As portfolio manager for the Carmignac Global Bond strategy, Abdelak Adjriou, continually seeks to find opportunities in areas of the bond market that can generate alpha. Given current geopolitical tensions in the region, it is easy to overlook Eastern Europe (circa. 15% of the Fund as of end of April 2025). In this article, Abdelak considers which investment prospects exist specifically in Poland, Hungary and Romania, despite the ongoing war in Ukraine.

Whilst talks between the US, Ukraine and Russia continue over securing lasting peace in Ukraine, the impact across Eastern Europe is becoming increasingly clear. Risks undoubtedly remain however opportunities are abundant across the region.

As the Ukraine-Russia conflict enters its third year, progress towards a ceasefire has advanced, following the proposed initiative by the United States, whilst Europe still seeks its place at the negotiating table. Russia’s true appetite for de-escalation remains to be seen, but this will undoubtedly affect the investment prospects of Ukraine’s neighbours, most notably its closest ones – Hungary, Poland and Romania.

On the economic front, the US administration has unveiled a series of reciprocal tariffs, imposing a minimum 10% tariff on all exporters. Certain trading partners will face even higher tariffs, initiating a potentially perilous situation for the global economy. Although these tariffs may have limited impact on Central and Eastern Europe (CEE), due to their relatively small trade flows with the US — only 1.5-3.5% of the region’s domestic gross value added is linked to the US — the overall direction of global foreign trade policies is a more alarming signal. CEE has clearly benefited from globalisation and integration into global supply chains. Therefore, the overall impact on the European Union must be closely monitored, as it is a key market for CEE exports, and the sensitivity of CEE GDP to fluctuations in the Euro area can average around 1% through economic cycles1.

Nevertheless, we believe there are reasons for optimism in the medium term. The German government’s historic fiscal shift should drive growth momentum in the region whilst minimising the impact of tariffs to some extent. Although more pertinently, each of these countries has its own idiosyncratic challenges and potential, whether triggered by potential political change or shifting fundamentals. The task for an active, flexible, go-anywhere global bond fund like ours is to sift through the noise and take advantage of those areas where value can be created for our clients. This flexibility allows us to think outside the box and go beyond traditional management to seek out sources of alpha regardless of where we are in the economic cycle.

Emerging market debt is a particularly interesting example. The heterogeneous nature of this investment universe offers opportunities that are often uncorrelated to the economic cycles of developed countries, while at the same time offering attractive valuations. At present, average yields in the CEE region show a premium of 300 basis points over German debt, with fundamentals such as debt levels often well below those of certain eurozone countries.

HUNGARY FOR CHANGE

One of the more open Central and Eastern European (CEE) states, Hungary is firmly plugged into the EU economic machine. Indeed, the EU, and Germany in particular, are the country’s major export destinations. Hammered by the global financial crisis, a multi-year deleveraging process ensued. The result? A much more balanced economy. However, the economic costs of the pandemic, political unrest and the energy crisis that followed Russia’s invasion of Ukraine have set the country back once again.

Indeed, Hungary experienced the worst inflation shock in the region, with a peak of around 26% and food prices increasing by 50% on a year on year basis2. The effects of this struggle are that inflation is a political hot potato, and there is a firm commitment to monetary stability. This means the central bank’s monetary policy remains very strict (rate cuts held off as long as possible), while efforts are now focused on preserving the stability of the Hungarian forint because of the looming elections.

Meanwhile, Prime Minister Victor Orbán is in his fourth term and remains a figure of conflict between the EU and Russia – he is also on good terms with US President Donald Trump – but in the form of Peter Magyar, leader of the new party Tisza, we believe that Orban faces a genuine leadership challenge come April 2026.

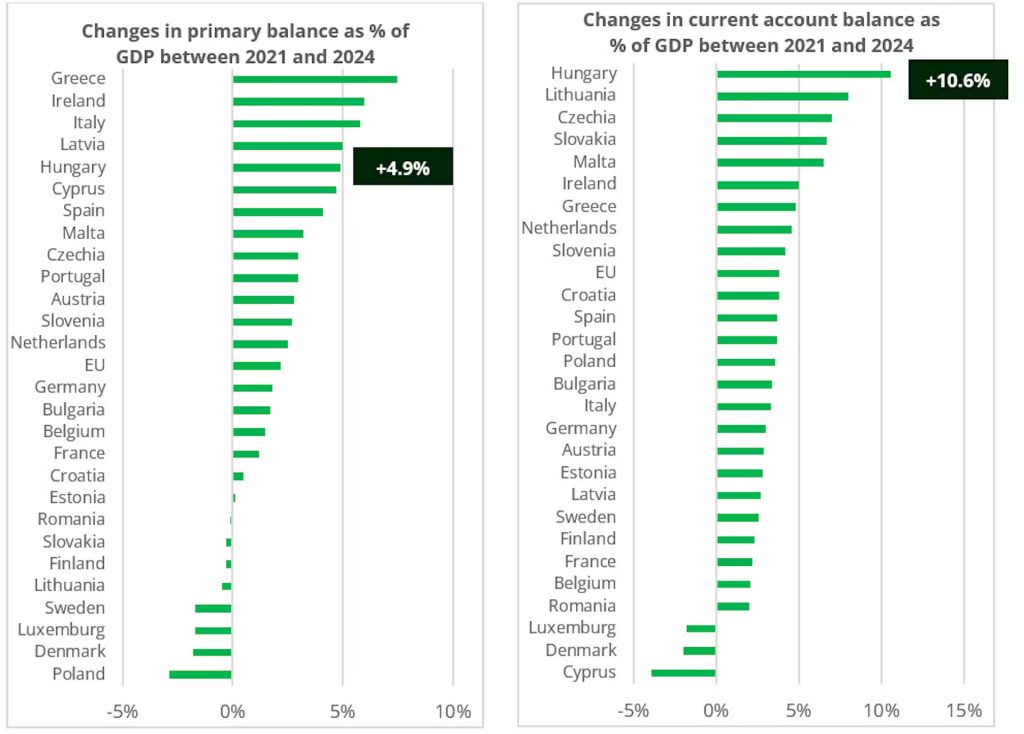

At the fundamental level, Hungary has seen one of the best improvements in its primary balance and current account balance in Europe over the past decade or so. The case for investing in Hungarian bonds is based on the country’s strong commitment to lower inflation and monetary stability, tight monetary policy and a disciplined fiscal approach.

Hungary’s balance indicators are improving significantly

A BUCHAREST BOUNCE?

As one of the least developed states in the EU, the upside potential for Romania is huge. But like much of the CEE region, it has its fair share of challenges.

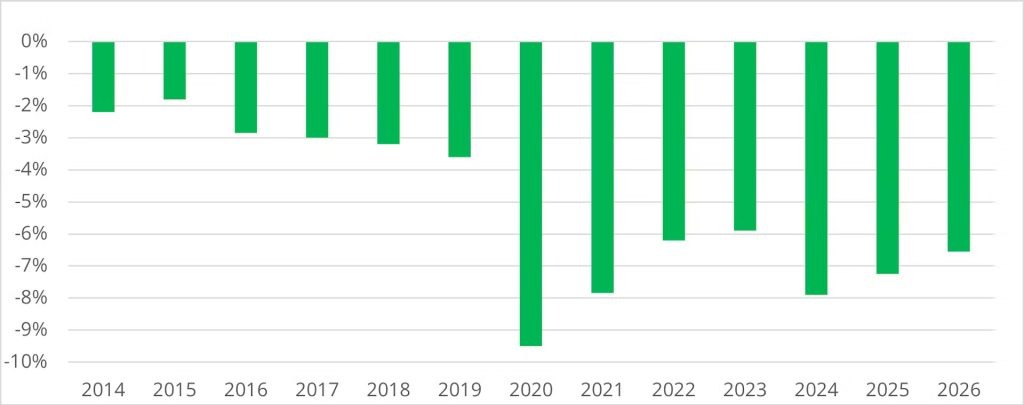

Among these challenges, Romania has seen economic growth significantly slow, the result of manufacturing slumps in Europe and an overvalued exchange rate. Indeed, the emphasis on reducing inflation, together with the large stock of foreign currency-denominated private sector debt, has historically led the central bank to maintain some stability of the Leu against the euro through market interventions to smooth volatility. As a result, GDP growth was below 1% in 2024 and is expected to be slightly below 2% in 2025. Meanwhile, its fiscal deficit has widened drastically to 8.7% of GDP3, the highest among the 27 member states, on the back of pension and wage increases in an election context, and a return to pre-COVID levels is not necessarily on the cards.

On the positive front, Romania is of major NATO significance; it holds a strategic position with three NATO bases, including the largest one in Europe (being built by the US) – this boosts the country’s geopolitical importance and potential for EU leniency. At the same time, Romania is nearly self-sufficient in energy – with expectations of becoming a gas exporter within two years – and is a significant exporter of agricultural commodities.

And then there is the political situation; having won the first round of the initial ballot ahead of the May elections, the far-right pro-Russian candidate Calin Georgescu has now been barred from running by the Constitutional Court, owing to him violating ‘the very obligation to defend democracy’.

With new elections scheduled for early May, now pitting Crin Antonescu, the candidate backed by Romania’s ruling coalition, against George Simion, the leader of the far-right party, we believe that one of the most important questions to assess is whether the ruling coalition, which could win in a second round according to the latest polls, will have the institutional structure necessary to implement more rigorous fiscal consolidation after the elections. The Romanian budget may need to be revised in the months following the elections, given its dependence on European funds. For now, the fiscal mess is so deep and the political fragmentation/nationalist wave so strong that fixing the macroeconomic problems anytime soon looks unlikely. It seems time to await the election results and hope for signals of political will to create a better macro policy mix.

Romania budget balance as % of GDP. A return to 3% is not expected anytime soon

POLE POSITION...

Poland is the largest and most diversified economy in CEE, and its broad domestic demand and competitive exports base have provided a cushion during various external downturns. The country has been among the largest recipients of EU funds since accession, which has been the key driver for growth. Meanwhile, World Bank data suggests Poland’s GDP-adjusted income will overtake that of Japan by 2026. The Polish economy is expected to grow from 2.6% in 2024 to 3.1% in 20254, driven by consumer spending and increased investment due to EU funds as for the 2021 to 2027 EU budget period, Poland is eligible for nearly €130bn (on average over 3% of GDP per annum) in grants from the EU Recovery Fund and the EU Structural and Cohesion Fund5.

Elsewhere, the political transition under Prime Minister Donald Tusk has ushered in a more market- and EU-friendly coalition government, helping to quicken the EU payments progress to Poland, bringing in over €20bn by early 2025 and boosting investor confidence.

The main challenge facing the country is its large budget deficit (6% of GDP in 2024) – the consequence of an eight-year populist fiscal stance by the previous government – and the country’s heavy defence burden, which is set to rise to 4.7% of GDP in 2025 from 4.2% of GDP in 20246.

Finally, inflation is also an issue that has complicated relations between the government and the governor of the National Bank of Poland (NBP), Adam Glapiński, resulting in the bank’s non-supportive growth stance. Indeed, the absence of fiscal tightening, the removal of energy price caps and the reduction in VAT on food and excise duties justified this wait-and-see attitude, in his view.

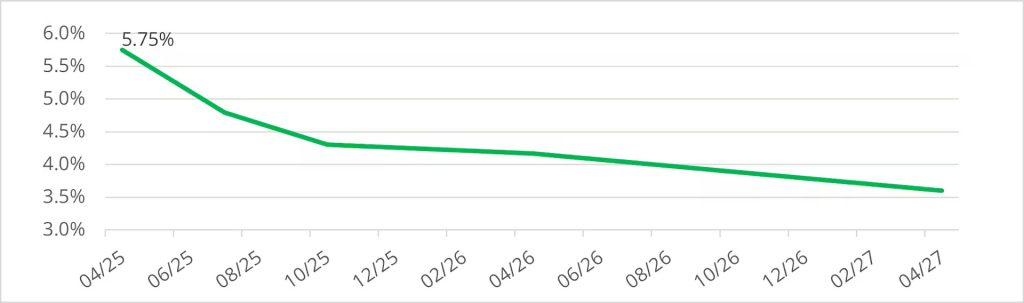

At the April meeting, however, the Governor made a complete U-turn, taking the market by surprise. Glapinski attributed the dovish shift to a “radical change” in the outlook. Revisions to the CPI basket have led to “significantly lower” inflation at the start of the year than originally reported, 4.9% vs. 5.3%. The slowdown in wage growth to single-digit rates, still high but “no longer in double digits”, was another factor that influenced the thinking. The NBP now forecasts inflation at 4.5% in Q2, 3.5% in Q3 and 4.2% in Q4, down sharply from the March Inflation Report projections of 5.2%, 4.1% and 4.8% respectively7.

Some may consider the NBP’s change of direction between March and April abrupt, but this decision could not have been better timed to cushion the shock of US tariffs on the economy. This decision, combined with Trump’s announcements on tariffs, triggered a significant rally in short-term rates, exacerbated by a decline in rates across the globe.

As a result, the market has revised its NBP rate profile downwards and now expects a rate slightly below 4.5% at the end of 2025, compared with the current policy rate of 5.75%.

Poland forward policy pricing. Market are pricing close to 145bp of cuts this year

EM debt in general, and Eastern European countries in this case, offer valuable diversification from their developed market counterparts. Underpinned by diversified economies with relatively strong fundamentals, this region provides a welcome hedge against global economic shocks, particularly in a volatile environment caused by the introduction of tariffs, the direct impact of which has been limited in the region, while generally offering higher yields.

However, it is important to consider the specific risks associated with these investments, with Romania being a good example. Political risks, currency fluctuations and economic vulnerabilities are all challenges for the management team, which means that a rigorous framework for analysing the specific economic and political conditions of each country is essential.

In terms of implementation, the flexibility of the Global Bond strategy offers a particularly wide range of options in terms of instruments such as investments in local interest rates, bonds denominated in hard currencies (EUR or USD) and, of course, currencies, each with its own dynamics. Abdelak will therefore favour one or other of these sources of performance, taking into account various factors such as macroeconomics, valuations, technicals and market sentiment, while keeping an eye on the overall balance of the portfolio.

COUNTRY THESIS & IMPLEMENTATION

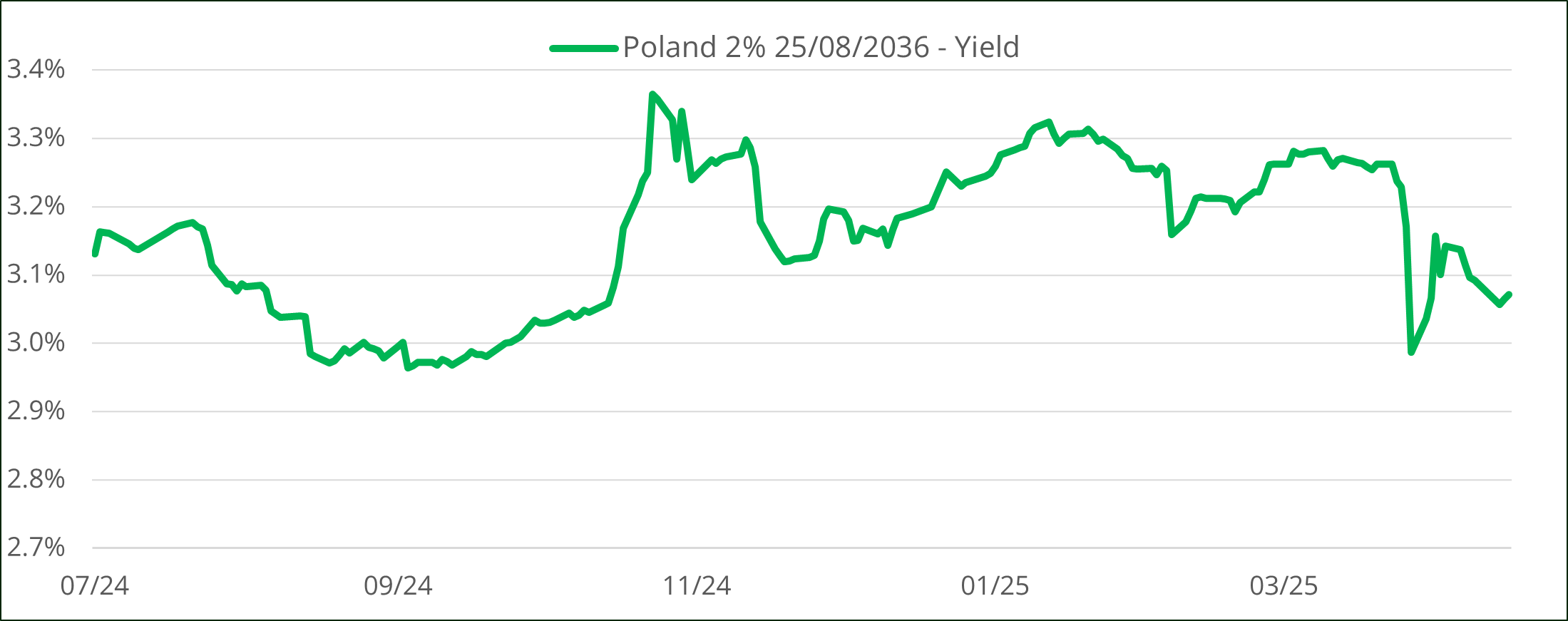

With the recent shift by the NBP towards a highly accommodative monetary policy and economic data, inflation and real wages trending downwards, we have taken a long position on Polish real rates, which are currently at 3%. Given the uncertain global context marked by the trade war, we do not believe they are sustainable at these levels and there is a chance that the curve could go even lower if there is more bearish economic data.

Poland 10-year inflation linked bond. Real rates are trading above 3%

Source: Carmignac, Bloomberg, 24/04/2025.

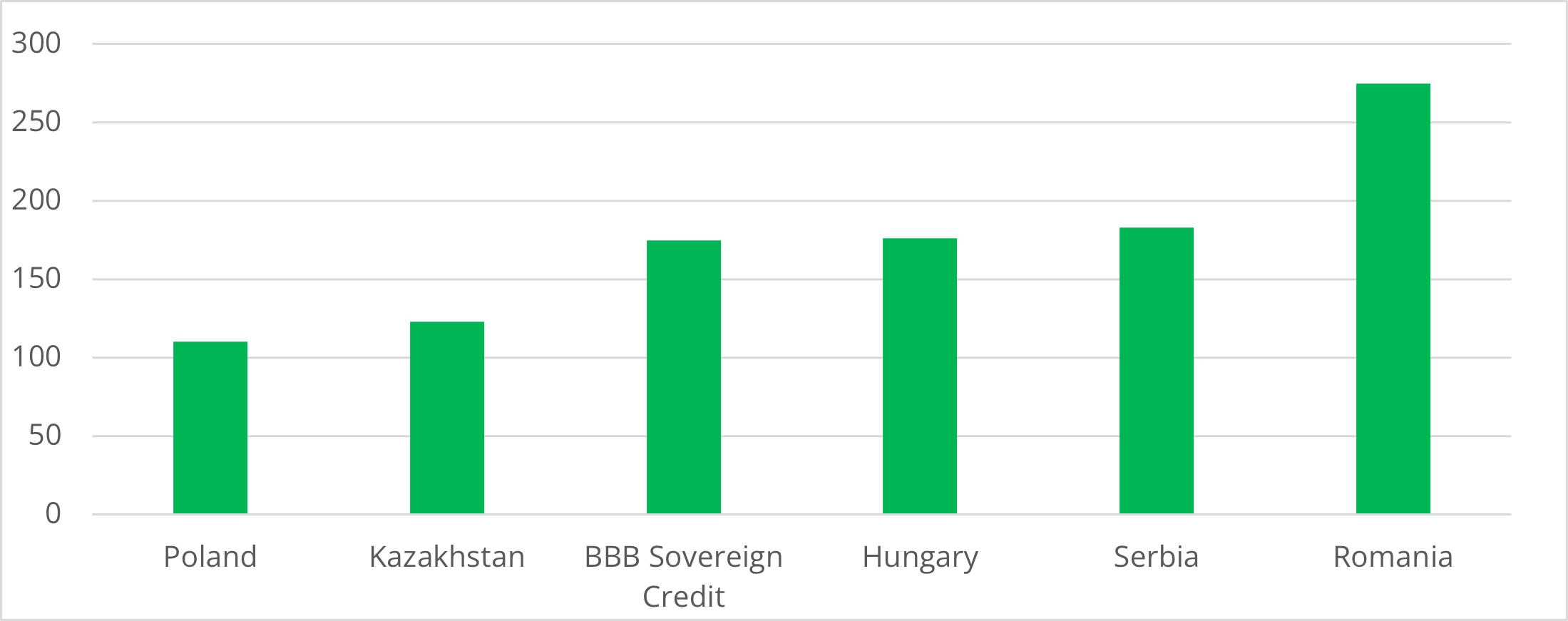

We see value in Hungarian hard currency debt where credit fundamentals continue to improve, driven by strong balance of payments dynamics and deleveraging, with a particularly notable decline in government external debt. Valuations are attractive, particularly relative to other global EM credits, and we believe spreads have yet to reflect an improvement in geopolitics.

We are also long Hungarian rates, which are offering yields close to 7% at 10-year maturities. Although the National Bank of Hungary (NBH) may consider easing monetary policy ahead of the 2026 elections, its options are constrained by high foreign exchange vulnerability and renewed underlying inflation pressures. Nevertheless, the evolving economic context might support a more dovish stance, potentially enabling some monetary easing later this year or in 2026.

Hungary sovereign spread versus eastern European peers

Source: Carmignac, Bloomberg, JP Morgan indices, 24/04/2025.

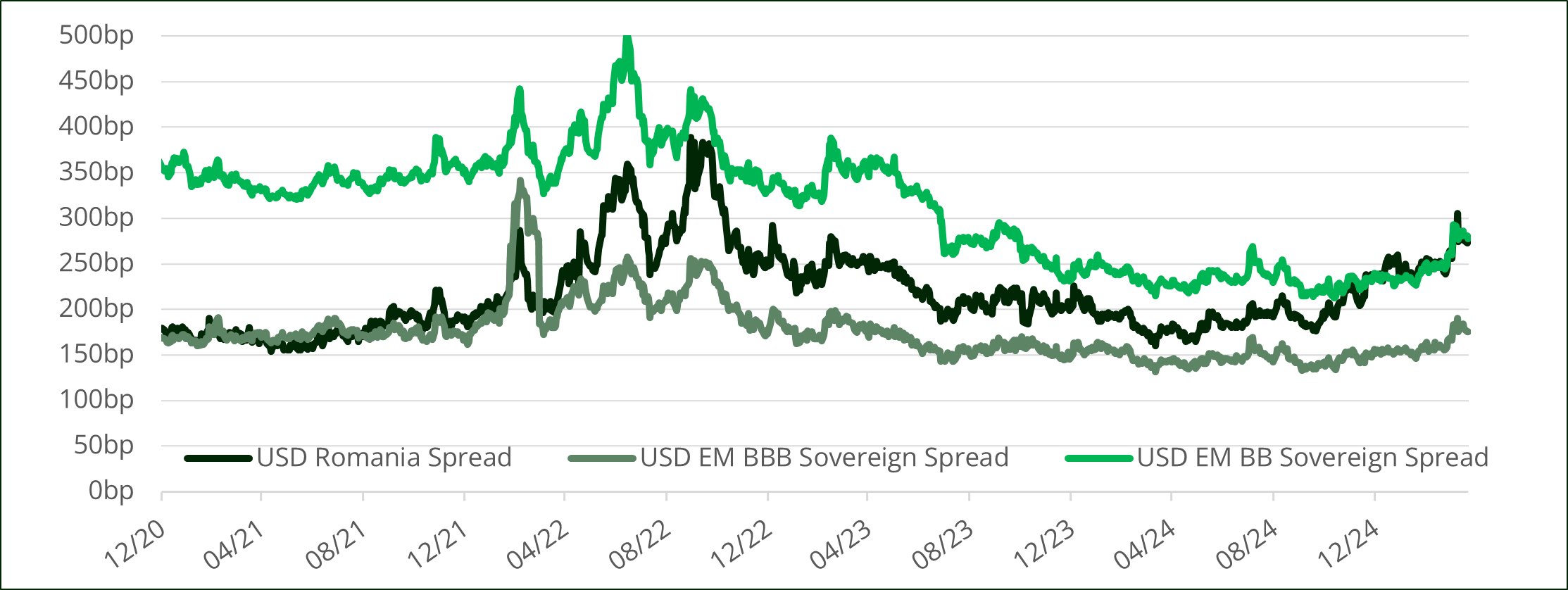

While Romanian hard currency debt has been a conviction in the portfolio in recent years, thanks to solid growth, substantial EU funds and FDI inflows and relatively low debt levels, we have sold the position given the uncertainty surrounding the elections and the lack of visibility on the candidates’ intentions for fiscal consolidation.

Today, hard currency bonds look more attractive on a valuation basis relative to peers as downgrade risks have diminished with the formation of the new coalition government. On the USD side, Romania is now trading around 100bp wide to BBB averages and flat to BB averages.

That said, we remain on the sidelines until there is more clarity on the upcoming elections due to the risks involved. However, if the grand coalition continues after the elections, we would be optimistic about the 2025 outlook and could then reposition on Romanian debt.

Romania sovereign spread versus BBB/BB. Romania now trading as a BB credit

Source: Carmignac, Bloomberg, JP Morgan indices, 24/04/2025.