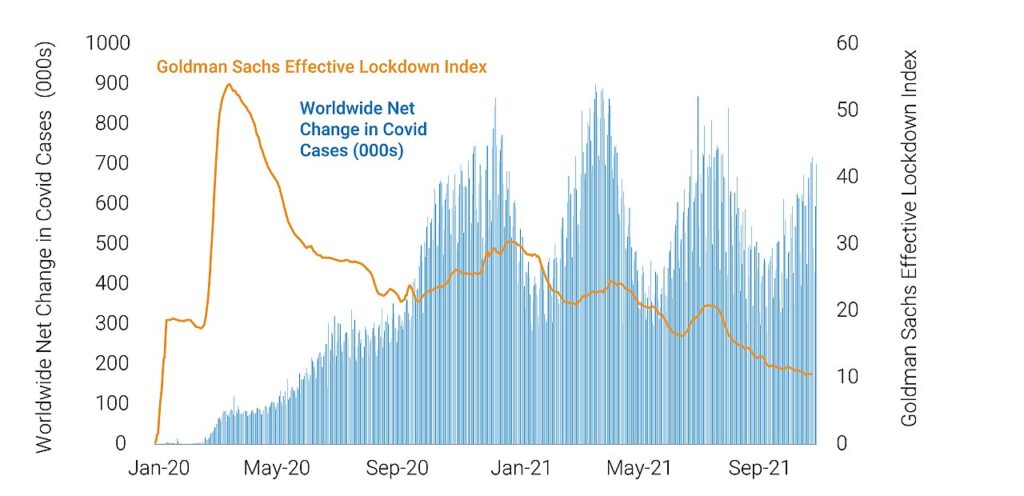

As the year draws to a close, the fourth wave of Covid-19 is underway with the Omicron variant grabbing the headlines. There have been many more reported Covid cases this year than last, but the impact on GDP has declined almost to insignificance: currently just 2% according to estimates by Goldman Sachs, compared with 20% in the worst days of last year.

Where restrictions have been tightened, as in Europe recently, they have been less severe than in 2020 and the economic impact has diminished as the world has learned to live with the pandemic.

Chart 1: Covid enters fourth wave but economic impact tumbles

Note: Goldman Sachs’ Effective Lockdown Index combines data on actual restrictions with mobility data for 46 countries. Impact on GDP (not shown) calculated with additional information.

The impact on overall GDP may be small but Covid has re-shaped other aspects of the world economy, both directly and indirectly via the massive fiscal and monetary response. Transport links have been stretched to and beyond breaking point. Inflation in the developed world has risen to levels not seen for decades. And although the recovery in employment has been remarkable, overall labour supply and immigration have been reduced in most countries.

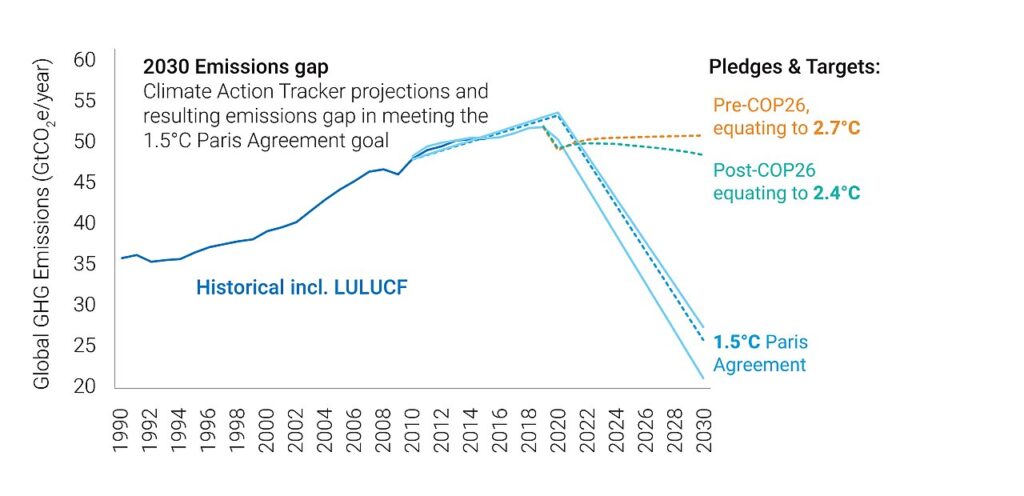

Long after Covid has receded as a macro issue, climate change will remain a massive influence on financial markets and life in general. November saw Glasgow host the COP26 climate summit. Before the summit, the world was on track for 2.7°C of warming, after Glasgow this has been reduced to around 2.4°C. Countries agreed to revisit their climate targets at the 2022 COP in Egypt, rather than in 2025, but the 1.5°C target remains some way off.

Chart 2: Net Zero targets pre and post COP26

While the summit did not live up to the hopes of all, some important steps were made. Key emerging market countries made more ambitious commitments, including India and Nigeria. COP26 also delivered compelling signals to global markets on the phase out of internal combustion engine vehicles and fossil fuels. Another big development was the agreement of a rulebook to govern international carbon markets, which should promote increased confidence, trust and activity in these markets moving forward. A final takeaway from COP26 was the increasing role that the private sector is playing in driving heightened ambition. This was embodied by the Glasgow Financial Alliance for Net Zero, which committed $130 trillion to Net Zero, and included BMO Global Asset Management (EMEA) and Colombia Threadneedle Investments amongst its members.

Navigating through these numerous cross currents has been hazardous for investors. Some of the biggest beneficiaries of the working-from-home (WFH) boom are now well below their peaks. The Citi Global Stay at Home Basket is 21% below its peak in February. Zoom Video Communications is down -56%, Peloton Interactive -73%, Roku -47% and Just Eat Takeaway -52%.

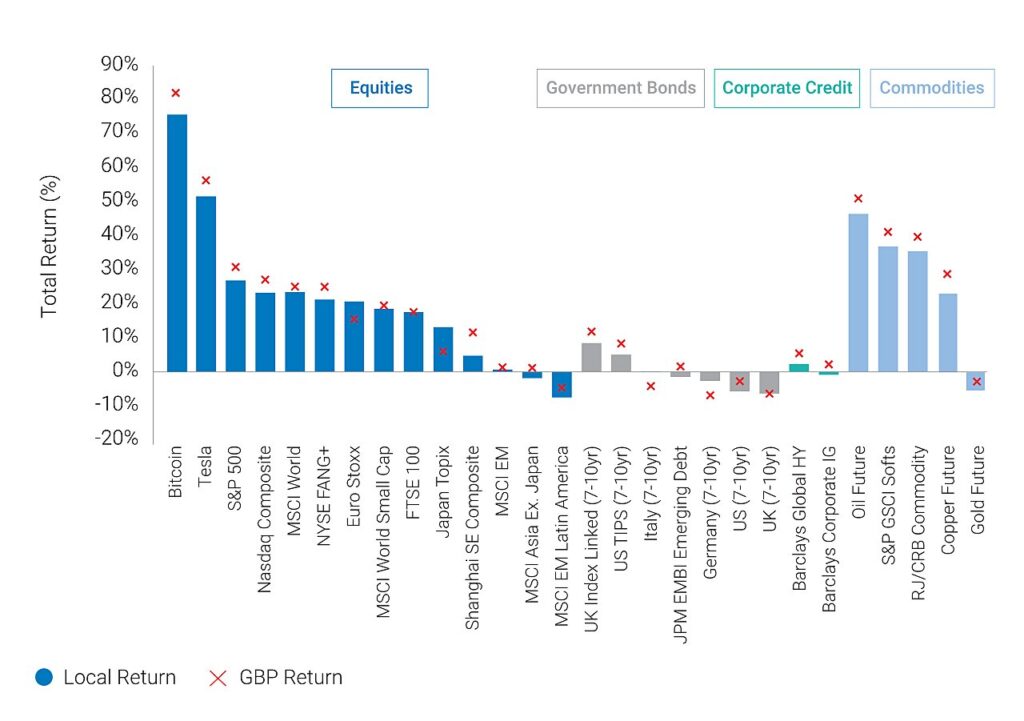

Chart 3: Year-to-date asset class returns

In the bond market, inflation protected securities were the place to be. Conventional government bonds gave negative returns in most markets. Long duration bonds (not shown in the chart) had a very volatile year and have rallied recently but still generated negative returns overall. Corporate debt fared only slightly better. Commodities generated strong returns, though gold was a notable poor performer despite rising inflation and negative real interest rates. Some commentators suggest that Bitcoin has displaced gold as a safe haven. I doubt that ‘safe haven’ will prove an enduring feature of Bitcoin and its relatives.

This pattern of returns can be readily traced to macro fundamentals. Economic growth surprised strongly to the upside in DM, even though forecasts began the year fuelled by optimism given the promise of vaccine success. By contrast, growth in EM in general, and China in particular, was disappointing. The crisis in the property sector looks set to cast a medium-term shadow over China’s economic performance, even though targeted policy supports are now being implemented.

Strong growth in DM fed through to corporate earnings, which beat analysts’ estimates in spectacular fashion. Earnings growth in 2021 looks set to come in at 51% in the US, 52% in continental Europe and 83% in the UK.

Inflation also beat forecasts and this damaged bond returns, even though central banks in most DM kept official rates on hold and maintained their aggressive bond buying programmes. Expectations of interest rate hikes for 2022 did rise and the US Federal Reserve finally retired the word ‘transitory’ as a description of inflation in December – much too late in my opinion – and gave a clear signal that they planned to taper their bong buying more steeply. Despite relatively weak growth, official interest rates were raised in numerous EM. Turkey deserves a special mention: the authorities believe that the way to tackle inflation is to cut interest rates. As a result, the currency has tumbled and the economy has fallen into recession.

Covid has been the biggest peacetime challenge the world has faced in a century or more. The response by economic policymakers has been unprecedented in terms of speed and scale. That provided massive immediate support, but it is medical science that has turned the tide in the war against Covid. Ordinary people in DM have suffered greatly, those in EM even more.