The start to 2025 has been anything but boring for the world’s financial markets and especially so for the emerging markets. But as the world adjusts to the shifting geopolitical realities, our outlook for Emerging Market Debt (EMD) remains constructive for the rest of 2025. Within our positive view on EMD, we hold greater enthusiasm for hard currency over local currency debt.

Our outlook is built on our overall house view on the global economy, which pays close attention to developments in the United States. Politically and economically, we recognize that the machinations of what takes place in Washington, D.C. will have repercussions for risk assets around the world, and particularly for those in emerging economies. From geopolitics to trade wars to monetary policy, all roads lead to the US.

A Brief Recap: Emerging Market Debt in 2024

Before we expand on the prospects for emerging market debt, a look at the lead up to current market conditions and a recap of recent performance drivers is worthwhile. The resilience of the US economy through 2024 was a key factor as robust growth and a slower-than-expected drop in the pace of inflation helped keep the Federal Reserve (Fed) in cautious mode until September, when it announced its first rate cut of the cycle. It followed up with two more cuts by year-end (for a total of 1.00% in cuts) as it seemed clear that inflation was close to bottoming out. This comparatively slower pace of US rate cuts kept the US dollar buoyant versus other currencies while the US Treasury yield curve reshaped from a two-year inversion to a more normal upward-sloping curve. And then in November, the election of Donald Trump as US President signaled a clear mandate for change – and change and uncertainty has been a feature in the months since.

For hard currency EMD, the asset class returned 6.54% (in USD terms) in 2024, as measured by the JP Morgan EMBI Global Diversified index, driven by strong performance in high yield sovereigns which returned 13.00%.1 Robust performance in the deeper parts of the market was driven by several idiosyncratic situations that found some form of resolution in the year – boosting returns through earned carry or price performance from low levels. Examples of this included:

- Egypt received a vital lifeline from the United Arab Emirates

- Argentina’s fiscal and monetary discipline was rewarded by the market

- Sri Lanka, Ghana, Ukraine, and Zambia successfully restructured their debt.

Investment grade (IG) debt returned only 0.32% for the year, as measured by JP Morgan CEMBI Broad Diversified index, with a slight widening of credit spreads and increasing Treasury rates offsetting current yields.

Strong currency headwinds detracted significantly from local currency debt performance, which posted a negative return in 2024 of -2.38% (in USD terms) as measured by the JP Morgan GBI-EM Global Diversified index. Indeed, currency weakness detracted -7.73% from overall returns, effectively cancelling out the carry from this asset class. Although high real yields were evident in some countries, most EM central banks cut rates cautiously in an effort to strike a balance between tighter monetary policy and currency weakness.

Key Themes for EM Debt in 2025

Despite the headline risks, we believe that there is a constructive environment for EMD. Within this view, we continue to have a preference for Hard Currency (HC), although extended USD weakness from the heights of last year could support Local Currency (LC).

The macro backdrop is largely favorable, with additional rate cuts and a soft economic landing envisaged. These conditions are generally positive for fixed income and we expect government bonds across most advanced economies to provide attractive returns. We believe that emerging market debt also offers value, although investors need to be comfortable with a more volatile external environment, from both a policy and currency perspective, that is likely to prevail throughout 2025.

“Goldilocks” Scenario for EM Debt

We expect to see the soft landing scenario anticipated for 2024 to play out in 2025, with decelerating growth in the US incentivizing the Fed to persevere with rate cuts. This would present a Goldilocks environment for EM debt where EM spreads are supported, while lower Treasury yields and a weaker US dollar become important tailwinds for EMD returns.

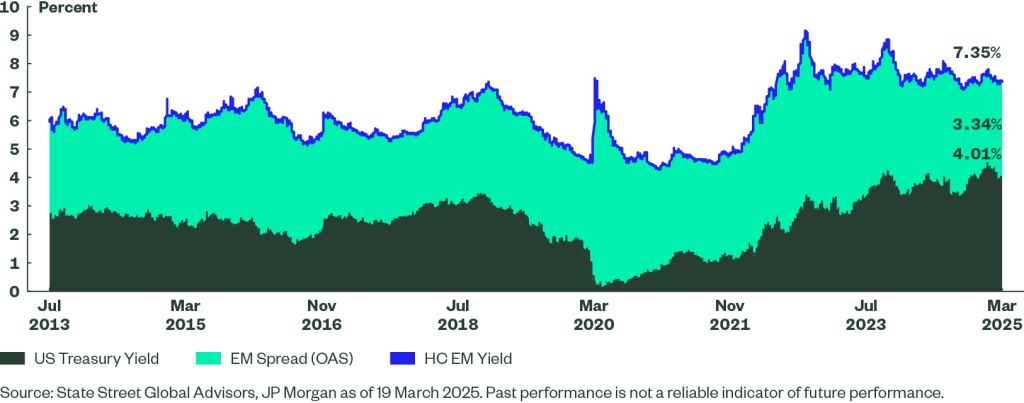

Figure 1: EM Spreads Offer Support

Hard Currency EMD: The investment grade (IG) portion of the asset class would benefit from a decline in Treasury yields. Meanwhile, high yield (HY) could continue to see positive outcomes from possible country-specific events such as :

– Lebanon could form a new government and address its debt burden

- Argentina inflation may abate paving the way for growth to finally take hold

- Ecuador run-off elections in April to provide clarity on economic and fiscal trajectory

- International Monetary Fund (IMF) reviews expected for Pakistan, Kenya, Lebanon, and El Salvador, among others.

A benign backdrop would also mean that new funding via primary market activity can take place, even for non-IG issuers. While contingent on market conditions and sentiment, evidence of primary market activity would augur well for overall EMD returns.

Local Currency EMD: The rationale for Fed rate cuts should also dampen the US dollar’s high valuation and allow EM currencies to at least stabilize, and then potentially appreciate. Should a faltering US economy require more aggressive rate cuts by the Fed, EM central banks would also have scope to cut rates and help generate additional performance from rallying bond yields.

If “Goldilocks” Does Not Hold

It is important to also consider how EMD would behave if the soft landing scenario does not play out. Tariffs, geopolitics, and fiscal strength are expected to be the main drivers of the US economy this year, and all have potential ramifications for EM economies. In a “no landing” scenario for the US, we would expect continued weakness in local currency debt as renewed USD strength would pressure EM FX; tariffs could also have an outsized impact on specific EM countries and act as an accelerant to devaluation for some EM currencies. Meanwhile, EM hard currency would be better insulated but would still have limited ability to deliver meaningful returns, especially if some countries are caught in geopolitical crosshairs. Moreover, the likelihood of US Treasuries rallying and offsetting any spread sell-off would also be lessened.

Trump: Lots of Headlines, All the Time

The second Trump administration has hit the ground running, with a flurry of activity on tariffs, geopolitics, and fiscal policy – all important drivers of growth and ultimately monetary policy. The market has been processing a multitude of headlines and policy actions (with some delays and reversals) that have direct implications for sentiment and performance of risk assets. This unprecedented and uncertain policy backdrop could lead to an environment of elevated volatility in risk assets as skittish investors grapple with the consequences of these policies.

Tariffs: More Bark Than Bite?

President Trump may be using tariffs as a negotiating tactic to achieve his domestic growth goals, but it is still too early to determine if this will be successful. Countries with trade surpluses with the US appear most at risk to such actions – these include China, Canada, Mexico, Japan, and most of Europe. The tariffs imposed thus far have impacted US companies the most, driving up costs. However, more comprehensive tariffs that harm US consumers could curtail spending and dampen the very growth this administration is trying to spur. Moreover, a slowdown in global growth could ensue as companies and consumers around the world rein in investment and spending. Put simply, tariffs need to be calibrated correctly to be effective, which is why we think they could be more bark than bite.

Geopolitics: Upside and Downside Risks

On the geopolitical front, President Trump has so far intervened in two major conflicts: Israel/Gaza and the war in Ukraine. However, the market outcome for impacted parties may not be fully understood until well after the fact. In the Gaza conflict, the role that Arab countries play in any resolution is just as important as the economic contribution that a growth backdrop could provide. For Ukraine, we do not yet know what its future might look in terms of borders or leadership, nor what the implications could be for neighboring countries in Europe. Meanwhile, the Trump administration will also be monitoring China’s ambitions in the South China Sea. The threat to the global economy should not be underestimated given the importance of China and the wider region to global growth.

US Fiscal Policies

We are also watching the fiscal health of the United States, which might seem counterintuitive for an emerging markets outlook. However, this serves as a useful barometer for how far the new US administration may go with tariffs and the geopolitical agenda. US government borrowing has soared, with US Treasury debt outstanding of $36 trillion, a six-fold increase since 2000; the US economy has grown three-fold in the same period, meaning that the US debt/GDP ratio is now approx. 120%. The cost of servicing this debt has also reached new highs at 20% of government revenues, a level not seen since the rebuilding period after World War II. Also, in the coming months, US lawmakers will be negotiating a new tax bill, which may encompass an increase in the debt limit. Were these fiscal efforts to fail, the US could increasingly use tariffs to make up any shortfall in targets or seek to extract a higher return from its roles in brokering international conflict resolutions.

Hard Currency Debt: Fed Cuts and High Yield Underpin Sentiment

Hard currency investment grade EM debt can benefit from Fed rate cuts and associated US Treasury yield declines. Spreads for IG are already at tight levels, so there is limited potential for them to narrow further from here. In a soft landing scenario, we would expect that spreads would not materially widen either, such that overall returns can be positive.

For the high yield segment, we believe that spreads offer some value given the many idiosyncratic situations that could have positive outcomes. However, not all countries are in the same position; in the absence of a catalyst, a softening of the US economy may not support spreads of these countries.

Local Currency Debt: EM Central Banks to Follow the Fed

Although inflation peaked in 2022 in most parts of the world, central banks adopted a cautious approach to cutting policy rates. Emerging economies, faced with domestic fiscal dynamics and currency headwinds, had particularly difficult decisions to make on the monetary policy front. Many EM central banks waited for the Fed to signal rate cuts before doing so themselves. We believe that a combination of rate cuts and a weaker USD is necessary to drive local currency debt returns.

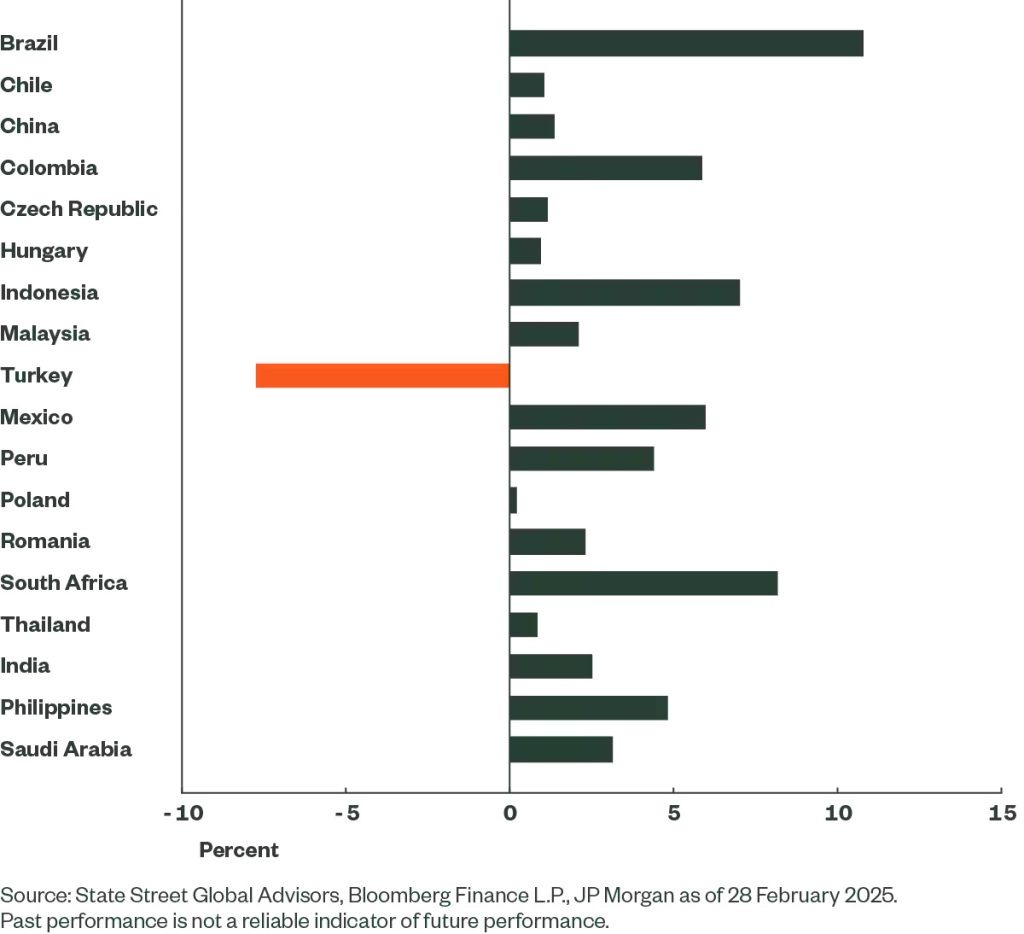

There is still scope for EM central banks to cut further given that real rates remain largely positive (Figure 2). However, we believe that the timing and size of additional Fed cuts will continue to guide the path for EM central banks.

For the FX component of local currency EM returns, a softening US dollar should enable EM FX – which is typically priced against the USD – to outperform. EM currencies remain significantly undervalued versus the US dollar.2 While difficult to time currency moves, when EM currency valuations are this low the bond returns can feed through, with the potential for some currency appreciation as well. Historically, at this level of undervaluation, this has the potential to benefit dollar-based local currency investors over the long term.

The Bottom Line

Our outlook rests on the belief that US economic, geopolitical, and fiscal policy will support EMD assets through the rest of 2025, while recognizing that it will be transmitted differently across hard currency and local currency debt. Hard currency EM debt will benefit from a favourable US Treasury performance. Meanwhile, local currency debt will depend more on monetary policy at the country level; however, Fed rate cuts and a weaker US dollar can also drive performance in this asset class. The underlying dynamics and technicals are different for each segment, but US policy actions will set the agenda in 2025.

Of course, emerging market debt is not a homogenous bloc – it is a diverse collection of countries with different political systems, cultural norms, demographic trends, growth and trade dynamics, and economic levers. This year, more than ever, we are expecting heightened volatility and headline noise. For these reasons, we continue to believe that an indexed approach to investing in this dynamic asset class best harnesses the return potential in an efficient and transparent way.

1 Source: JP Morgan as of December 31, 2024.

2 We estimate an undervaluation of close to 12%, based on our FX models and using the currency weights of the JPM GBI-EM benchmark as of February 28, 2025.

Marketing Communication

State Street Global Advisors Worldwide Entities

The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2014/65/EU) and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor’s particular investment objectives, strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other professional advisor.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

Past performance is not a reliable indicator of future performance. Investing involves risk including the risk of loss of principal.

Investing involves risk including the risk of loss of principal.

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable.

Diversification does not ensure a profit or guarantee against loss. It is not possible to invest directly in an index. Index performance does not reflect charges and expenses associated with the fund or brokerage commissions associated with buying and selling a fund. Index performance is not meant to represent that of any particular fund.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates rise bond values and yields usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. International Government bonds and corporate bonds generally have more moderate short-term price fluctuations than stocks, but provide lower potential long-term returns. Investing in high yield fixed income securities, otherwise known as junk bonds, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Increase in real interest rates can cause the price of inflation-protected debt securities to decrease. Interest payments on inflation-protected debt securities can be unpredictable.

Investing in foreign domiciled securities may involve risk of capital loss from unfavorable fluctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Investments in emerging or developing markets may be more volatile and less liquid than investing in developed markets and may involve exposure to economic structures that are generally less diverse and mature and to political systems which have less stability than those of more developed countries.

Currency Risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged.

This document may contain certain statements deemed to be forward-looking statements. All statements, other than historical facts, contained within this document that address activities, events or developments that SSGA expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on certain assumptions and analyses made by SSGA in light of its experience and perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances, many of which are detailed herein. Such statements are subject to a number of assumptions, risks, uncertainties, many of which are beyond SSGA’s control. Please note that any such statements are not guarantees of any future performance and that actual results or developments may differ materially from those projected in the forward-looking statements.

All the index performance results referred to are provided exclusively for comparison purposes only. It should not be assumed that they represent the performance of any particular investment.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The views expressed in this material are the views of Jennifer Taylor and David Furey through the period ended 18 March, 2025 and are subject to change based on market and other conditions.

© 2025 State Street Corporation – All Rights Reserved. 7767361.1.1.GBL.RTL

Expiry date 31 March 2026