Boston – The most common question posed by our Value clients lately has been whether the cycle of value outperformance over growth is ending. Despite recent market noise, we don’t think that is the case, but to answer this question effectively, it’s essential to review how the definition of value investing has evolved over time.

What is value investing?

Traditionally, value investing is about identifying businesses trading a discount to their intrinsic value. From the standpoint of active portfolio management, value investing is designed to generate a risk-adjusted excess return — aka alpha — by constructing a portfolio of mispriced securities, something our team has done across market environments.

However, due to the emergence of passive and factor investing, a new definition of value has evolved. This alternate definition generally represents value stocks as the “old economy” in contrast to the often tech-related “high flyers” in the growth camp.

To us, the issue with today’s growth investing is that the future value of a stock, the promise of tomorrow, is discounted to its present value at an artificially low interest rate, inaccurately reflecting risk. These new definitions of value and growth are precisely what the market has been sorting through over the past six months.

Tuning out the noise, we believe true value investing, seeking out solid businesses priced at a discount to their intrinsic value, is the most consistent way to generate equity returns over time and through an economic cycle.

Can value's outperformance continue?

We believe this most recent period of value outperformance over the new growth style may just be starting (as of July 31, one-year total returns were -1.43% for the Russell 1000 Value Index versus -11.93% for the Russell 1000 Growth Index).

Today’s inflation and subsequent tight monetary policy will likely be with us for far longer than appreciated. Labor costs will continue to rise based on slower labor force growth and a falling labor participation rate. Geopolitical tensions seem to have shifted generationally, and global supply chain dynamics may continue to be disrupted.

The result is going to be a far more vigilant U.S. Federal Reserve. According to a Bank of America study, the decades of the 1940s and 1970s witnessed seven to eight years of value outperformance, due to the shifting paradigm of inflation dynamics and the resulting fiscal and monetary policies. We believe today’s environment is akin to those periods.

Against this backdrop, equity returns could potentially be lower, where generating alpha will involve deeper analysis. While much in today’s markets leads us to believe value will continue to outperform growth for some time, it is key to find a value manager who does not get caught up in the timing of “value versus growth” and focuses instead on identifying businesses priced at a discount to their intrinsic value, regardless of the cycle.

In short, we believe active management — the ability to tune out the noise and focus on business fundamentals — is of the utmost importance.

Challenges ahead

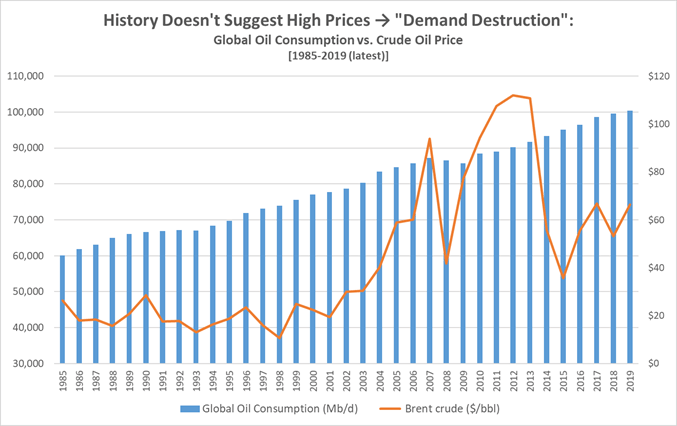

Look no further than the energy sector to appreciate the challenges ahead. Market focus has shifted from the supply concerns that pre-dated Russian aggression to demand destruction today. Despite periodic fears, energy demand destruction rarely occurs, as evidenced in the chart below:

What impacts energy prices more acutely is supply, and the global economy is facing a supply challenge brought on by a long period of underinvestment. This will take years to correct, with all the benefits of lower inflationary pressure and easier monetary policy to follow.

Bottom line: Energy is just one example of why active management is essential in value investing, highlighting the importance of being able to navigate effectively through ever-changing markets.

Russell 1000® Value Index is an unmanaged index of U.S. large cap value stocks.

Russell 1000® Growth Index is an unmanaged index of U.S. large cap growth stocks.

Past performance is no guarantee of future results. The value and growth returns referred to are those of representative indices and are not meant to depict the performance of a specific investment.

Risk Considerations: The value of investments may increase or decrease in response to economic and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility.

Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions.