Although it is already a major driver of the Global Economy, China has launched structural reforms with a view to generating more sustainable and environmentally friendly growth. Its new strategy could create long-term investment opportunities in four areas: technological innovation, ecological transition, changing consumption patterns, and health and medical innovations.

Environmental protection, an ageing population, trade tensions, self-sufficiency… these are all challenges that China is facing head-on by launching structural reforms based on technological innovation and changing consumption patterns.

Therefore, the Chinese government has announced its 2021- 2035 development plan in response to these demographic and economic challenges, and also to create new engines of growth. The resulting reforms highlight four major long-term trends that offer numerous investment opportunities: technological innovation, ecological transition, changing consumption patterns and health and medical innovations.

The Covid-19 health crisis has reinforced China’s strategic shift, even though it was initiated before the pandemic. The crisis has actually strengthened China’s economic power at an international level. Its exports have benefited greatly from the support measures in the United States and Europe in 2020, and the country also stands to gain from the recovery of the global economy expected this year. In addition, China demonstrated its research and development capabilities by launching five vaccines against Covid-19.

“China appears to be one of the big winners of the Covid-19 crisis, which has accelerated the technological revolution and the digitalisation of the economy by profoundly changing our consumption, work and entertainment habits,” observes Haiyan Li-Labbé, Fund Manager specialising in Chinese equities at Carmignac. “Several Chinese companies are among the world leaders in key sectors of this revolution such as online commerce and payments. In addition, the economic support measures announced since the beginning of the pandemic by the Chinese government have focused on key new infrastructures such as 5G, data centres, the cloud, and artificial intelligence…”

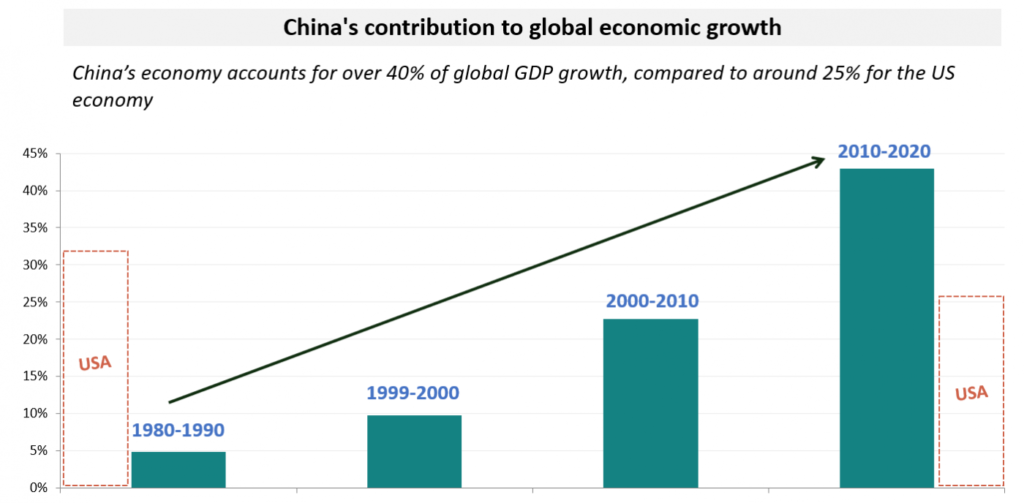

As evidence of its strength, the Chinese economy was the only major world power to escape a recession in 2020 thanks to better management of the health crisis, which allowed it to rapidly relaunch manufacturing and consumption in the country. It is now one of the main drivers of global growth. According to the OECD, China’s economy is expected to grow by nearly 8% (+7.8%) in 2021, after growing by 2.3% last year, while eurozone growth is expected to rebound by 3.9% this year, after a 6.6% drop in 2020.

Over the years, Carmignac has developed genuine expertise in China, investing in the country since it was founded over thirty years ago. The independent asset management company has been agile enough to rapidly increase its investments in China, where there are numerous companies operating in the most promising sectors.

In order to seize the opportunities offered by the country, Carmignac has created a specialised investment fund, Carmignac Portfolio China New Economy. This fund mainly focuses on companies in the new Chinese economy (consumer goods, technological innovation, health care, etc.) and is managed by Haiyan Li-Labbé, who has 19 years’ professional experience and is a specialist in China where she grew up.

“Given the country’s economic potential, Chinese equities should offer superior investment opportunities over the next 10 to 15 years, provided that we adopt a selective, long-term approach” says Haiyan Li-Labbé.