Oceans cover almost two-thirds of the earth’s surface. They provide more than half of all oxygen on the planet and absorb massive quantities of carbon dioxide as one the world’s largest ‘carbon sinks’.

Despite the ocean’s importance for humanity, only 1% of the area has been under any protection protocol, and just 39% of the ocean falls under the national jurisdiction of individual countries. For the rest, the result has been overexploitation, with little regard for the health of the natural resources it harbours – and with zero accountability for the damage caused.

After more than a decade of talks and negotiations, member states of the United Nations have agreed a High Seas Treaty that should lead to the protection and sustainable use of marine biodiversity in areas beyond national jurisdictions. For the first time in history, rules will be in place to effectively manage and govern oceans and seas in their entirety.

Importantly, these rules will provide a legal framework for establishing vast marine protected areas (MPAs) to protect against the loss of wildlife and inform the usage of marine genetic resources. These areas will put limits on how much fishing can take place, the routes of shipping lanes, and exploration activities such as deep-sea mining. By providing the tools to establish and manage marine protected areas (such as environmental impact assessment requirements), this new treaty represents a landmark contribution towards the UN’s Global Biodiversity Framework. Agreed late last year, this involved countries pledging to protect 30% of ocean, land and coastal areas by 2030.

Collecting plastic waste is of paramount importance if ocean ecosystems are to be protected. Having initially been hailed for its non-decaying, cheap to manufacture, lightweight properties, we remain heavily reliant on plastic. It is everywhere, including in our oceans. Every year, around 30% of all plastic packaging ends up ‘leaking’ into our environment, and if current practices continue there could potentially be more plastic than fish in our oceans by 2050.

So, what are some of the companies that are addressing this sustainability problem and in turn helping to protect our seas?

TOMRA

Tomra is the leading provider of advanced sensor-based collection and sorting solutions and is a key enabler of the effective recovery and recycling of used materials, including plastic.

The company’s approximately 80,000 automated reverse vending machines (RVMs) represent over 70% of the global RVM market. It is responsible for collecting, recognizing and processing more than 44 billion used beverage containers annually. However, this represents only around 9% of all beverage containers currently sold globally each year.

The EU Single Use Plastic (SUP) Directive should bring further improvements to collection rates – it has a target for all EU member states to collect 77% of SUP beverage bottles by 2025 and 90% by 2029. TOMRA itself has been aiming to increase plastics recycled within a closed-loop system to 30% of total used material by 2030.

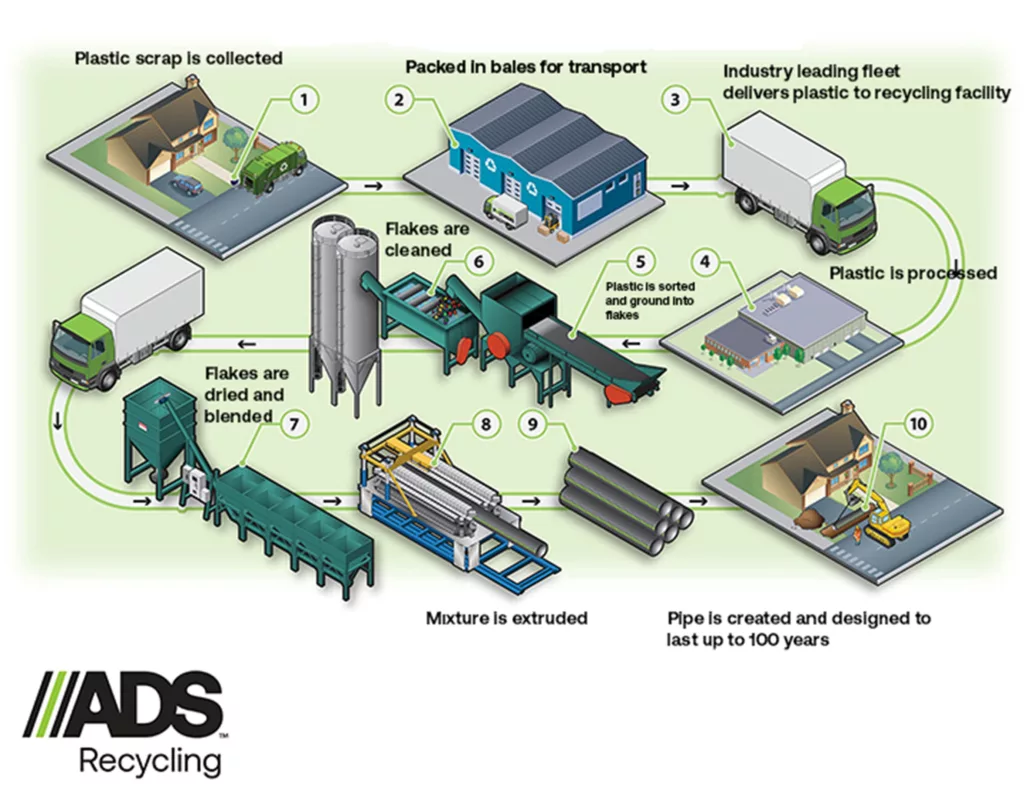

Advanced Drainage Systems

is a leading manufacturer of high-density polyethylene pipe (HDPE) and polypropylene pipe (PP) used for the drainage, storage, and treatment of water. These types of pipes continue to take market share from traditional concrete/steel drainage by being cheaper, more durable, and more cost-effective to install.

Advanced Drainage Systems is the largest plastic recycler in the US with 59% of pipe revenue being derived from re-manufactured products. In 2021, they consumed over 1-in-4 recycled US HDPE bottles and in fiscal 2022 they recycled 600 million pounds of plastic, keeping it out of landfills and preventing the emission of 770 million pounds of GHGs – equivalent to taking 74,000 cars off the road.

By 2032, Advanced Drainage Systems aims to be using 1 billion pounds of recycled material each year.

Kornit Digital

Kornit provides an effective solution to the problem of excessive wastewater in traditional textile manufacturing. The dyeing, printing, and finishing stages of the process account for roughly 20% of global wastewater – this is equivalent to 5 trillion litres or 2 million Olympic sized swimming pools every year. This problem extends beyond the manufacturing process, as water waste is often not treated to remove pollutants before disposal.

Kornit is particularly impressive from a sustainability perspective. Their printers utilise a 100% water-free process, with no pre-treatment, steaming, or washing required; and uses printing inks that are completely non-hazardous, non-toxic, and biodegradable.

The High Seas Treaty is a landmark agreement – however, the work to translate this into action has only just begun. Ocean ecosystems are critical to marine life, biodiversity and livelihoods. It is crucial that we act on both land and sea to protect this natural resource – and as investors, we can buy into companies that are helping to support this goal.

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2022 Aegon Asset Management or its affiliates. All rights reserved.