Our Return to Normal index

What has changed?

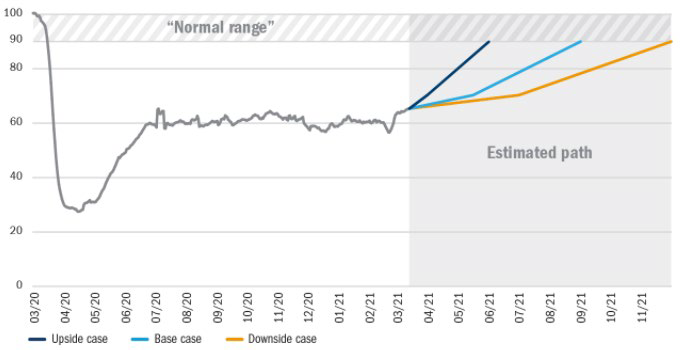

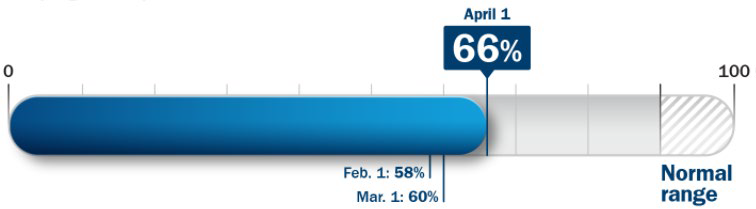

Since our March 2021 update, the Return to Normal Index has climbed to 66% – all of the index components that we track are improving. Drivers of this increase include a broader pool of people receiving vaccines and looser

restrictions on many activities. The monthly jump has made it clear that widespread vaccination can fuel behavioural and economic recovery. By May 2021, two more vaccines will probably be approved in the US, enabling supply to meet demand by the end of the second quarter.

We are at an important inflection point for the return to normal, as we continue to watch data indicating that infection rates have plateaued – or started to increase – in some locations. We are also watching the data on variants that have significantly spread throughout the US. If we see a large spike in cases, the momentum carrying the country to our normal range could slow. Among the index components, return to in-person schooling saw the greatest monthly gain as more counties moved away from remote learning and back to in-person or hybrid models.

Activity numbers won’t all return to where they were before Covid. The index could hit “normal” at a point lower than the 100 level due to continued changes in behaviour, like working from home and reduced business travel. The definition of the future normal is evolving, and the index’s normal threshold will reflect our data science and fundamental research insights.

Figure 1: The Return to Normal Index tracks activity compared with pre-pandemic levels as we progress to post-Covid life

What are we monitoring, and where is it at?

Figure 2: Tracking inputs

What could drive change?

Figure 3: The Return to Normal Index over time – level as of 1 April: 66%