Our Global Wealth Report 2021 looks into the impact of the COVID-19 pandemic and the response of policymakers on global wealth and its distribution. The analysis shows continued wealth growth; nevertheless, bearing in mind the widespread economic disruption, household wealth and macroeconomic indicators seem to be on different trajectories.

The short-term consequences of the COVID-19 pandemic for household wealth are now much clearer than they were last summer. They confound expectations. The widespread negative impact on gross domestic product (GDP) was recognized early in 2020, and since reductions in the level of economic activity are typically associated with reductions in household wealth, financial markets responded in a predictable way and share prices dived in February and March. No region was immune. By the second half of March, main indexes had fallen dramatically.

Uncertain Times for Wealth in 2020

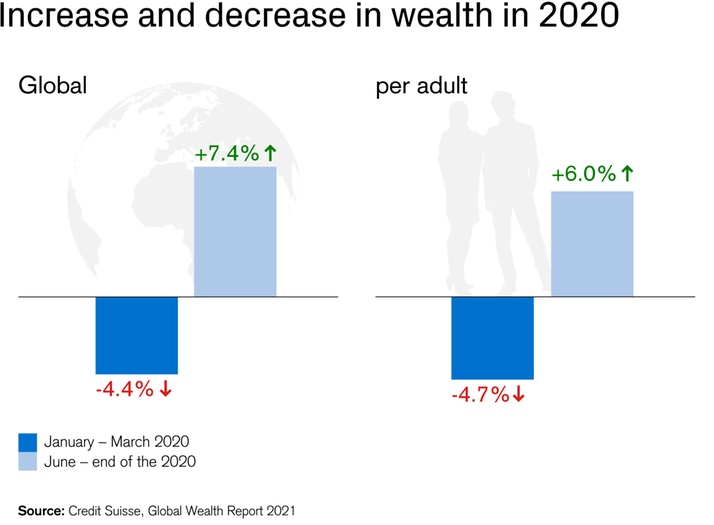

We estimate that 4.4% from total global household wealth was lost between January and March 2020 and global wealth per adult declined by 4.7%. Reassured by the prompt action of governments and central banks, financial markets regained confidence and the losses in equity markets were largely reversed by the end of June.

That much was understandable. But what happened in the second half of 2020 was unforeseen:

- Share prices continued on an upward path, reaching record levels by the end of the year.

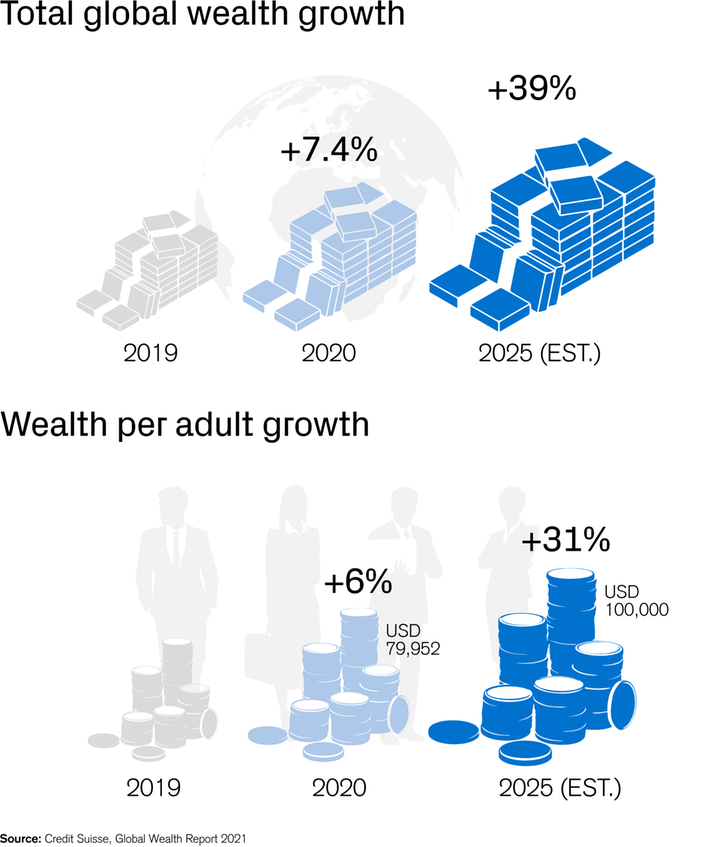

- House prices rose at rates not seen for many years. This has led to major gains in household wealth throughout the world. The net result was that USD 7.4 trillion was added to global household wealth during the year. At the end of 2020, it totalled USD 418.3 trillion, up 7.4%.

- Wealth per adult rose 6.0% to a new record high of USD 79,952.

- Depreciation of the US dollar flatters these gains: adjusting for exchange rate changes, total wealth would have risen by 4.1% and wealth per adult by 2.7%.

Nevertheless, bearing in mind the widespread economic disruption, household wealth and macroeconomic indicators seem to be on different trajectories.

Low Interest Rates Make an Impact

The lowering of interest rates by central banks has probably had the greatest impact on household wealth. Lower interest rates also seem to be a cost-free option, except perhaps to those relying on interest payments to supplement their income. Lower interest rates have no direct impact on public expenditure and coordinated action by central banks can even reduce expenditure via reduced public debt interest. There are inflation implications in the longer run and questions related to future rises in interest rates. However, these are relatively unimportant compared to the immediate economic challenges.

Post-COVID Global Wealth Outlook (2020-2025)

Despite the burden of COVID on the global economy, the world can expect robust GDP growth in the coming years, especially in 2021. The latest estimates by the International Monetary Fund in April 2021 suggest that global GDP in 2021 will total USD 93.9 trillion (up 11%) – just USD 1.5 trillion below the pre-pandemic forecast.

The link in normal times between GDP growth and household wealth growth, combined with the expected rapid return of economic activity to its pre-pandemic time path, leads us to believe that global wealth will grow at a fast pace: We estimate it to rise by 39% over the next five years.

Low- and middle-income countries will also play an important role, as they are responsible for 42% of the growth, although they account for just 33% of current wealth.