What’s happened in the Contingent Convertible (CoCo) markets recently? CoCo bonds have been at the centre of attention in the new issuance space in recent months, driven by a surge in issuance volume. Notably, September witnessed particularly heavy activity in the CoCo market, with significant issuance from major financial institutions. For example, Nordea’s €1 billion issuance was met with overwhelming demand, receiving orders worth €11 billion, signalling strong investor appetite for these hybrid instruments1. This issuance surge reflects the attractive yield that CoCos offer in the current interest rate environment. CoCos are wanted.

Another notable trend in the CoCo market has been the continued occurrence of issuer calls, regardless of the backend yields. This phenomenon underscores the strength of the “pull-to-par” effect in the market. Issuers are choosing to exercise their call. The consistent call activity supports investor confidence, as many CoCo bonds are trading with the expectation of early redemption. The anticipation of these calls helps stabilise prices and reduce downside risk for investors as the likelihood of receiving par value at the call date becomes increasingly probable.

In addition, there is still a curious disconnect in the market between bank fundamentals and CoCo bond pricing. Over the past 5 to 10 years, bank balance sheets have significantly strengthened, partly due to the higher interest rate periods that we have seen. This has not been fully accounted for, and this lack of repricing suggests that investor perceptions have lagged behind the reality of the improved bank fundamentals.

The combination of high yields, active issuer calls, and improving bank fundamentals positions CoCo bonds as a potentially attractive asset class in this current interest rate environment.

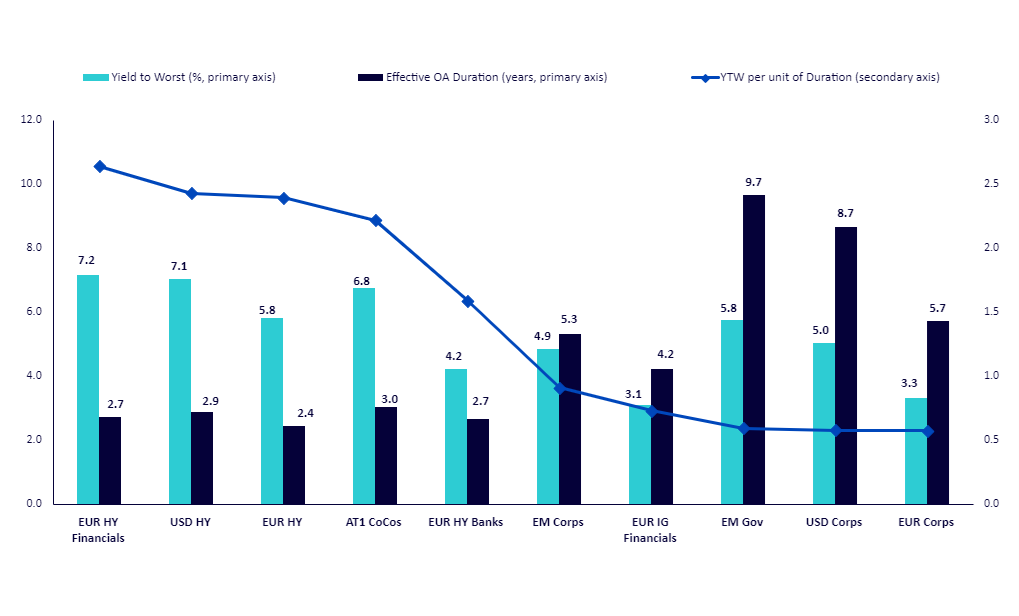

The WisdomTree AT1 CoCo Bond Strategy is based on the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. It offers a combination of higher yield derived from capital subordination (not from riskier issuers), low duration, and portfolio diversification. The yield per unit duration of CoCos has historically ranked high among peers, offering investors an attractive risk-return profile, as shown in Figure 1 below.

Figure 1: Yield to worst and effective to option adjusted duration of CoCos versus peers A graph with blue and green bars

Key Takeaways

- CoCos have seen strong demand in the last few months with some new issuances subscribed more than 10x. The “pull-to-par” effect, along with strong fundamentals, has revived and boosted investor confidence.

- WisdomTree AT1 CoCo bond strategy could provide an attractive risk-return profile and the benefit of diversification across countries and currencies.

- European CoCos have outperformed other relevant peers since inception despite weathering storms like COVID-19 and the fall of Credit Suisse.

- Related ProductsWisdomTree AT1 CoCo Bond UCITS ETF – USD Acc

Find out more

What’s happened in the Contingent Convertible (CoCo) markets recently? CoCo bonds have been at the centre of attention in the new issuance space in recent months, driven by a surge in issuance volume. Notably, September witnessed particularly heavy activity in the CoCo market, with significant issuance from major financial institutions. For example, Nordea’s €1 billion issuance was met with overwhelming demand, receiving orders worth €11 billion, signalling strong investor appetite for these hybrid instruments1. This issuance surge reflects the attractive yield that CoCos offer in the current interest rate environment. CoCos are wanted.

Another notable trend in the CoCo market has been the continued occurrence of issuer calls, regardless of the backend yields. This phenomenon underscores the strength of the “pull-to-par” effect in the market. Issuers are choosing to exercise their call. The consistent call activity supports investor confidence, as many CoCo bonds are trading with the expectation of early redemption. The anticipation of these calls helps stabilise prices and reduce downside risk for investors as the likelihood of receiving par value at the call date becomes increasingly probable.

In addition, there is still a curious disconnect in the market between bank fundamentals and CoCo bond pricing. Over the past 5 to 10 years, bank balance sheets have significantly strengthened, partly due to the higher interest rate periods that we have seen. This has not been fully accounted for, and this lack of repricing suggests that investor perceptions have lagged behind the reality of the improved bank fundamentals.

The combination of high yields, active issuer calls, and improving bank fundamentals positions CoCo bonds as a potentially attractive asset class in this current interest rate environment.

The WisdomTree AT1 CoCo Bond Strategy is based on the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. It offers a combination of higher yield derived from capital subordination (not from riskier issuers), low duration, and portfolio diversification. The yield per unit duration of CoCos has historically ranked high among peers, offering investors an attractive risk-return profile, as shown in Figure 1 below.

Figure 1: Yield to worst and effective to option adjusted duration of CoCos versus peers A graph with blue and green bars

Source: WisdomTree, Markit. Data as of 30 Sep 2024. Yield is yield to worst (YTW) and is based on the duration-adjusted market value weighting. Effective OA duration is effective option-adjusted duration. AT1 CoCos is the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index, USD HY is the iBoxx USD Liquid High Yield Index, EUR HY is the iBoxx EUR Liquid High Yield Index, USD Corps is the iBoxx USD Liquid Investment Grade Index, EUR Corps is the iBoxx Euro Liquid Corporates Index, EUR IG Financials is the iBoxx EUR Liquid Financials Index, EUR HY Financials is the iBoxx EUR Liquid High Yield Financials Index, EUR HY Banks is the iBoxx EUR High Yield Banks Index, EM Corps is the iBoxx USD Liquid Asia ex-Japan Corporates Large Cap Investment Grade Index, EM Gov is the iBoxx USD Liquid Emerging Markets Sovereigns Index. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

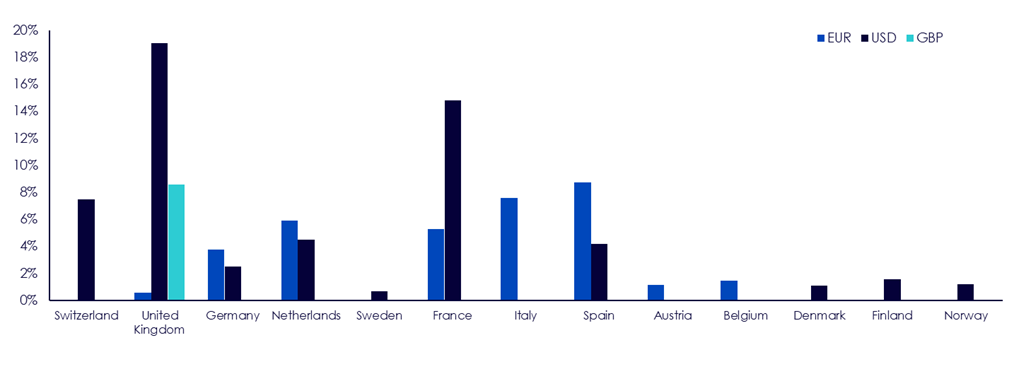

In addition to its attractive risk-return profile, the strategy is diversified across currencies and countries, providing full market exposure to European CoCos.

Figure 2: Country and currency exposure of the WisdomTree AT1 CoCo Bond Strategy

Source: WisdomTree, Markit. Data as of 30 Jun 2024. The strategy is represented by the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. Breakdowns are based on the index weights in underlying CoCos. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Having withstood the Credit Suisse storm just 18 months ago, CoCos as an asset class has come out stronger, bolstered by renewed support from regulators across the European Union and the United Kingdom. As of 30 September 2024, it is the best-performing asset class among some of its peers since inception, as shown in Figure 3 below.

Figure 3: Performance compared to peers since inception of the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index

Source: WisdomTree, Bloomberg. Period from 31 December 2013 to 30 Sep 2024. Based on returns in EUR. All fixed income indices are total return indices; all equity indices are net total return indices. Performance includes backtested data. Performance of the iBoxx. Liquid Developed Europe AT1 Index is based on the EUR-hedged version of the strategy. The iBoxx Contingent Convertible Liquid Developed Europe AT1 Index (EUR Hedged) started its live calculation on 09 March 2018. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Please note CoCos are complex securities and potential investors should not discount tail risk and the possibility of conversion. CoCos coupon payments are fully discretionary and hence can in theory be skipped at any time.