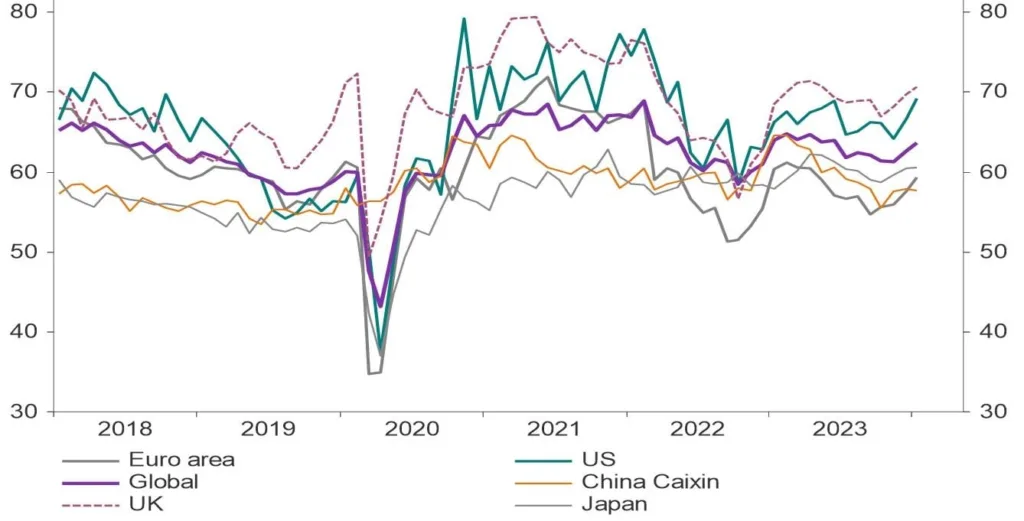

Even with markets at high valuations, we believe equities could continue to move higher from here. Last week, we noted that improvements in global growth had sent our Investment Clock into the equity-friendly Recovery quadrant, a time in the business cycle where stocks tend to outperform on a relative basis. Business optimism has notably improved, especially in the US, as corporates look forward to the prospect of easing interest rates this year (Chart 2). We would expect this to translate to an improvement in earnings and provide further support to equity markets over this year.

Chart 2: Business optimism surveys are improving

PMIs: Business optimism

PMI composite indicators for “future output”

There is a risk, of course, that an improved growth backdrop will deter central banks from easing policy in line with expectations, and equity markets could be set for a correction from all-time highs if the expected policy ease does not materialise. However, for the time being, with technical conditions still favourable for equities and the macro environment improving, we think this historic run for stocks could go further.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.