Boston – Continuing our series of midyear outlook blogs, our emerging markets team reviews the second quarter and highlights the importance of fundamental analysis to seek value among differentiated countries in the period ahead.

Emerging markets (EM) debt rallied back quite strongly during the second quarter, recouping much of the pullback of the first quarter, powered by a number of factors:

- Fundamentals that remained on solid footing, in broad terms, with robust economic activity, helped by a continued rally across the commodity complex

- Support from the IMF and other multilateral institutions

- A relatively supportive macro backdrop with loose fiscal and monetary policy throughout much of the developed world

- Subsiding volatility in the U.S. Treasury market, following a turbulent first quarter

- A wide-open new-issue market, buoyed by demand for the EM debt sector

The inflation threat has spurred some EM central banks to hike rates, with markets continuing to price in more such moves — in some cases, aggressively. This combination has led to relatively steep yield curves in many countries and also provided additional support to currencies, which had been the strongest factor for EM for most of the period.

The rally cooled a bit toward the end of the quarter, as the U.S. Federal Reserve shifted to a slightly more hawkish tone at its June 16 meeting, prompting a strengthening of the U.S. dollar versus EM currencies.

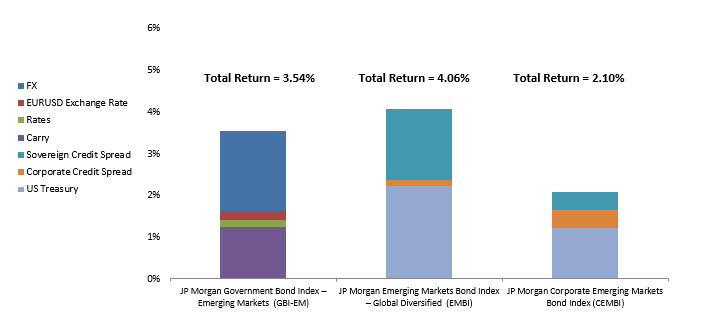

- EM local-currency debt returned 3.54%, mostly driven by the strength of currencies versus the dollar and “carry” — the relative return advantage of the higher-yielding EM versus developed-market debt.

- Dollar-denominated, hard-currency debt benefited from rallying U.S. Treasury debt and tightening sovereign credit spreads, which were helped by the bullish factors noted above, and returned 4.06%.

- Corporate EM debt also benefited from the U.S. Treasury rally, plus corporate and sovereign credit spread compression, returning 2.10%.

EM debt stages a strong comeback in the second quarter

Sources: JP Morgan, Eaton Vance as of 6/30/21. The vertical axis reflects the amount contributed by each factor to total return — adding the bars above 0% and below 0% (negative numbers) results in the total return in the headline. FX is the gain or loss in the GBI-EM from currency changes relative to the U.S. dollar. EURUSD reflects the portion of currency movement in the GBI-EM that is explained by the change of the euro versus the U.S. dollar. Rates refers to the contribution of change in local-currency interest rates in the GBI-EM. Carry refers to the risk-free returns in each GBI-EM country that cannot be attributed to FX, EURUSD or rates. Sovereign credit spread refers to the spread above U.S. Treasurys in the EMBI paid by a country. Corporate credit spread is the spread above the sovereign spread paid by an EM corporate issuer. US Treasury refers to the contribution to return in the EMBI and CEMBI (both dollar-denominated indexes) due to interest-rate changes on the U.S. Treasury.

A look ahead

EM fundamentals and valuations remain appealing and support our belief in a neutral-to-slightly-bullish stance in the sector — the risk premiums available on EM debt are favorable to most other asset classes, in our view.

The real interest-rate differential between developed and emerging markets suggests EM debt is now offering attractive value. But there is a wide dispersion of inflation forecasts within EM countries, and some central banks are moving more aggressively to tighten policy. Russia, Brazil, Ukraine and Turkey are examples of where central banks have already hiked rates this year to help control inflation. It will be important to watch the dynamic between emerging and developed markets, as central banks and markets continue to calibrate inflation expectations.

More than a year after the start of the pandemic, COVID-19 still remains a dominant macro factor — one that continues to play out to various degrees across the EM sector, in many cases wreaking havoc on lives and livelihoods. Many countries have learned to live with the virus, but the rise of variant strains will continue to challenge such efforts.

One of the major milestones for the sector during the difficult pandemic market has been the differentiation by investors among countries and credits — it is no longer viewed monolithically. This is appropriate because while broad EM fundamentals are on solid footing, there are notable concerns over countries like El Salvador, Zambia and Belarus.

Bottom line: With the global outlook for inflation and growth in flux, combined with the continuing impact of COVID-19, there has never been a more important time to rely on EM fundamental analysis and proprietary due diligence. More than ever, we believe this is the key to unlocking value in the EM sector.

J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified is an unmanaged index of USD-denominated bonds with maturities of more than one year issued by emerging markets governments.

J.P. Morgan Government Bond Index-Emerging Markets (GBI-EM) Global Diversified is an unmanaged index of local-currency bonds with maturities of more than one year issued by emerging markets governments.

J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Diversified is an unmanaged index of USD-denominated emerging markets corporate bonds.

Data provided is for informational use only and should not be considered investment advice. Information has been obtained from sources believed to be reliable, but JP Morgan does not warrant its completeness or accuracy. The Indexes are used with permission. The indexes may not be copied, used, or distributed without JP Morgan’s prior written approval. Copyright 2019, JP Morgan Chase & Co. All rights reserved.