Reviewing the impact of new regulations on housing association debt burdens

Under the UK government’s 2017 Clean Growth Strategy (CGS), Britain’s housing associations are all required to have as many rented homes as possible classified as EPC grade C by 2030. EPC stands for Energy Performance Certificate, and rating C is the third most efficient possible grade (grades span from A – most efficient – to G – least efficient).

However, this is only one of the challenges housing associations face: tightening fire safety regulations, tackling the housing and cost of living crises, keeping existing stock up to standards, and meeting requirements for the building of new housing mean that budgets are under a lot of pressure, and management teams must engage in an extensive prioritisation exercise.

This has been exacerbated by the tragic events in Rochdale, where in 2022 a child died due to black mould in a Rochdale Boroughwide Housing property, leading housing associations to recalibrate their expenditure around damp and mould.

A 2021 study by the National Housing Federation (NHF) found that decarbonising housing associations’ stock in England by 2050 would cost a minimum of £36bn and warned that it will be difficult for the sector to absorb the entire amount without subsidies[1]. To reach this target, many companies will need significant grant funding, coupled with borrowing to the limits of covenants.

With only eight years to go until the EPC deadline, are housing associations doing enough to ensure they meet the C rating throughout their portfolio? And what is the impact of this requirement on their debt burden?

Engagement – purpose and results

To answer these questions as comprehensively as possible, we conducted an engagement exercise directed at housing association issuers into the bond market.

We framed EPC spending intentions with stock age data provided by the Regulator of Social Housing. The purpose was to compare stock age with the plans for EPC spending to identify threats to balance sheets and cash flow quality. We engaged with all the housing associations in our coverage by requesting details of their EPC rating plans and characteristics of existing stocks.

This engagement allowed us to understand the extent of companies’ expectations, due diligence conducted, understand how important management teams deemed the topic, and their willingness to engage.

We sent questionnaires to 36 companies and received replies from 25. Both the answers and companies’ willingness to engage varied greatly. Some associations were very helpful and willing to share further data, but at the extreme opposite of the scale, some were not prepared to share the information we asked for.

The target timeframe within which companies are aiming to reach 100% EPC C rating also varies greatly: some are aiming to do so within the next year, while some are aiming to hit the target only by 2035.

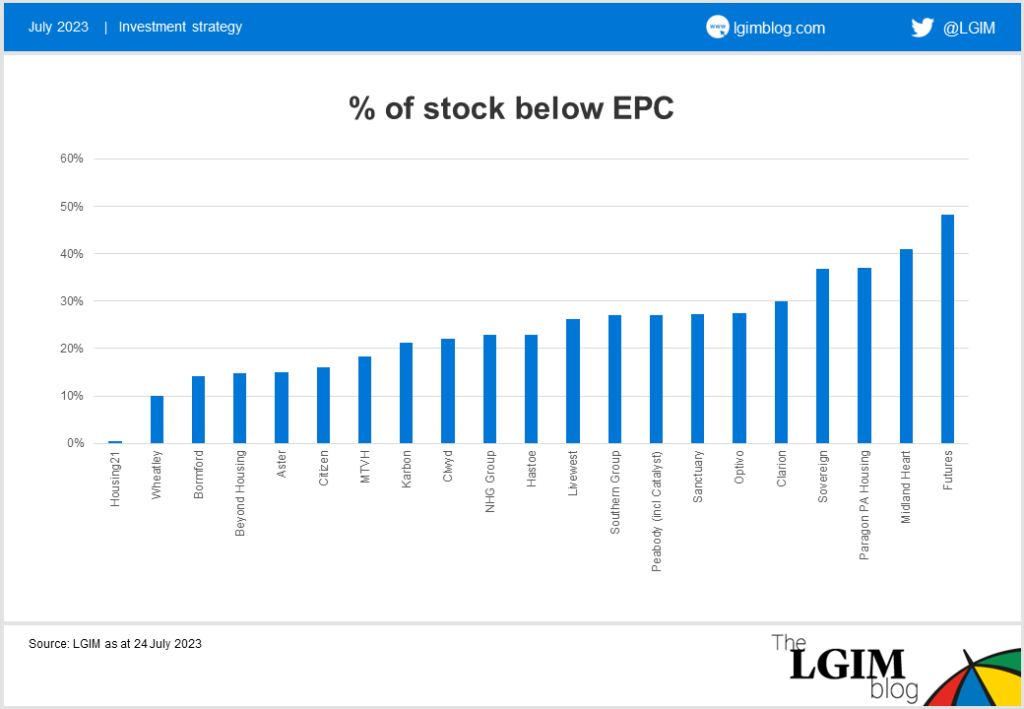

The percentage of stock currently below EPC rating C spans from 1% to 48%, with the average is 24%. The stock average age ranges from 24 to 63 years.

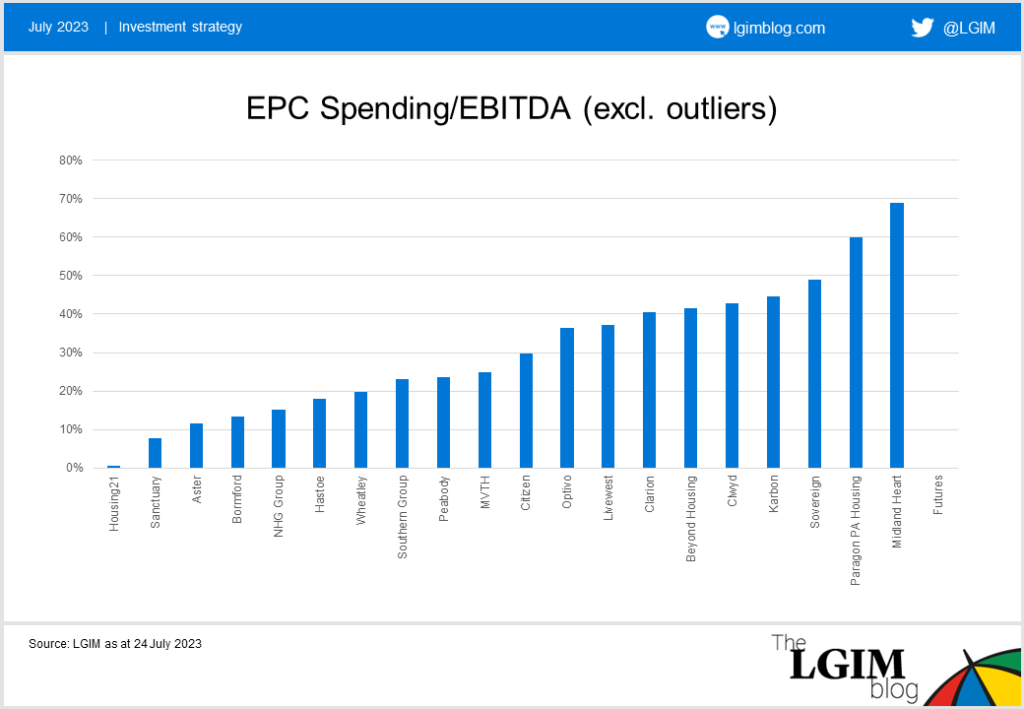

We elaborated on this data and calculated the annual percentage of EBITDA that housing associations need to spend to update all their housing stock to the required standard[2].

Again, the variation is very significant, from 1% to almost 70%:

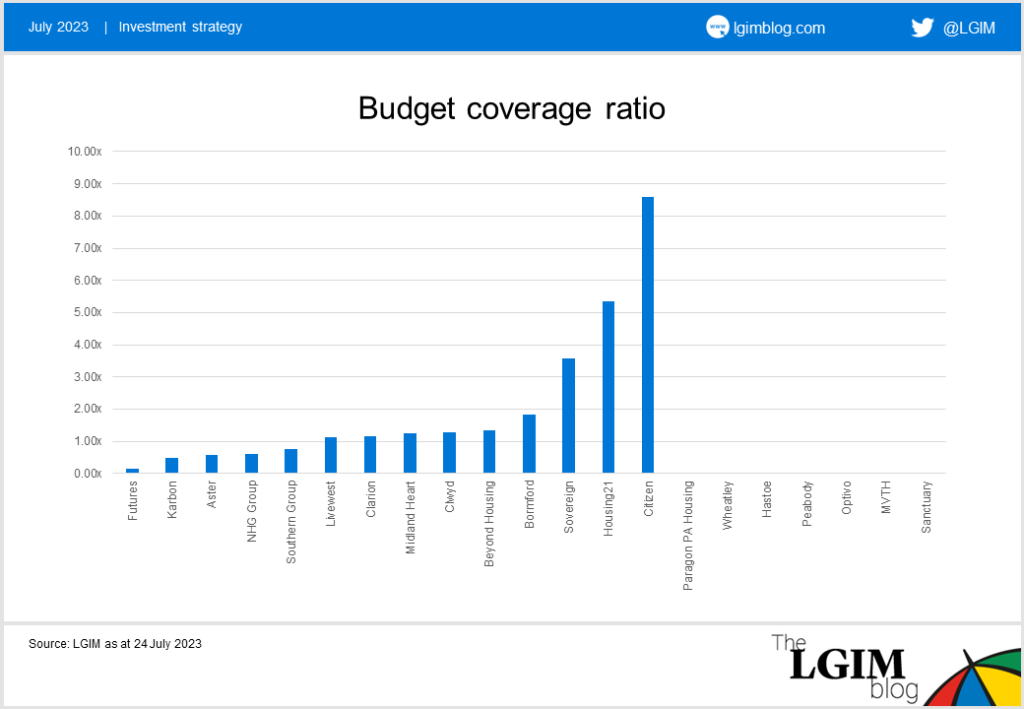

We have also estimated the ‘budget coverage ratio’[3], i.e. whether the budgets companies are planning to spend on upgrades will be enough to cover all the outflows needed to upgrade their stock. Again, the results vary significantly.

These ratios give us an insight into how aware companies are regarding what it will take for them to reach their target, as well as companies that may have exaggerated their estimates as their plans are neither realistic nor sustainable.

Final remarks

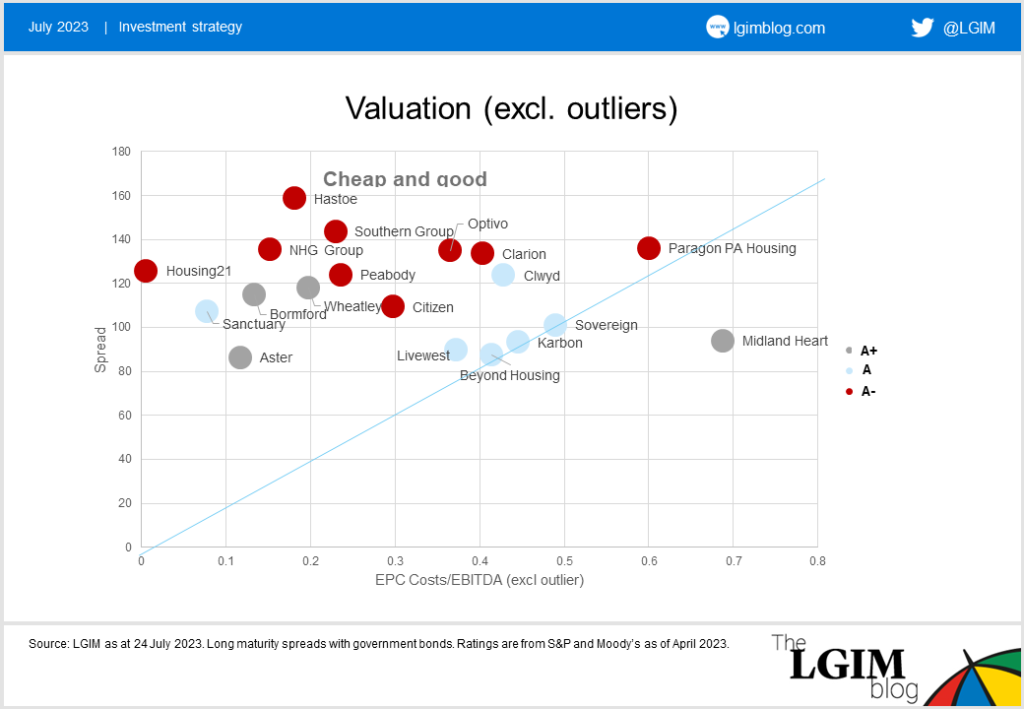

It is interesting to note that the dynamics described above are not even close to being priced by the market. There is no correlation between individual names’ progress on the EPC rating target and the spreads they are trading at, or indeed their credit ratings.

Although the topic has not yet been addressed by the broader market, we believe this data will become material in the near future, and companies’ performances on the matter will represent a significant differentiating factor.

So far, we have identified winners of the ‘EPC C race’ because of their willingness to engage, low percentages of stock below EPC C, a very close target date, and their ownership of young buildings. They will barely need to spend any money on the upgrade.

By contrast, the companies failing to appreciate the importance of the topic and refusing to have a conversation around it are the ones we are most concerned about, and this will have an impact on our investment process on the single names.

We are now in the process of carrying out a second round of engagement to let these companies have the chance to explain their positions and reflect on their spending on EPC rating following the reporting season to formulate realistic budget plans. Once completed, our investment recommendations will be amended to reflect the results of this exercise.

[1] We estimated the cost of upgrading housing stock to EPC C rating according to housing stock EPC and age distribution. The average upgrading price for house at different EPC rating and ages is provided by Bromford.

[2] https://www.housing.org.uk/news-and-blogs/news/decarbonising-housing-associations-homes-cost-36bn/

[3] The higher the better. A coverage of 1.00x indicates that the budget allocated covers the exact amount of spending that is needed. A coverage of 2.00x indicates that the budget allocated is twice as much as the amount needed.