Key Takeaways

- In the first half of 2021, rising U.S. rates brought on by the uncertainty of rising inflation as well as ongoing COVID-19 concerns weighed on emerging markets.

- Markets are becoming gradually less concerned about global overheating. Investors are more confident that, despite the temporary spike in inflation, the Fed will maintain its dovish stance and its focus on the labor market.

- Mass vaccination rollouts are beginning across EM as supply is set to surge. Activity can quickly recover as COVID-related restrictions are removed. This is a key reason for optimism in the second half.

A Staggered Recovery

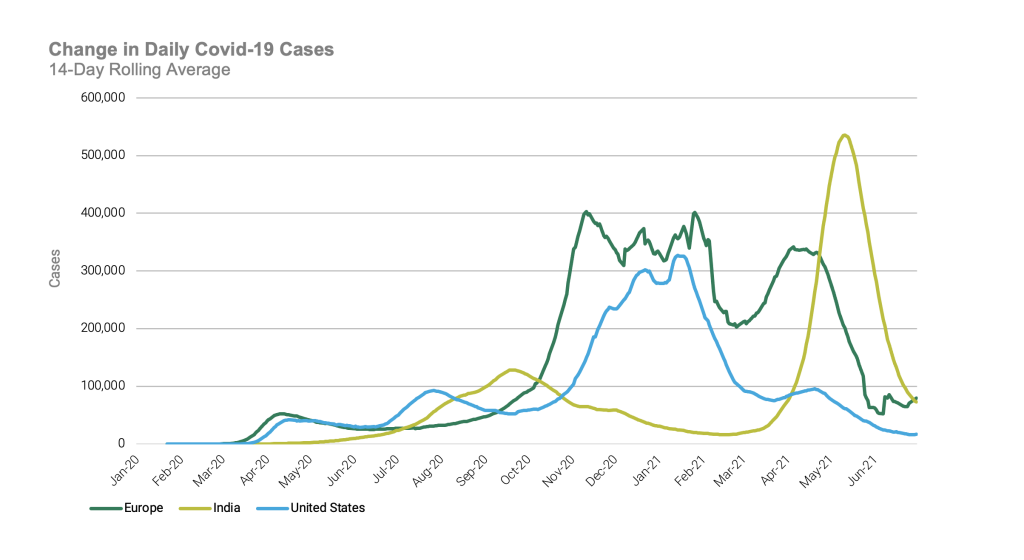

Developed markets (DM), particularly the U.S., outperformed in the first half of 2021, reflecting effective stimulus and more successful containment and vaccination programs. This supported the market’s generally bullish view on DM equities, particularly in more cyclical areas. As growth peaks in DM and the recovery broadens, we think emerging markets (EM) have more room for vaccine-related optimism to support growth. Daily vaccine rates are accelerating in countries such as India and Brazil, suggesting that market optimism can shift to EM.

Figure 1 | Vaccine Rollouts Lead to Varying Degrees of Recovery

Data from 1/1/2020 to 6/30/2021. Source: FactSet, World Health Organization.

Inflation Likely to Prove Transitory

EM softened amid rising inflation and yield expectations in the U.S. After initial volatility, markets seem to have taken stock of the situation and decided that any inflationary pressures are transitory even if protracted. COVID-related supply chain disruptions, higher commodity prices, pent-up demand and labor imbalances are keeping inflation top-of-mind for investors currently. However, markets seem to expect these factors to recede with time. This is key because the markets’ acceptance of a gradual return of inflation should preclude the need for any drastic policy shifts from the Fed.

While the Fed may be moving closer to tapering asset purchases and eventually increase rates, policy changes will likely be transparent and well communicated. Such a strategy should help avoid the “taper tantrum” that rattled markets in 2013. EM central banks appear ready to follow the Fed when the time comes. In fact, central banks in Russia, Brazil and Hungary have already begun to raise rates this year.

Regional and Sector Differences Continue

The growth recovery has not been consistent across regions, a result of the different levels of success each region had in dealing with the health crisis.

Northern Asia performed well during the early stages of the COVID crisis, partly because of the high concentration of technology, internet, and e-commerce stocks. These industries outperformed widely amid stay-at-home advisories, mobility restrictions and lockdowns.

EM ex-North Asia has posted strong returns recently, a trend that we expect to continue into the second half, given that many of these economies are still below their pre-pandemic levels of growth. Earnings momentum in Latin America has accelerated in recent months. Following a challenging 2020, LatAm now claims the highest 2021 earnings growth outlook in EM, and valuations are supportive. We believe these regions have more room to recover relative to January 2020 levels because post-pandemic global economic recovery is not completely reflected in these markets.

While many information technology and communication services stocks were volatile in the first half, it’s important to emphasize that we continue to see an upward momentum in existing trends, such as digitization, cloud-based computing, and e-commerce. Companies well-positioned to deliver on these secular trends remain attractive and should continue to support emerging markets. While these trends have normalized somewhat after the extraordinary growth during the pandemic, year-to-date 2021 data remain above pre-pandemic levels. We are also seeing an improvement in cyclicals and sectors with a greater sensitivity to stronger GDP growth. Financials and conventional cyclical sectors positioned to benefit from the reopening of the global economy (such as materials) still have room to recover.

EM Valuations Remain Attractive Relative to DM

While EM is currently trading at a premium to its historical forward price-to-earnings ratio (P/E) it is still trading at a wider-than-historical discount relative to developed markets.

Outlook: Robust, Yet Differentiated Recovery

We expect a shifting, but continuing global recovery, combined with accommodative central bank monetary policy to support EM. Economic activity and earnings growth remain on an upward slope in EM as developed markets peak. EM can begin to restore its GDP growth premium as vaccine laggards ramp up vaccination rates. The growth differential between EM and DM has historically been an important driver of the relative performance. Many EM countries have yet to price in the global economic recovery. Finally, EM valuations remain attractive compared to DM which reflects the nature of the global recovery, which has staggered in tandem with each country’s vaccine rollout. The continued improvement in growth prospects and accelerating vaccination rates in EM will be important drivers in the second half.